The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SoFi Technologies (SOFI) Favors Rally Between $34.95 – $38.49

Read MoreSoFi Technologies, Inc., ( SOFI ) provides various financial services in the US, Latin America, Canada & Hong Kong. It operates through three segments; Lending, Technology Platform & Financial services. It comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI favors rally in bullish sequence from December-2022 low in weekly. It […]

-

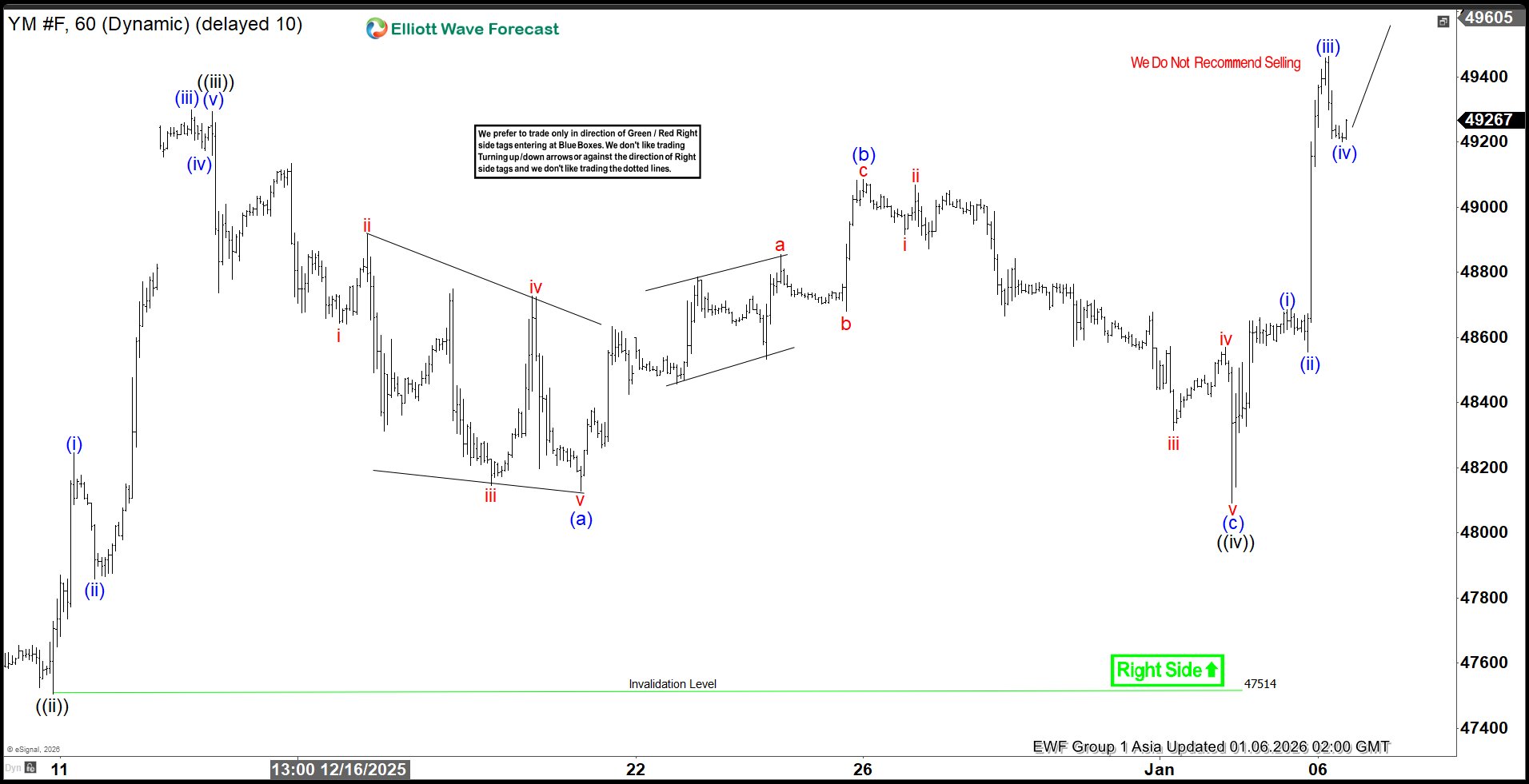

$YM (Dow Futures) Final Wave ((v)) Set to Wrap Short‑Term Cycle from Nov 21

Read MoreDow Futures (YM) is looking to complete cycle from November 21, 2025 low as a diagonal. This article and video look at the Elliott Wave path.

-

Uranium Miners (URA) Eye Another Strong Year in 2026

Read MoreUranium Miners ETF (URA) has consolidated since gaining in 2025. The ETF is poised to continue the gain in the coming year.

-

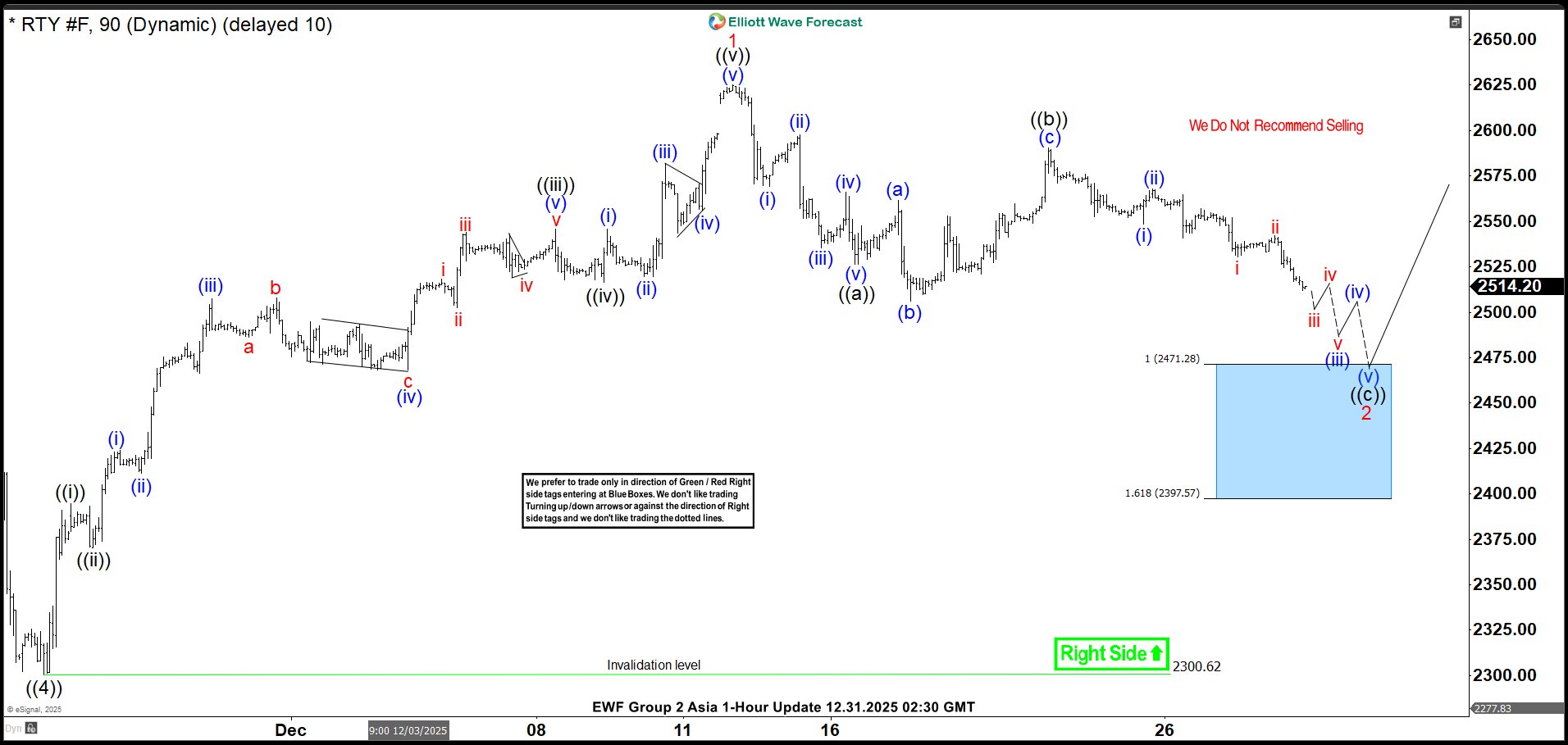

Russell 2000 Futures (RTY): Zigzag Correction Likely to Find Support for Extension to New Highs

Read MoreRussell 2000 Futures (RTY) is correcting in zigzag pattern. This article and video look at the Elliott Wave path of the Index.

-

SPY Confirms Elliott Wave Mastery with Blue Box Rally

Read MoreIn this technical blog, SPY manages to reach the blue box & confirms the Elliott wave mastery with blue box rally higher.

-

RY (Royal Bank of Canada) Favors Rally To 187.25 or Higher

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY extends rally from April-2025 low as nesting as it managed to erase the momentum divergence. It favors […]