The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

TSLA: Forecasting the decline in Tesla from November

Read MoreOne of the most trending and discussed stocks as of recent is Tesla. People seeing the decline in the stock and not able to understand why it is happening. TSLA has ended a grand degree super cycle. When an instrument ends a larger degree super cycle the pullback usually gets extensive and deep from the […]

-

HDFC BANK Is Looking Good To Continue The Rally From The Blue Box

Read MoreHDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalization as of April 2021, the third largest company by market capitalization of $122.50 billion on the Indian stock exchanges. It is also the fifteenth […]

-

Elliott Wave Projects Further Downside in DAX

Read MoreDAX is correcting cycle from 9.28.2022 low and the Index can see further downside. This article and video look at the Elliott Wave path.

-

Best Metal Stocks to Buy Now

Read MoreInvesting in metals, like gold or silver, is a good choice not only because it will always be considered valuable, but because it also helps to protect your other investments. Metal stocks are shares in companies that explore for, mine, and refine metals such as copper, nickel, and zinc. Some metal stocks are unique because […]

-

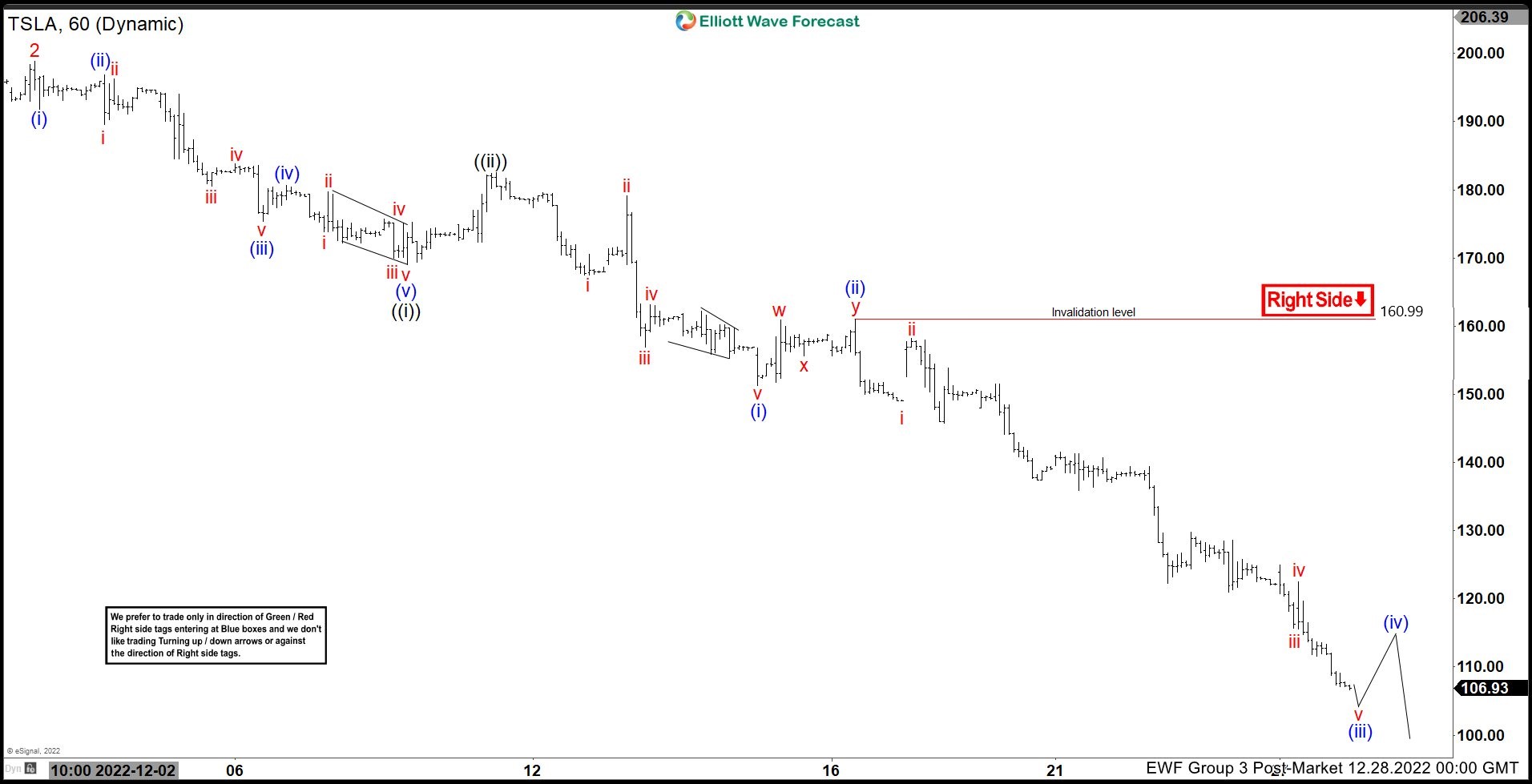

What Elliott Wave Say About How Low Tesla (TSLA) Can Go

Read MoreTesla (TSLA) declines in impulsive structure. This article and video look at the short term Elliott Wave path as well as finding the support zone.

-

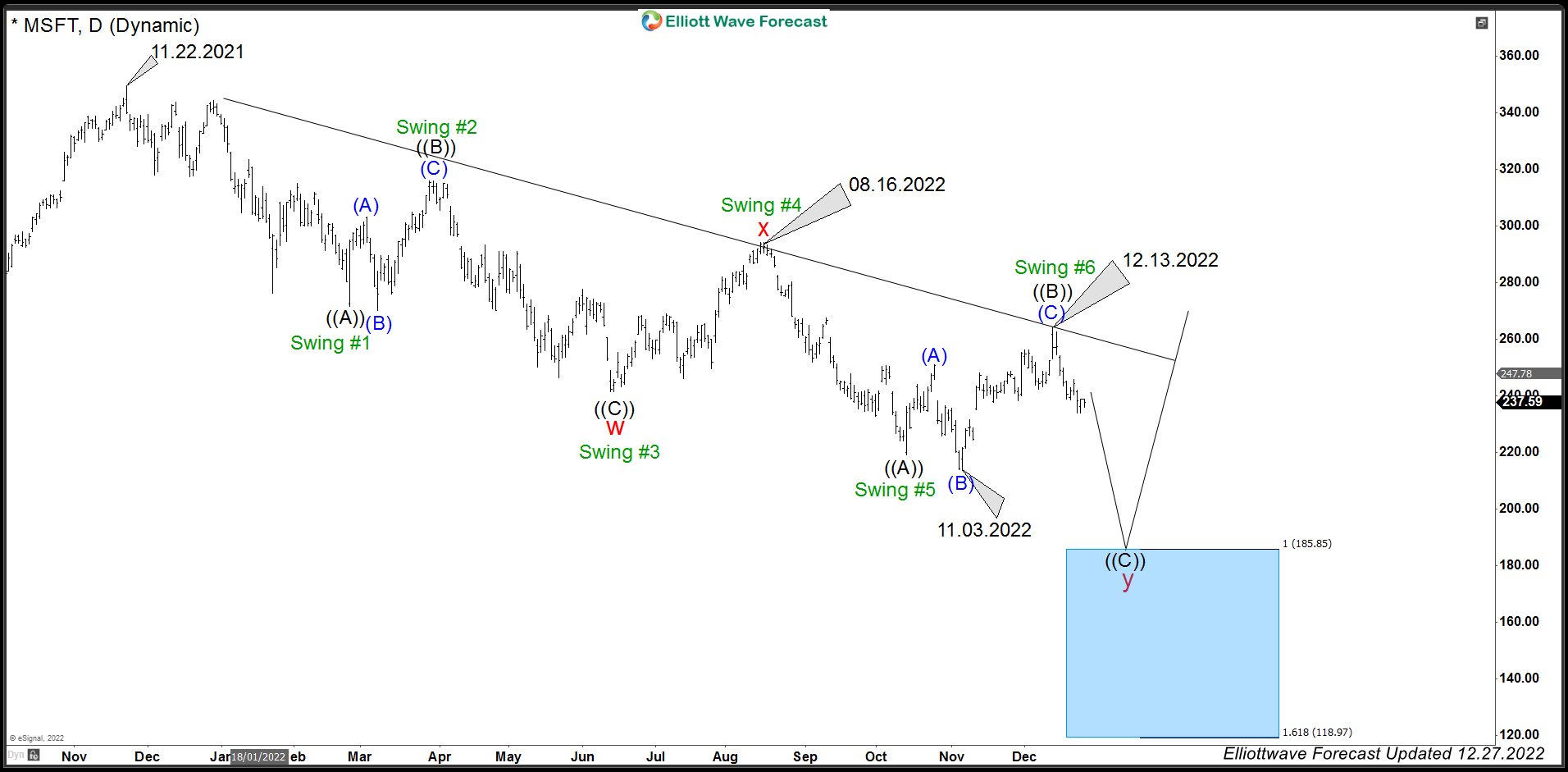

Microsoft Elliott Wave Sequence Favors Extension Lower

Read MoreMicrosoft Corporation is an American multinational technology corporation producing computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington and listed on NASDAQ stock exchange with the ticker symbol (MSFT). The series of rate hikes by the Fed has provided a challenge for the World Indices […]