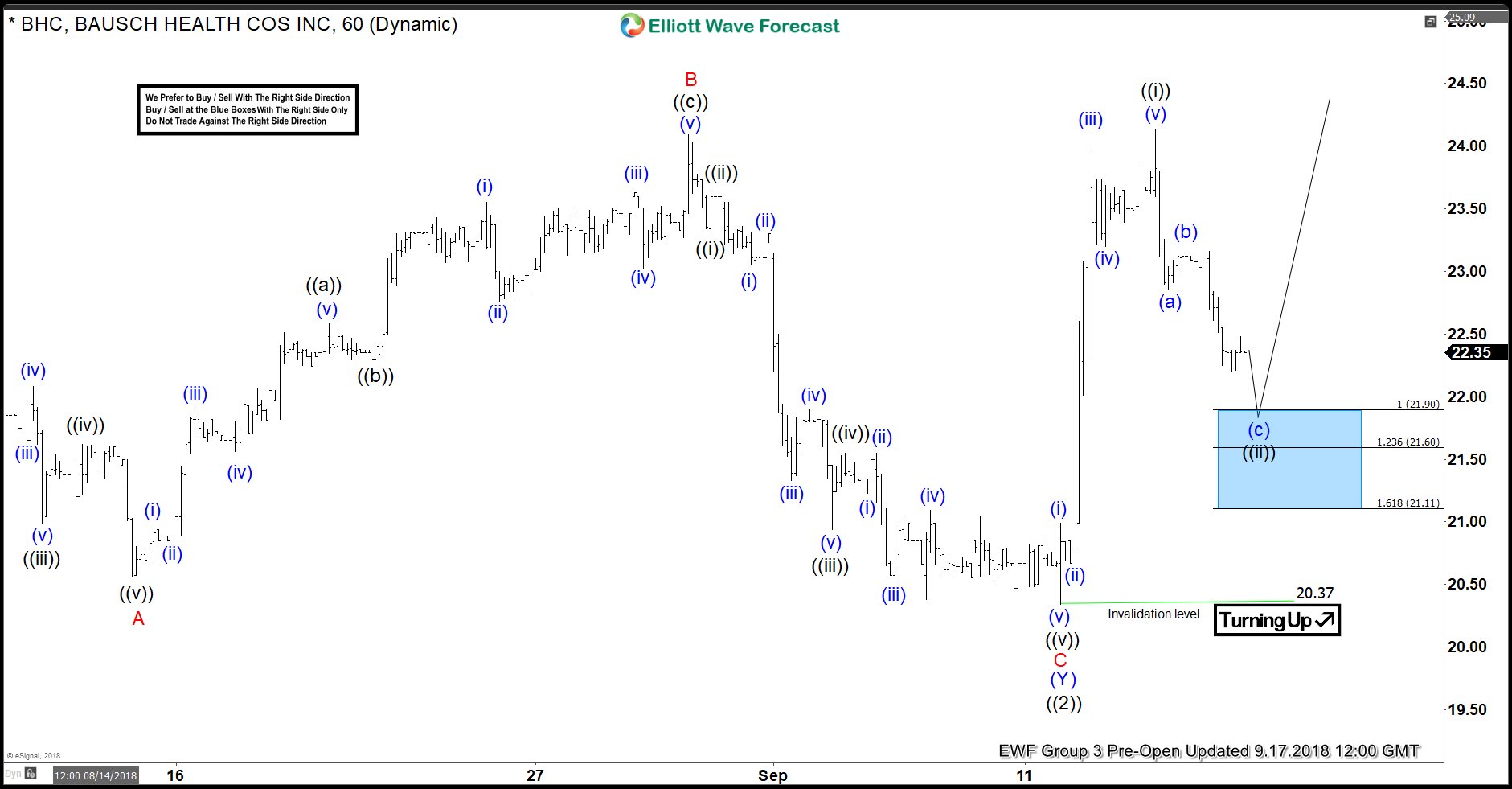

In this blog, I want to share some short-term Elliott Wave charts of the BAUSCH Health stock which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 09/17/18 indicating that BHC ended the cycle from 06/13 peak low in black wave ((2)).

As BHC ended the cycle from 06/13 peak, at the low of around 20.37. It started a bounce higher. The bounce higher from 09/11 low (20.37) unfolded as a 5 waves Elliott Wave Impulse structure. Due to the right side bullish stamp, in the higher timeframe (4H chart). We advised members that the right side remains to the upside against 20.37 low. Therefore, we expected buyers to appear in the dips in the sequences of 3, 7 or 11 swings. At the 100 – 1.236 Fibonacci extension of blue (a)-(b). Which came at around 21.90-21.60 area. And that was the first area for buyers to appear to take prices to new highs above black wave ((i)) peak or a larger 3 waves bounce at least.

BHC 09.17.2018 1 Hour Chart Elliott Wave Analysis

In the last Elliott Wave chart, you can see that BHC reached the blue box area (21.90.21.60) and bounced nicely higher and took price above black wave ((i)) peak. Confirming that the next extension higher has started. So if traded our blue box area shown in the chart above. Any trades from that area were risk-free, which means the stop-loss should be moved to breakeven, targeting higher levels. Do please keep in mind that the 1-hour chart which I presented have changed already.

If you are interested in how to trade our blue box areas and want to understand how Elliott Wave works then I recommend you to join our Special Webinar which we will hold on the 7th of October. You can join here.

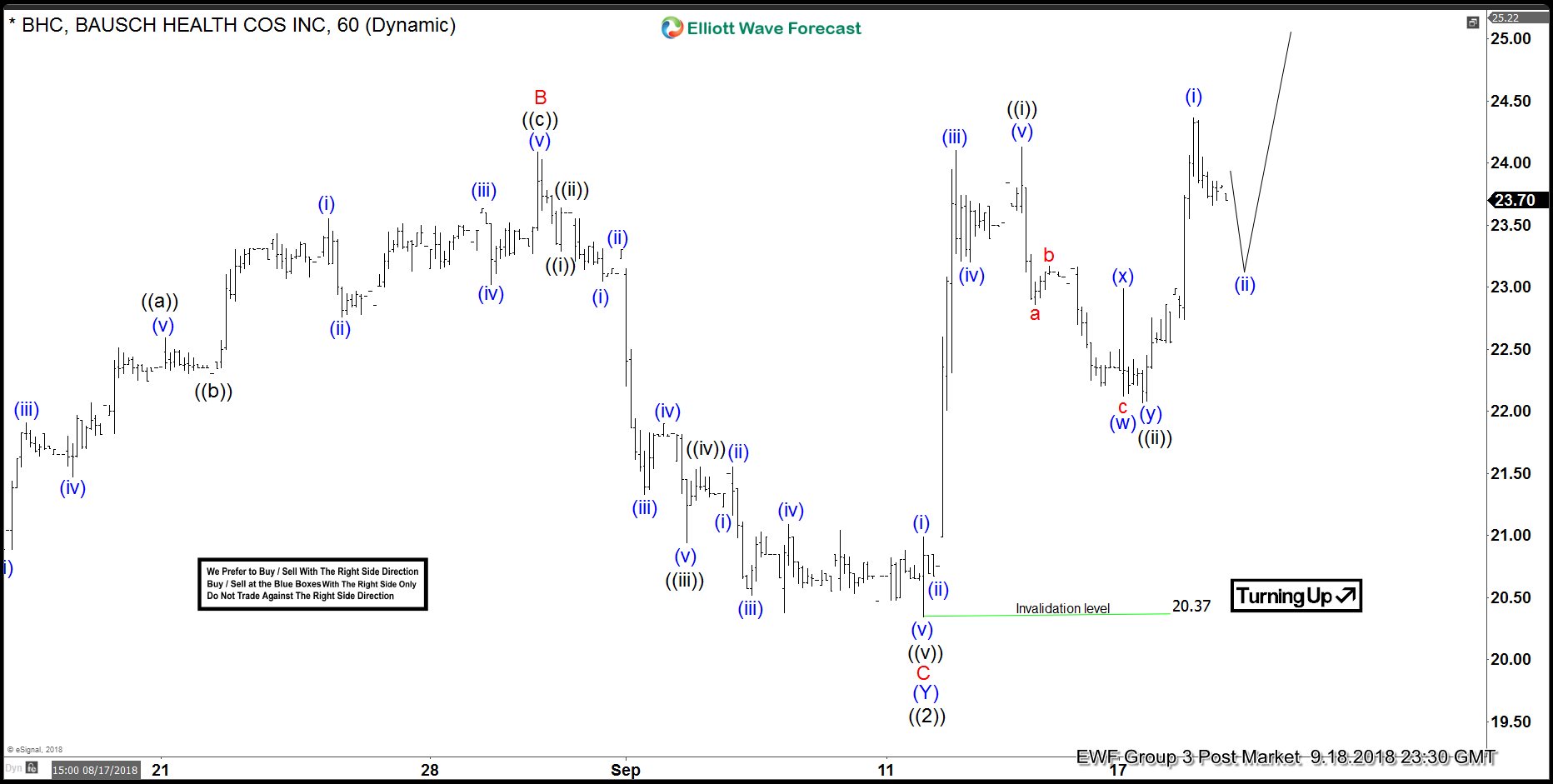

BHC 08.06.2018 1 Hour Chart Elliott Wave Analysis

I hope you enjoyed this blog and I wish you all good trades and if you interested in learning more about our unique blue box areas and also want to trade profitably. You can join us on our special webinar. Limited Seats available!

We believe in cycles, distribution, and many other tools in addition to the classic or new Elliott Wave Principle.

Back