The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Incomplete Bullish Elliott Wave Sequence in Netflix (NFLX) Argues for More Upside

Read MoreNetflix (NFLX) shows incomplete bullish sequence from 4.22.2024 low favoring further upside. This article and video look at the Elliott Wave path.

-

Elliott Wave Analysis shows NIFTY-50 Pullback is Imminent

Read MoreHello traders. In this post, we will analyze the NIFTY-50 price chart. The Nifty 50 includes 50 major companies listed on the National Stock Exchange (NSE) of India. It is one of India’s two main stock indices, alongside the BSE Sensex. NIFTY-50 Elliott Wave Analysis – Weekly Chart NIFTY 50 is in a long-term bullish […]

-

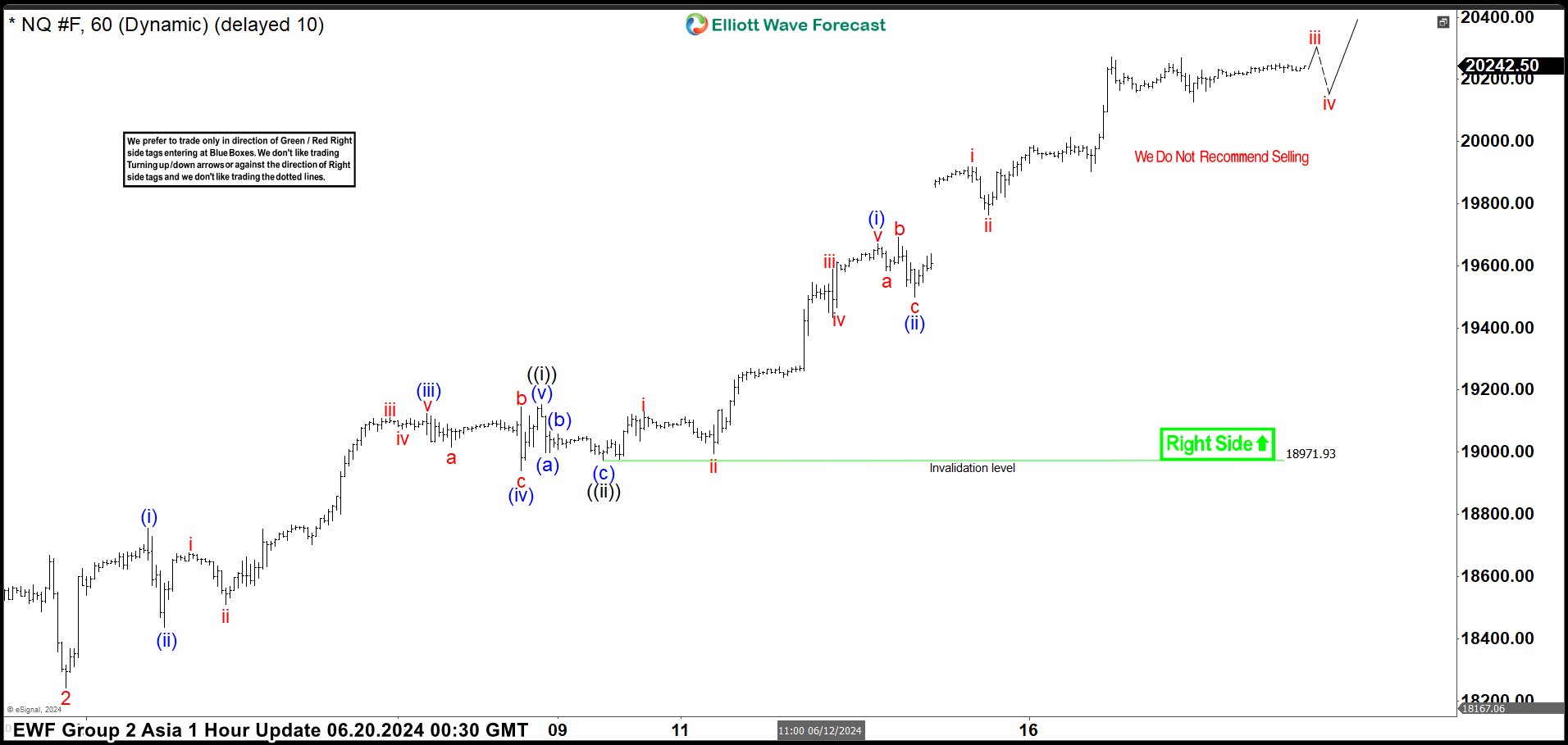

Elliott Wave Analysis on Nasdaq (NQ) Looking for Further Rally

Read MoreNasdaq (NQ) shows incomplete bullish impulse from 4.19.2024 low favoring more upside. This article and video look at the Elliott Wave path.

-

Uranium Miners ETF (URA) Looking to End Impulsive Rally

Read MoreThe Global X Uranium ETF ($URA) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components. It includes those miners involved in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. $URA offers a convenient way for investors to gain diversified exposure […]

-

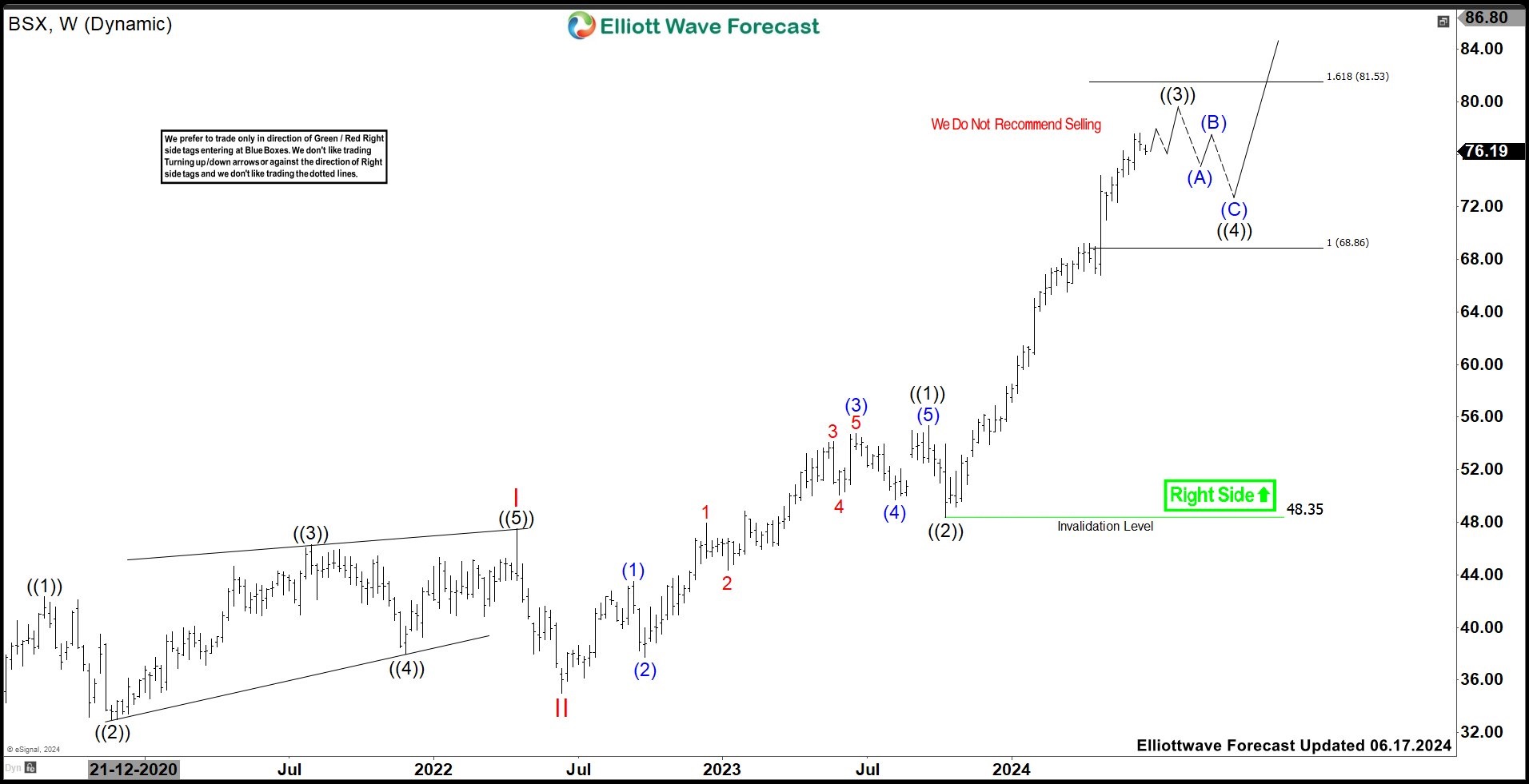

BSX Should Pullback Soon Providing A Buying Opportunity

Read MoreBoston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions and offer remote patient management systems. It is based in Marlborough, US, comes under Healthcare sector & trades as “BSX” […]

-

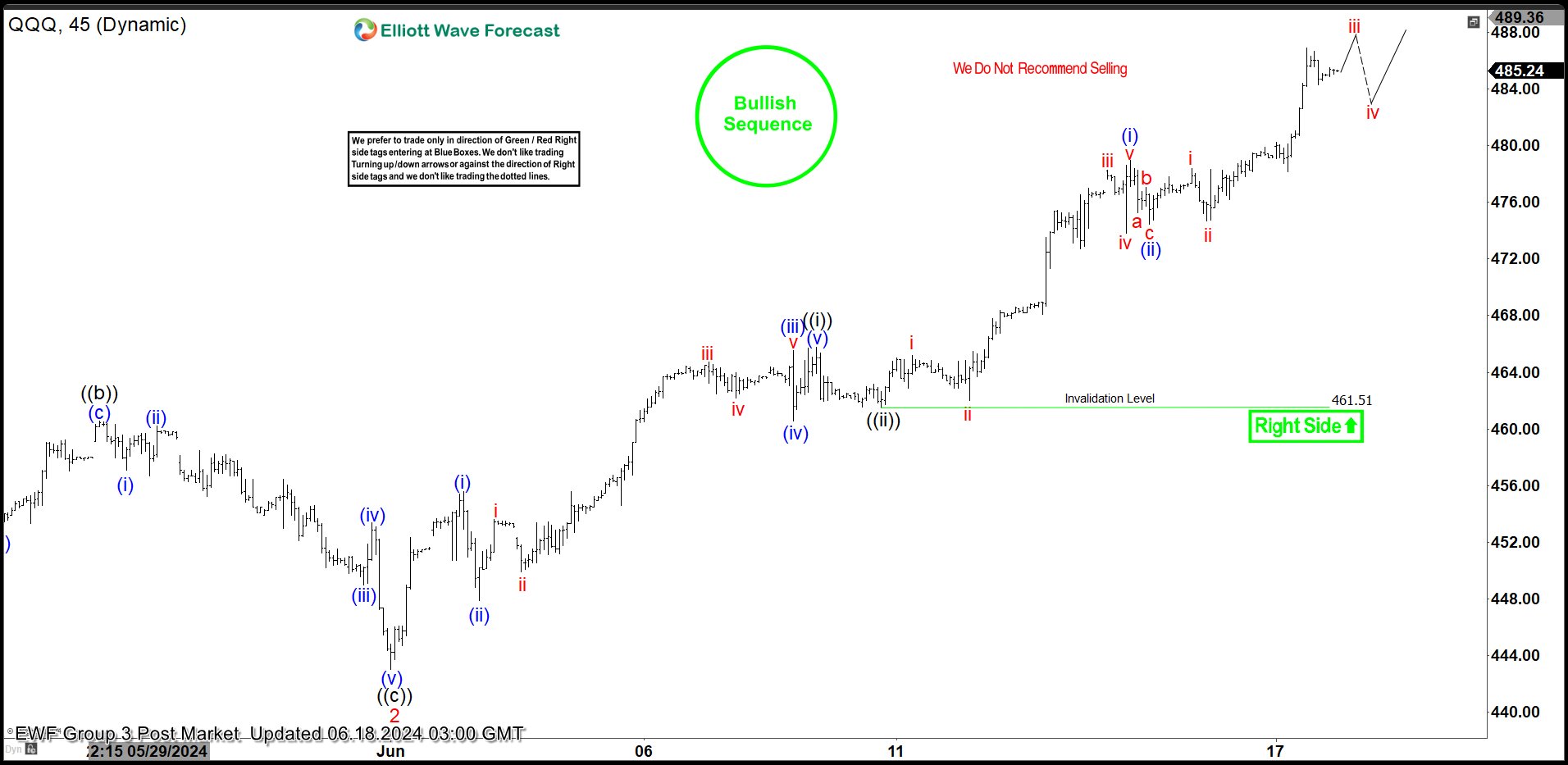

Elliott Wave Expects Nasdaq 100 (QQQ) to Continue Higher

Read MoreNasdaq 100 ETF (QQQ) shows bullish sequence favoring higher. This article and video look at the Elliott Wave path of the ETF.