The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

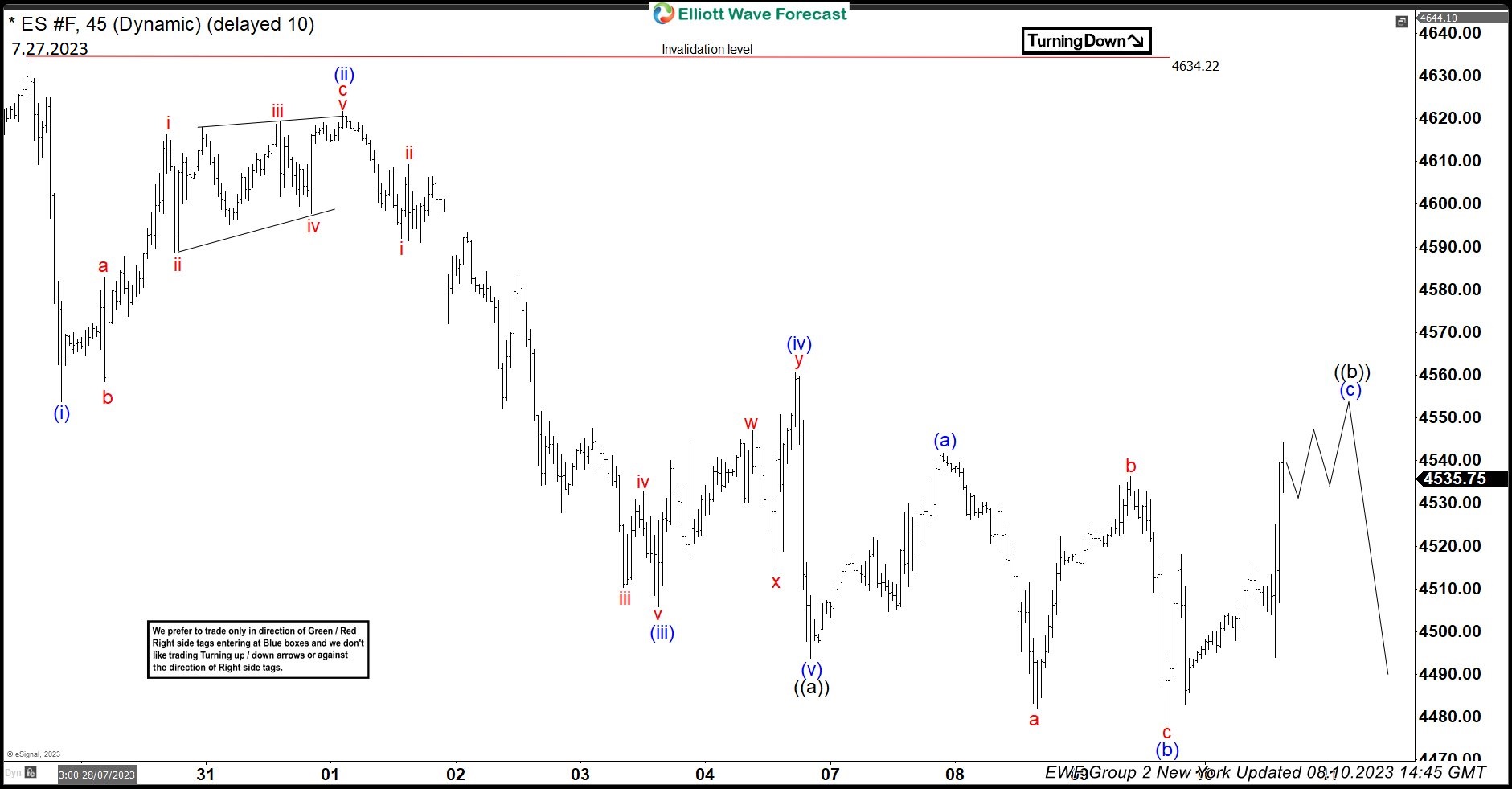

ES_F: Forecasting The Decline In A ZigZag Elliott Wave Structure

Read MoreES_F (E-mini S&P 500) dropped from 4634.50 to 4350 from 7.27.2023 to 8.18.2023. This decline took the form of a zigzag Elliott wave structure. Today, we will take a look at the structure of the decline from 7.27.2023 peak and how we spotted this zigzag structure and forecasted another leg lower in ES_F. Elliott Wave […]

-

Cameco (CCJ) Consolidation Resolve to the Upside

Read MoreCameco Corporation (ticker symbol: CCJ) is a prominent Canadian uranium mining company headquartered in Saskatoon, Saskatchewan. Founded in 1988, Cameco has established itself as one of the world’s largest and most respected uranium producers. The company is involved in all stages of the uranium mining process, from exploration and mining to refining and marketing. We […]

-

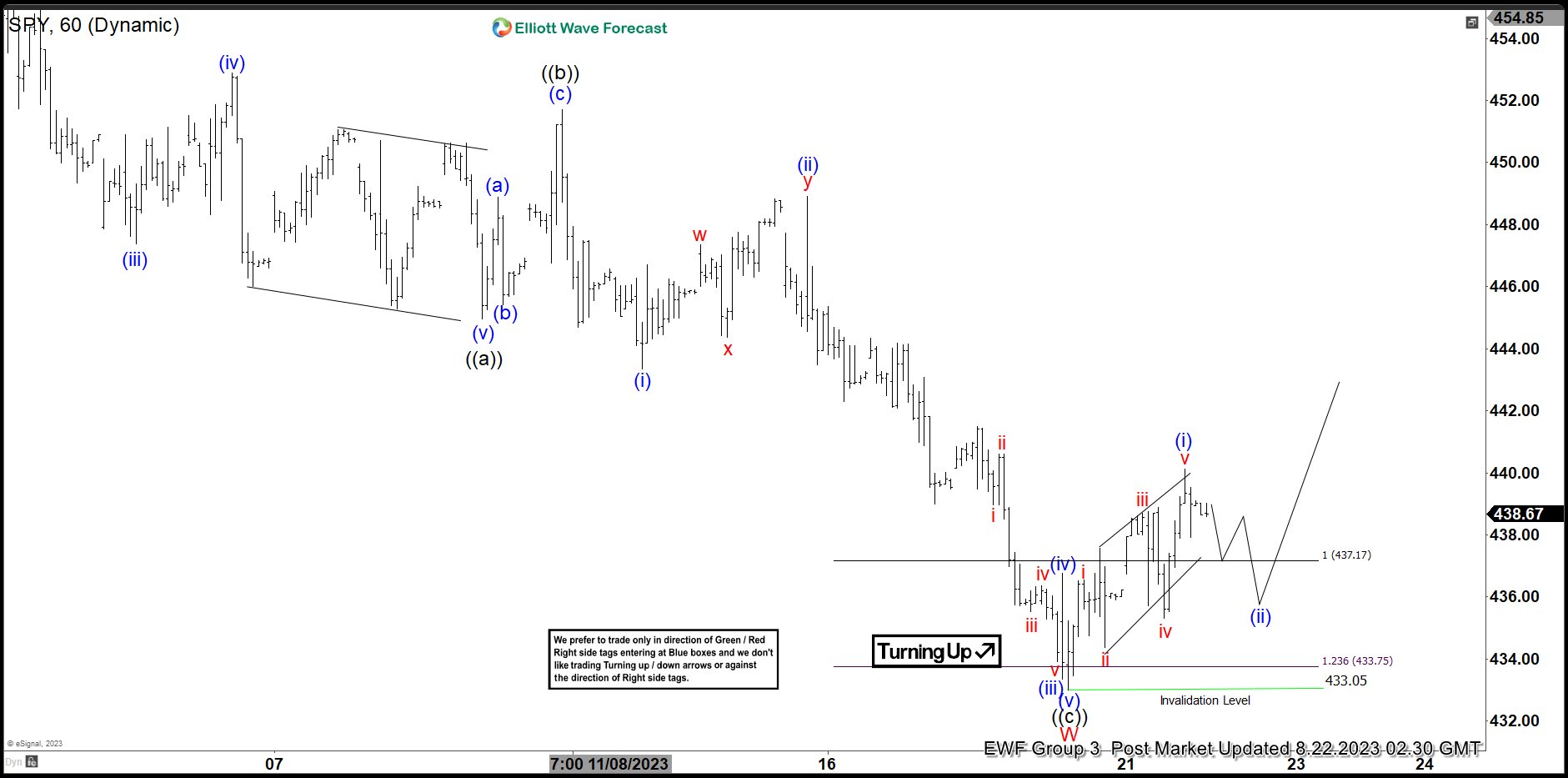

SPY Likely to Extend Correction in Double Three Structure

Read MoreSPY is correcting cycle from March 2023 low as a double three and rally can fail in 3 or 7 swing. This article & video look at the Elliott Wave path.

-

HCA Healthcare (HCA) Favors Pullback Providing Another Opportunity

Read MoreHCA Healthcare, Inc., (HCA) provides health care services company in the United States. The company operates general & acute care hospitals that offers medical & surgical services, including inpatient care, intensive care, cardiac care, diagnostic & emergency services & outpatient services. It is based in Tennessee, comes under Healthcare (XLV) sector & trades as “HCA” […]

-

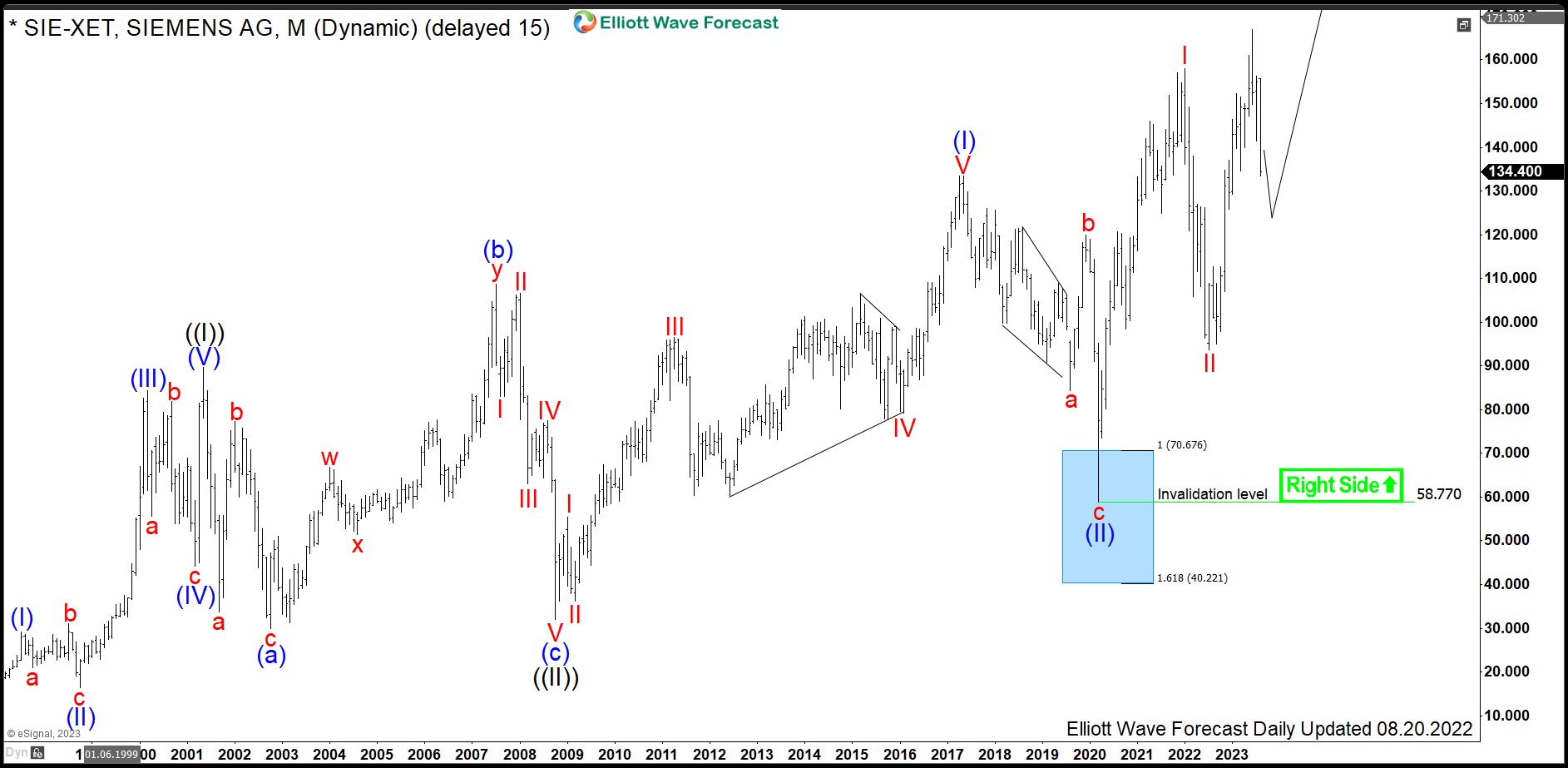

$SIE: Join the Siemens Rally in a Pullback from All-Time Highs

Read MoreSiemens SE is a German multinational conglomerate company and by revenue the largest industrial manufacturing enterprise in Europe. Company’s principal business divisions are Industry, Energy, Healthcare, Infrastructure & Cities. Founded in 1847 and headquartered in Munich, Germany, the company employs approx. 385’ooo people worldwide. Siemens is a part of both DAX40 and of SX5E indices. […]

-

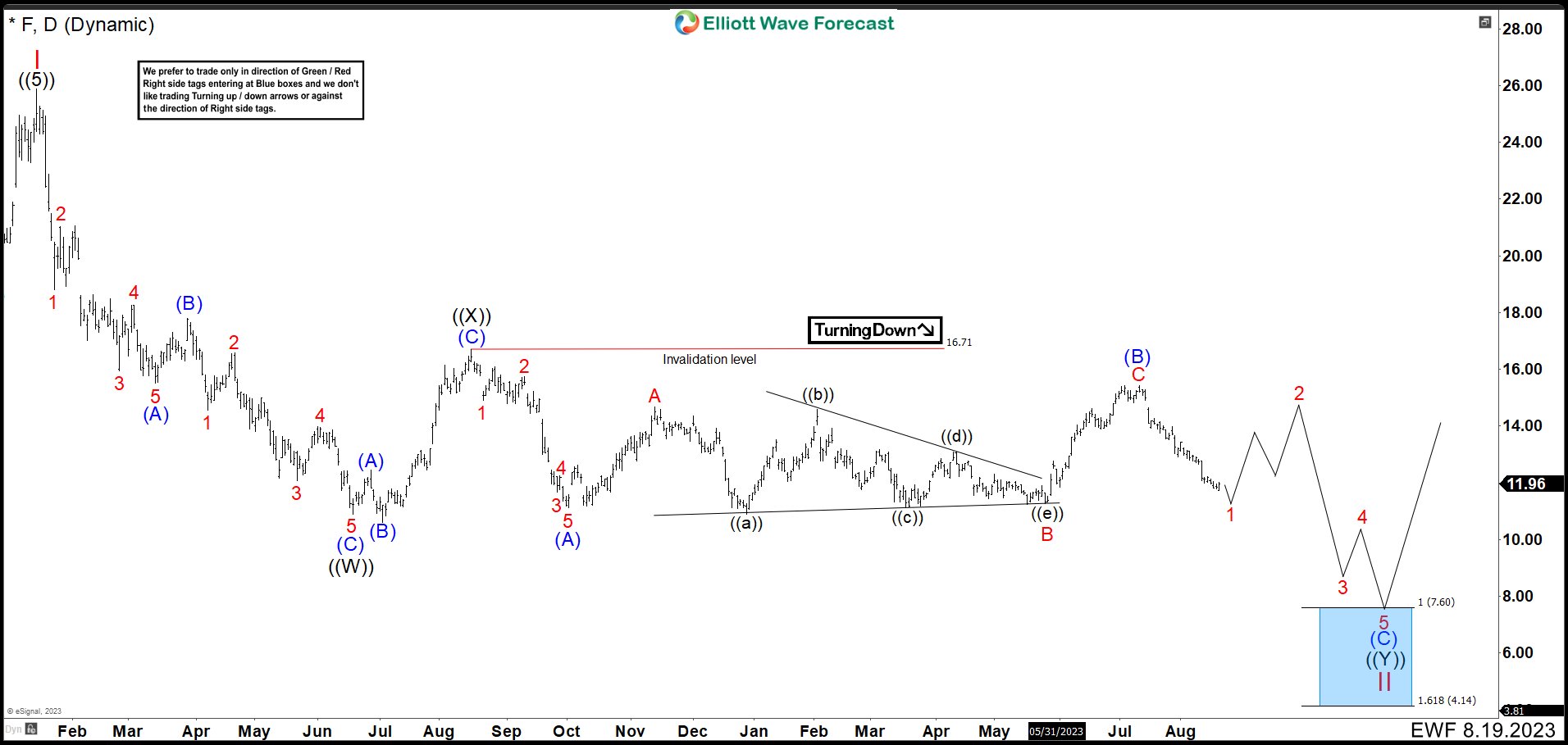

Ford (F) Should Resume Lower After Sideways Movement Ends

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD (F) Daily Chart March 2023 Last update in March, we can saw that Ford (F) price remained sideways creating a triangular […]