The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: FTSE Looking to End 5 Waves

Read MoreFTSE shows impulsive structure from 10.13.2022 low looking for more upside. This article and video look at the Elliott Wave path.

-

10 Best Coal Stocks To Buy Now

Read MoreWorldwide coal consumption in 2021 rebounded by 5.8 % to 7 947 million tonnes (Mt), according to research by IEA.org. While the economy recovered from the pandemic, the higher natural gas price shifted the consumers towards coal-fired power generation. As a result, global coal consumption rose above 2019 levels. Coal use for power generation increased […]

-

AIZ : Should Expect Short Term Weakness

Read MoreAssurant Inc., (AIZ) together with its subsidiaries, provides lifestyle & housing solutions that support, protect & connect consumer purchases in North America, Latin America, Europe & Asia Pacific. The company operates through two segments: Global lifestyle & Global housing. It is based in New York, Comes under Financial services sector & trades under “AIZ” ticker […]

-

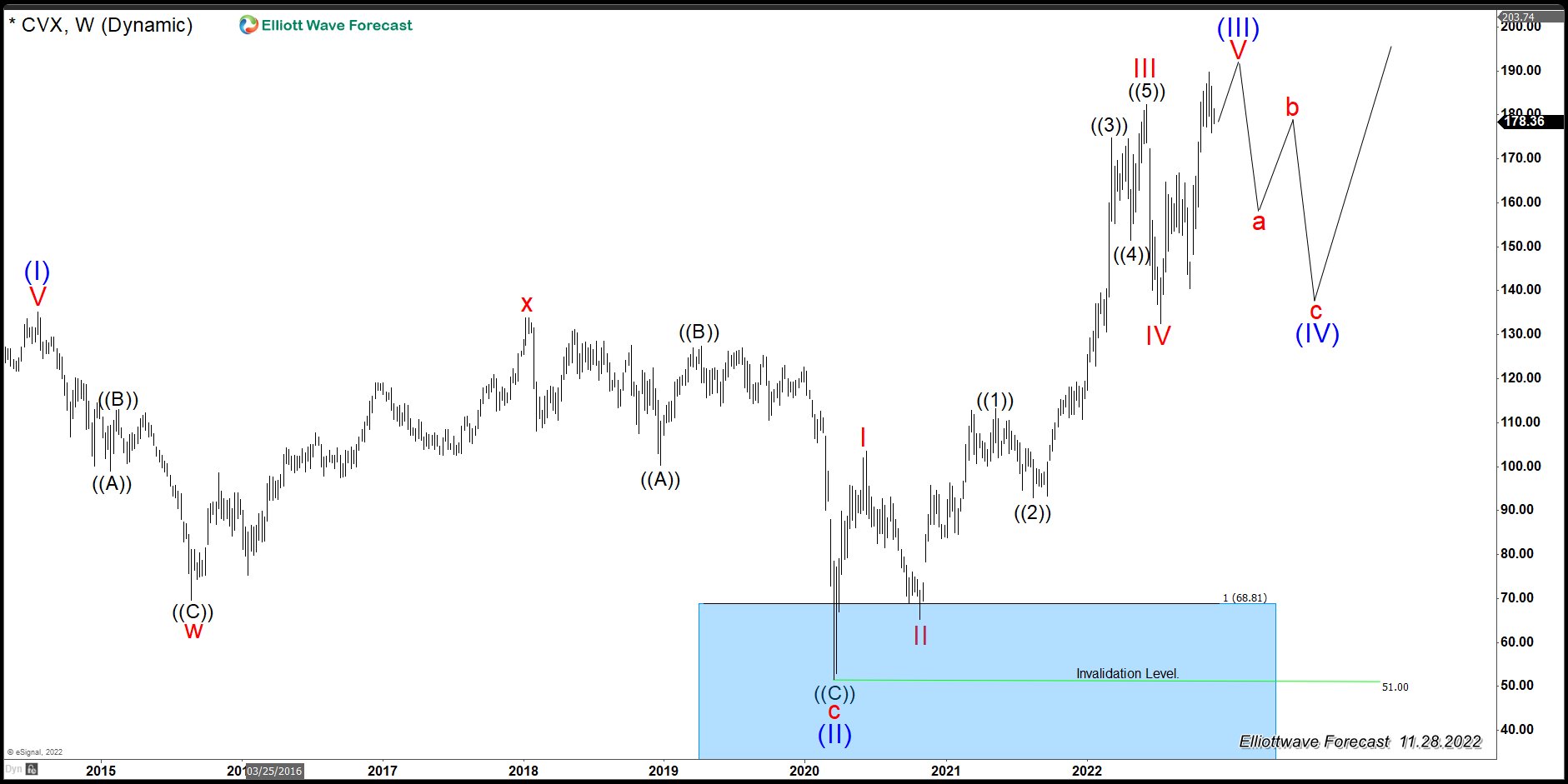

CVX (Chevron): The Symbol Might be Ending a Cycle.

Read MoreThe Elliott Wave Theory’s main pattern is that the market advances in five waves and corrects in three waves. The five waves advance is easy to identify. Most of the time the rally is well-defined and the subdivision is visible. Also, the powerful wave three creates separation making the sequence clear and easy to label. […]

-

$ADS: German Adidas Stepped Down in 11 Swings into Big Buy

Read MoreAdidas is a German multinational corporation designing and manufacturing shoes, clothing and accessories. Created in 1934 by Adolf Dassler and headquartered in Herzogenaurach, Germany, the company is the largest sportswear manufacturer in Europe. Adidas is a part of both DAX40 and of SX5E indices. From the all-time lows, Adidas has been showing a strong bullish […]

-

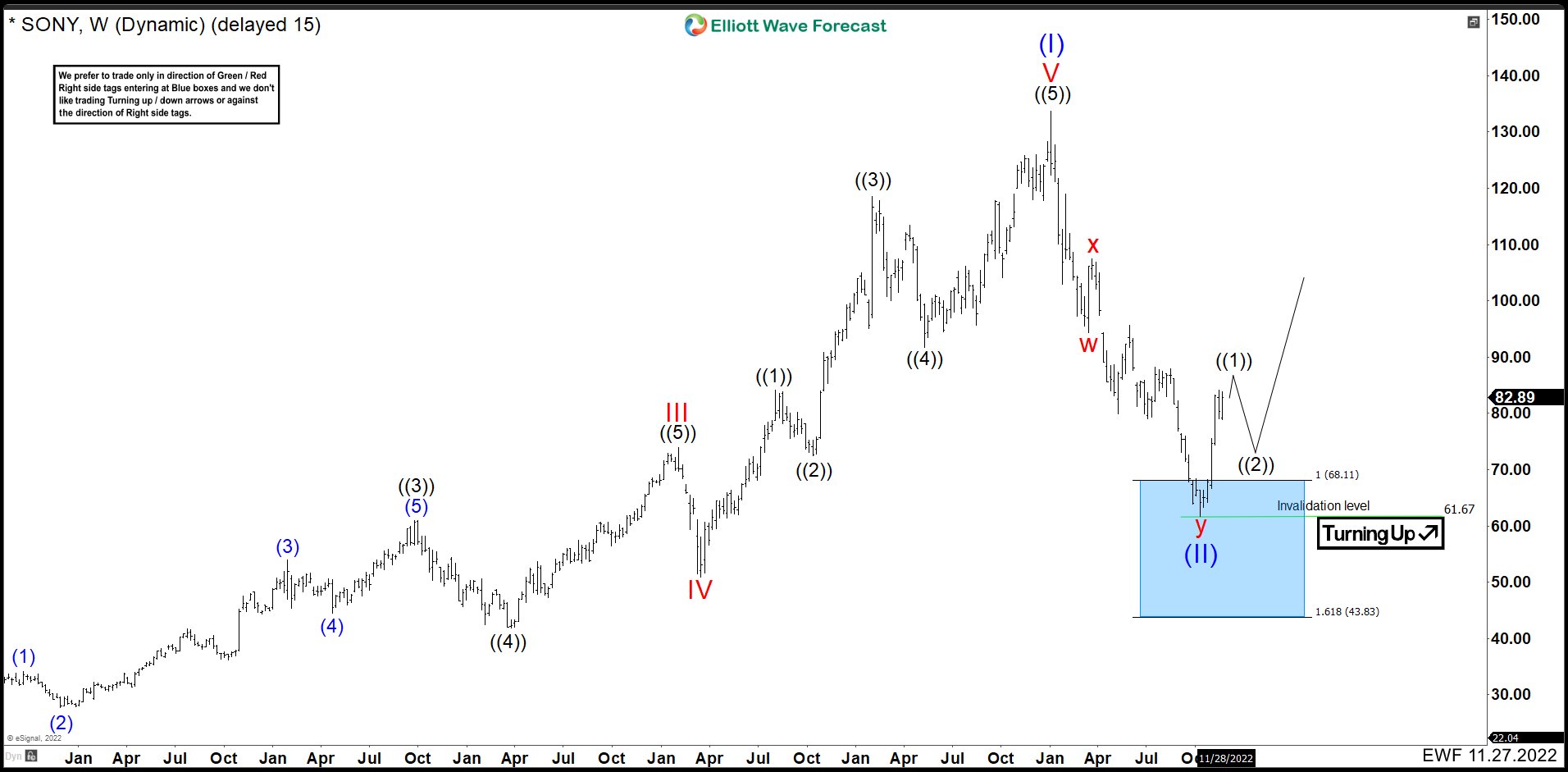

SONY Ended A Correction And Reaction Higher From The Blue Box

Read MoreSony Group Corporation, commonly known as Sony and stylized as SONY, is a Japanese multinational conglomerate corporation headquartered in Kōnan, Minato, Tokyo, Japan. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company and the largest video game publisher. […]