The last time I analyzed DataDog I favoured that the instrument had completed a major pullback in Red II. And this stock was ready to start moving higher within a wave III advance. This article can be viewed here. I wanted to revisit this stock and take a look at what has happened since July 2021.

At the time, in July 2021, I was looking for a pullback against Red II Low (at 69.79) to take place before moving higher:

Datadog July 2021 Elliottwave View:

I was taking the less aggressive approach, calling for a pullback against the cycle from May 2021, before resuming higher in a wave 3 advance. My less aggressive view turned out to be too conservative. DataDog decided to immmediatly rally in a wave 3 breakout. Lets take a look at the new view below.

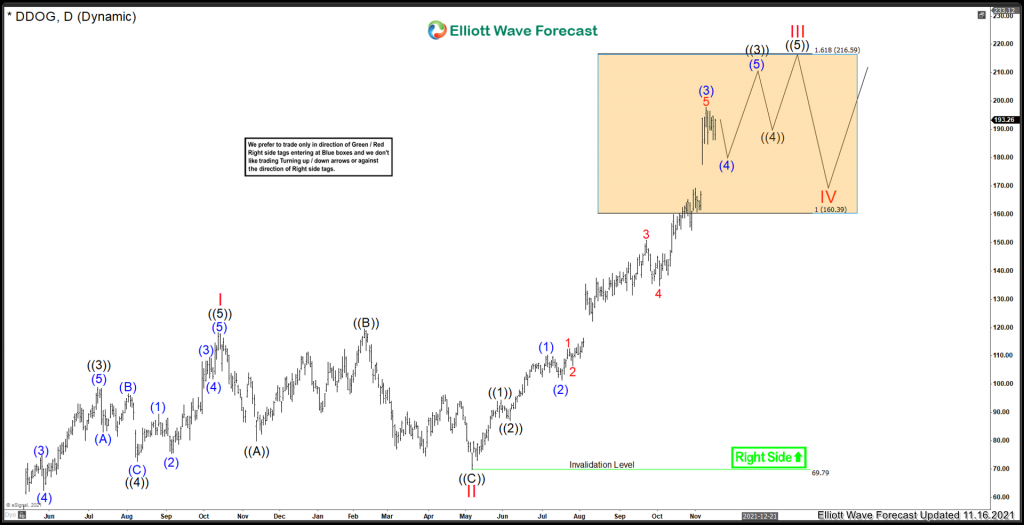

Datadog November 2021 Elliottwave View:

As you can see, the stock has been on a tear with shallow pullbacks and sharp rallies. This is a good example of why we do not prefer to sell short stocks that have confirmed the move higher. Right now, it still has a few degrees of wave 3s and wave 4s before pulling back in Red IV. The 216.59 area is a bit of a magnet at this point for where Red III can peak, and the cycle from May 2021 can correct in Red IV. For now, the trend is higher, which is the path of least resistance.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our 14 day trial today. Get Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back