The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

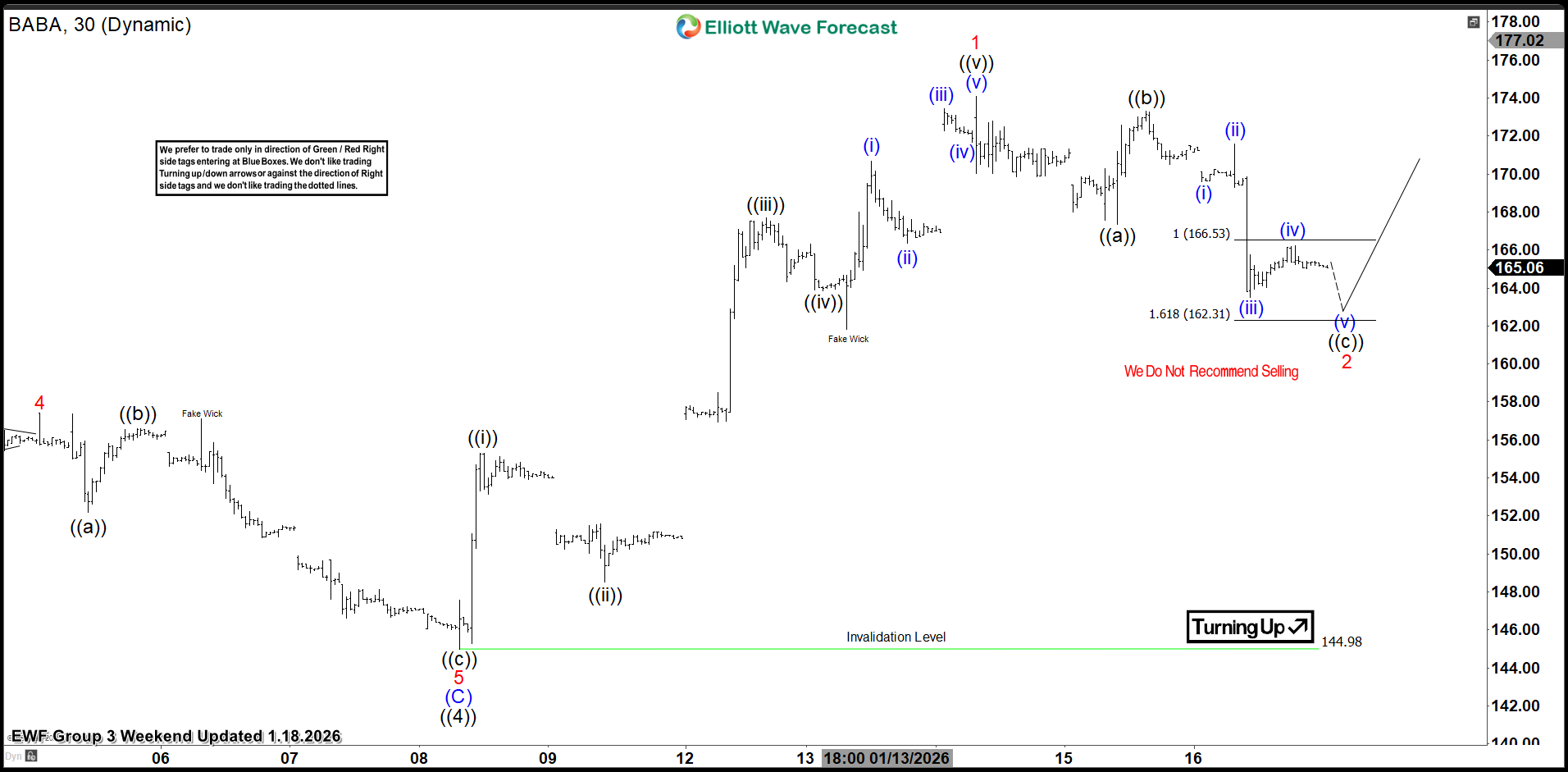

Alibaba Group. $BABA Extreme Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of Alibaba Group. ($BABA) through the lens of Elliott Wave Theory. We’ll review how the rally from the Jan 8th 2026 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss what could come next. Let’s explore the structure and the expectations for this stock. 5 Wave […]

-

Raytheon Technologies (RTX): The Breakout Toward $222

Read MoreRaytheon Technologies Corp (NYSE: RTX) leads the aerospace and defense sector. Recent geopolitical events have fueled strong outperformance and momentum for the stock. Today, we analyze the Elliott Wave pattern driving its strategic breakout. Our examination provides a clear technical roadmap for its ascent. This convergence of sector strength and wave structure creates a compelling […]

-

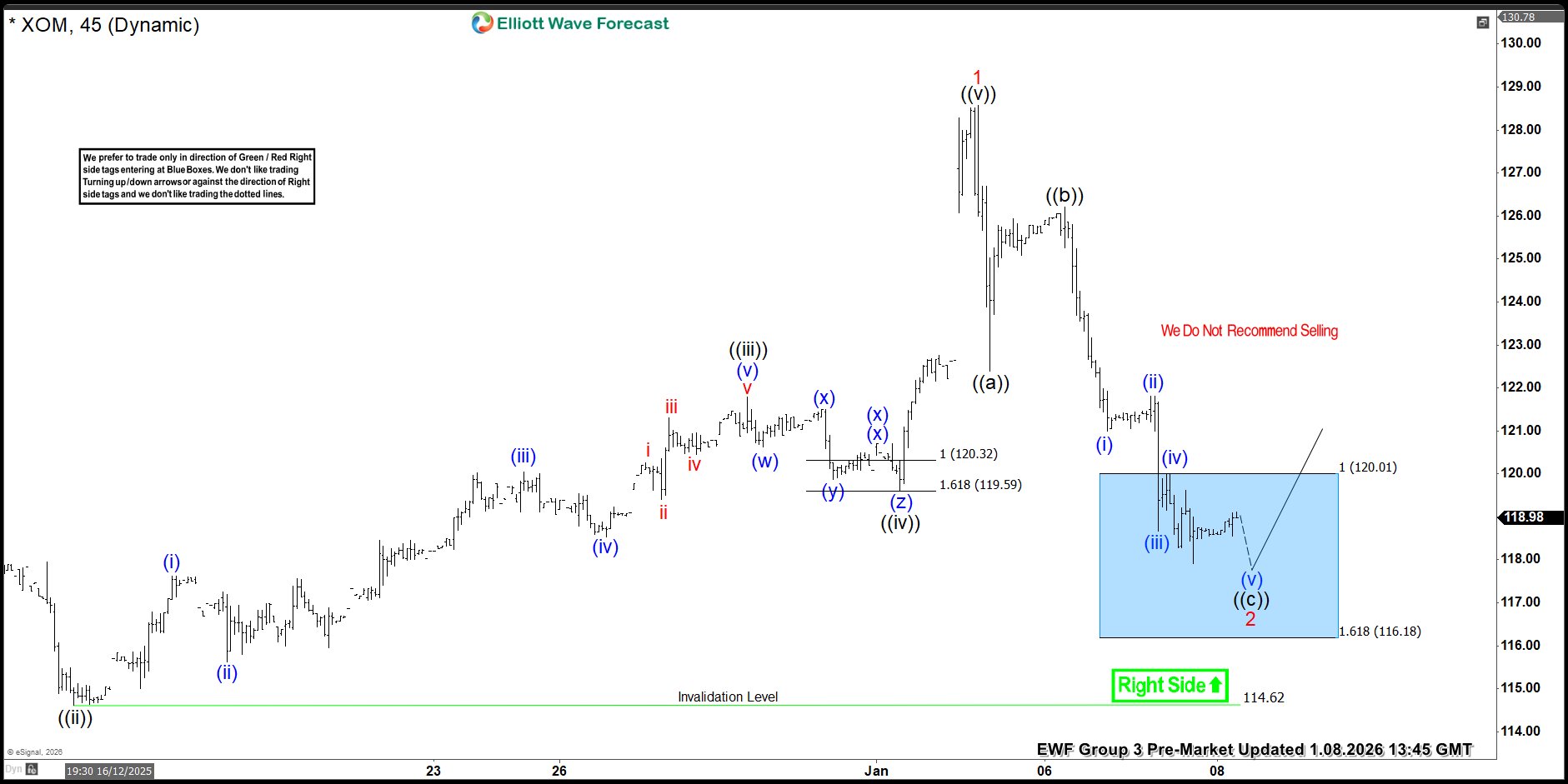

Elliott Wave in Action: XOM Rockets from Blue Box Area

Read MoreDriving XOM to new highs as expected — a textbook example of the powerful combination of Elliott Wave & Blue Box analysis.

-

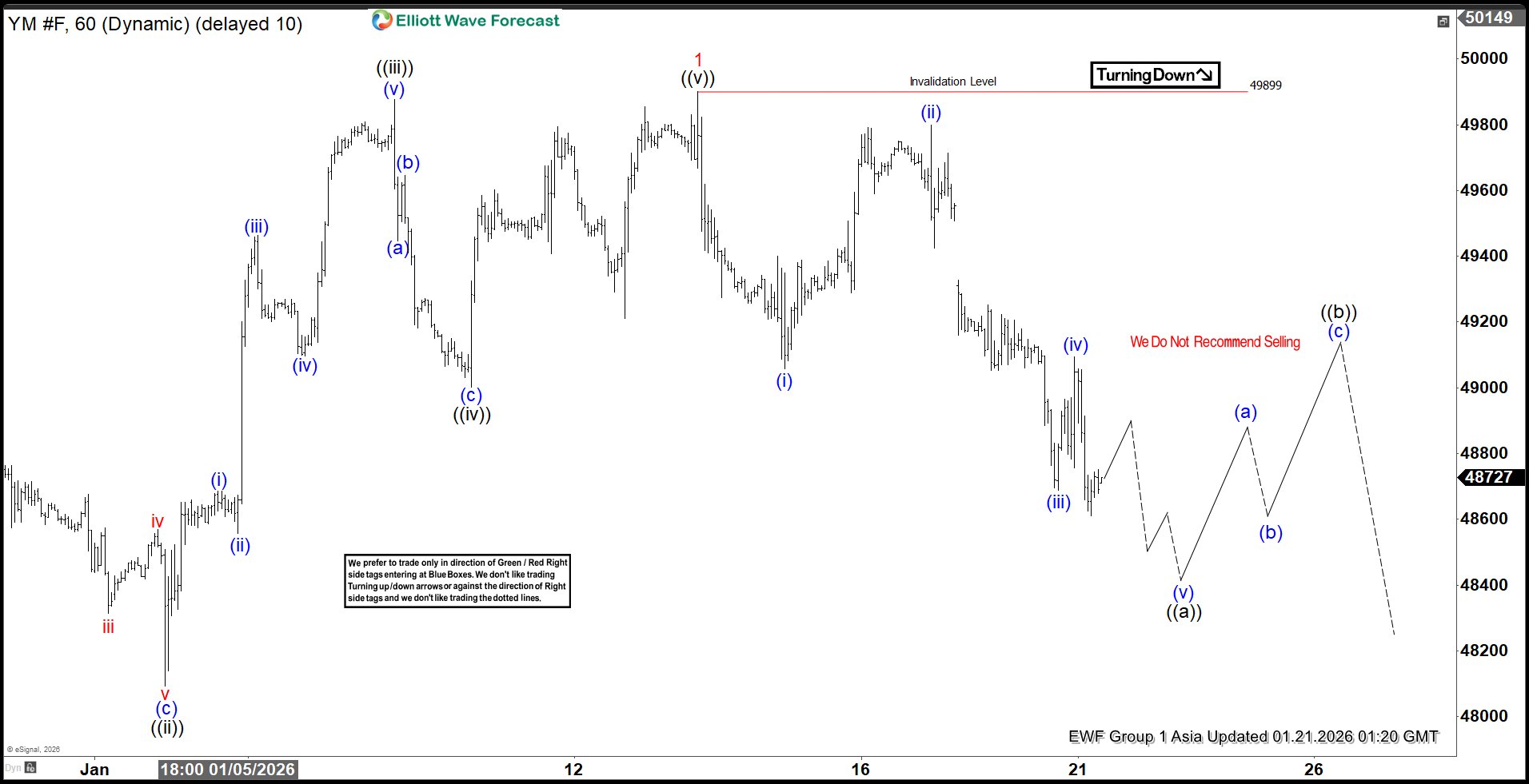

Elliott Wave Outlook: Dow Futures (YM) Correcting Cycle From Nov 2025

Read MoreDow Futures (YM) ended cycle from Nov 21 low and now correcting this cycle before the next leg higher. This article and video look at the Elliott Wave path.

-

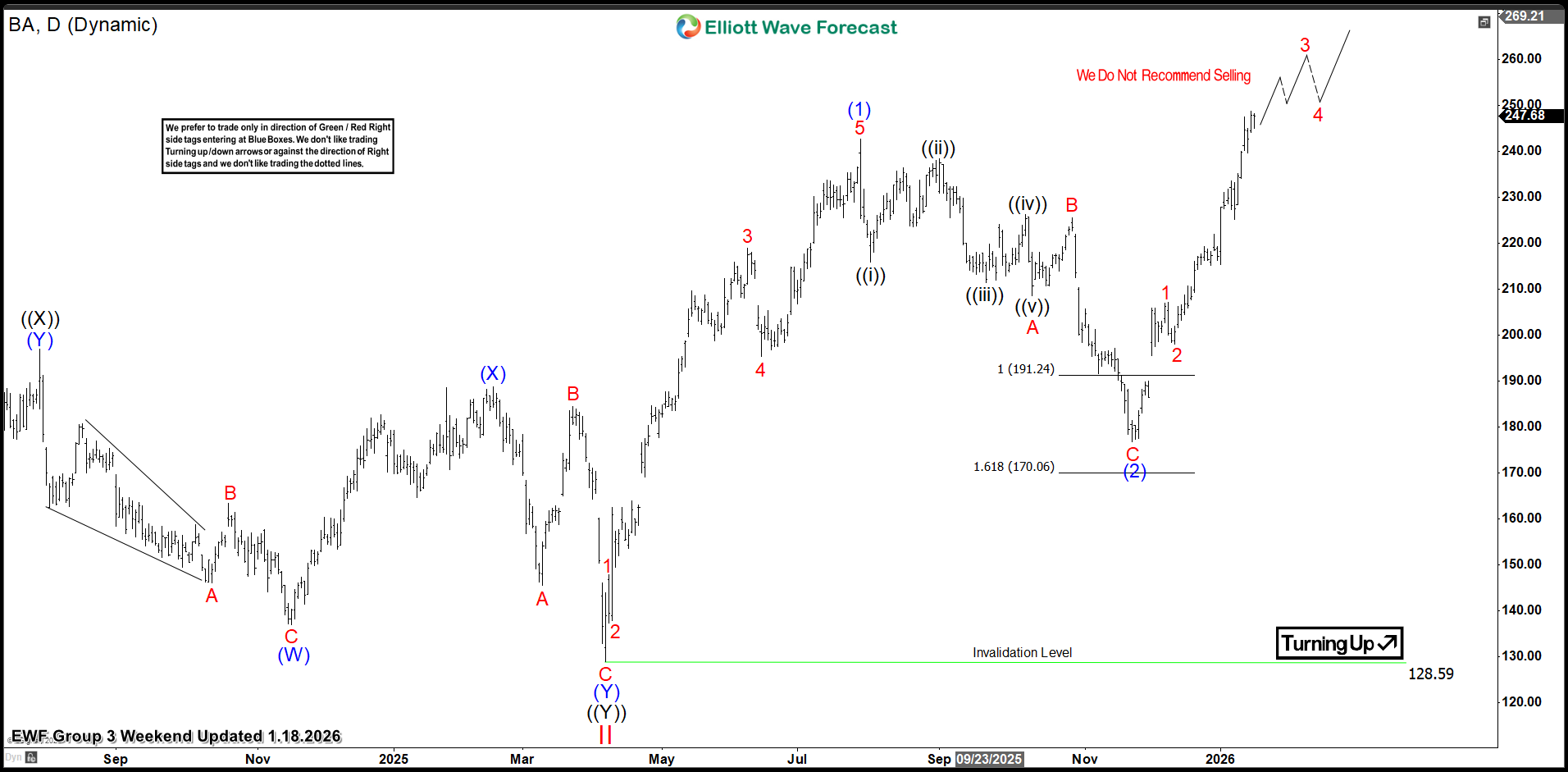

Boeing Co. $BA Extreme Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll review the recent performance of Boeing Co ($BA) through the lens of Elliott Wave Theory. We’ll look at how the pullback from recent 52 week highs unfolded as a textbook 3-swing correction and discuss what could come next. Let’s explore the structure and the expectations for this stock. 5 Wave Impulse Structure + ABC […]

-

ASML Holding (ASML) Favors Rally Towards 1457.74

Read MoreASML Holding N.V., (ASML) provides lithography solutions for the development, production, marketing, sales, upgrading & servicing semiconductor equipment systems. It also offers hardware, software & services to chipmakers to produce the patterns of integrated circuits. It comes under Technology sector & trades as ‘ASML’ ticker at Nasdaq. ASML trading at ATH, broke the price channel […]