The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P 500 E-Mini Futures ( ES_F ) Forecasting The Path

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of E-Mini S&P 500 ( ES_F) published in members area of the website. As our members know ES_F ended cycle from the 3790.2 low as 5 waves structure and we have been forecasting the correction. In the further […]

-

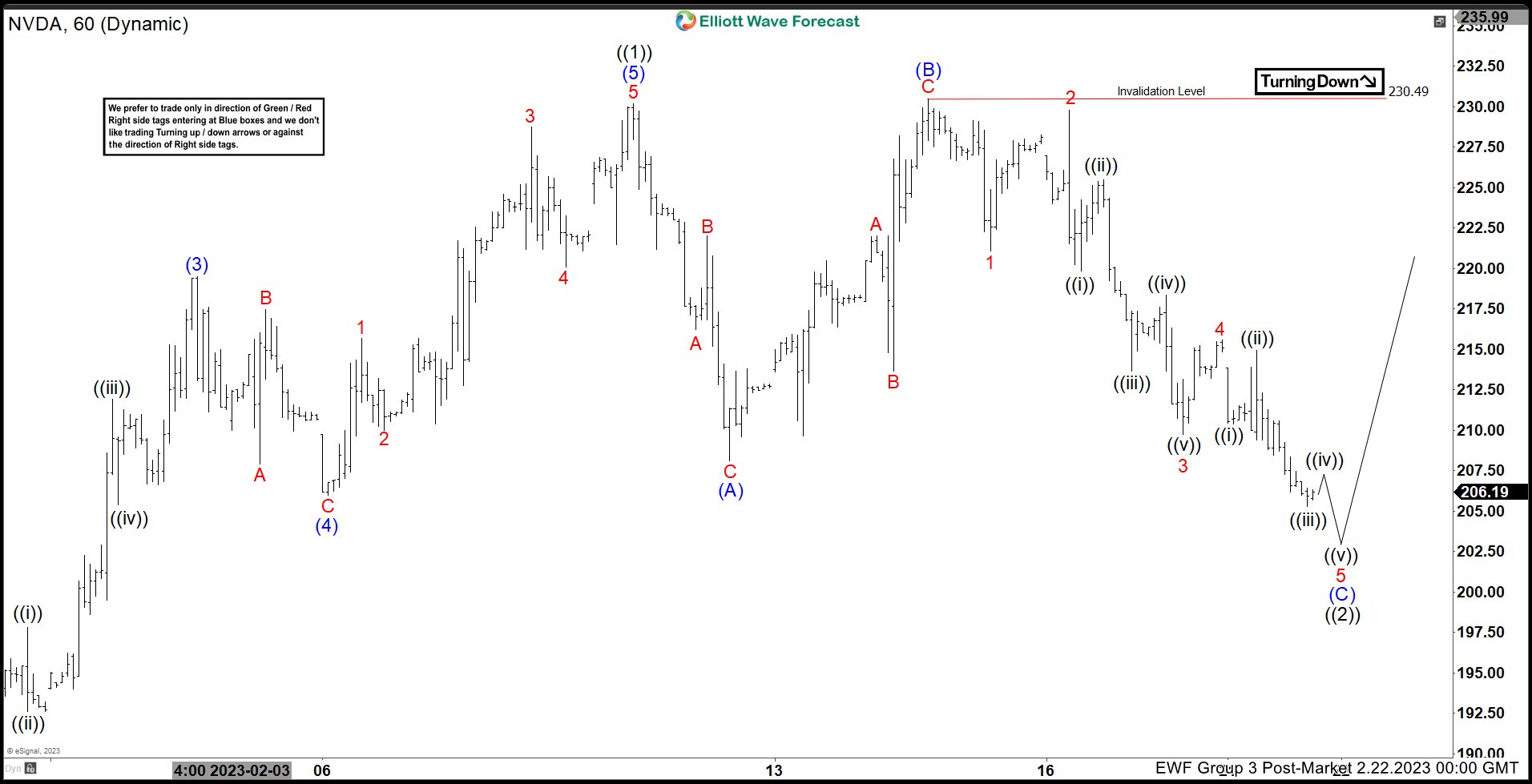

NVDA Pullback in Expanded Flat Elliott Wave Structure

Read MoreNVDA rally from September 2022 low in a series of nest. Current pullback takes the form of expanded flat. This article looks at the Elliott Wave path.

-

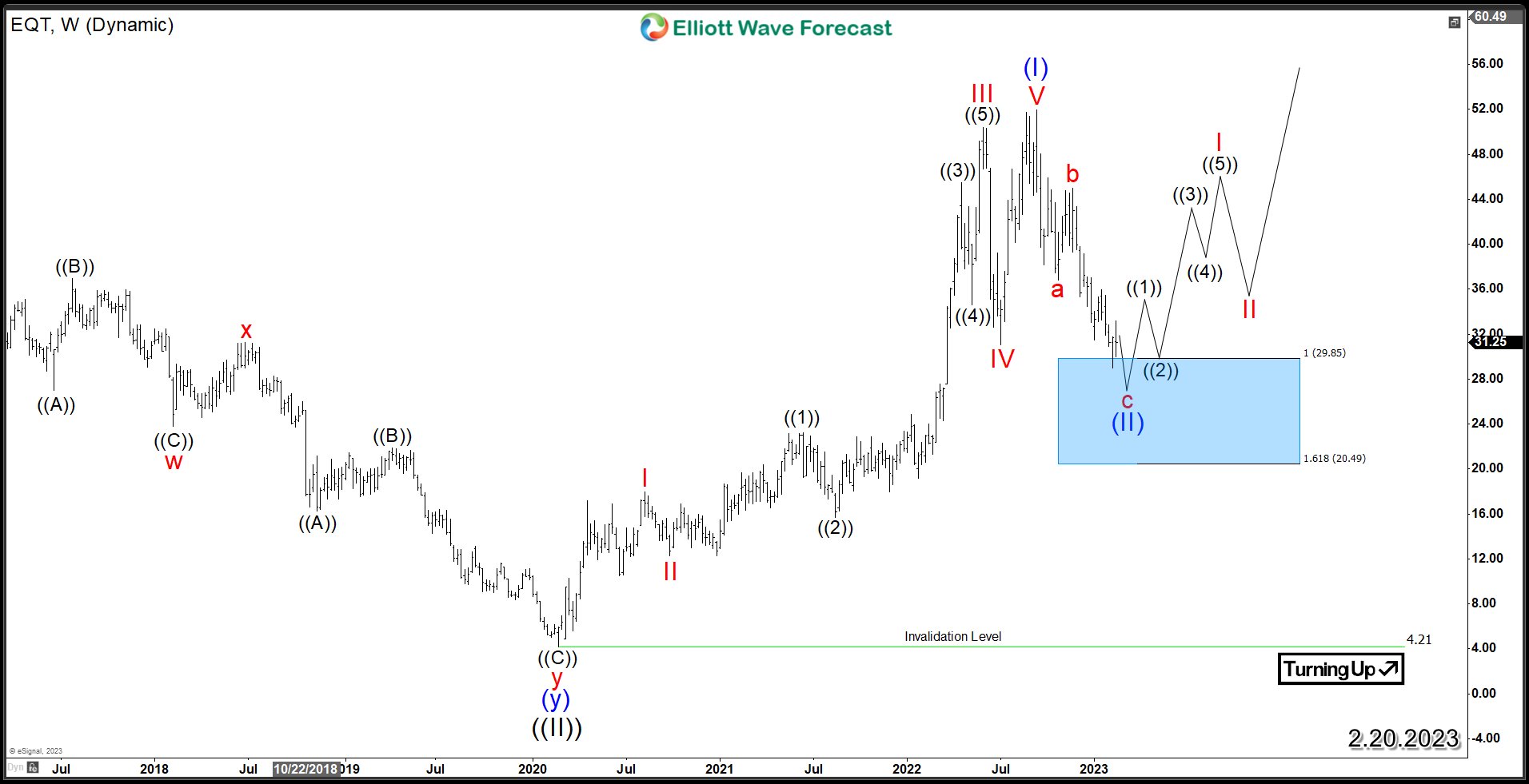

EQT Corporation Remains a Solid Investment Opportunity

Read MoreThe EQT Corporation (NYSE: EQT) is a leading natural gas production company with operations across the United States. The company has a strong track record of generating significant returns for its shareholders through its efficient operations and commitment to responsible resource development. EQT faced its longest bear market, lasting almost six years (69 months), following its […]

-

Elliott Wave Shows the Support Zone for DAX

Read MoreDAX is correcting cycle from 12.20.2022 low in 3, 7, or 11 swing before the next leg higher. This article and video look at the Elliott Wave path.

-

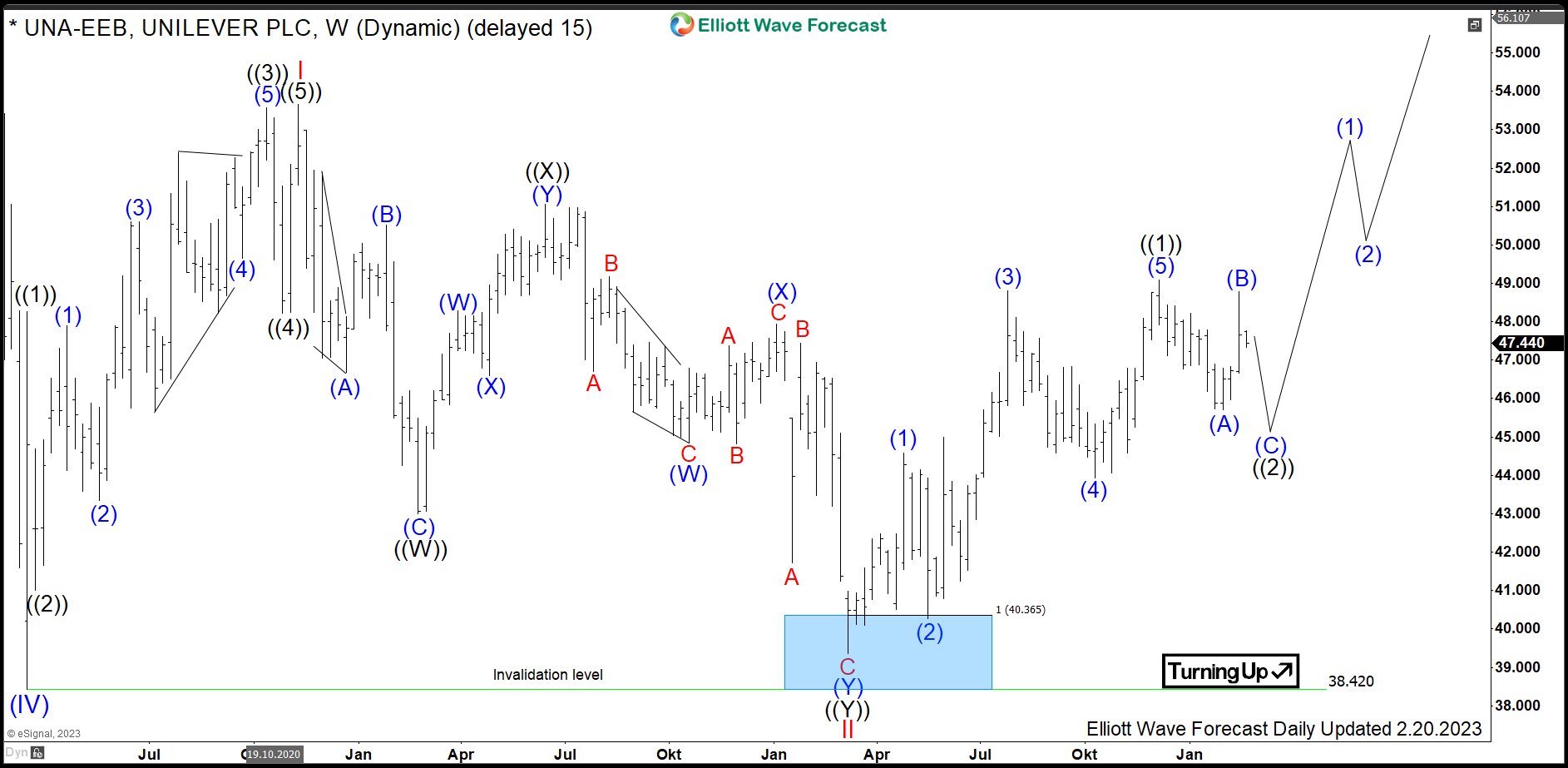

$UNA : Unilever Stock Reacting from Weekly Bluebox

Read MoreUnilever is a multinational consumer goods corporation. Unilever products include food, condiments, ice cream, coffee, cleaning agents, pet food, beauty products, personal care and more. Founded 1919 by the merger of the Dutch margarine producer Margarine Unie and the British soapmaker Lever Brothers, it is headquartered in London, UK. Unilever is a part of FTSE 100, AEX and Eurostoxx […]

-

Uranium ETF (URA) Pullback in Progress

Read MoreIn our previous article, we mentioned that Uranium ETF (ticker URA) has ended correction to the cycle from 2020 low and ready to resume higher. In this article, we will update the outlook for the ETF. We see the commodity complex forming a high on early February 2023 and pulling back. We see further pullback […]