Cisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products.

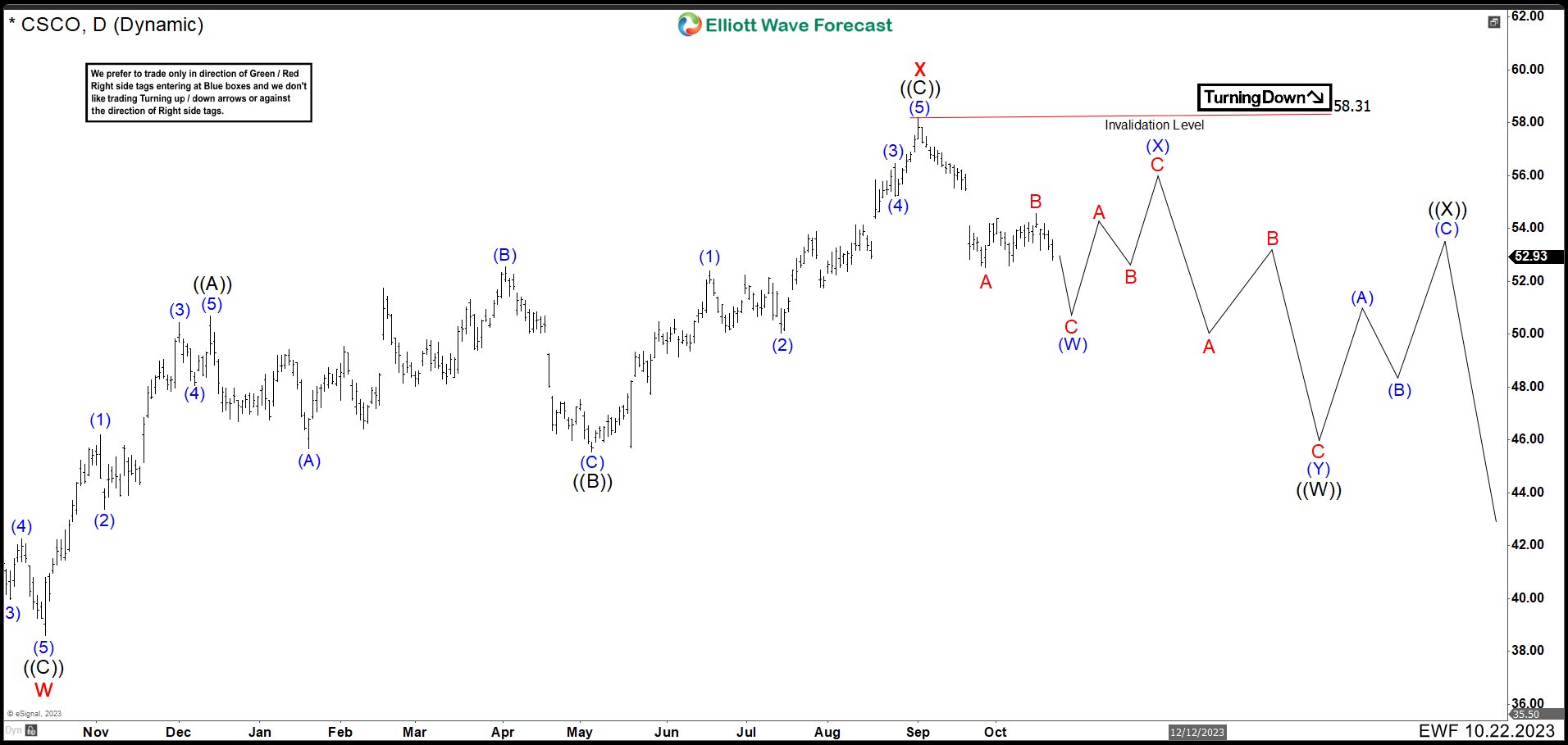

CSCO Daily Chart October 2023

Last October, we talked about an alternative view on CSCO. That was wave (II) has not finished and it could do a double correction. After 3 waves higher we cannot rule out a double correction until we see a clear impulse higher. In June, we suggested that CSCO shares price should continue to rise to the $57.66 – $60.52 area. Thus, the price should be rejected from this zone opening the possibility of a double correction that sends the price below $38.73. The market ends a new high at $58.19 in the area and the market was rejected. Actually, the path still could not break above $58.19 and it is more like to expect more downside. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

Last October, we talked about an alternative view on CSCO. That was wave (II) has not finished and it could do a double correction. After 3 waves higher we cannot rule out a double correction until we see a clear impulse higher. In June, we suggested that CSCO shares price should continue to rise to the $57.66 – $60.52 area. Thus, the price should be rejected from this zone opening the possibility of a double correction that sends the price below $38.73. The market ends a new high at $58.19 in the area and the market was rejected. Actually, the path still could not break above $58.19 and it is more like to expect more downside. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory).

CSCO Daily Chart March 2024

In the chart above, we can see a double correction structure formed from wave X. Down from 58.19 high, CSCO dropped in 3 swing ending wave (W) at 50.95. Wave (X) pullback did a small bounce at 53.50 high and continue lower. The movement was strong finishing at 44.70 to complete wave (Y) structure and also Wave ((W)) in higher degree. Currently, CSCO is building wave ((X)) connector. Up from 44.70 low, market did 3 swings higher to end wave (W) at 52.86 and pullback as wave (X) ended at 46.90 low and resumed higher. Market is trading in wave (Y) and we should see 3 swings higher above 52.86 to end wave (Y) and ((X)) correction before turning lower in wave ((Y)).

CSCO Alternative Daily Chart March 2024

The difference of this alternative chart with the main view, it is just wave ((X)) is completed at 52.62 high. While price action stays below this level, we are looking further downside double correction structure.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a 24 hours chat room where we will help you with any questions about the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back