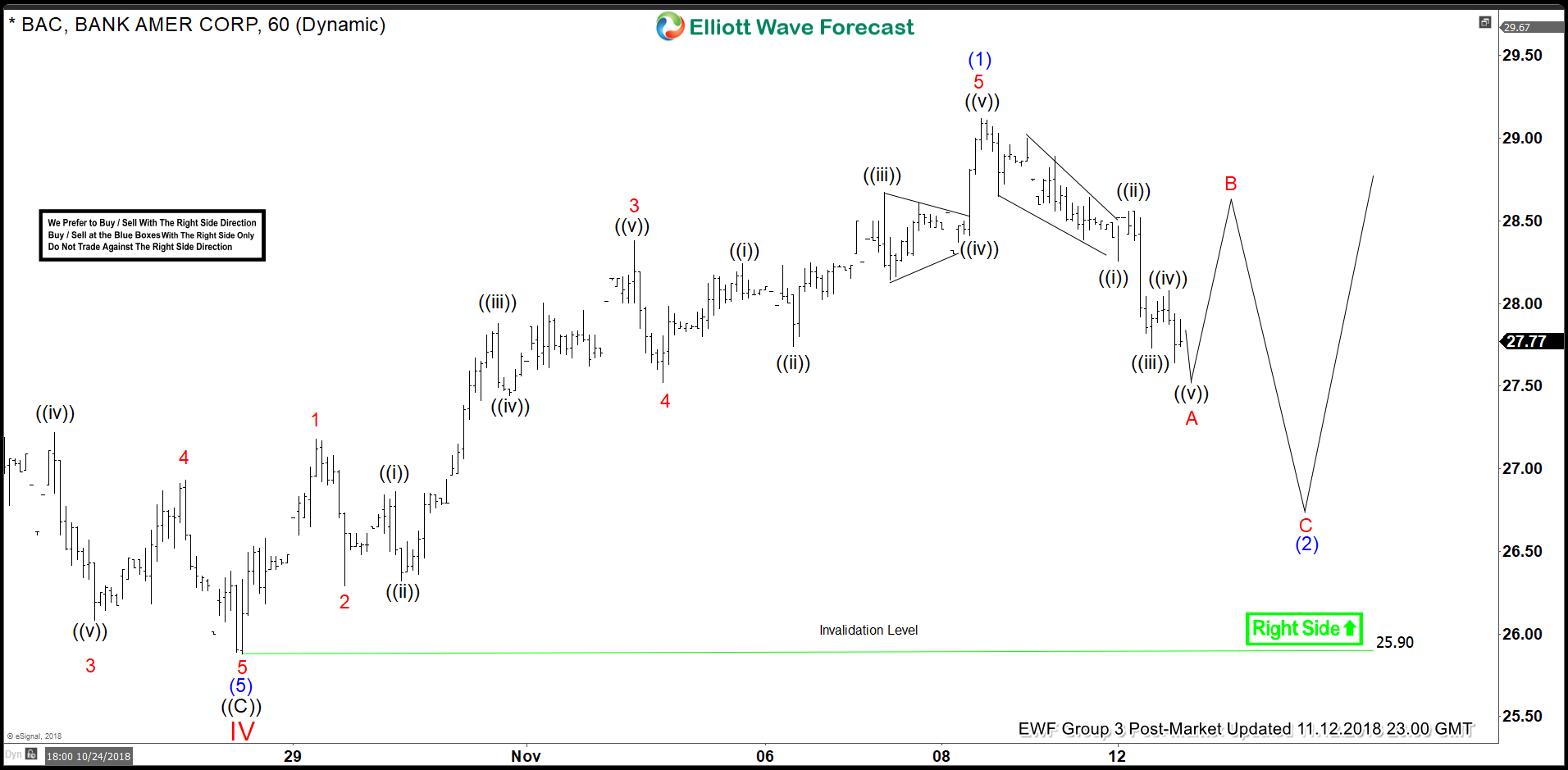

BAC short-term Elliott wave view suggests that a decline to $25.90 low ended cycle degree wave IV pullback as a Flat correction. Up from there, the stock is expected to resume the next leg higher in cycle degree wave V or should do another extension higher from $25.90 low because the rally higher from that low unfolded in 5 waves impulse structure suggesting a continuation pattern. Therefore, we expect stock to do another extension higher at least from $25.90 low.

Up from $25.90 low, the initial rally to $27.18 high ended Minor wave 1 in lesser degree 5 waves structure. Down from there, Minor wave 2 pullback ended at $26.29 low. Then a rally to $28.38 high ended Minor wave 3 in lesser degree 5 waves structure. Below from there, a pullback to $27.52 low ended Minor wave 4. And finally a rally to $29.12 high ended Minor wave 5 in another 5 wave structure & also completed intermediate degree wave (1).

Down from there, intermediate wave (2) pullback remain in progress to correct the cycle from $25.90 low. The internals of that pullback unfolding as a zigzag (5-3-5) structure before upside renew once again. Near-term, while dips remain above $25.90 low expect stock to resume the upside or should do another extension higher at least. We don’t like selling it.