The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P 500 E Mini Futures (ES) Advance in Wave 5 Rally

Read MoreS&P 500 E-Mini Futures (ES) is looking to extend higher in final wave (5). This article and video look at the Elliott Wave path.

-

SPDR Financial Sector $XLF Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of SPDR Financial Sector ($XLF) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. 5 […]

-

Nikkei Futures (NKD) Reach Historic Highs, Extending Bullish Rally

Read MoreNikkei Futures (NKD) has reached all-time high suggesting the trend remains bullish. This article and video look at the Elliott Wave path.

-

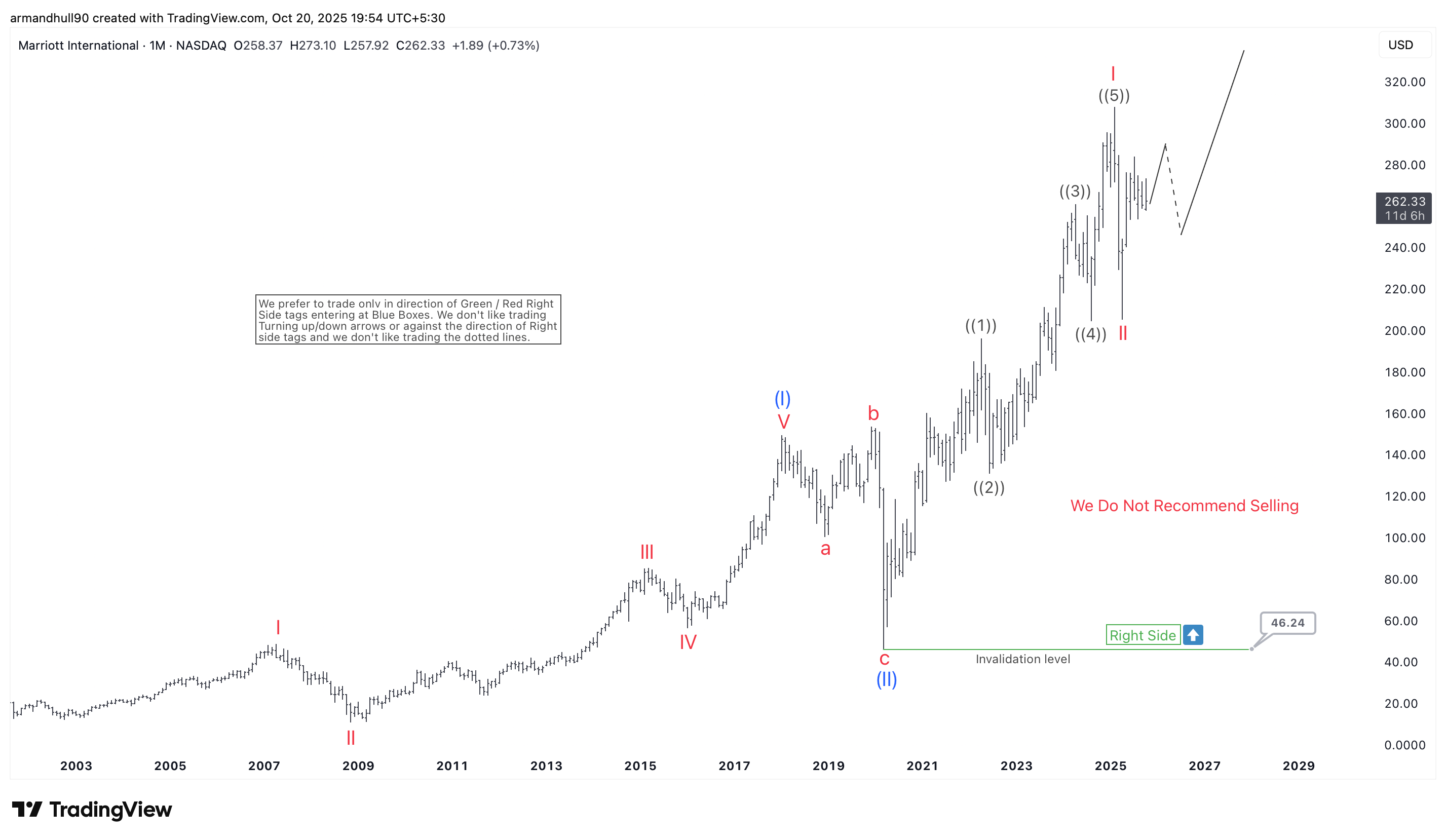

Marriott International (MAR) Elliott Wave Analysis: Strong Bullish Outlook Ahead

Read MoreMarriott International Inc. (NASDAQ: MAR) shows a strong long-term bullish setup based on Elliott Wave analysis. The monthly chart indicates that the company has finished a major correction and started a new upward cycle. The structure suggests that Marriott may continue rising in the coming years as global travel demand stays strong. The rally from […]

-

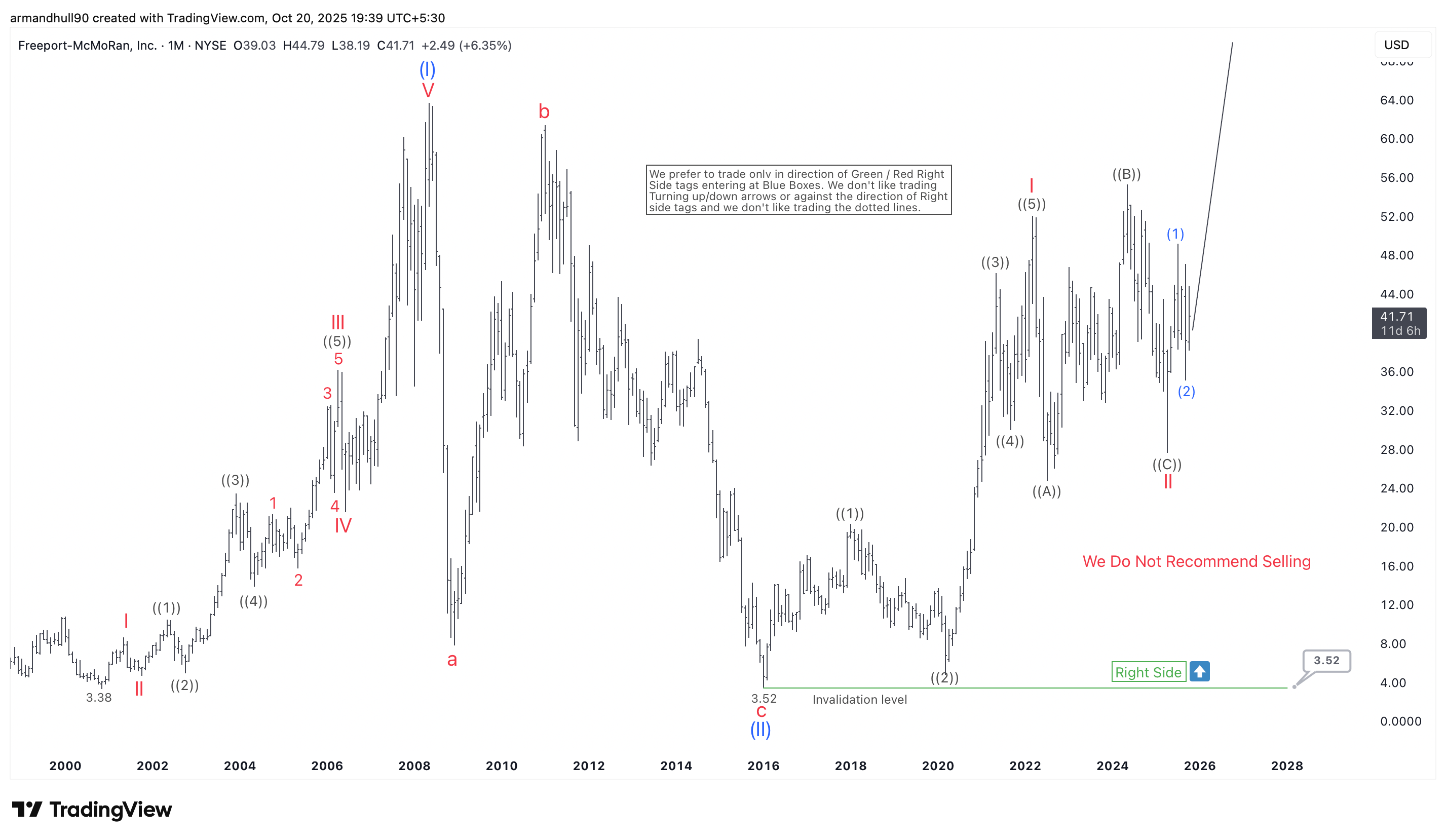

Freeport-McMoRan (FCX) Elliott Wave Analysis: Copper Giant Poised for a Powerful Long-Term Rally

Read MoreElliott Wave structure of Freeport-McMoRan (NYSE: FCX) suggests the completion of a major correction and the beginning of a new bullish cycle, supported by rising global copper demand and strong market momentum. Freeport-McMoRan Inc. (NYSE: FCX), one of the world’s leading copper producers, continues to display a strong bullish structure in the long term. According […]

-

Core Scientific (NASDAQ: CORZ) Enters Bullish Phase

Read MoreCore Scientific Inc. (NASDAQ: CORZ) stands as a dominant force in the North American Bitcoin mining sector, operating one of the largest and most efficient infrastructures. As the digital asset ecosystem rallies, CORZ has emerged as a top performer, confirming a powerful bullish regime for the entire mining segment. Today, we analyze the precise Elliott […]