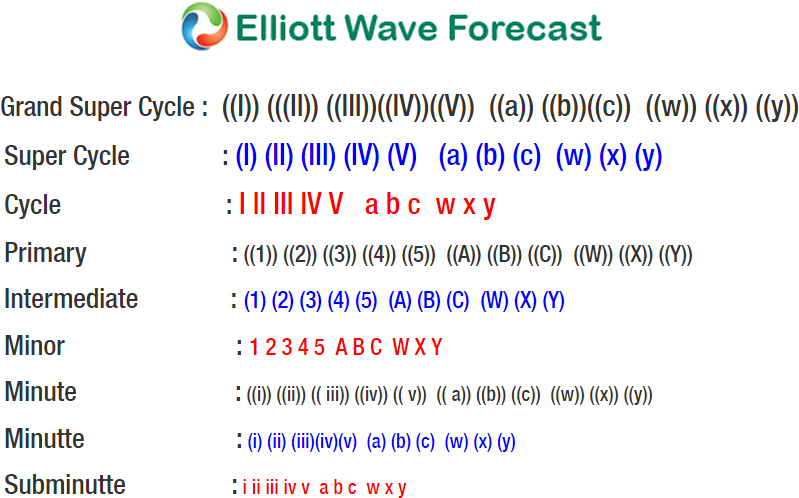

AAPL short-term Elliott wave view suggests that a rally to $233.53 high ended supercycle degree wave (III) as an impulse. Down from there, supercycle degree wave (IV) remains in progress as double three structure. Where the initial decline to $212 low ended cycle degree wave w. The internals of that leg lower unfolded as a Zigzag structure where primary wave ((A)) ended in 5 waves at $220.20 low. Up from there a bounce to $227.48 high ended primary wave ((B)) bounce. Then finally a decline to $212 low ended primary wave ((C)) in another 5 waves & also completed cycle degree wave w.

Up from there, the stock corrected the cycle from $233.53 high in wave x bounce. The internals of that bounce unfolded as lesser degree double three structure. Where primary wave ((W)) ended at $222.25 high as zigzag structure. Then a pullback to $216.82 low ended primary wave ((X)) as a Flat structure. Above from there, a rally to $223.93 high ended primary wave ((C)) as a Flat & also completed cycle degree wave x. Currently, cycle degree wave y remain in progress as a Zigzag structure where primary wave ((A)) ended at $213 low. And while primary wave ((B)) bounce fails below $223.93 high and more importantly below $233.53 high expect AAPL to extend lower 1 more time towards $202.52-$189.25 100%-161.8% Fibonacci extension area of cycle degree w-x before upside renew or stock does a 3 wave bounce at least. We don’t like selling it.