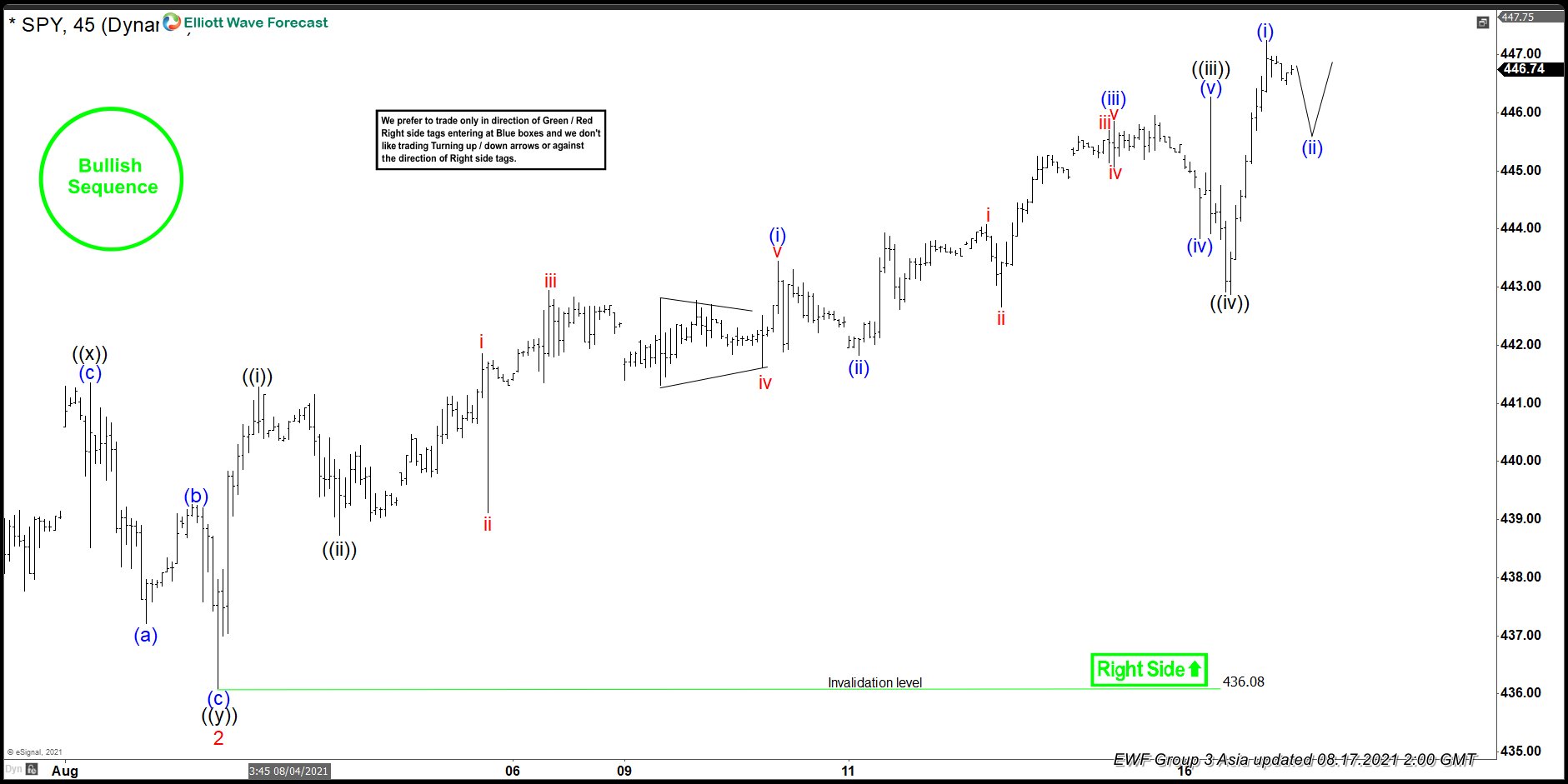

Short-term Elliott wave view in SPY suggests that the cycle from 19 July 2021 low is unfolding in an impulse sequence favoring more upside extension to happen. Up from that low, the index has ended the first leg in wave 1 at 441.16 high. Then wave 2 pullback unfolded as a double three structure where wave ((w)) ended at 436.86 low. Wave ((x)) bounce ended at 441.37 high and wave ((y)) ended at 436.08low, thus completed the wave 2 pullback.

Above from there, wave 3 remains in progress in lesser degree 5 waves structure where wave ((i)) ended at 441.29. Wave ((ii)) pullback ended at 438.73 low. Wave ((iii)) rally finished at 446.28 and wave ((iv)) pullback as a zig zag structure at 442.88. Near-term, as far as dips remain above wave ((iv)) low at 442.87, expect SPY to extend higher within wave ((v)). Alternatively, SPY could end wave ((v)) of 3 already at 447.25, and the pullback will then become a wave 4 pullback. In the alternate scenario, pullback is expected to hold above wave 2 low at 436.08 for further upside. As far as August 3 pivot at 436.08 low stays intact, expect dips to find support in 3, 7, or 11 swings for further upside.