The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

IBEX Elliott Wave Analysis – Perfect Reaction from Equal Legs Area

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave charts of IBEX index . As our members know, IBEX has been showing impulsive bullish sequences in the cycle from the August 13739.3 low, pointing to further strength ahead. We have been calling for a rally in IBEX. Recently we got an intraday […]

-

Elliott Wave Flags More Gains for AMD

Read MoreAdvanced Micro Devices (AMD) made an all-time high in impulsive structure. This article and video look at the Elliott Wave path.

-

S&P 500 ETF $SPY Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of S&P 500 ETF ($SPY) through the lens of Elliott Wave Theory. We’ll review how the rally from the October 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. 5 […]

-

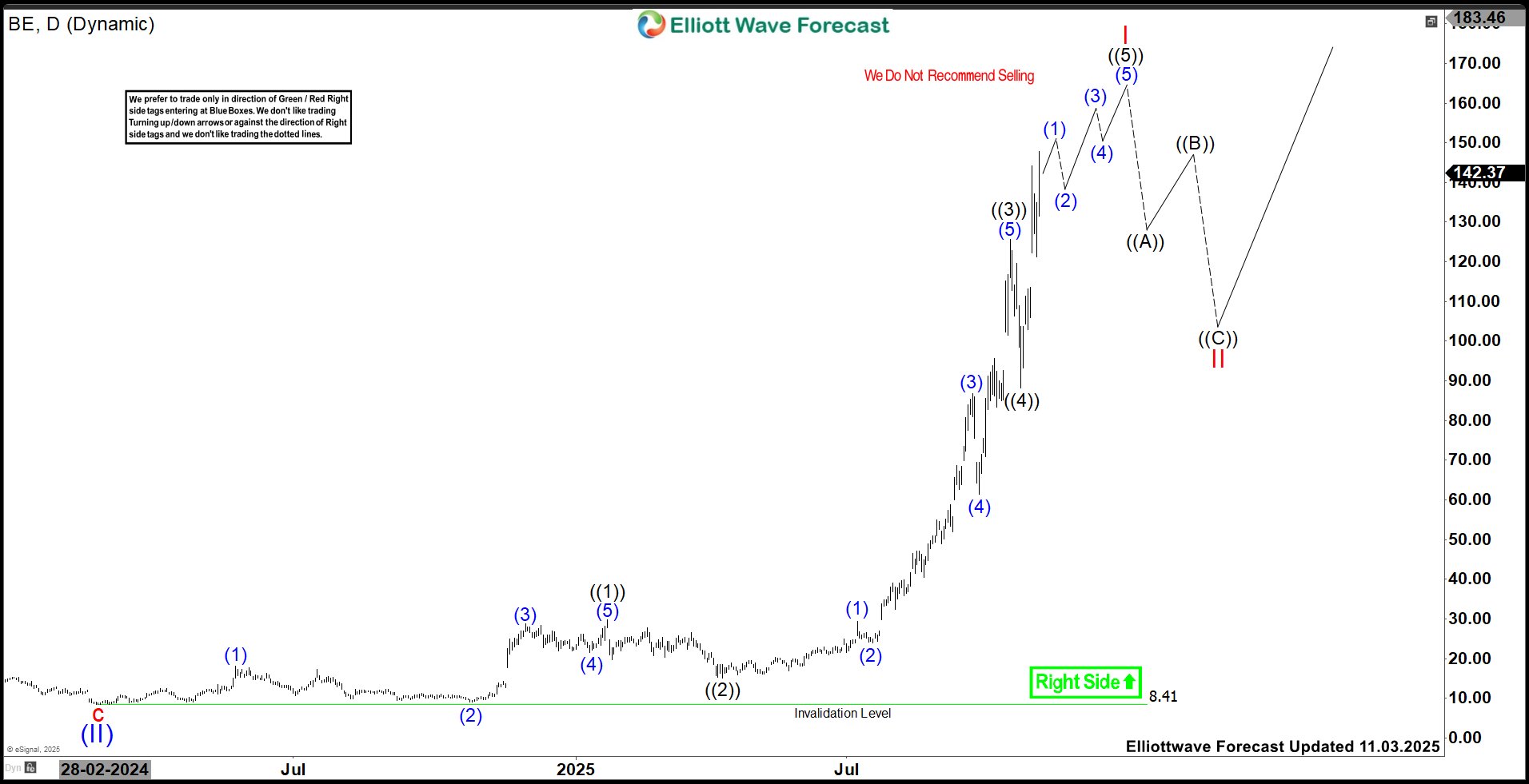

Bloom Energy (BE) Expects Rally Between 160.6 – 205.4

Read MoreBloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity. It comes under Industrials sector & trades at “BE” ticker at NYSE. BE […]

-

AppLovin Corporation (NASDAQ: APP) Bullish Surge

Read MoreAppLovin Corporation (NASDAQ: APP) operates a leading marketing platform that fuels mobile app growth through advanced AI and machine learning. The company has demonstrated exceptional performance, with its stock breaking decisively into new high territory and confirming a powerful bullish trend. Today, we analyze the Elliott Wave structure behind this impressive breakout. Our technical blueprint outlines […]

-

Elliott Wave Outlook: Pan American Silver (PAAS) Pullback Offers Buying Opportunity

Read MorePan American Silver (PAAS) shows a bullish sequence and should continue to extend higher. This article and video look at the Elliott Wave path.