The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

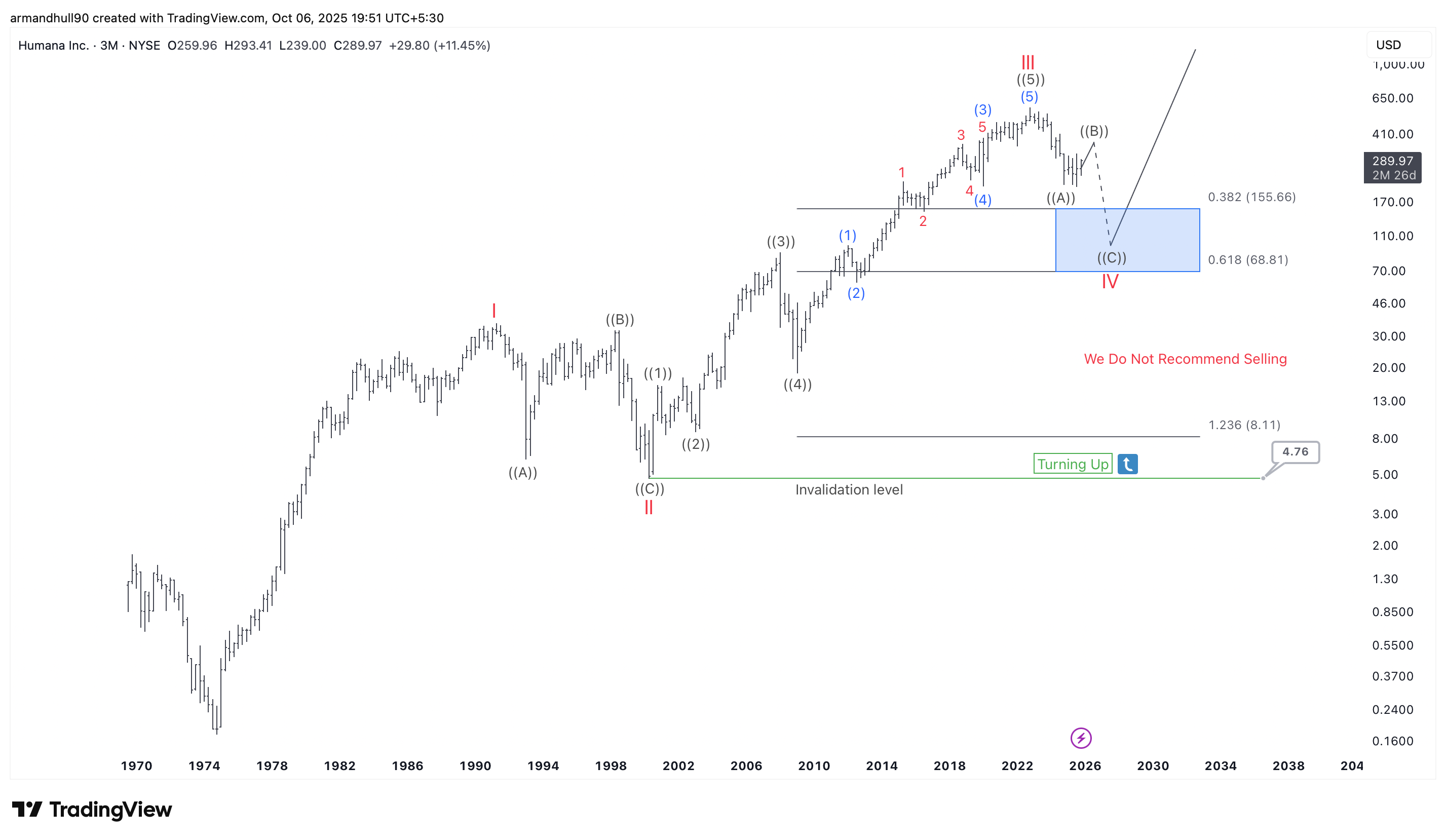

Humana Inc. (HUM) Elliott Wave Forecast: Wave IV Correction Nearing Completion

Read MoreHumana (NYSE: HUM) shows signs that its large wave IV correction is almost complete, hinting at the next major bullish cycle ahead. Humana Inc. (NYSE: HUM) has spent the last few years correcting after a long and strong rally. The chart shows that the company completed a major five-wave advance from the early 2000s. That […]

-

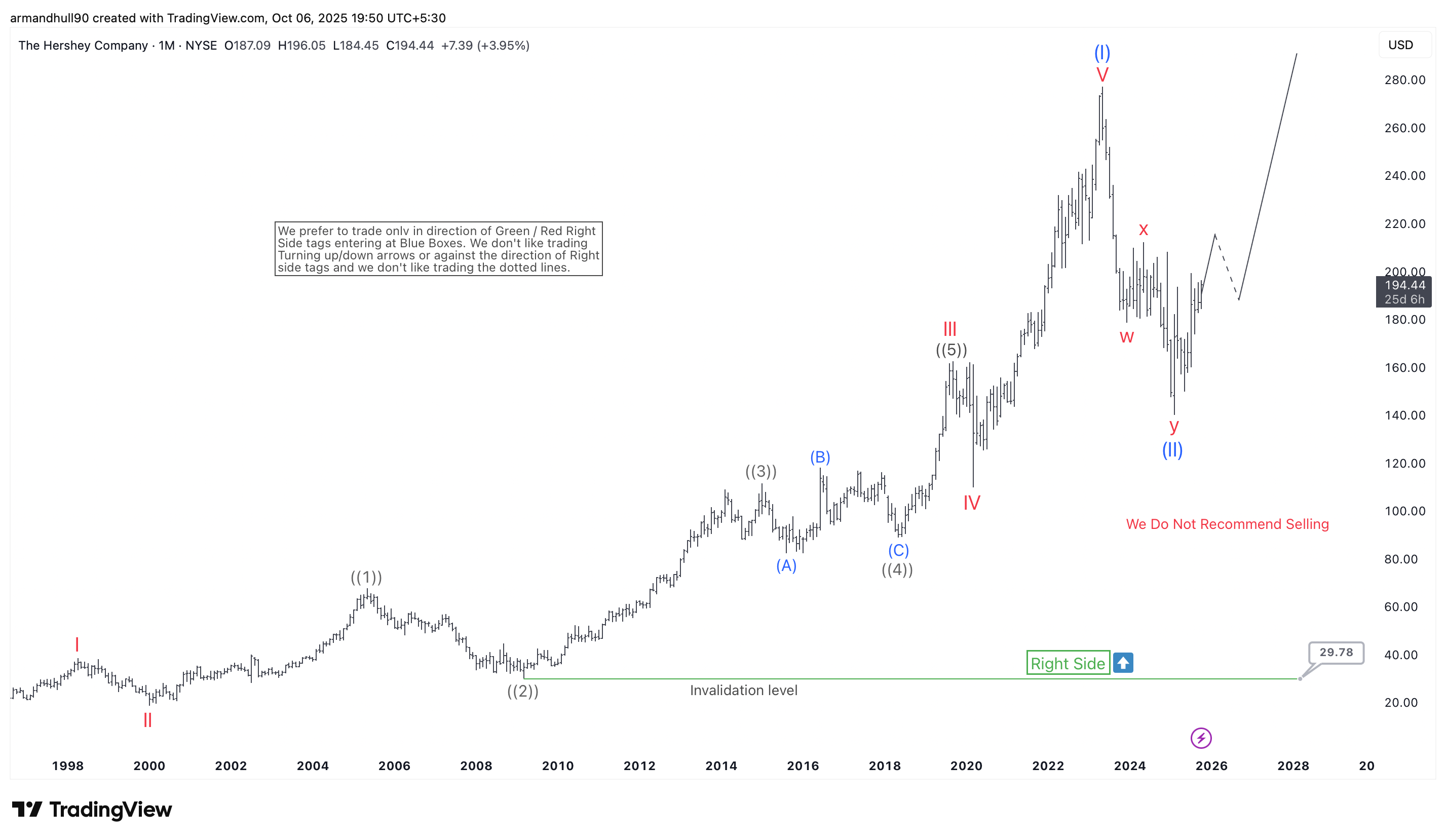

Hershey Company (HSY) Elliott Wave Analysis: Bullish Setup Suggests Next Rally Ahead

Read MoreHershey (NYSE: HSY) shows a bullish Elliott Wave structure indicating that the correction may have ended, and a new upward cycle could soon resume. The Hershey Company (NYSE: HSY) is showing early signs of strength after months of decline. Based on Elliott Wave Theory, the long-term chart suggests that the correction may have ended and […]

-

URA’s Breakout: Uranium Miners ETF Rally Gains Steams

Read MoreThe Global X Uranium ETF ($URA) offers investors a way to invest in a basket of global companies involved in the uranium mining and nuclear components industry. As a thematic fund, it seeks to benefit from the growing demand for nuclear energy as a clean power source. URA holds a diversified portfolio of companies involved […]

-

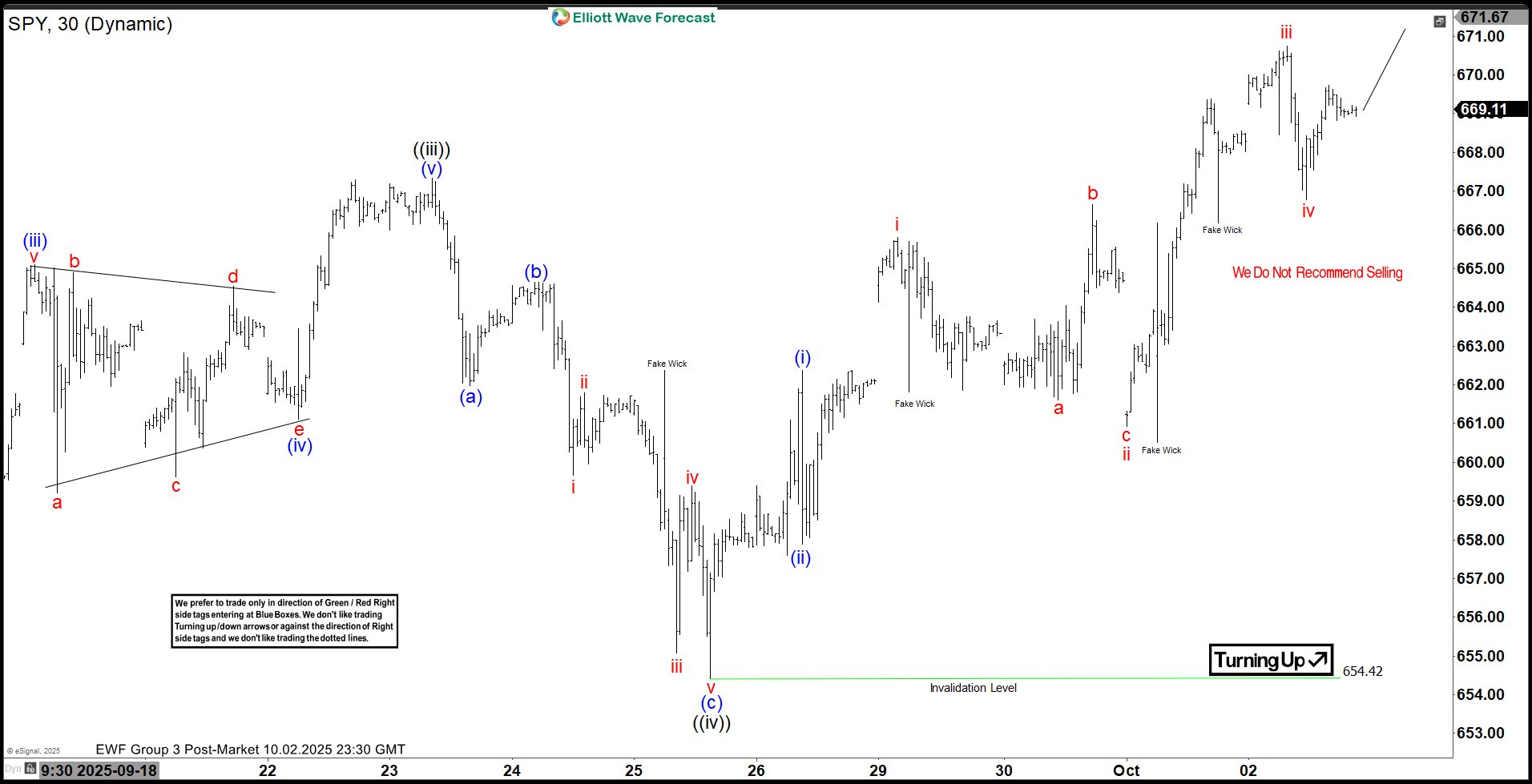

Elliott Wave Forecast: SPDR S&P 500 (SPY)’s Path to Record Peaks

Read MoreThe Short-Term Elliott Wave analysis for the SPDR S&P 500 ETF (SPY), starting from August 2, indicates an ongoing impulsive rally. From the August 2 low, the ETF surged in wave ((i)) to 647.04, followed by a dip in wave ((ii)) concluding at 634.92. The ETF then climbed in wave ((iii)) to 667.34. A corrective […]

-

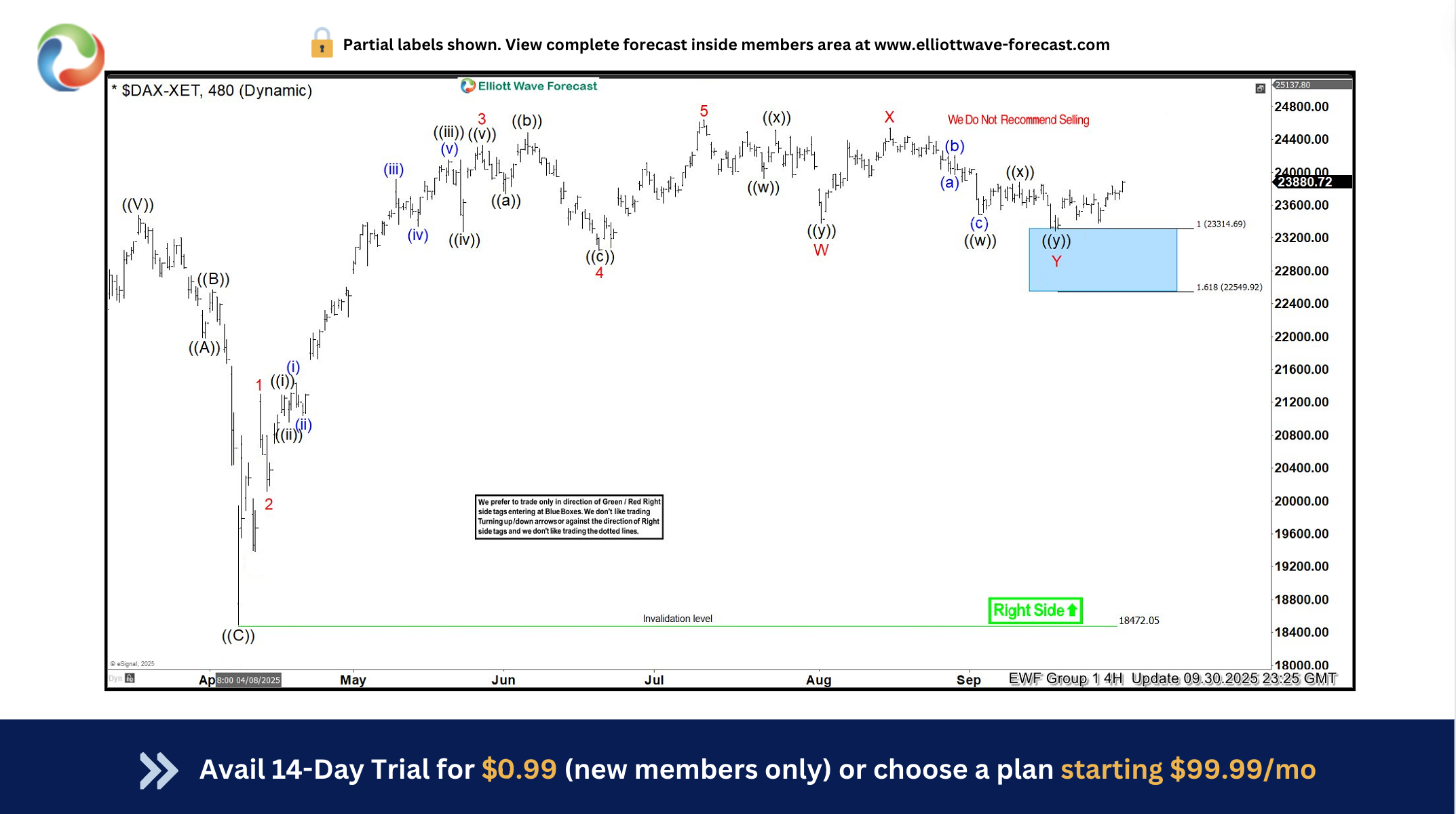

DAX Trading Setup Explained : Buying the Dips in the Blue Box

Read MoreAs our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in DAX. The Index has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this article, we’ll break […]

-

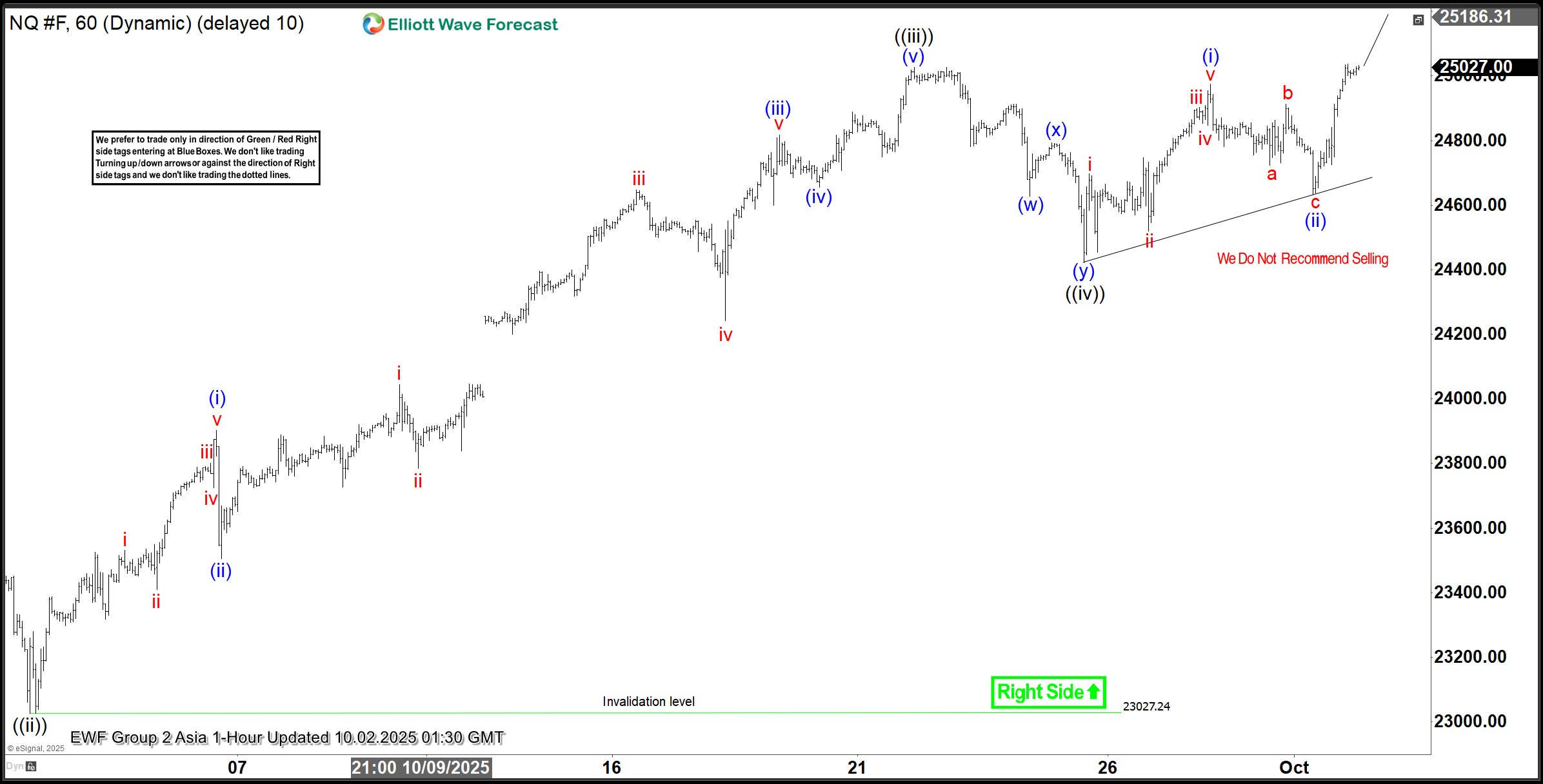

Nasdaq (NQ) on Track for Higher Wave 5 Finish

Read MoreNasdaq (NQ) has rallied to new high and the structure is incomplete favoring more upside. This article and video look at the Elliott Wave path.