The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

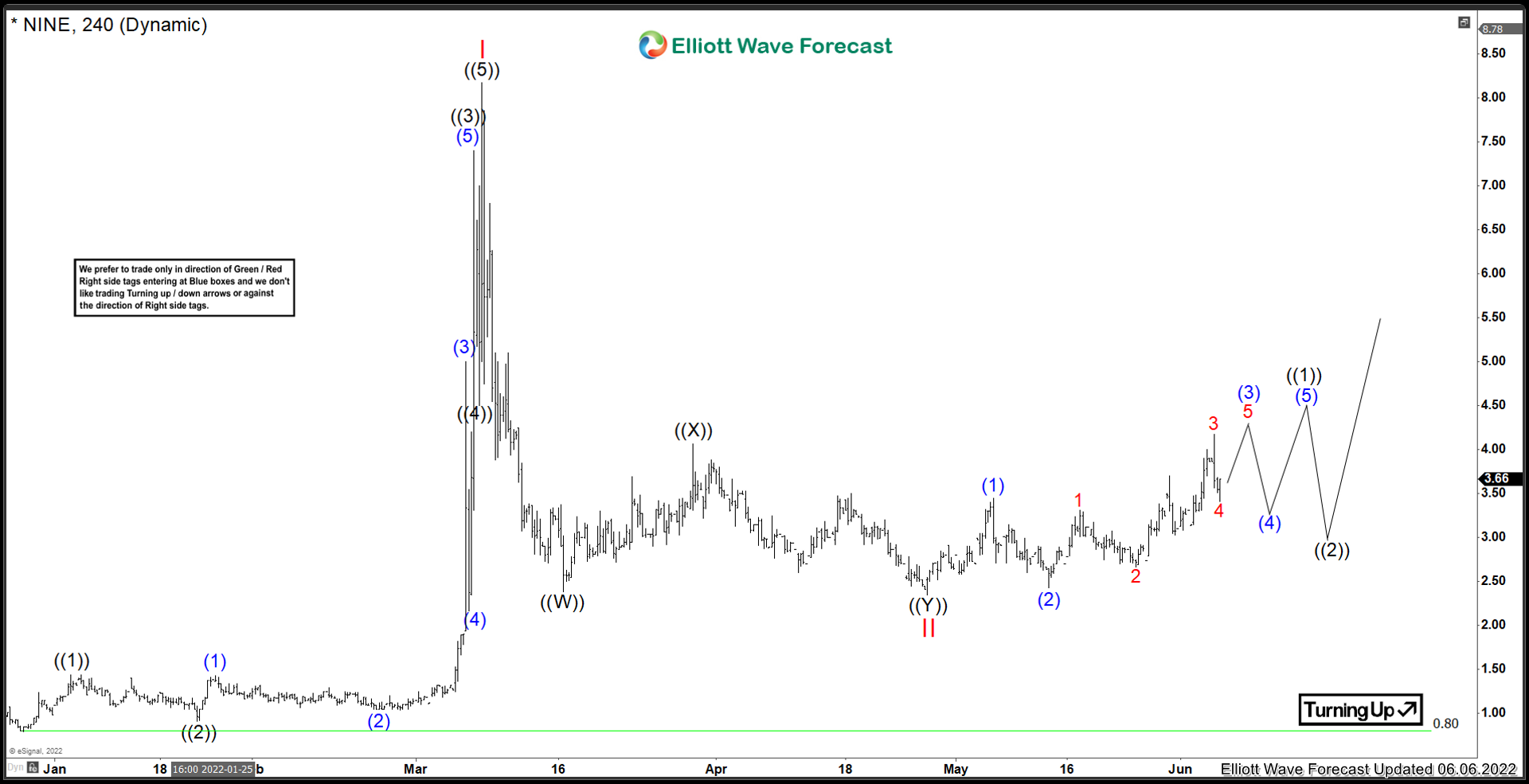

Nine Energy Services ($NINE) Extension Higher Favoured

Read MoreThe last time I covered Nine Energy Services was back in April 2022. At the time, the stock was looking like more upside was favoured. Before we get into the charts, lets get a refresher on this company: “Nine Energy Service, is a nimble completions company with experience in major North American basins and abroad, […]

-

Nasdaq Forecasting The Path Using Elliott Wave Theory

Read MoreIn this blog, we will take a look at the recent rally in Nasdaq Futures up from May 20, 2022 low, structure of this rally and some charts from the recent past showing our forecast calling for a new high to complete the sequence before starting a pull back. We will then look at how […]

-

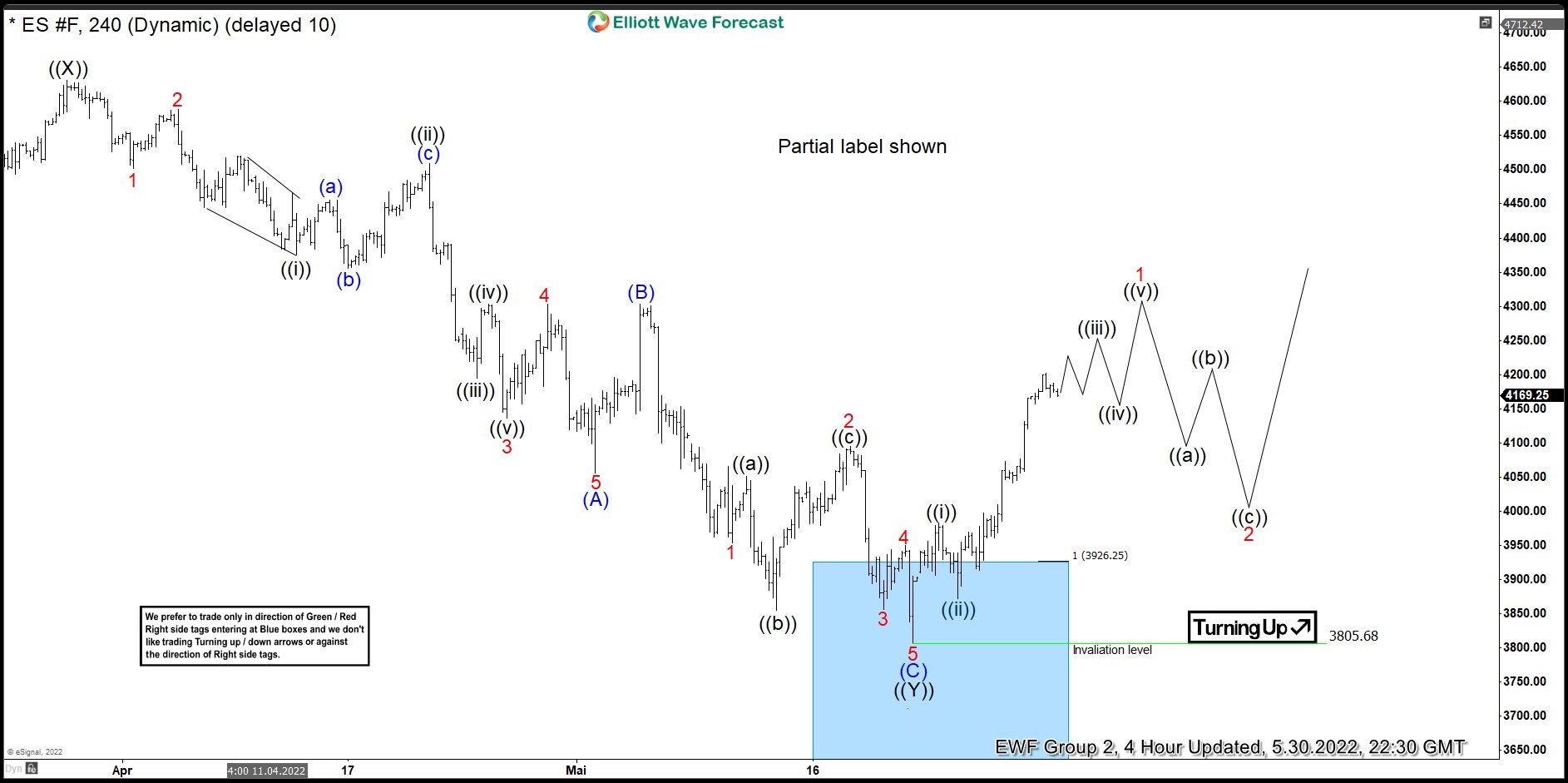

ES – Seems to be bottomed out and ready for another rally

Read MoreI always wondered why we as Analysts are so talented at Elliott Wave Forecast. We do not have a crystal ball to rub to give us an insight of the future nor are we psychic. This made me wonder even more what makes us so good at reading the market. Then I realised, we are […]

-

WSC – Is It Continue to Resume Higher ?

Read MoreWillScot Mobile Mini Holdings Corp., (WSC) provides work space & portable storage solutions in the US, Canada, Mexico & UK. The company leases modular space & portable storage units to customers in the commercial & industrial, construction, education, energy & natural resources, government & other end markets. It is based in Phoenix, Arizona, US, comes […]

-

Bist 100 (XU100) Impulse Completed or Extended?

Read MoreThe Borsa İstanbul (BIST or XU100) is the sole exchange entity of Turkey combining the former Istanbul Stock Exchange (ISE), the Istanbul Gold Exchange and the Derivatives Exchange of Turkey under one umbrella. It was established as an incorporated company with a founding capital of ₺423,234,000 (approx. US$240 million) on 2013 and began to operate […]

-

New Bullish Cycle in Cameco (CCJ)

Read MoreCameco (CCJ) is a Canadian-based providers of the uranium fuel, refining, conversion, and fuel manufacturing services. It’s the second largest uranium producer with 18% of the world production. It operates uranium mines in North America and Kazakhstan. As a key component of nuclear energy, uranium can continue to rise higher as the world looks for […]