Hello traders, and welcome to another blog post where we explore trade opportunities from the blue box. Today, the focus is on the IBEX 35, Spain’s benchmark stock market index. The index comprises the 35 most liquid companies listed on the Madrid Stock Exchange.

In early August of this year, stock market indices saw significant declines across the board. Once again, so-called experts started predicting doom. However, we maintained the same outlook we’ve held for months. Our members at Elliottwave Forecast understood our position. We consistently believed that indices should remain within the long-term bullish cycle. We anticipated counter moves would develop as corrective pullbacks in a sequence of 3, 7, or 11 swings. These pullbacks should end at the equal leg, setting up for the next rally. And that’s precisely what happened. Major indices hit their extremes on August 5th, 2024, ending the corrective pullback that began in June 2024 with 3, 7, or 11 swings.

Prices have since recovered from the sharp early August decline. While the experts spread fear, we encouraged our traders to buy indices at the extremes. The IBEX 35 was one of the indices our members successfully traded.

IBEX 35 H4 chart 08.03.2024

We shared the IBEX 35 H4 chart with members on August 3rd, 2024. The decline from the June 2024 high was completing a zigzag structure. We identified the extreme zone at 10,643 to 10,260 with a blue box. Members entered LONG positions within the blue box, with stops placed below 10,260. Although we found the initial LONG entry using the H4 chart, we continued managing the shorter cycles on the H1 chart several times a day.

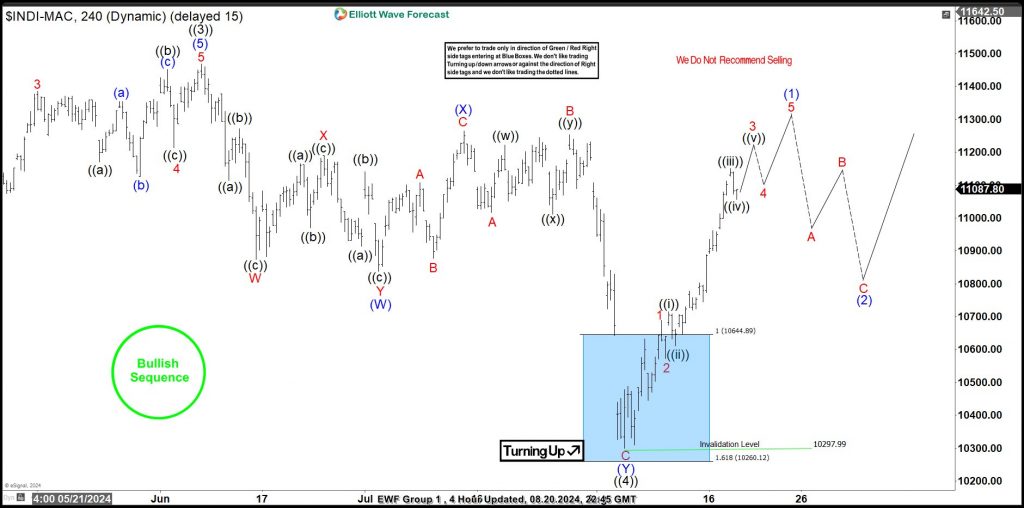

IBEX 35 H4 chart 08.21.2024

The chart above shows how the IBEX 35 found fresh buyers in the blue box. We shared this chart with members on August 21st, 2024. The rally advanced with an impulse structure, reaching a risk-free zone. The end of wave ((4)) is now confirmed. We identify the impulse rally from the blue box as wave (1) of ((5)). A pullback in wave (2) is expected to hold above the 10,297.99 invalidation level. Afterward, the long-term bullish trend should resume. Therefore, we aim to remain buyers from the extremes of 3, 7, or 11 swings pullbacks across all the indices we cover.

About Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Moreover, experience our service with a 14-day Trial for only $9.99. Cancel anytime by contacting us at support@elliottwave-forecast.com

Back