The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Uranium ETF (URA) Bullish Cycle in Progress

Read MoreGlobal Uranium ETF (URA) has started the new bullish leg for the next multiple years. This article looks at the Elliott Wave path.

-

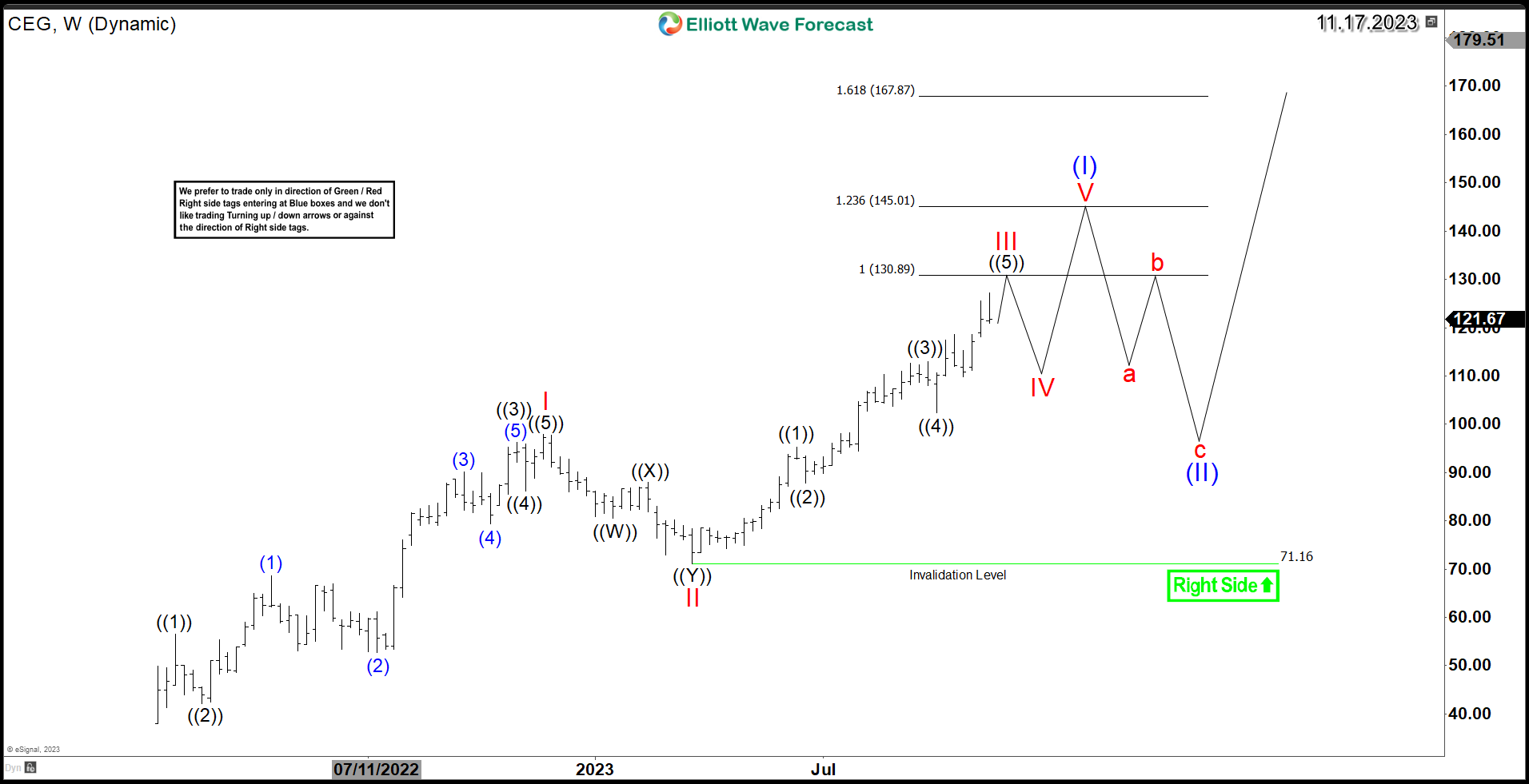

Constellation Energy (CEG) Riding the Renewable Energy Bullish Wave

Read MoreAmid the global momentum toward sustainable energy, Constellation Energy (CEG) stands out as a dynamic player in the renewable sector. In this article, we explore CEG’s recent performance, analyze its technical structure, and highlight its promising potential for further growth. Following its spinoff from Exelon Corporation (EXC) on February 1, 2022, Constellation Energy Corporation (CEG) […]

-

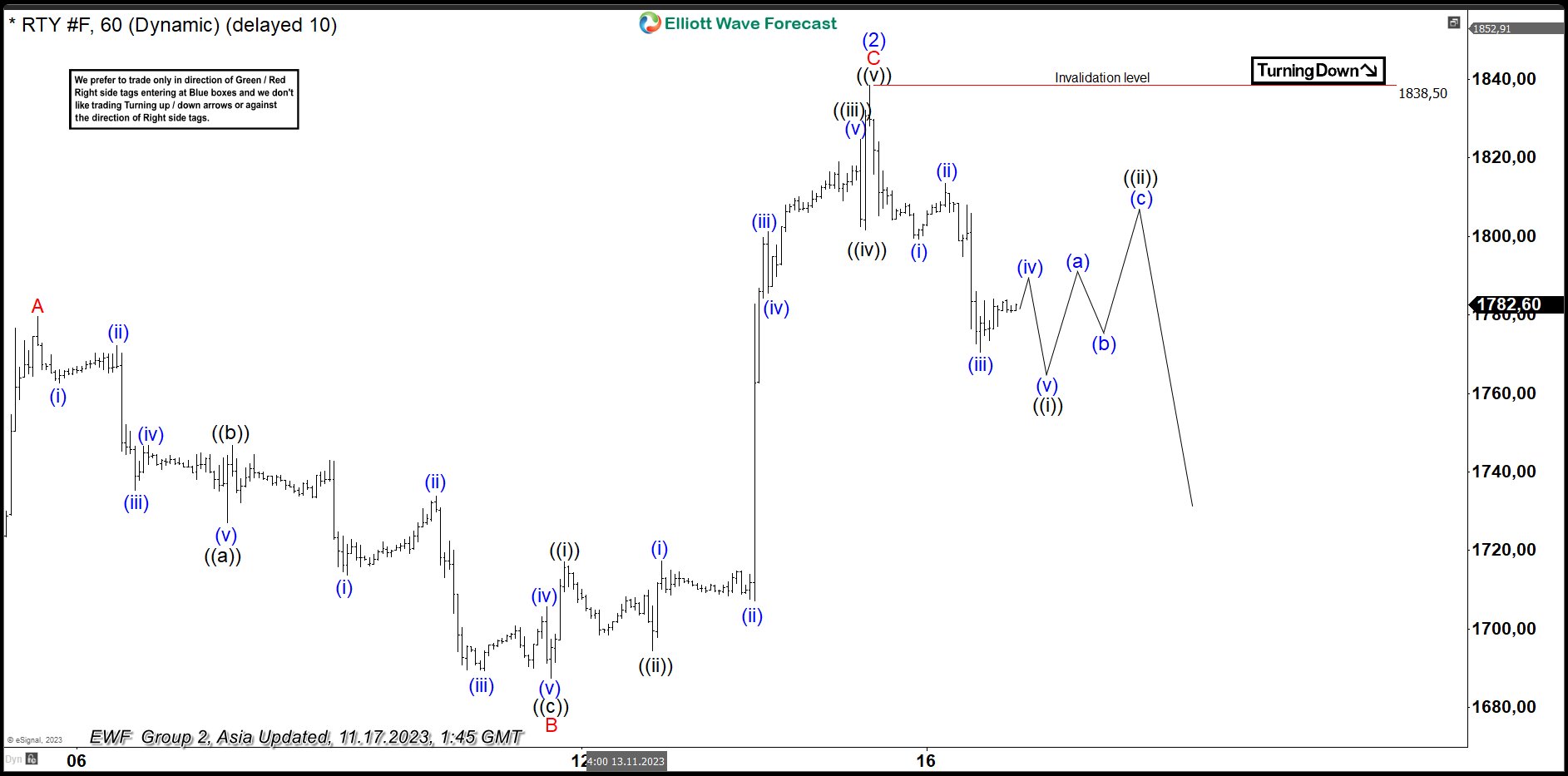

Russell 2000 Futures (RTY) Turning Lower After 3 Waves Rally

Read MoreRussell 2000 (RTY) ended 3 Waves Rally from 10.28.2023 low and turned lower. This article and video look at the Elliott Wave path.

-

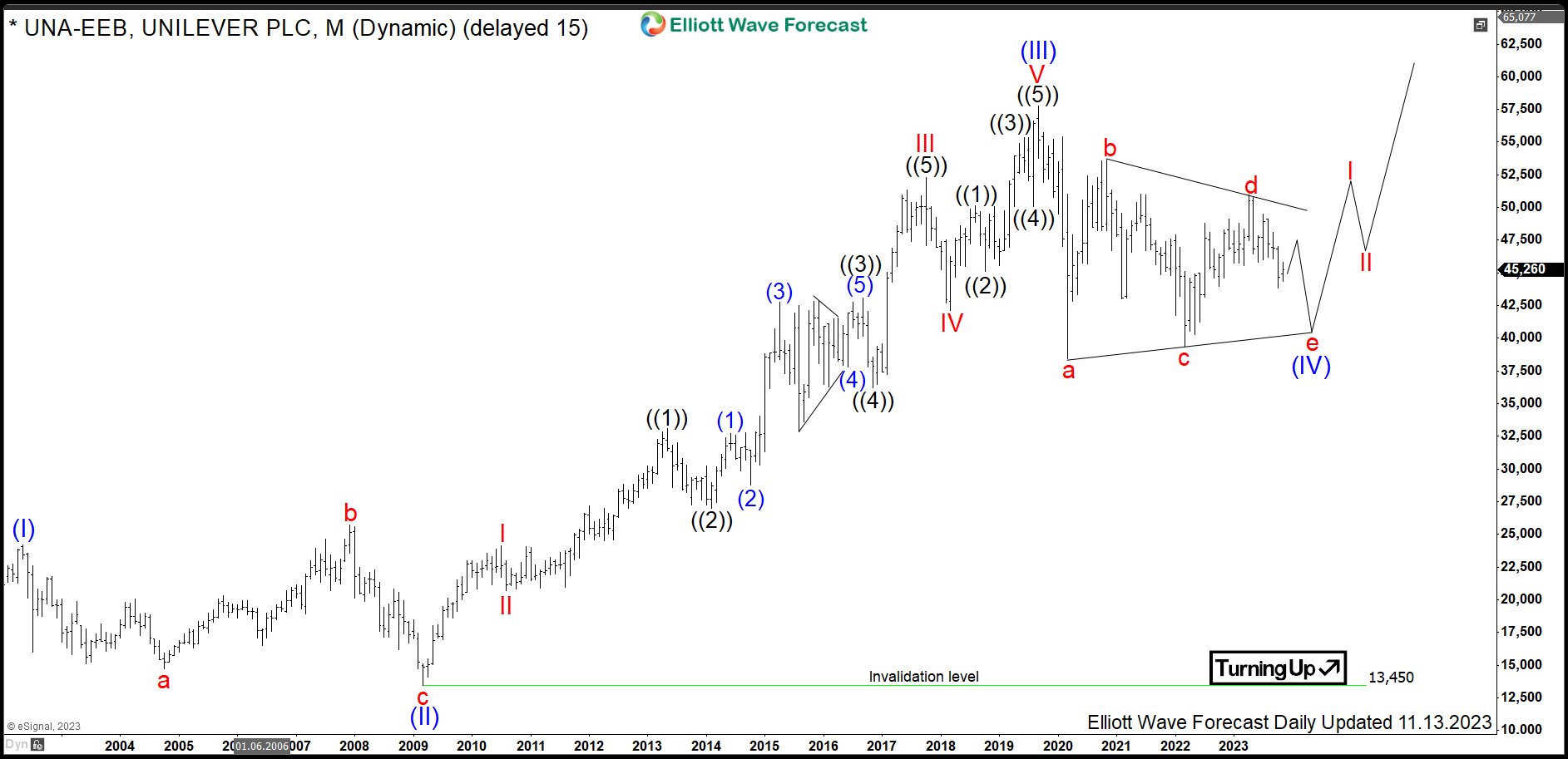

$UNA : Unilever Heading for a Thrust out of Bullish Triangle

Read MoreUnilever is a multinational consumer goods corporation. Unilever products include food, condiments, ice cream, coffee, cleaning agents, pet food, beauty products, personal care and more. Founded 1919 by the merger of the Dutch margarine producer Margarine Unie and the British soapmaker Lever Brothers, it is headquartered in London, UK. Unilever is a part of FTSE 100, AEX and Eurostoxx […]

-

Nifty Producing Strong Reaction Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Nifty charts. The index produced a strong reaction higher from blue box area.

-

Tesla Inc. ($TSLA) Reacting Higher From Another Extreme Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Tesla Inc. ($TSLA). The rally from 10.31.2023 low unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings (ABC) and find buyers again. We will explain the structure & […]