Good day Traders and Investors. In today’s article, we will look at the past performance of 1 Hour Elliottwave chart of Boeing ($BA). The decline from 08.16.2022 high is unfolding as a Double three (WXY) and made a lower low on 09.14.2022 which created a bearish sequence in the 1H timeframe. Therefore, we knew that the structure in $BA is incomplete to the downside & should see more weakness. So, we advised members to sell the bounces in 3, 7, or 11 swings at the blue box area. We will explain the structure & forecast below:

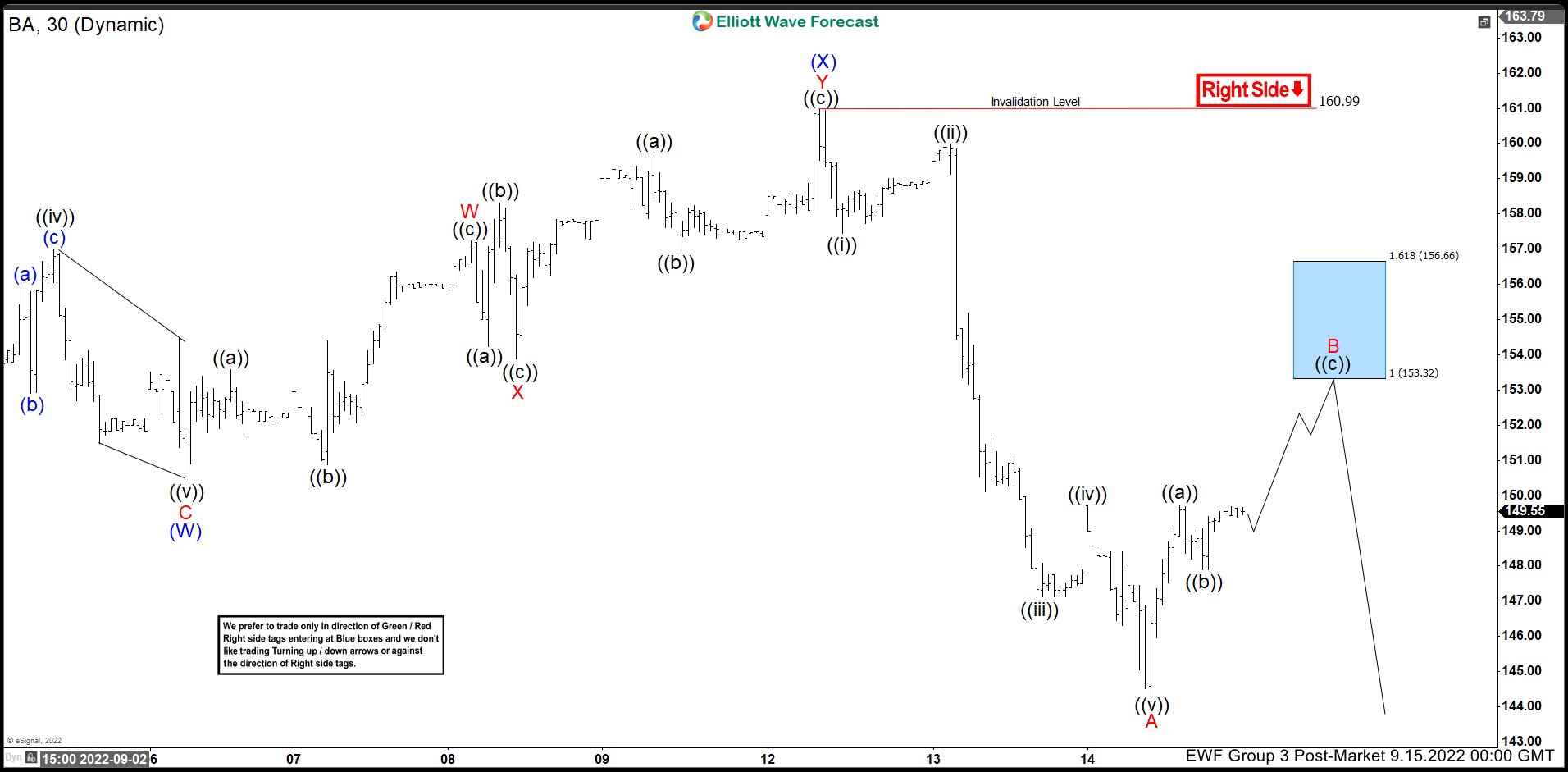

$BA Elliottwave Chart (1H):

Here is the 1H Elliottwave count from 09.15.2022. The decline from 09.12.2022 unfolded in a 5 wave impulse breaking below blue (W) creating a bearish sequence. We were calling for the bounce to fail in 3 swings at red B where we like to sell it at the equal legs at $153.32 with a stop at $156.66.

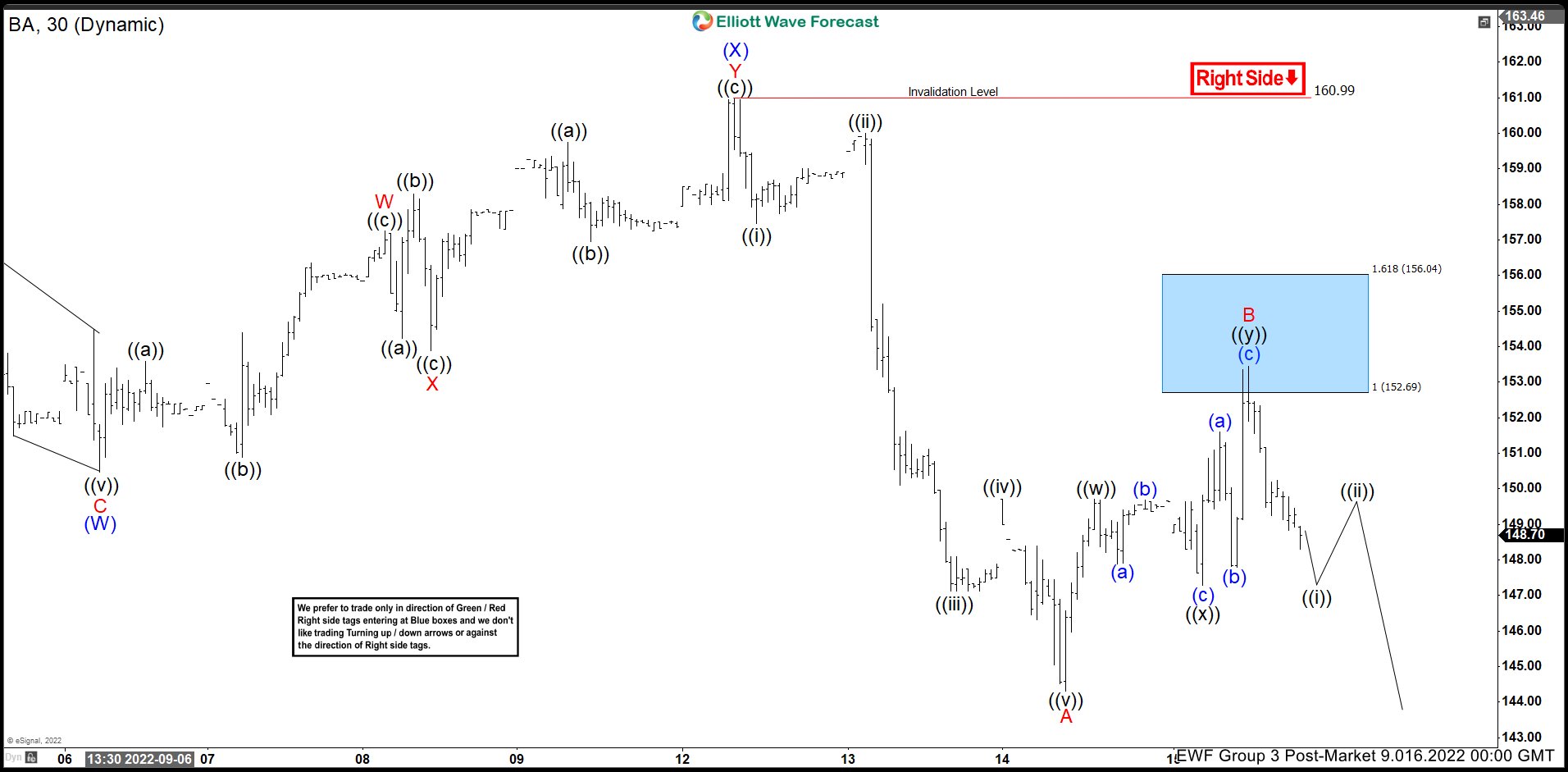

$BA Latest Elliottwave Chart (1H):

Here is the 09.16.2022 1H update showing the move taking place as expected. The stock has reacted lower from the blue box allowing any shorts to get risk free shortly after taking the position. Currently, the stock has already made a new low confirming that the next extension lower is taking place targeting $137.56 – 123.02 before a bounce can take place in 3 swings at least.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy. It defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast!

Back