The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

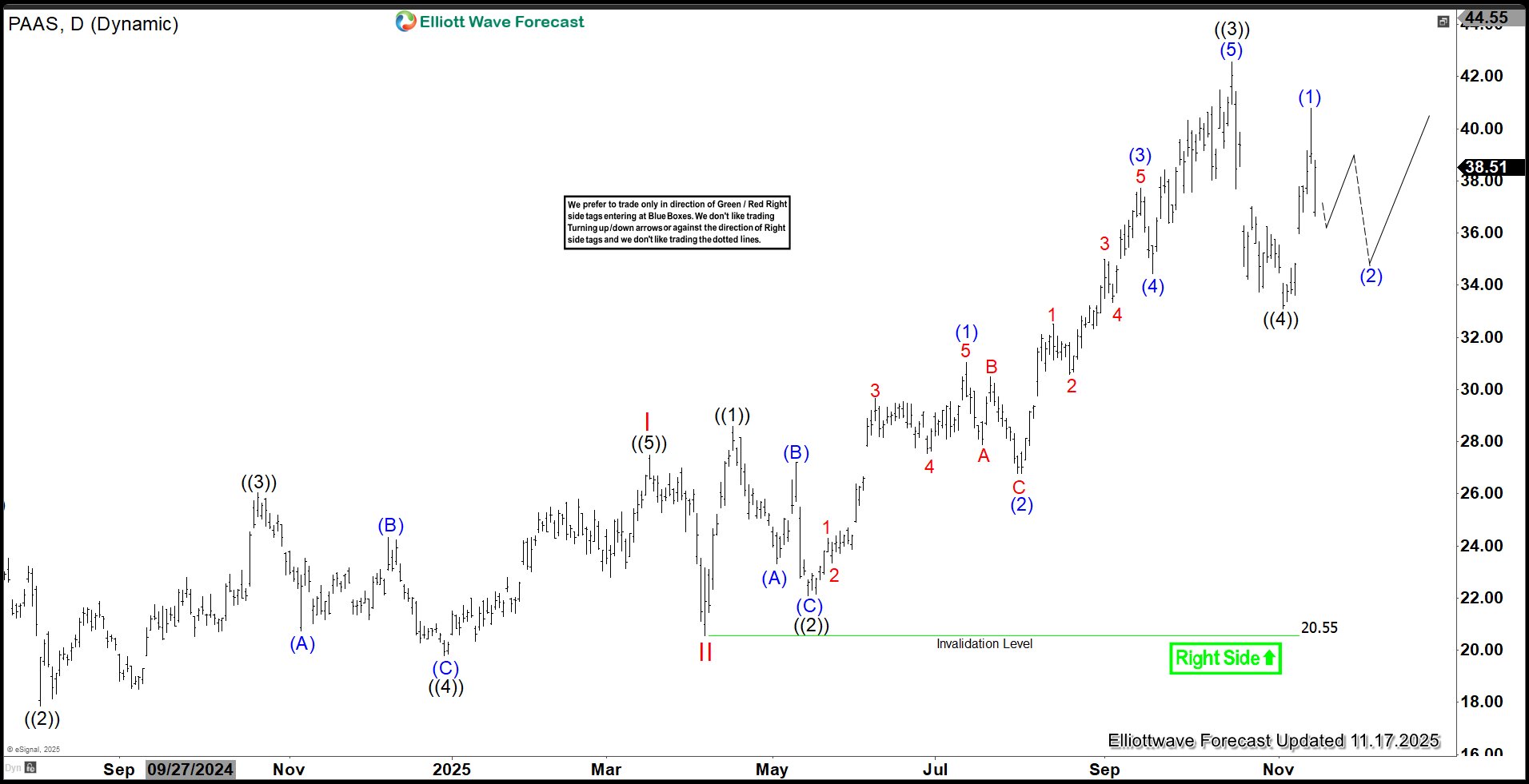

Elliott Wave: PAAS to Resume Higher in Wave ((5)), Targeting $44.8

Read MorePan American Silver (PAAS) is looking to extend higher within wave ((5)). This article and video look at the Elliott Wave path.

-

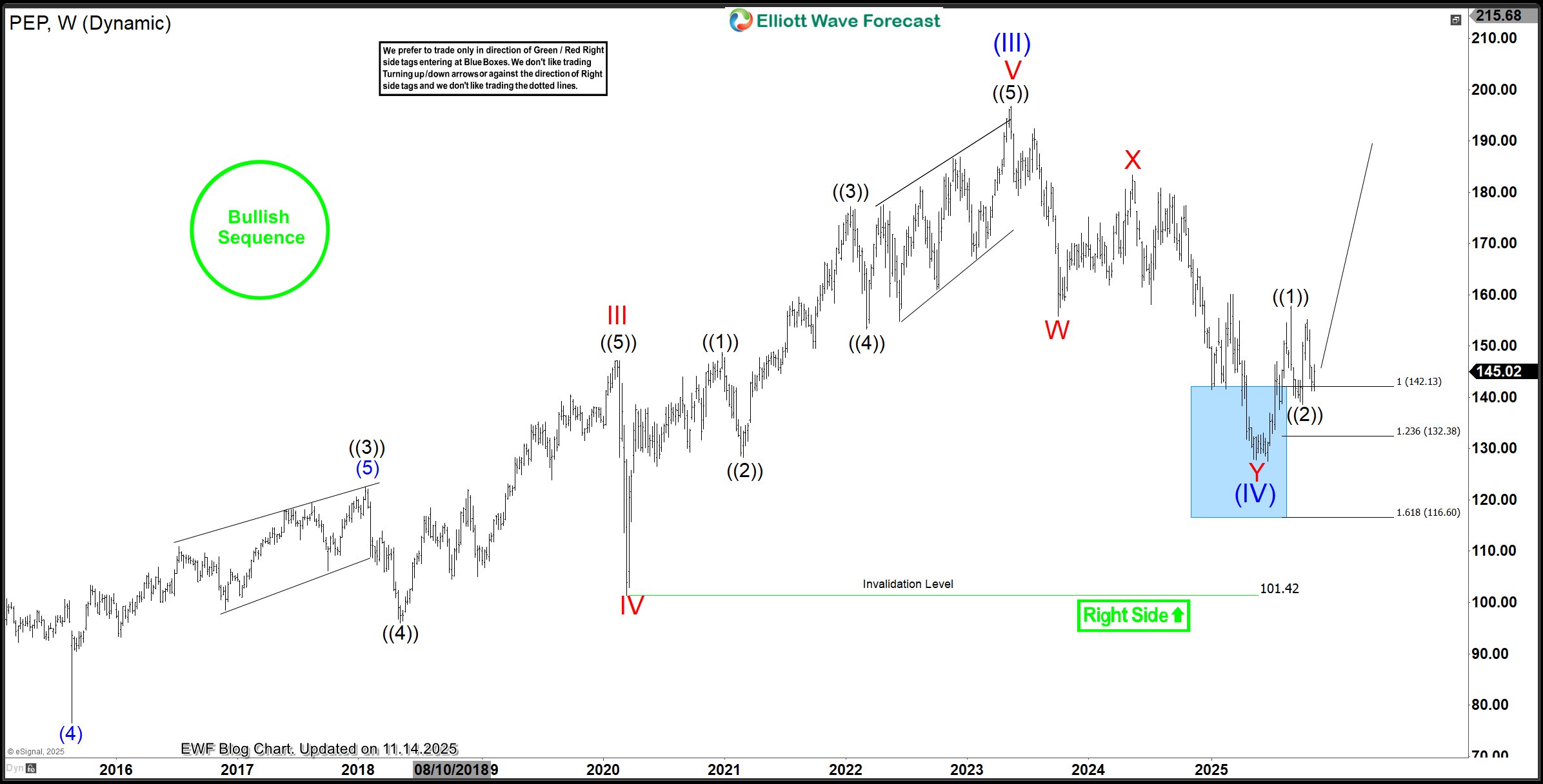

PepsiCo Analysis: Elliott Wave Signals a Possible Rally Toward $215

Read MorePepsiCo appears to have completed the bearish cycle from May 2023. In the coming weeks, price action that supports a new bullish cycle, leading to a new high, could emerge. Meanwhile, in the previous forecast on this stock, we highlighted a high probability buying zone, using the blue box. In this post, we will discuss […]

-

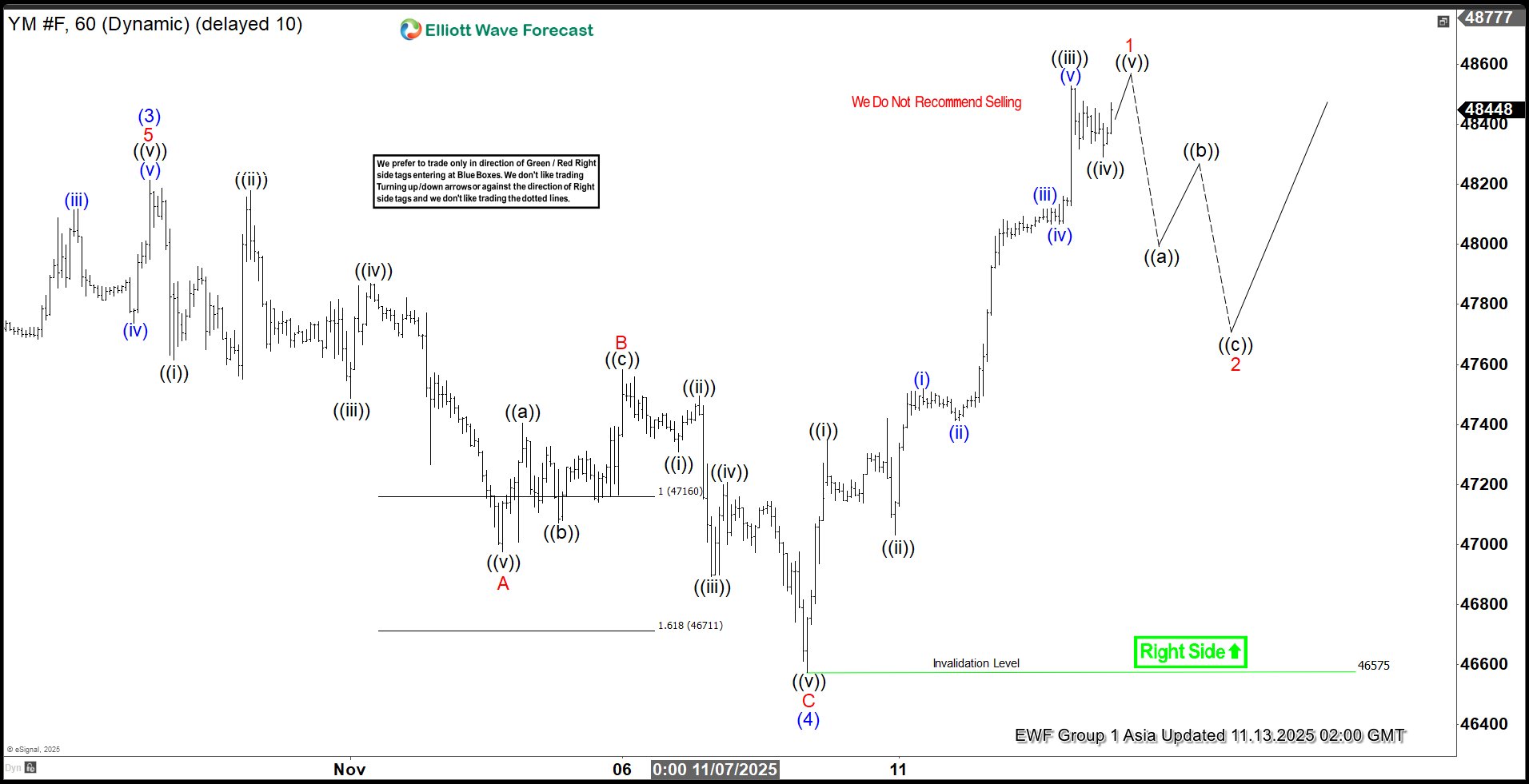

Dow Futures (YM) Breaks Record : Five Waves Elliott Wave Impulse in Sight

Read MoreDow Futures (YM) breaks to new all-time high and should extend higher within impulse structure. This article and video look at the Elliott Wave path.

-

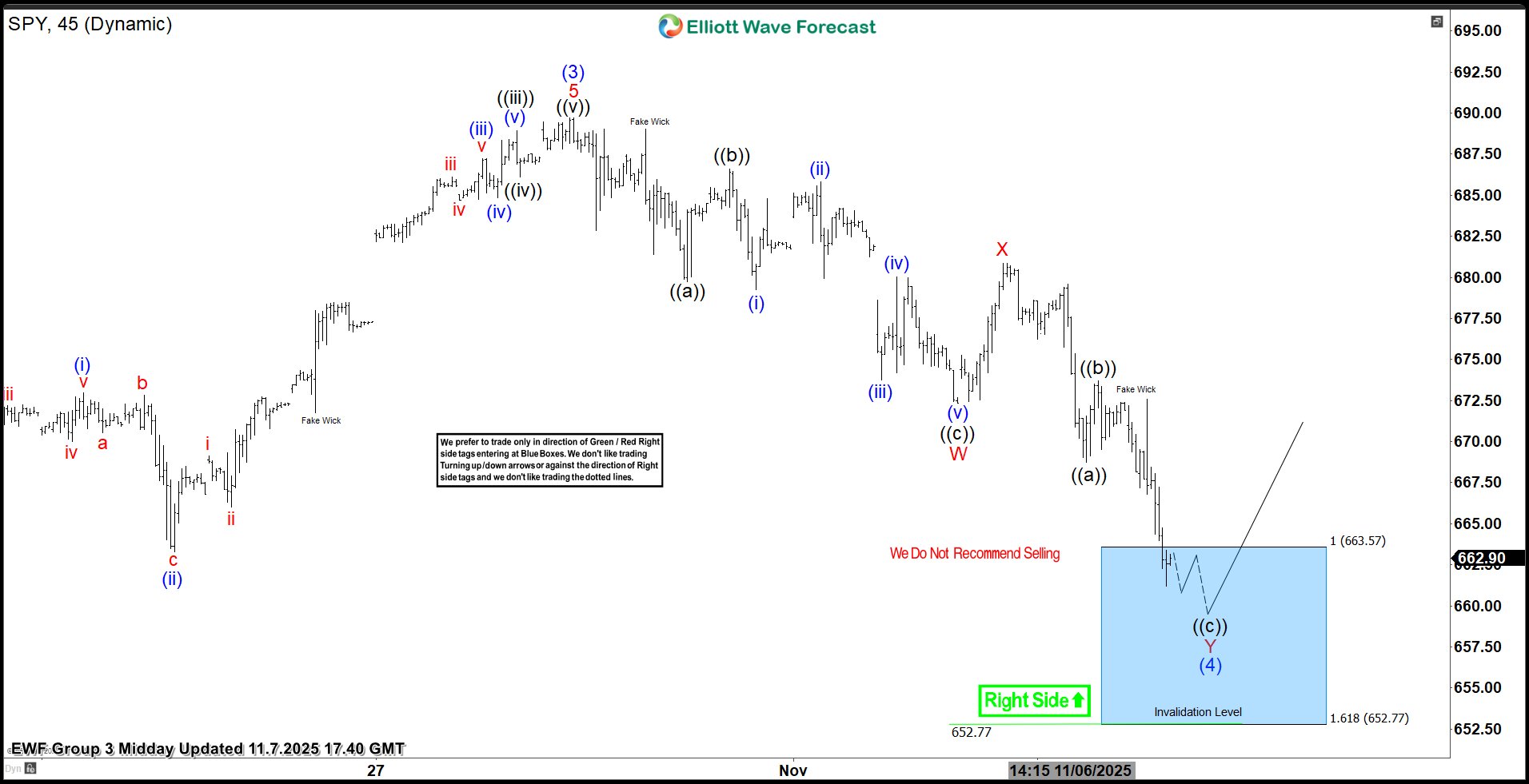

S&P 500 ETF SPY Elliott Wave Trading Setup Explained

Read MoreHello fellow traders ! As our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in S&P 500 ETF. SPY has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. […]

-

Elliott Wave Analysis of Nasdaq (NQ) Forecasts New All Time High, Targeting at Least 26793

Read MoreNasdaq (NQ) has ended correction in wave (4) and turned higher aiming for new high. This article and video look at the Elliott Wave path.

-

MicroStrategy (MSTR) Bearish Shift: The Case for Further Weakness

Read MoreStrategy Inc (NASDAQ: MSTR), formerly known as MicroStrategy, remains Bitcoin’s largest corporate holder. However, a stark divergence has emerged throughout 2025. While Bitcoin consistently notches new all-time highs, MSTR stock displays persistent weakness and failing momentum. This disconnect signals underlying technical damage. Today, we analyze the bearish Elliott Wave sequence explaining this underperformance. Our analysis […]