CrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services.

Analysts have a positive outlook for CrowdStrike Holdings, Inc. (CRWD) in 2025. The stock has a consensus rating of “Moderate Buy,” with 33 analysts recommending it as a buy. The average price target for CRWD is $400.76, with a high of $475.00 and a low of $275.00. CrowdStrike’s strong performance in the C sector and its innovative product offerings contribute to its favorable ratings.

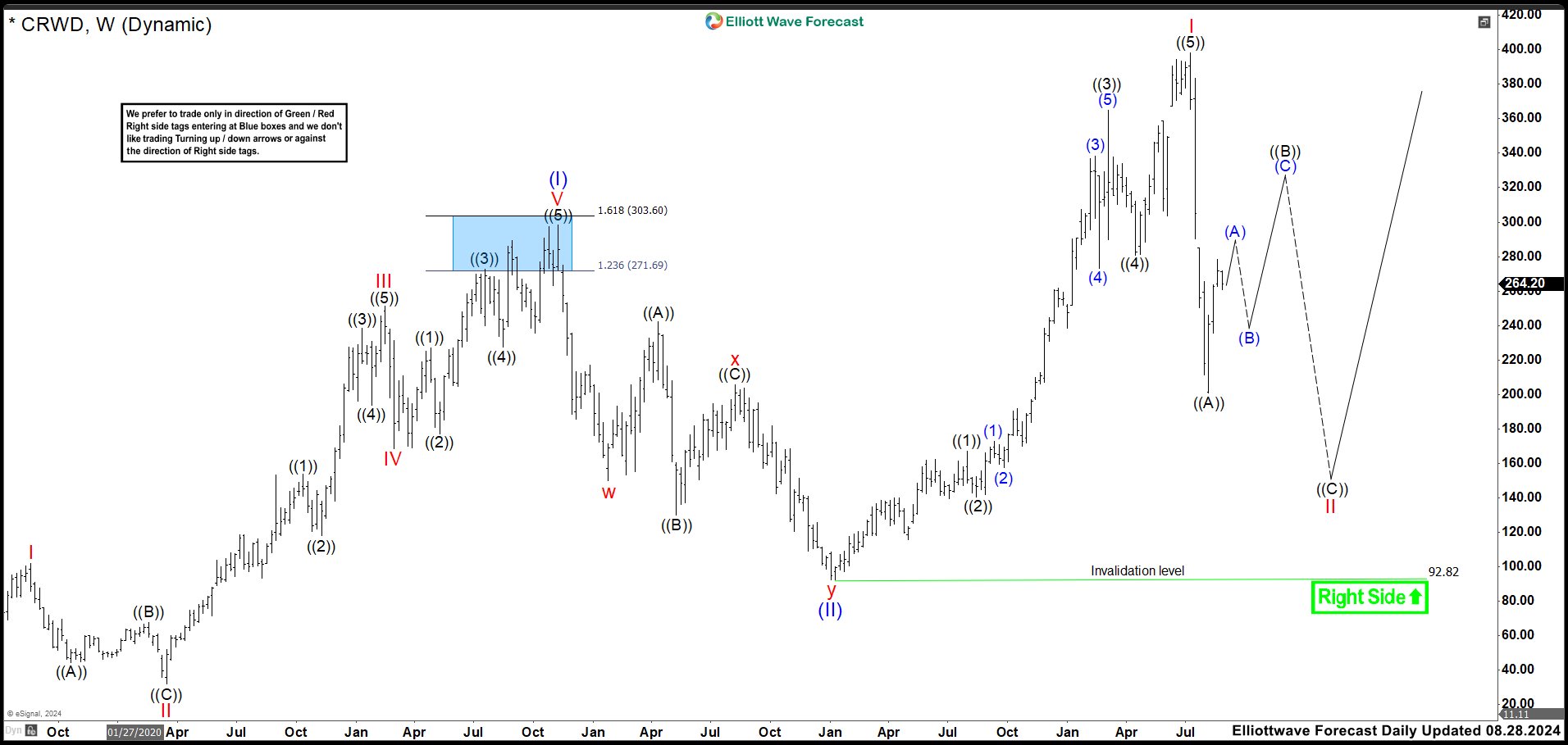

CrowdStrike (CRWD) August 2024 Weekly Chart

Previously, we identified key patterns in its price movements, focusing on Elliott Wave structures that unfolded with precision. Initially, CRWD completed wave (II) at the 92.25 low, which set the stage for an impressive rally. The stock surged through waves ((1)) and ((2)), ending at 166.99 and 140.52, respectively. Then, wave ((3)) climbed to an all-time high at 365.00, followed by wave ((4)) at 280.88 and wave ((5)) at 398.33 high to complete an impulse structure.

We called a nest (I) (II), I II. After this wave I, we saw a very sharp drop making the stock to lose 50% of his value. As last time, with this pullback wave II could have completed already. However, we were calling as part of a bigger wave II. The global market was showing some relative bullish exhaustion that could send the stock to see more downside. Therefore, wave ((A)) of wave II ended at 200.81 and we were expecting a corrective rally to stay below 398.33 high. Then CRWD should resume lower in wave ((C)) of II to complete the structure before resuming to the upside.

If you’re enthusiastic about exploring Elliott Wave Theory and uncovering how its concepts influence market predictions, these references could prove valuable: and .

CrowdStrike (CRWD) April 2025 Weekly Chart

In this update, we revised the structure and introduced a leading diagonal. The original nest concept was reclassified, with wave I now labeled as wave (III) and the correction as wave (IV). From here, an impulse wave must develop to complete wave (V). Conservatively, we proposed an ending diagonal for wave (V), requiring wave IV to enter wave I’s area. This adjustment ensures wave (V) aligns with the ideal fractal, maintaining its position as the smallest within the diagonal.

Looking ahead, we expect the bullish trend to continue, forming two additional highs to finalize the structure. The grand super cycle’s ideal completion zone lies between 493.75–507.59 area, where the market could react downward, marking the end of the cycle and wave ((1)). If this occurs, a significant correction may follow, potentially pushing CRWD’s price below 250. Stay tuned for market movements and trade wisely!

Transform Your Trading with Elliott Wave Forecast!

Ready to take control of your trading journey? At Elliott Wave Forecast, we provide the tools you need to stay ahead in the market:

✅ Hourly Updates: Fresh 1-hour charts updated 4 times a day and 4-hour charts updated daily for 78 instruments.

✅ Blue Boxes: High-frequency trading zones, calculated using sequences, cycles, and extensions. These areas pinpoint ideal setups for smarter trades.

✅ Live Sessions: Join our daily live discussions and stay on the right side of the market.

✅ Real-Time Guidance: Get your questions answered in our interactive chat room with expert moderators.

🔥 Exclusive Offer: Start your journey with a 14-day trial for only $9.99. Gain access to exclusive forecasts and Blue Box trade setups. No risks, cancel anytime by reaching out to us at support@elliottwave-forecast.com.

💡 Don’t wait! Elevate your trading game now. Trial us at: 🌐

Back