AT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S.

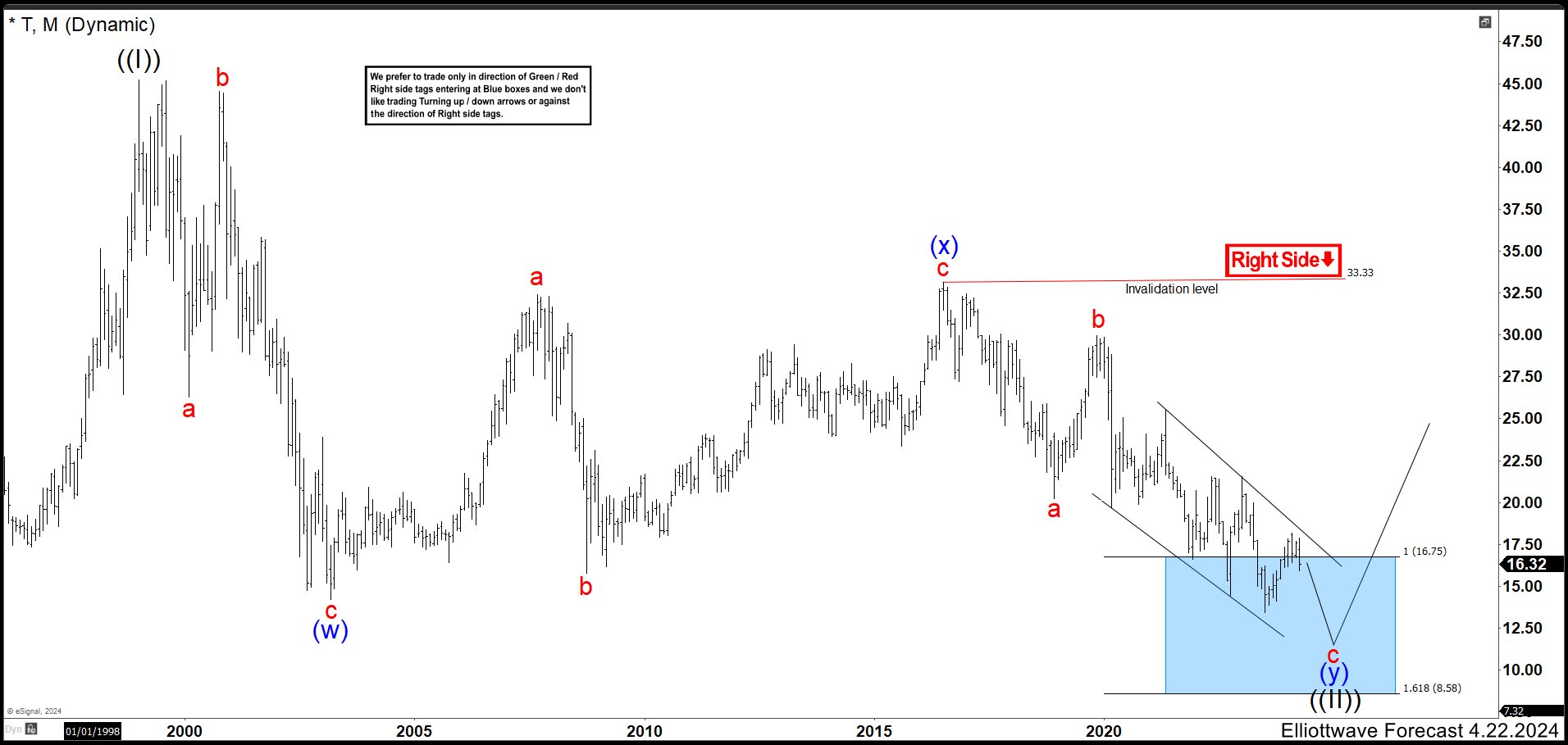

AT&T (T) Monthly Chart April 2024

Above we have montly chart from 5 months ago. We can see that AT&T shares finished an all-time high with a price of $45.23 as wave ((I)). Since the beginning of 1999, the value held a downtrend and we were looking to end this correction. Using the Elliott Wave Principle, a double correction structure (w), (x) and (y) can be clearly seen. From the peak, we have 3 waves in a flat structure that ended wave (w) at $14.17 low. Then, we had another flat structure that built a wave (x) ending in the value of $33.33 high.

The last leg of the double correction is the wave (y). We had already completed wave a and b of (y), and we were developing wave c as an ending diagonal. The market had already reached the blue box in the $8.58 – $16.75 area expecting a rally soon because the market had break wave (w) low and the cycle could have ended. However, we were looking for one more leg lower to complete a clear structure below $13.43 to end wave ((II)) correction and resume the rally.

AT&T (T) Monthly Chart September 2024

On the current monthly chart, we can see the rally that left the blue box. This invalidated the bearish continuation of the ending diagonal as wave c. The rally does not mean that T cannot resume to the downside again. To confirm that wave ((II)) is over at $13.43 low, the market needs to break above of wave (x) high. Until then, T could make perfectly any other structure that leads us to lower prices.

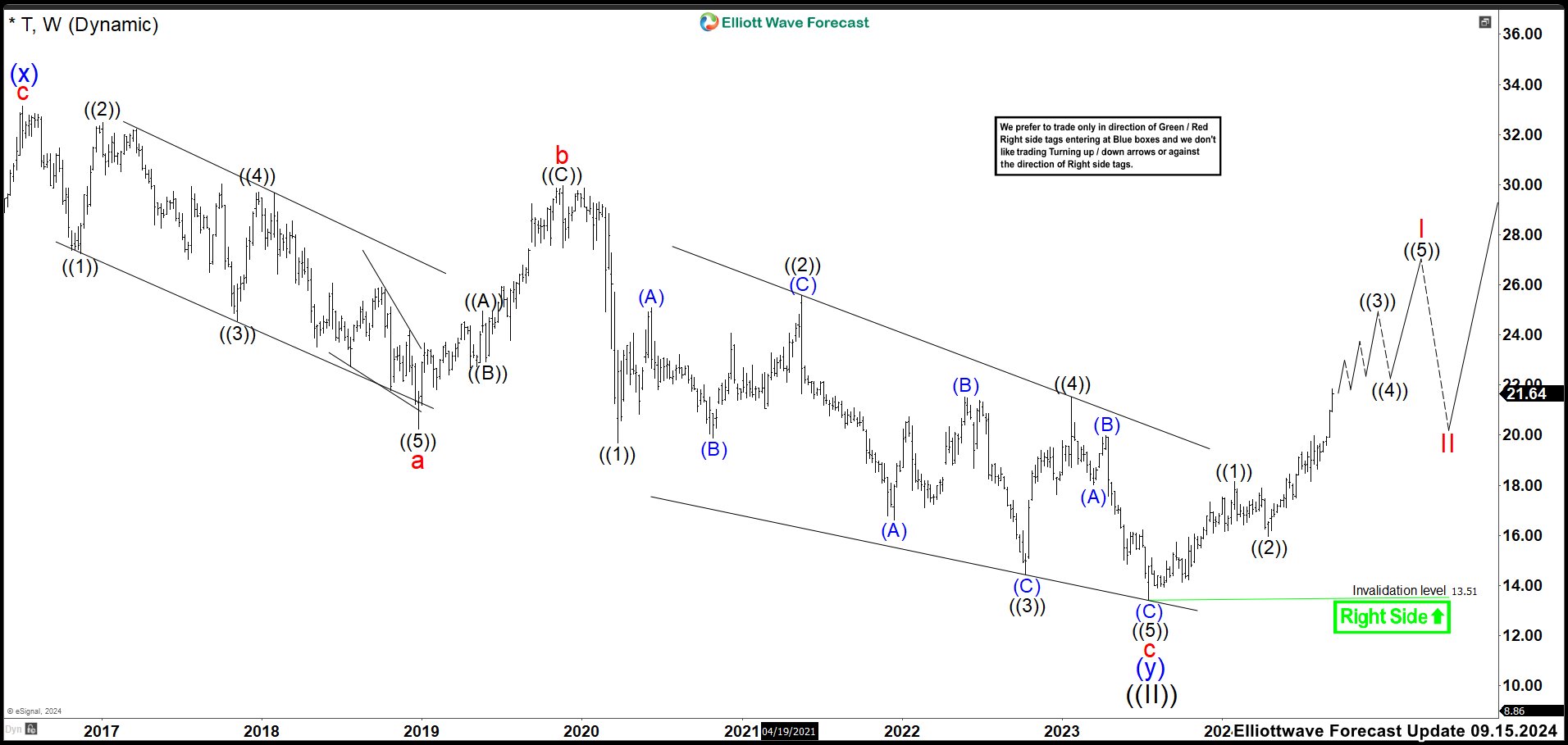

AT&T (T) Weekly Chart September 2024

The weekly chart above shows how the wave ((5)) of c of the ending diagonal completed the structure. The (A), (B), (C) looks like more as the wave ((1)) and we were looking for one more like wave ((3)). That is why we were calling for more one more leg lower. Wave ((II)) ended at $13.43 low and rally and it should be developing an impulse higher as wave I. The first leg higher as wave ((1)) ended at $18.16 high. Wave ((2)) pullback finished at $15.94 low and rally again. AT&T has pushed strongly higher breaking the pivots of the RSI in the weekly timeframe, suggesting the market cycle is over. Now, we should expect to build an impulse structure as the chart before seeing 3, 7 or 11 swings correction as wave II.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back