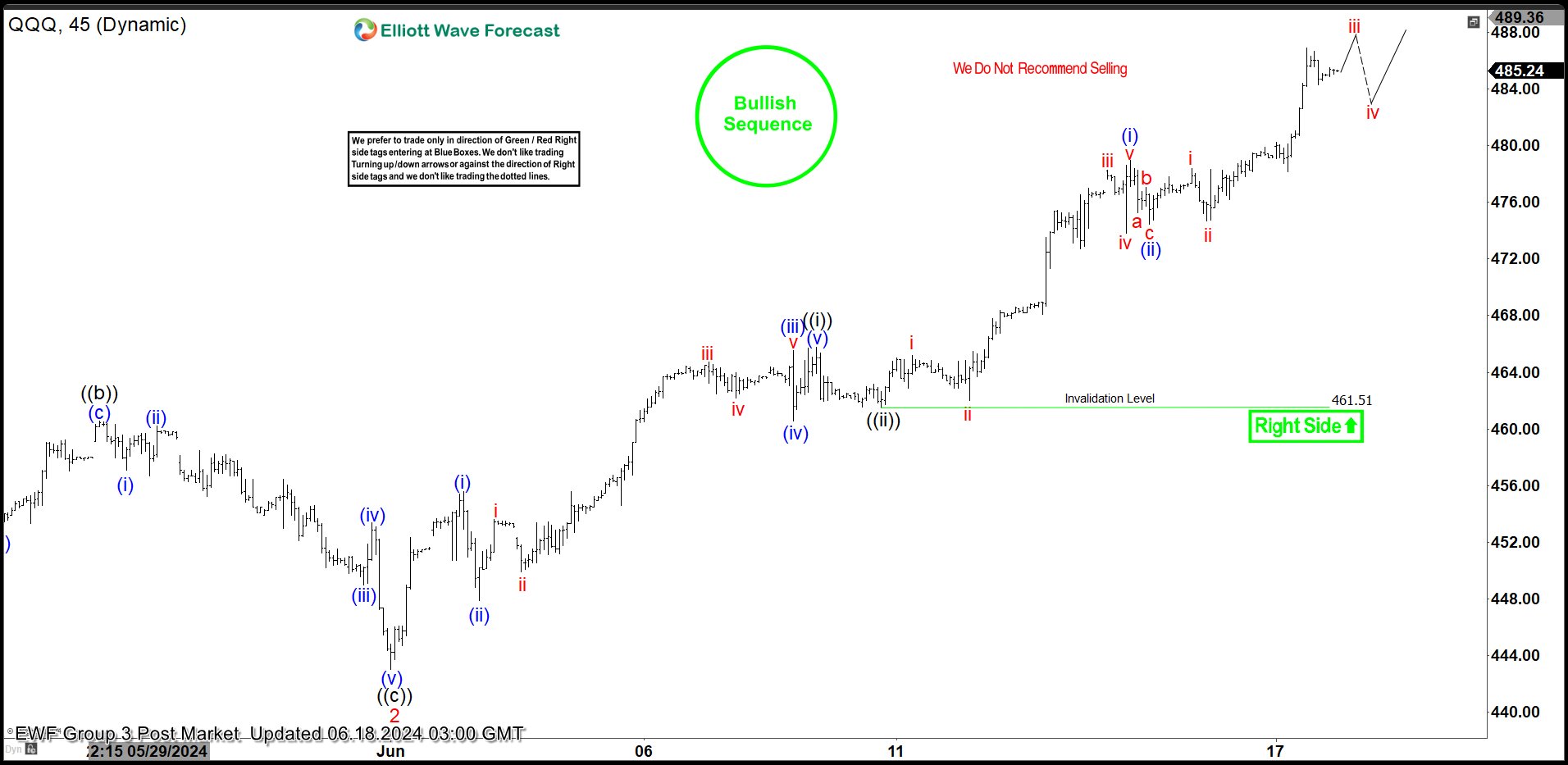

Short Term Elliott Wave in Nasdaq 100 ETF (QQQ) suggests it shows a bullish sequence from 4.20.2024 low favoring more upside. Up from 4.20.2024 low, wave 1 ended at 461.5 and pullback in wave 2 ended at 443.06. The ETF has extended higher in wave 3. Internal subdivision of wave 3 is unfolding as a nesting impulsive structure. Up from wave 2, wave (i) ended at 455.58 and wave (ii) ended at 447.9. Wave (iii) higher ended at 465.55 and pullback in wave (iv) ended at 460.54. Last leg wave (v) ended at 465.74 which completed wave ((i)) in higher degree. Pullback in wave ((ii)) ended at 461.5 and the ETF has extended higher.

Up from wave ((ii)), wave i ended at 465.19 and wave ii dips ended at 462.03. Then it rallied higher in wave iii towards 478.28 and wave iv pullback ended at 473.80. Last leg wave v ended at 478.95 which completed wave (i) in higher degree. The ETF then pullback in wave (ii) towards 474.42. Near term, as far as it stays above 461.51, expect pullback to find support in 3, 7, or 11 swing for further upside.