The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

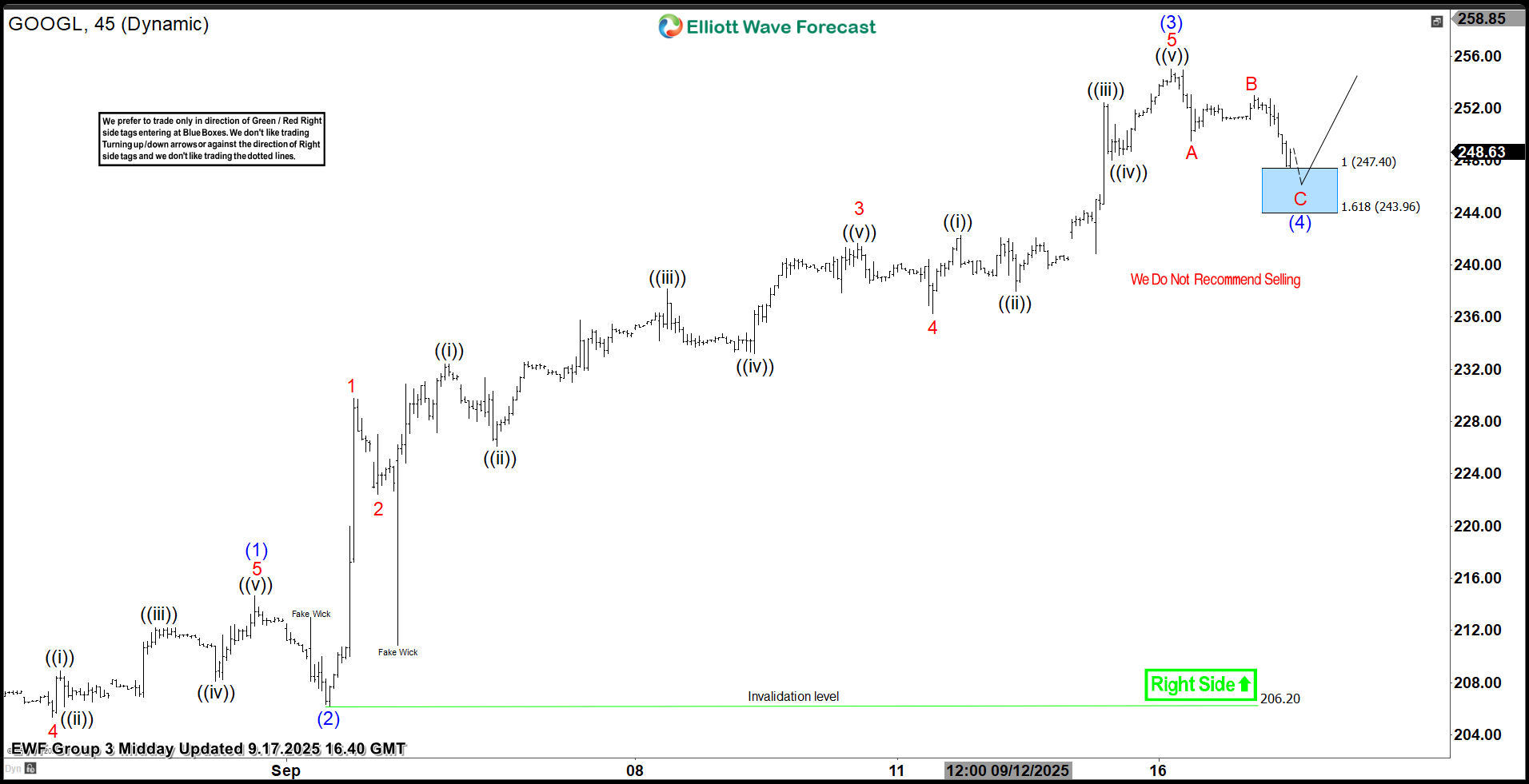

Google Stock (GOOGL) Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of Google Stock (GOOGL) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup […]

-

S&P 500 (SPX) Remains Bullish and Should See Support in 3, 7, 11 Swing

Read MoreS&P 500 (SPX) is extending higher impulsively and pullback should continue to find buyers in pullback. This article and video look at the Elliott Wave path.

-

Oracle (ORCL) Technical Breakout Confirms Further Upside

Read MoreOracle Corp (NYSE: ORCL) has doubled in value during 2025, consistently breaking into new all-time highs. This powerful surge establishes a clear bullish trend. Today, we analyze the underlying Elliott Wave structure driving this momentum. Our analysis outlines precise pathways and upside targets for the next leg higher. Elliott Wave Analysis Oracle launched a strong […]

-

RY Elliott Wave Structure: Looking to Buy the Next Pullback

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. As discussed in the last article, RY extends impulse sequence against April-2025 low. Currently, it favors rally in […]

-

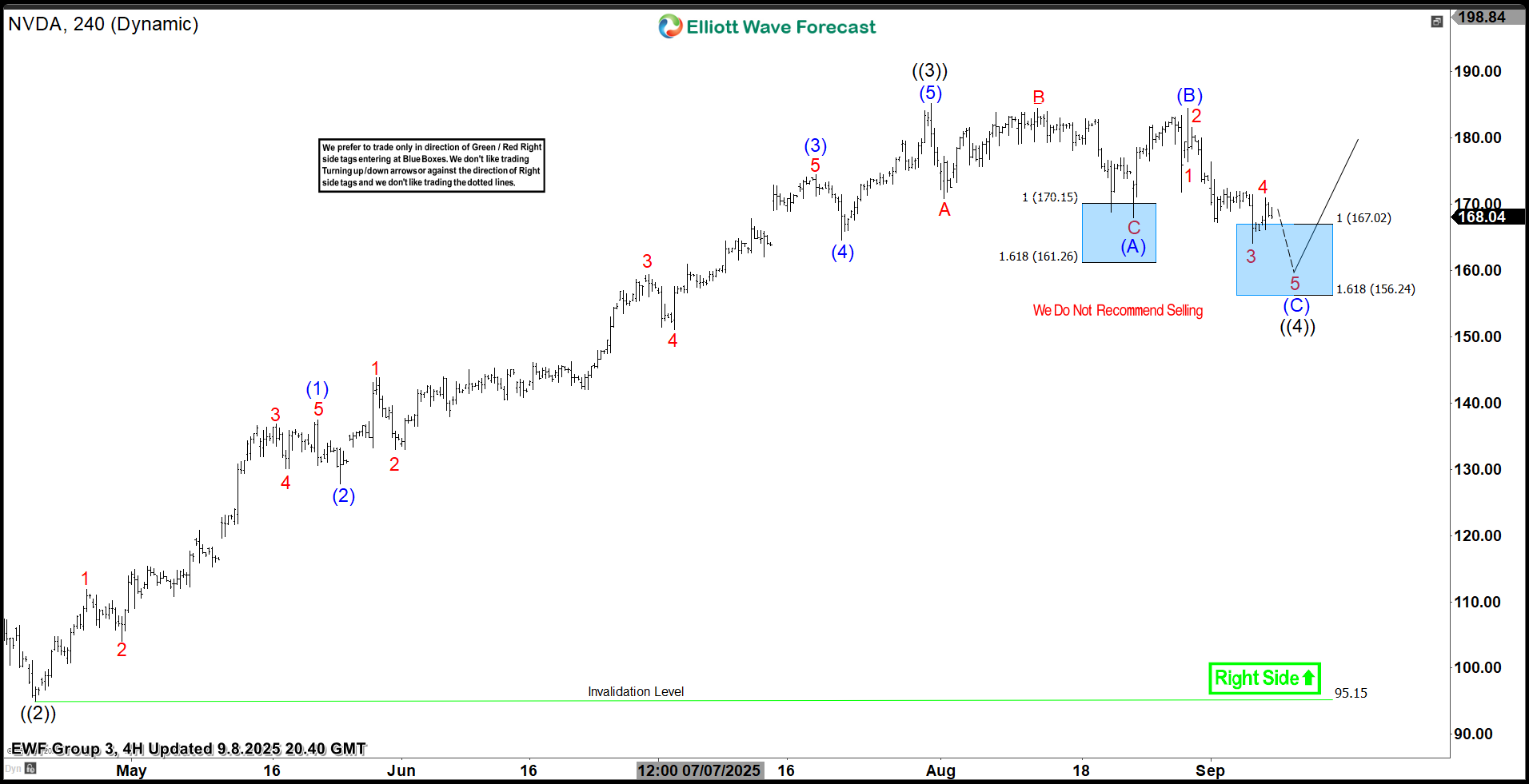

The Blue Box Bounce: NVDA’s Perfect Reaction Higher

Read MoreIn this blog, we take a look at the past performance of NVDA charts. In which, the stock reacts higher from Elliott wave blue box area.

-

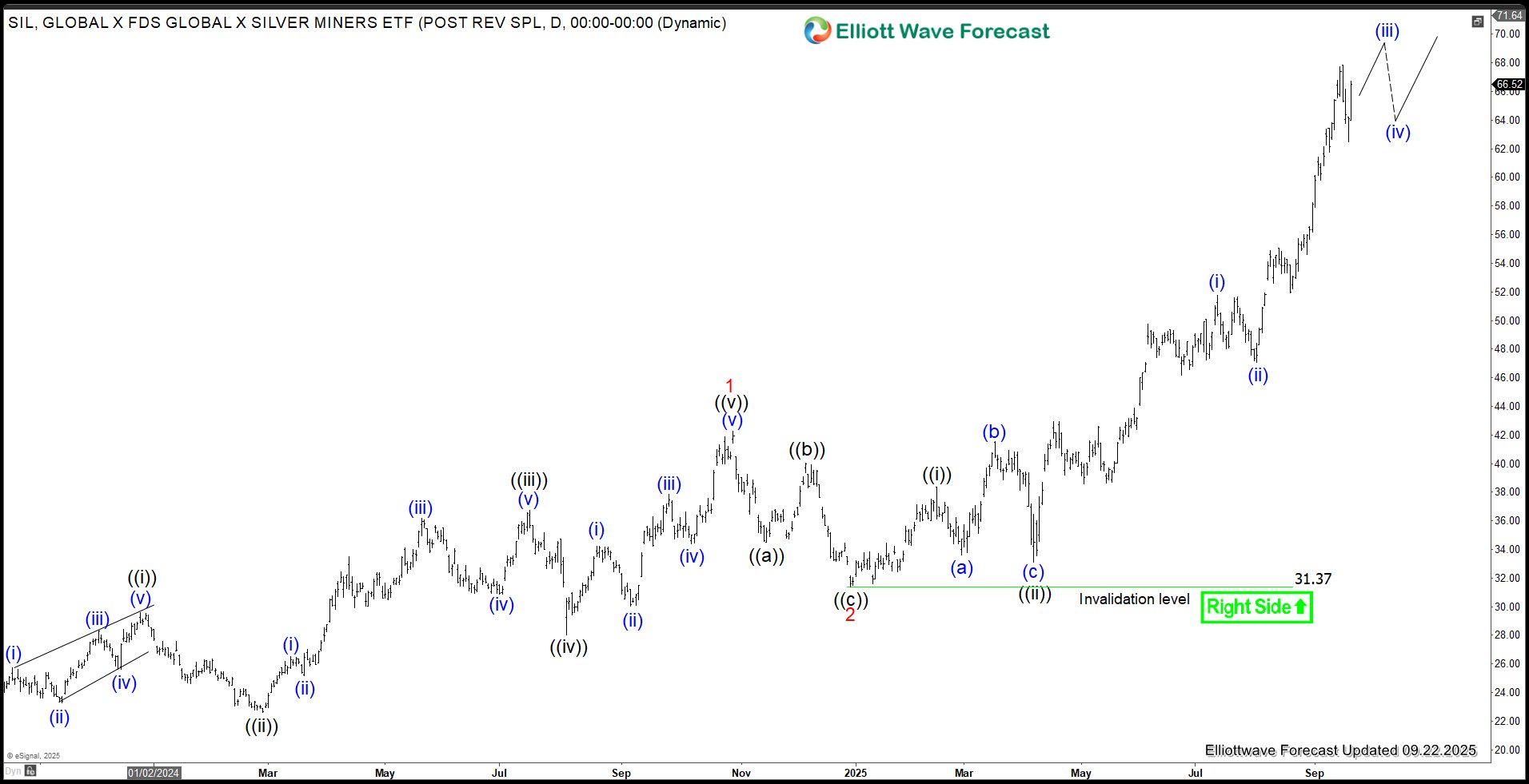

Silver Miners ETF (SIL) Rides Strong Bullish Wave

Read MoreThe Global X Silver Miners ETF (SIL), launched in April 2010, tracks the Solactive Global Silver Miners Total Return Index, offering exposure to silver mining companies like Wheaton Precious Metals and Pan American Silver. With over $1 billion in assets, SIL provides a volatile yet targeted investment option for those seeking to capitalize on silver […]