The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

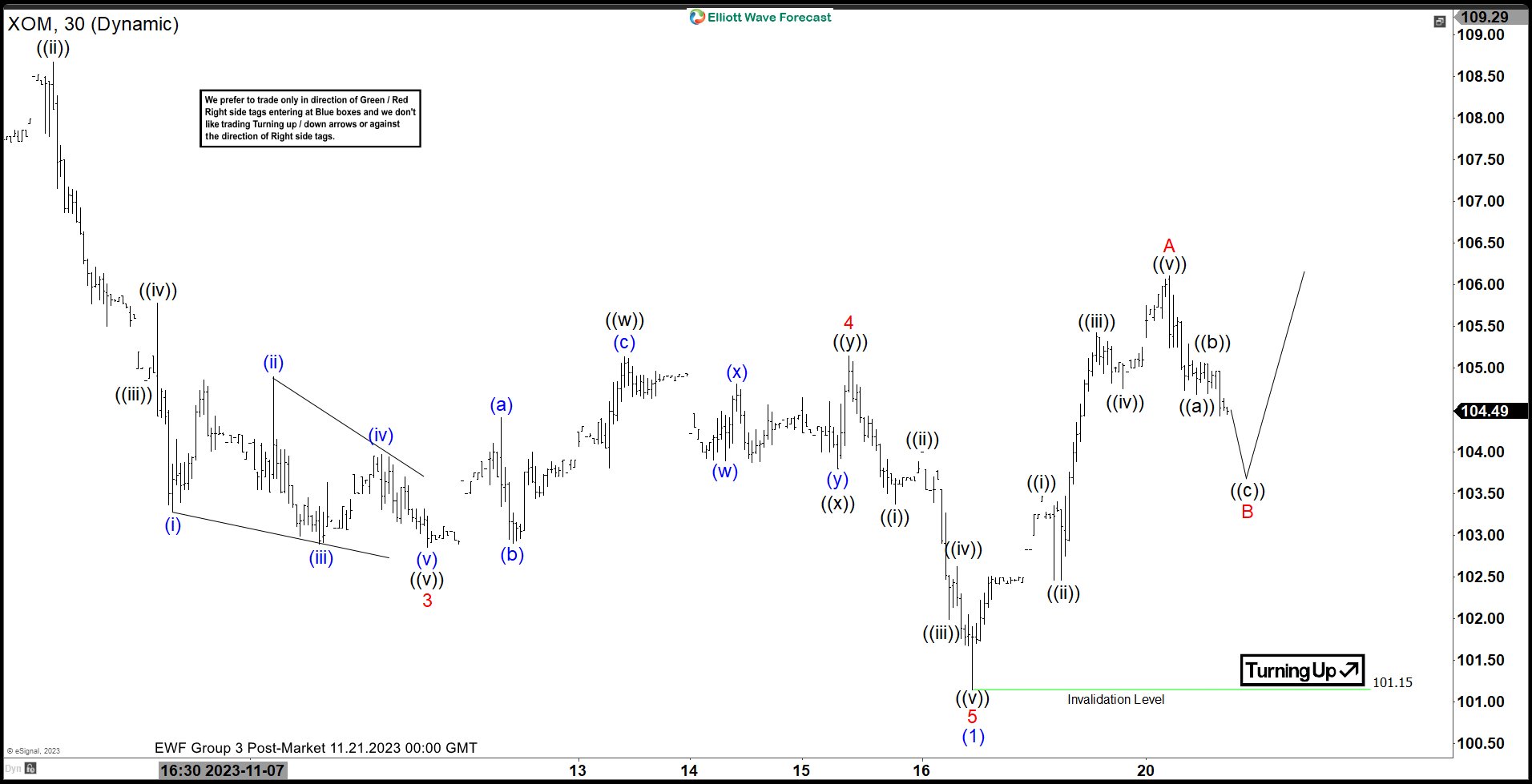

Exxon Mobil Corp ($XOM) Calling the Zigzag Higher.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Exxon Mobil Corp ($XOM). The rally from 11.16.2023 low at $101.15 unfolded as a 5 wave impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]

-

The Role of Technical Analysis in Forex & Stock Market Forecasting

Read MoreKey Content: What is Technical Analysis? Key Concepts in Technical Analysis Why use Technical Analysis? Key Assumptions of Technical Analysis The Benefits of Technical Analysis The Disadvantages of Technical Analysis Technical Analysis in Forex Trading Different Types of Charts Used in Forex Technical Analysis Time Frames Used in Forex Trading Technical Analysis in Stock Trading […]

-

Cameco (CCJ) New Bullish Cycle In Progress

Read MoreCameco is one of the world’s largest uranium producers, involved in the exploration, mining, refining, and conversion of uranium for use in nuclear power generation. The company’s operations span across Canada, the United States, and Kazakhstan. Below we are updating the Elliott Wave outlook for the company. Cameco ($CCJ) Monthly Elliott Wave Chart Monthly Elliott […]

-

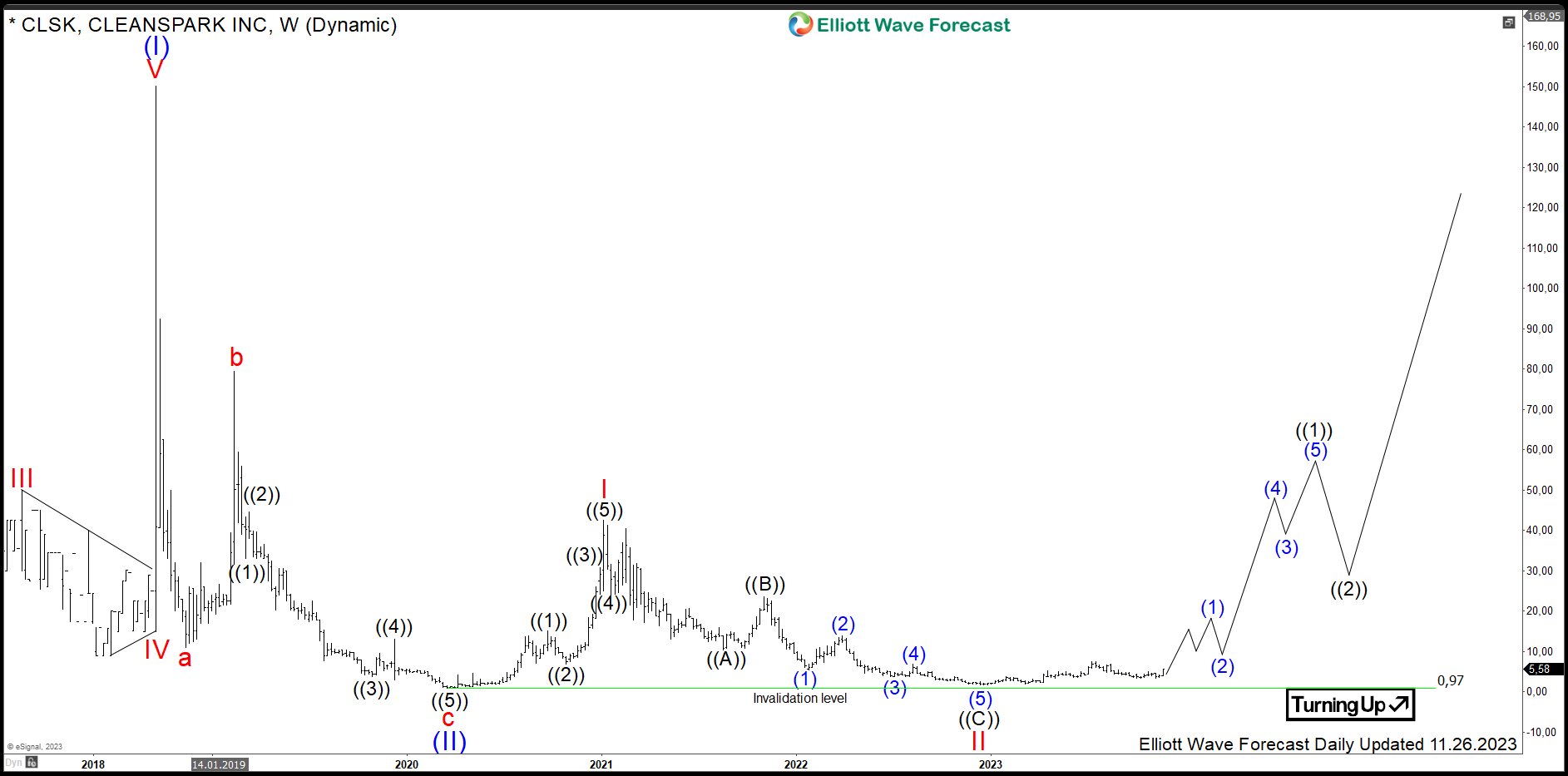

$CLSK: Bitcoin Miner Cleanspark Heading to an Acceleration

Read MoreCleanSpark, Inc. is a bitcoin mining company. The Company designs its infrastructure and data centers to support Bitcoin which is a digital commodity and a tool for financial independence and inclusion. CleanSpark serves clients in the United States. Founded 2014 and headquartered in Henderson, Nevada, US, one can trade it under ticker $CLSK at NASDAQ. […]

-

Bank of America (BAC) Bearish Sequence Provides Floor for Indices

Read MoreIn this video blog, we will look at the bearish sequence in BAC (Bank of America) and present two views that are slightly different in terms of the extent of the bounce but both are calling for an extension lower. We will also look at the area that can act as a floor for BAC […]

-

Nasdaq (NQ_F) Short Term Cycle is Mature and May See Pullback

Read MoreShort Term Elliott Wave in Nasdaq Futures (NQ_F) shows cycle from October 27, 2023 low is unfolding as a 5 waves impulse. This cycle is mature even though it still can extend higher in the shorter cycle. Up from October 27 low, wave (1) ended at 15453.75 and pullback in wave (2) ended at 15207.75. […]