The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

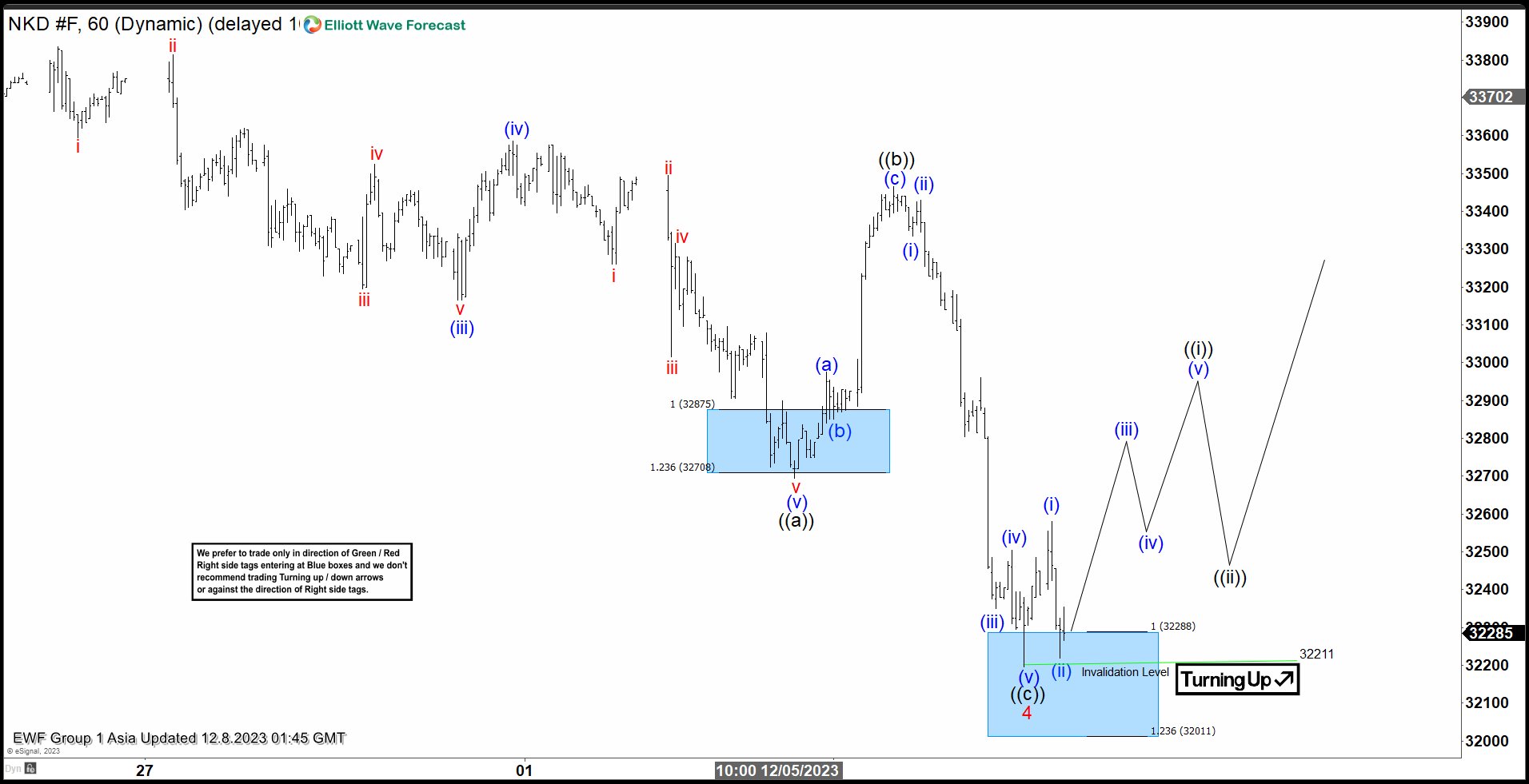

Nikkei Futures (NKD_F) Reached Support Area

Read MoreNikkei Futures (NKD) looking to continue rally from 10.4.2023 low as a diagonal. This article and video look at the Elliott Wave path.

-

Apple (AAPL) Looking to Complete Impulsive Rally

Read MoreApple (AAPL) rallies as a 5 waves impulse from 10.27.2023 low. The stock is currently ending wave 5 and the article and video show the Elliott Wave path.

-

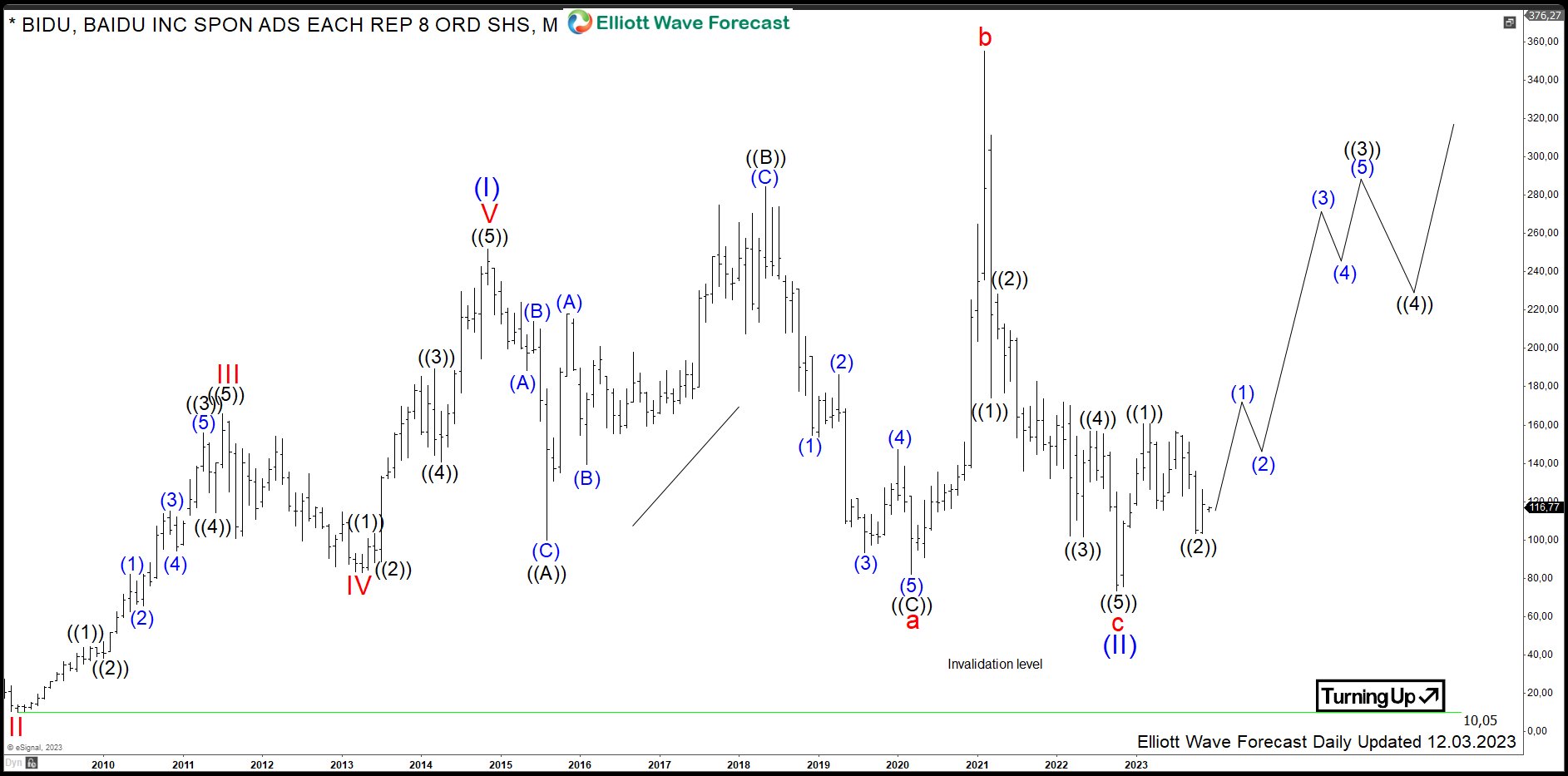

$BIDU: Tech Stock Baidu Reacting from Daily Bluebox Area

Read MoreBaidu Inc. is a Chinese multinational technology company specializing in internet related products and artificial intelligence (AI). The company offers various services, including a Chinese search engine, mapping service called Baidu Maps, an online encyclopedia Baidu Baike, a cloud storage service Baidu Wangpan and more. Founded 2000, it is headquartered in Haidian District, Beijing, China. International investors can trade it under the ticker $9888 […]

-

Coinbase Global (NASDAQ: COIN) Bullish Cycle In Progress

Read MoreCoinbase Global (NASDAQ: COIN) went public on April 14, 2021 with its Initial Public Offering (IPO) and the stock reached its peak on the same day. Subsequently, the cryptocurrency sector was hit hard by the bear market, causing COIN to lose 90% of its value over the following 21 months . Since the beginning of this year, Coinbase has shown an […]

-

Costco Wholesale (COST) Continues Further upside & Remain Supported

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private label products in the range of merchandise categories. It also operates e-commerce websites in the US, […]

-

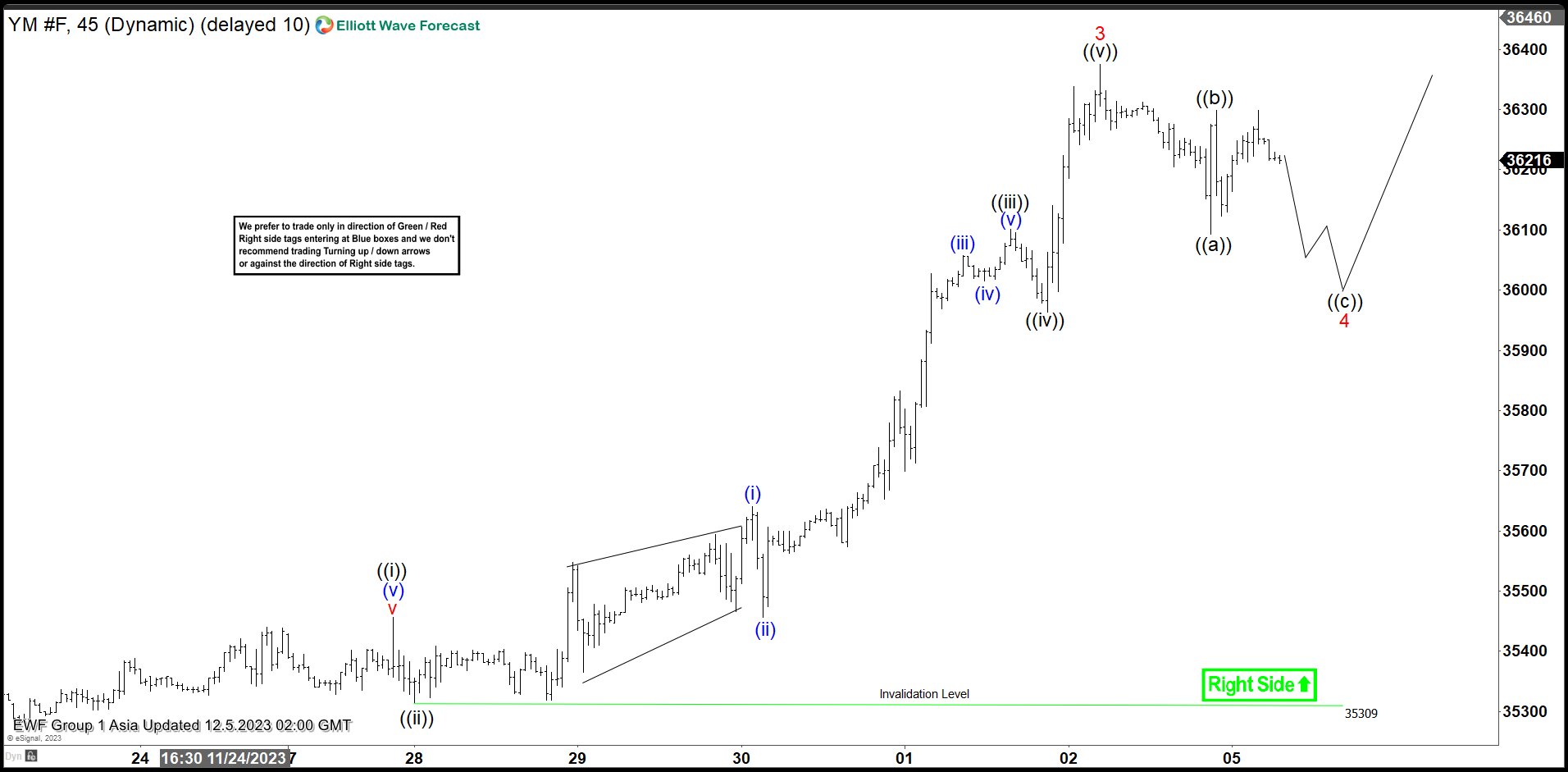

Dow Futures (YM_F) Sequence Remains Bullish

Read MoreDow Futures (YM_F) shows incomplete sequence from 10.3.2022 low favoring more upside. This article and video look at the Elliott Wave path.