American Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average.

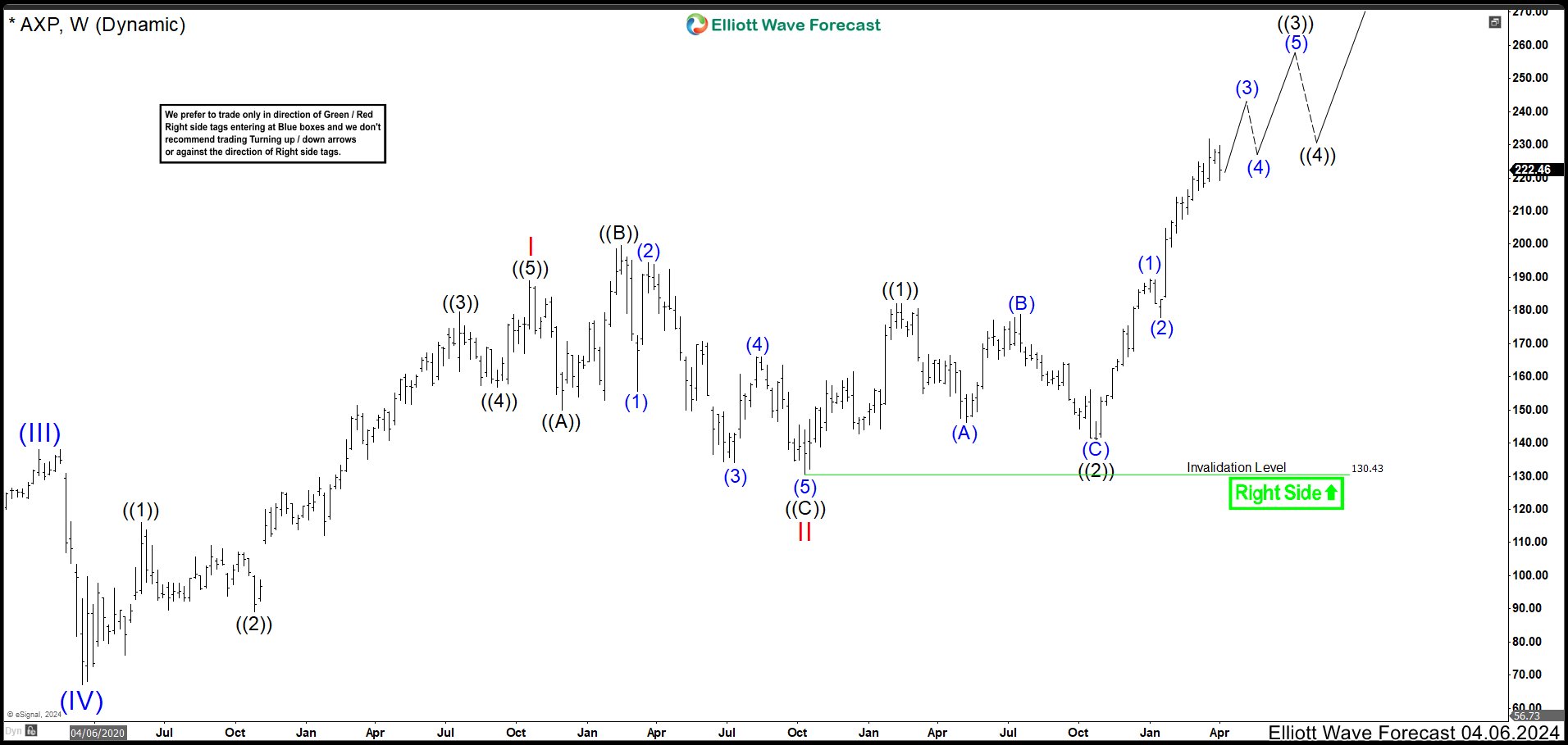

AXP Weekly Chart April 2024

The stock was building an extension as wave (V) of ((I)). Wave I ended at 189.03 high. Then wave II built an expanding flat correction ending at 130.65 low. The wave ((1)) of III completed at 182.15 and pullback as a flat correction ended wave ((2)) at 140.91. From here, AXP started a strong rally that was wave ((3)) of III and the market was trading in wave (3) of ((3)). We were calling one more leg higher to end wave (3) and any pullback after wave (3) was ended, we looked for buying opportunities to trade in favor of the trend. (If you want to learn more about Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory)

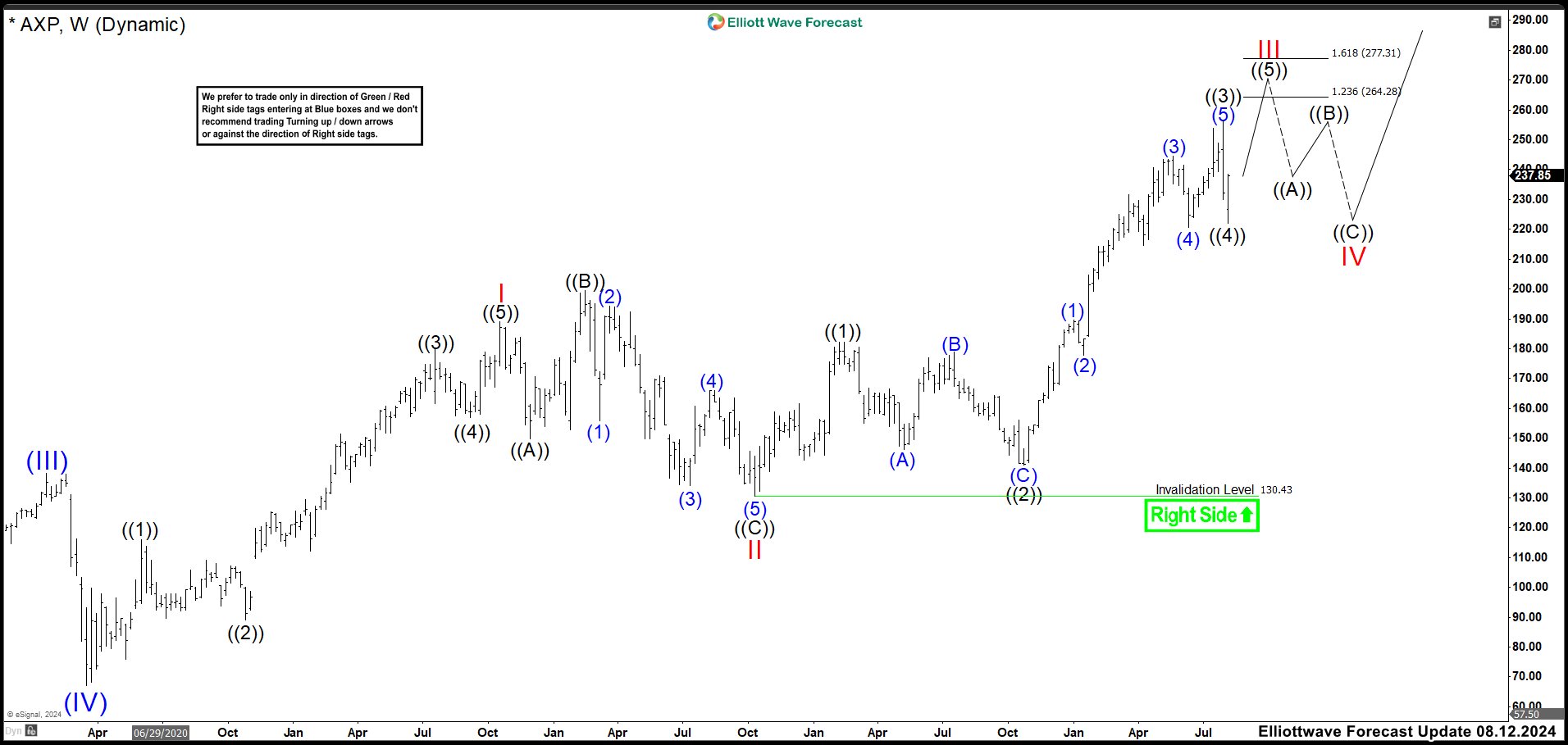

AXP Weekly Chart August 2024

After 4 months, AXP continued the rally as expected. It ended wave (3) of ((3)) at 244.41 high. The pullback as wave (4) finished at 220.74 low and market resumed to the upside in wave (5) of ((3)). This cycle ended at 256.24 high and we had strong pullback as wave ((4)) retesting last wave (4) low around 222.03. Actually, the market is trading in wave ((5)) higher. If there is not more extensions. This wave ((5)) of III could reach 264.28 – 277.31 area where AXP could begin a large correction in wave IV.

After 4 months, AXP continued the rally as expected. It ended wave (3) of ((3)) at 244.41 high. The pullback as wave (4) finished at 220.74 low and market resumed to the upside in wave (5) of ((3)). This cycle ended at 256.24 high and we had strong pullback as wave ((4)) retesting last wave (4) low around 222.03. Actually, the market is trading in wave ((5)) higher. If there is not more extensions. This wave ((5)) of III could reach 264.28 – 277.31 area where AXP could begin a large correction in wave IV.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back