The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

VanEck Gold Miners ETF ( $GDX ) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of VanEck Gold Miners ETF ($GDX) . The rally from 2.28.2024 low at $25.66 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]

-

Chevron (CVX) Still in Expanded Flat Correction

Read MoreChevron Corporation (CVX) is one of the world’s largest integrated energy companies, engaged in all aspects of the oil and natural gas industry. Headquartered in San Ramon, California, Chevron operates in various segments including exploration and production, refining, and marketing. The company’s operations span across multiple continents, with significant assets in the United States, Australia, […]

-

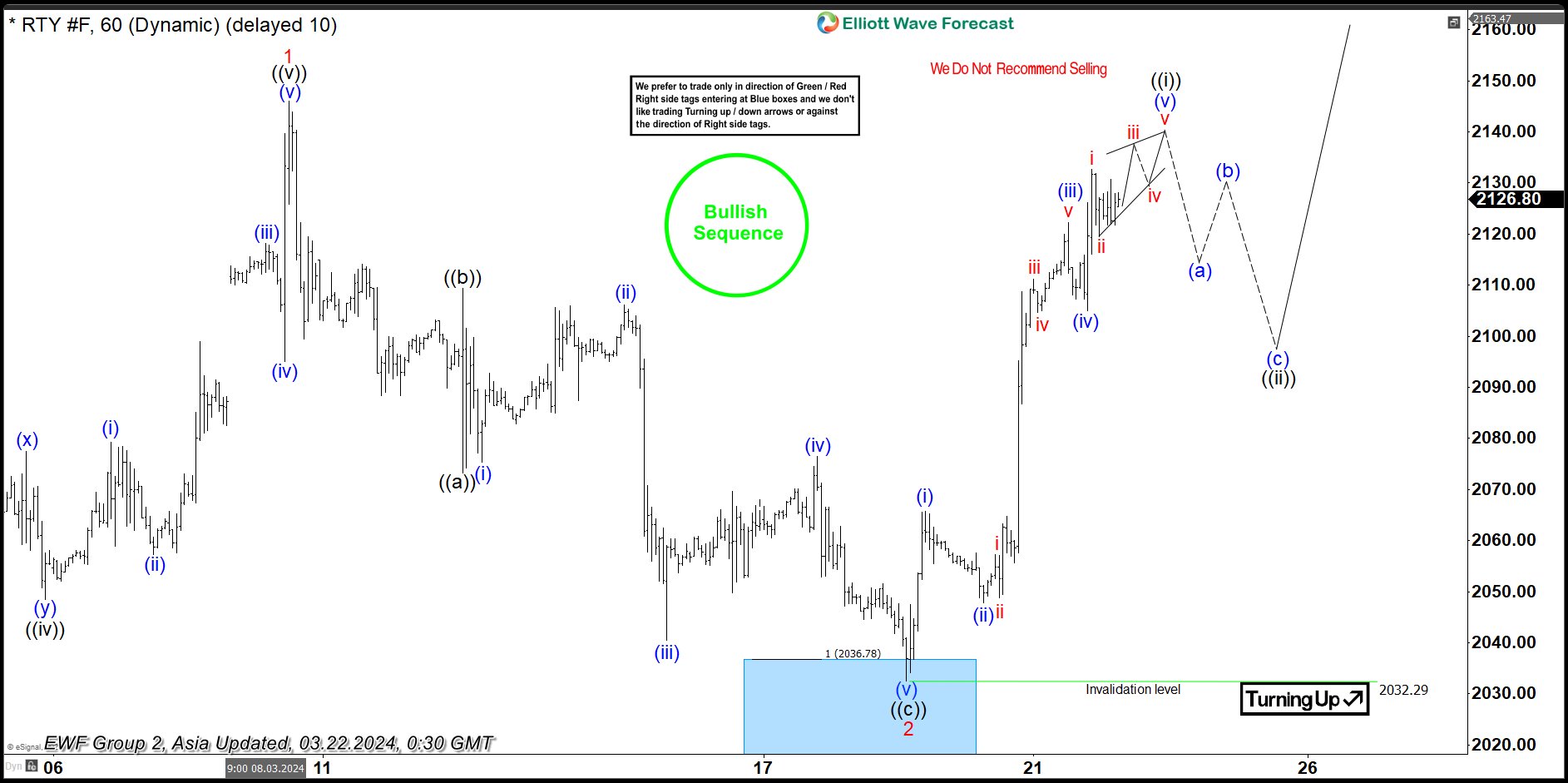

Russell 2000 (RTY) Looking for Short Term Pullback Soon

Read MoreRussell 2000 (RTY) is looking for a short term pullback soon. This article and video look at the short term Elliott Wave path.

-

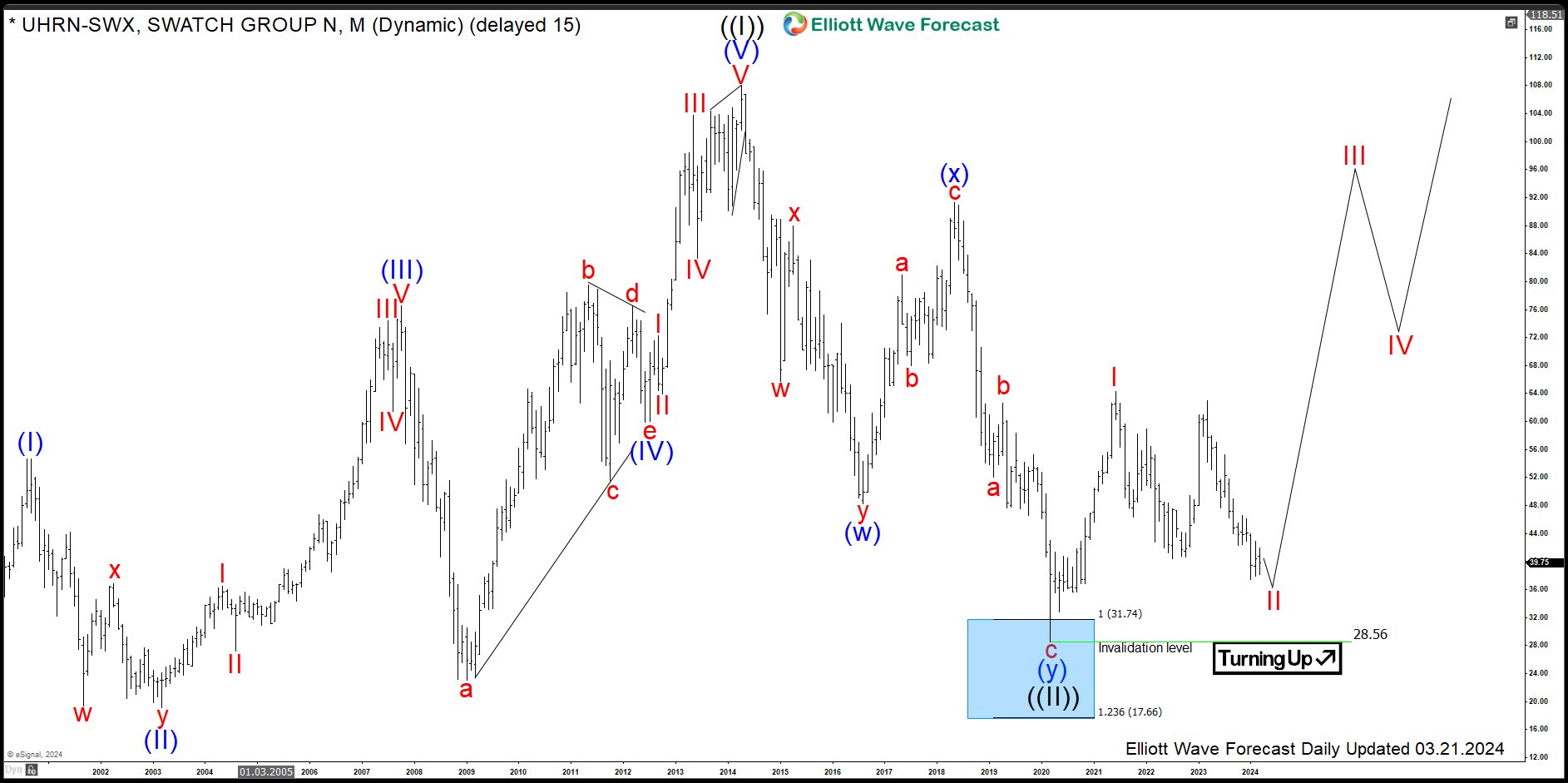

$UHRN : Buying Swatch Group in a Zigzag Pullback

Read MoreSwatch Group is a Swiss manufacturer of watches and jewellery. Besides the product line Swatch, the group owns brands including Blancpain, Breguet, ETA, Glashütte, Omega, Longines, Tissot, Hamilton, Certina, Rado and Harry Winston. As a matter of fact, the Swatch company employs about 36000 people in over 50 countries. Founded 1983 and headquartered in Biel/Bienne, […]

-

Travelers TRV Did a Strong Rally Missing the Blue Box Area

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Weekly TRV Chart July 2023 TRV ended a great super cycle in the year of 2019 reaching a peak at $154.86 which we call […]

-

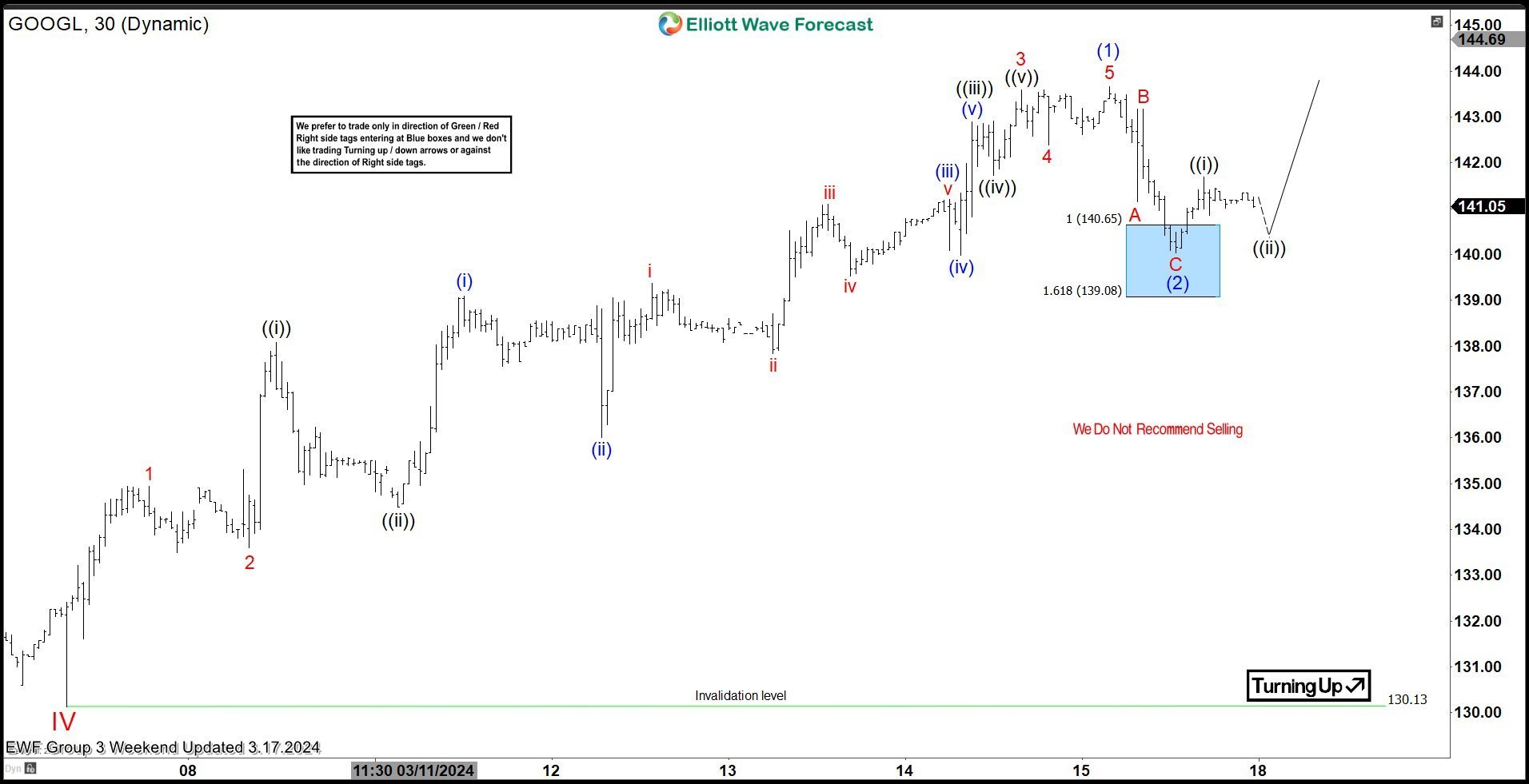

$GOOGL Stock Elliott Wave: Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $GOOGL Stock published in members area of the website. As our members know we have been favoring the long side in $GOOGL. Recently we got a pull back that has made a clear 3 waves […]