Since its stock became available for trading, FTNT has continued to make profits for its investors. Similarly, speculators have been able to find positions from pullbacks as the stock has maintained a bullish sequence since 2009. This blog post will reveal when traders can jump into another trade from the dip. This is from the perspective of the Elliott wave theory as we see it.

Fortinet, Inc. (FTNT) is a leading cybersecurity company known for providing a wide range of security solutions, including firewalls, antivirus, intrusion prevention, and endpoint security. Founded in 2000 by Ken Xie, the company is headquartered in Sunnyvale, California. Fortinet’s flagship product is the FortiGate firewall, but it also offers a broad portfolio of products covering areas such as cloud security, network security, and advanced threat protection.

Fortinet went public in 2009 and trades on the NASDAQ under the ticker symbol FTNT. The company has consistently shown strong revenue growth, driven by the increasing demand for cybersecurity solutions in the face of rising cyber threats. It serves a global customer base across various industries, including government, healthcare, finance, and education.

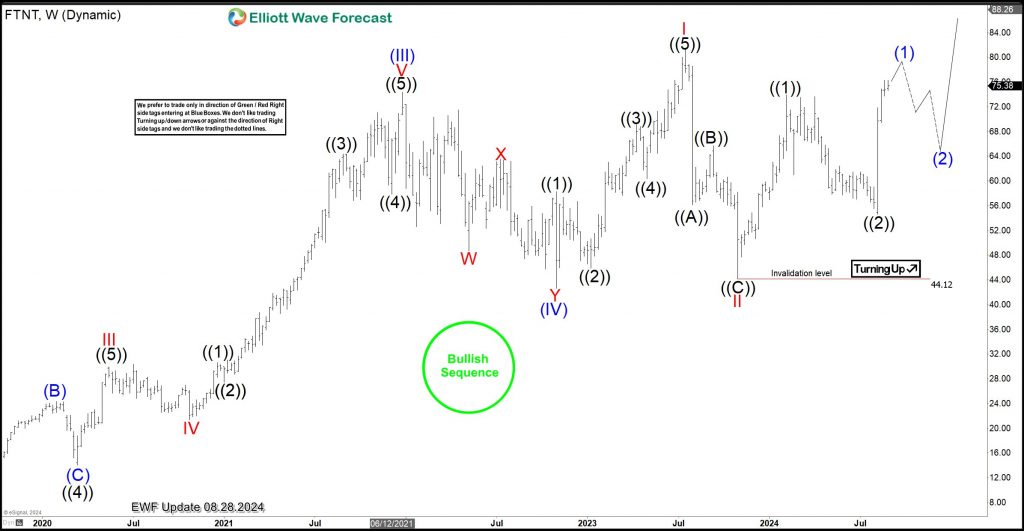

FTNT Elliott Wave Analysis, Weekly Chart – 08.28.2024

The weekly chart above shows the bullish sequence from the all-time low. A clear impulse sequence is evolving for the grand supercycle degree wave ((I)). The impulse structure already completed the supercycle degree waves (III) and (IV) of ((I)) in December 2021 and October 2022 respectively. From the low of October 2022, the stock prices rallied again to break above the December 2022 high and reached a fresh all-time high in July 2023. The top of July 2023 marked the start of wave (V) of ((I)) as wave I of (V). A corrective zigzag pullback followed as wave II of (V) of ((I)) at 44.12. Wave III is already progressing upwards and should make an impulse rally into a fresh all-time high.

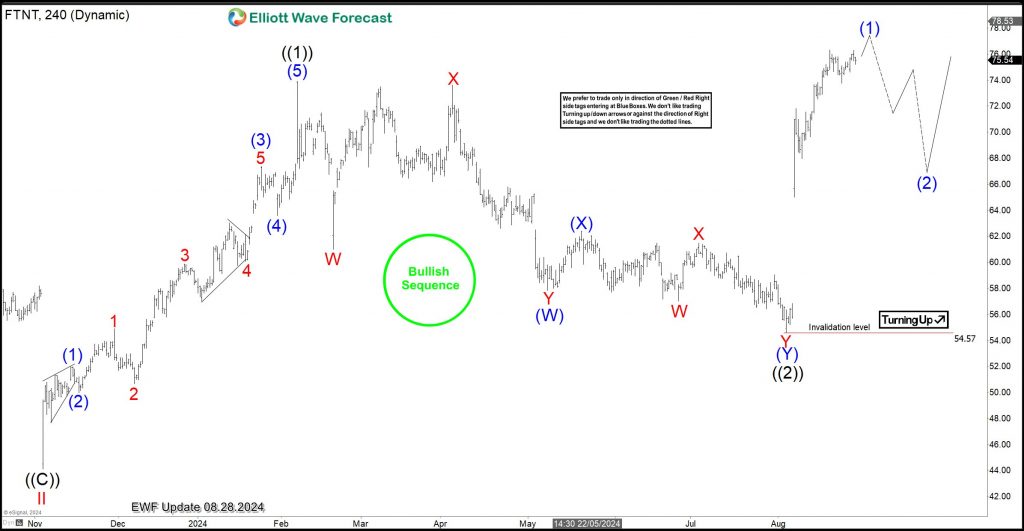

FTNT Elliott Wave Analysis, H4 Chart – 08.28.2024

On the H4 chart, Wave ((1)) and ((2)) of III have been completed. Price is now in wave ((3)) of III which should reach at least 92.5 and ideally 127.8. Each pullback, either in wave (IV), II or even ((2)), presented buyers the opportunity to enter LONG positions at lower prices. What we can notice is that each of these pullbacks either completed a 3 or 7 swings corrective sequence. This is typical of corrective structures. As the price breached wave ((1)) high, we can confirm ((2)) has finished. The most recent surge from 08.05.2024 can now be wave (1) of ((3)). Therefore, buyers will find opportunities again at the end of the wave 2 pullback, especially in the lower time frames.

About Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Moreover, experience our service with a 14-Day Trial for only $9.99. Cancel anytime by contacting us at support@elliottwave-forecast.com

Back