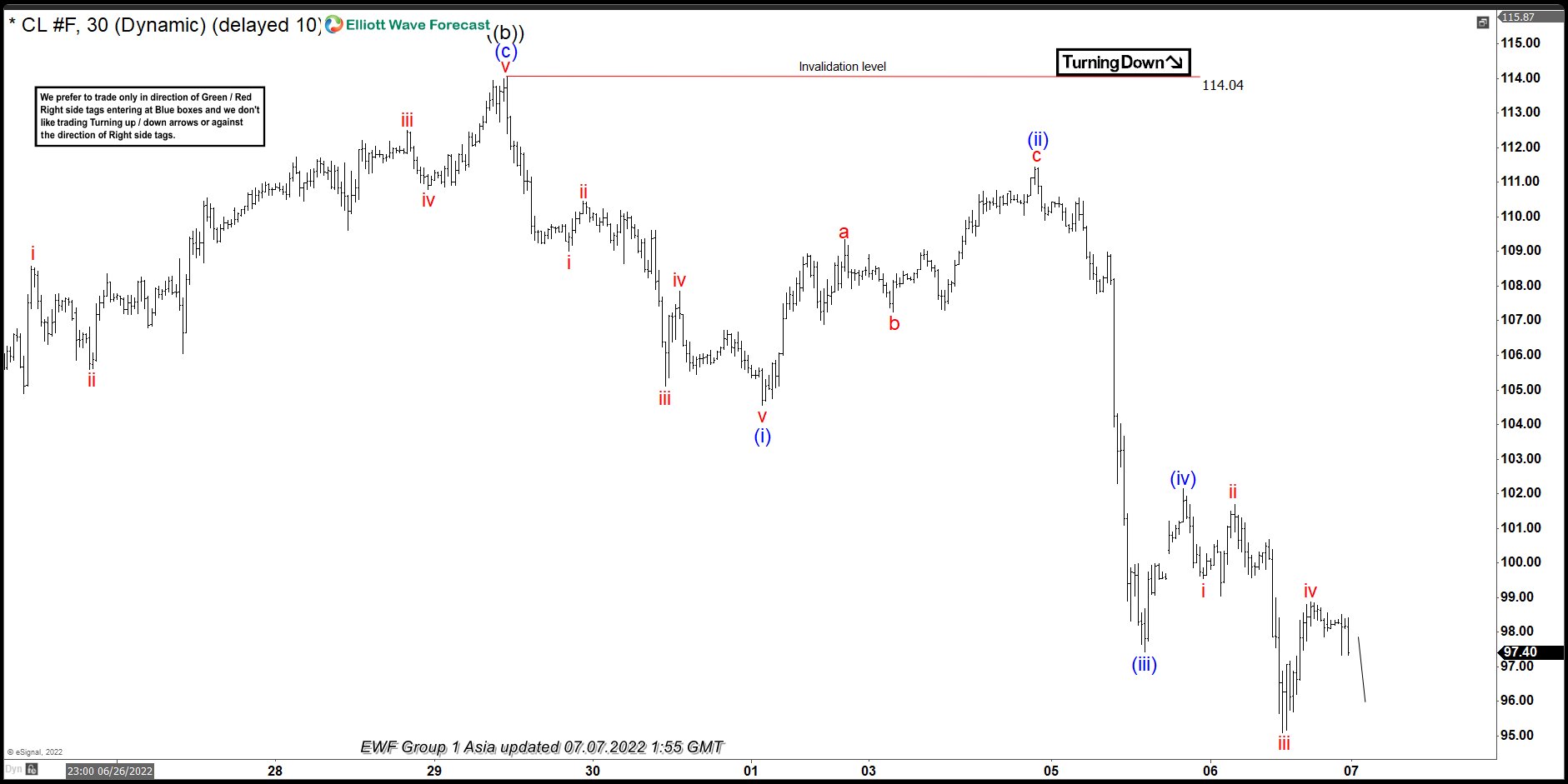

Short term Elliott Wave view in Oil suggests the decline from 123.77 did 5 waves down ended an impulse as wave ((a)) at 101.56. Then market bounced building a corrective structure and ended wave ((b)) at 114.04. Oil has turned lower in wave ((c)) to complete a 3 swings structure to look for a double correction pattern.

Internal subdivision of wave ((c)) is unfolding as a 5 waves impulse structure. Down from wave ((b)), wave (i) ended at 104.52 and wave (ii) rally ended at 12174.25. Oil then resumes lower in wave (iii) towards 97.37 and wave (iv) rally ended at 102.11. We are looking to complete final leg lower wave (v). That will complete wave ((c)) and also wave W of the double correction. The subdivion of wave (v) is building an impulse. Wave i ended at 99.51 and wave ii rally ended at 101.69. Then it turned lower to 95.15 to complete wave iii and pullback in wave iv ended at 98.87. Now we are calling one more low below 101.69 to complete wave (v) of ((c)) of W and see a bounce. If market breaks above 99.51 before turning lower, wave ((c)) of W should be completed and we expect to corrective rally in 3, 7 or 11 swing before turning lower again.