The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Gold Miners Junior (GDXJ) Looking to End Flat Correction

Read MoreGDXJ, short for VanEck Vectors Junior Gold Miners ETF, is an exchange-traded fund (ETF) that focuses on providing exposure to junior companies involved in the exploration and mining of gold and other precious metals. This ETF is designed to track the performance of small and mid-cap companies within the global gold mining industry. The ETF […]

-

IONQ Favors Corrective Pullback Before Rally Continue

Read MoreIONQ Inc., (IONQ) engages in the development of general-purpose quantum computing systems in the US. It sells the access to quantum computers of various qubit capacities. The company makes access to its quantum computers through cloud platforms, such as Amazon web services, Amazon Braket, Microsoft’s Azure Quantum & Google’s cloud marketplace. It is based in […]

-

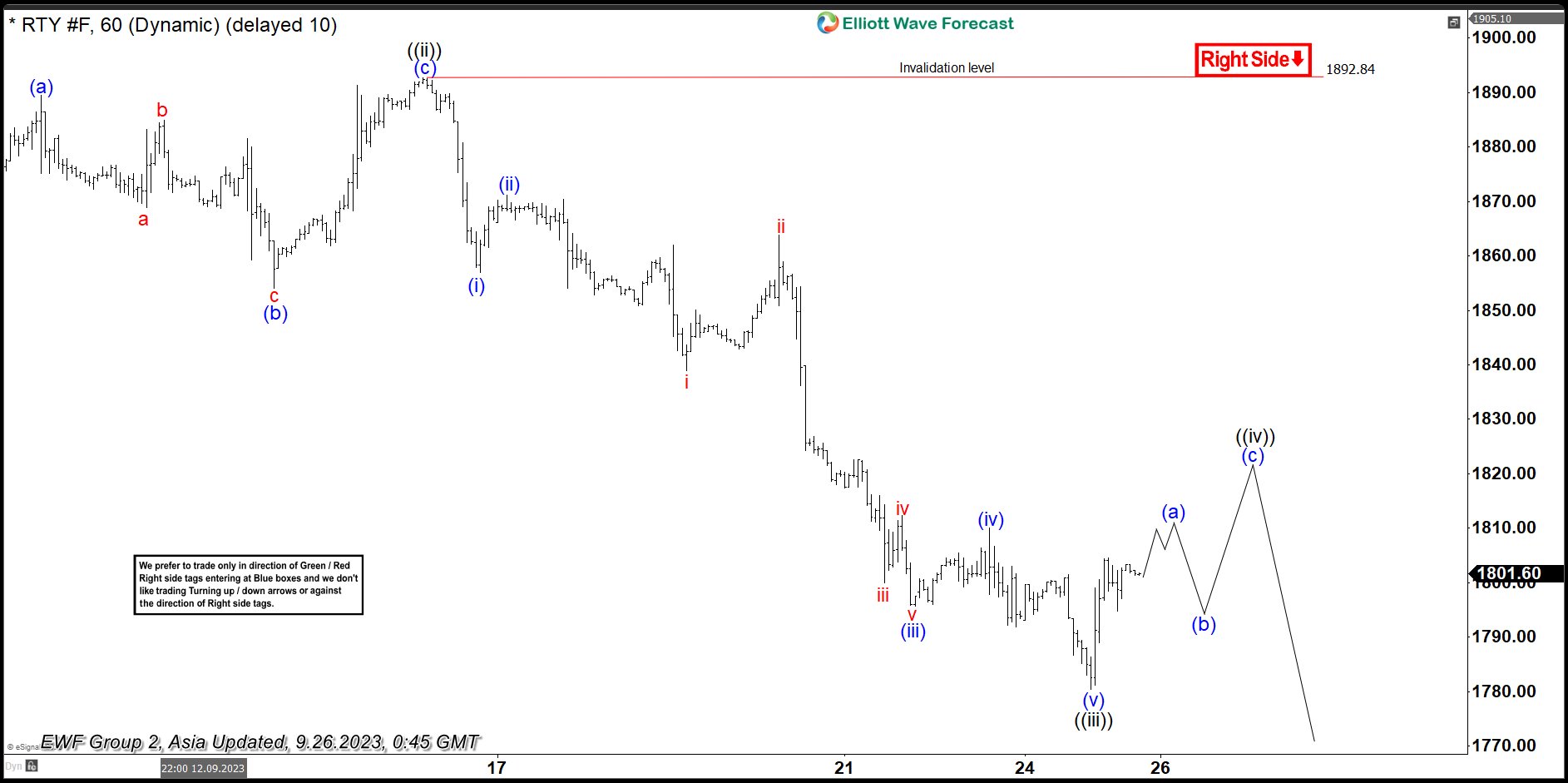

Russell 2000 (RTY) Bearish Sequence Favors Downside

Read MoreRussell 200 (RTY) shows bearish sequence from 8.1.2023 high favoring more downside. This article and video look at the Elliott Wave path.

-

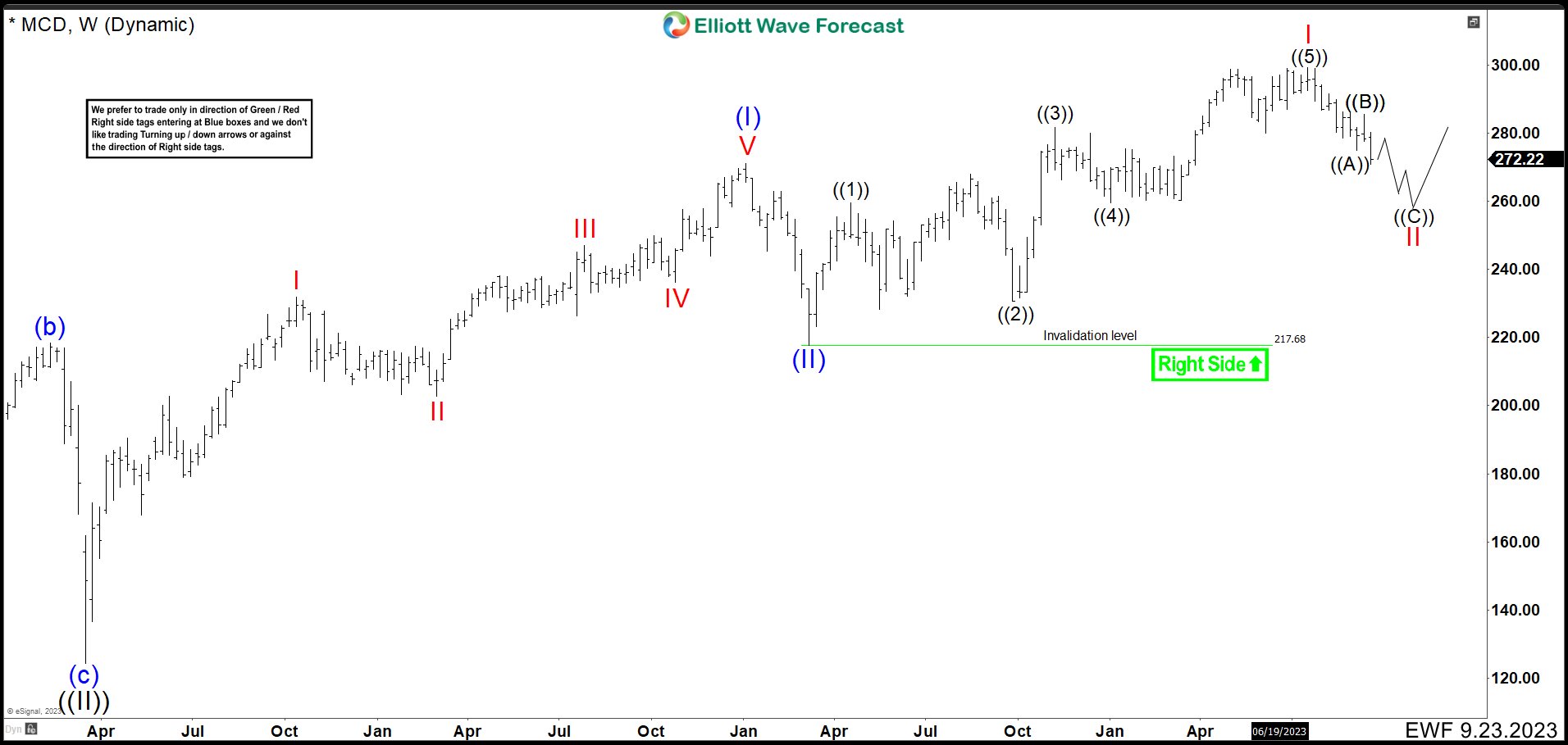

McDonald’s (MCD) Is Going To Give Us Buying Opportunities

Read MoreMcDonald’s (MCD) is the world’s largest fast food restaurant chain, serving over 69 million customers daily in over 100 countries in more than 40,000 outlets as of 2021. It is best known for its hamburgers, cheeseburgers and french fries, although their menu also includes other items like chicken, fish, fruit, and salads. McDonald’s MCD Weekly […]

-

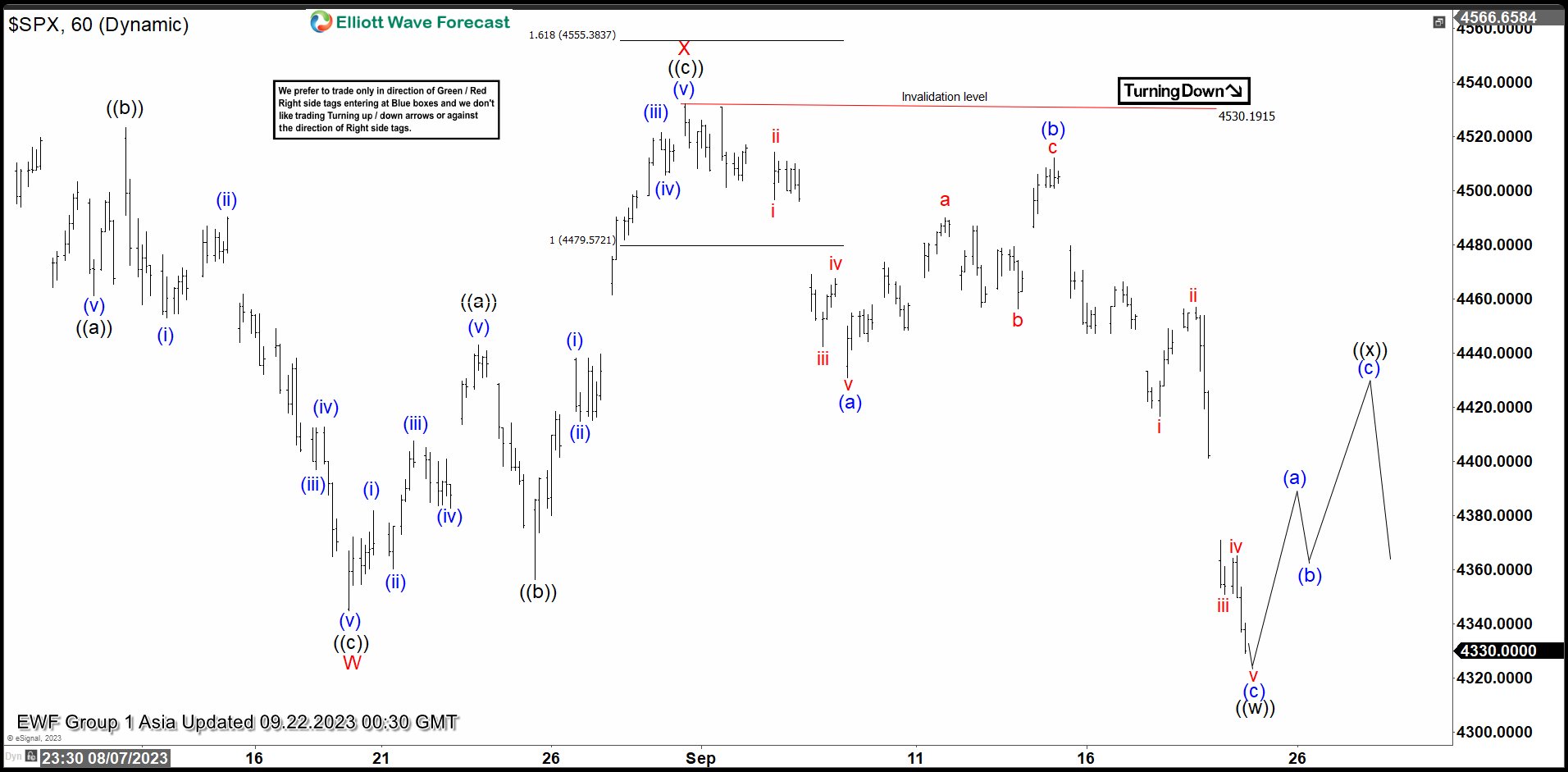

Short Term S&P 500 ($SPX) Bearish Target

Read MoreS&P 500 (SPX) shows incomplete bearish sequence favoring further downside. This article and video look at the Elliott Wave path of the Index.

-

$CLF: Cleveland Cliffs Heading for a Next Big Rally

Read MoreCleveland Cliffs, Inc. (formerly Cliffs Natural Resources) is an US American company that specializes in the mining, beneficiation, and pelletizing of iron ore, as well as steelmaking, including stamping and tooling. It is the largest flat-rolled steel producer in North America. Founded in 1847, it is headquartered in Cleveland, Ohio, USA. The stock being a component of the S&P MidCap 400 index […]