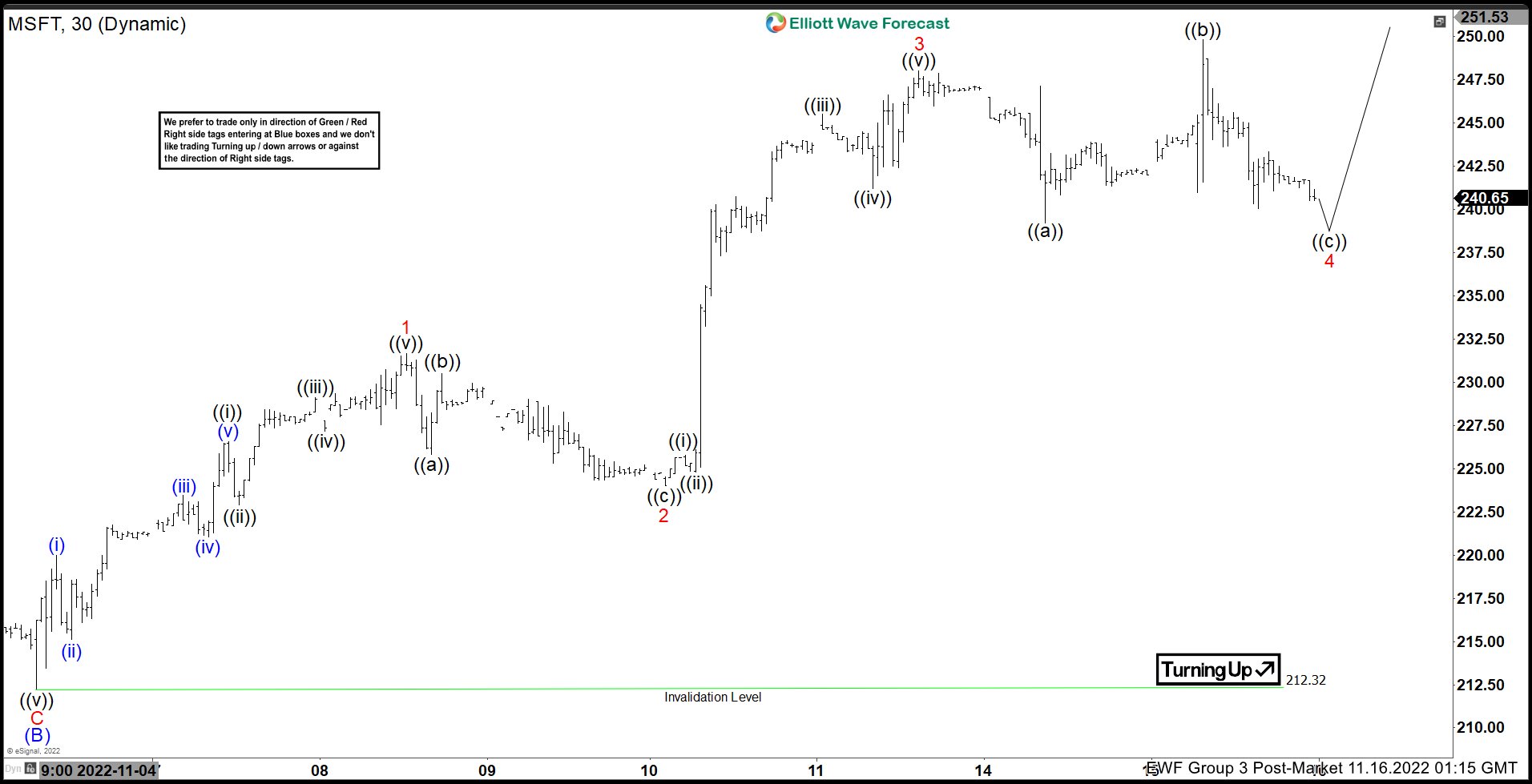

Short term Elliott Wave View in Microsoft (MSFT) shows an incomplete bearish sequence from 11.22.2021 high favoring further downside. Short term, rally from 10.13.2022 low is unfolding as an expanded flat Elliott Wave structure. Up from 10.13.2022 low, wave (A) ended at 252.62 and pullback in wave (B) ended at 212.24. Wave (C) higher is in progress as a 5 waves impulse structure before the stock turns lower again.

Up from wave (B), wave 1 ended at 231.60 and pullback in wave 2 ended at 223.90. MSFT then rallies again in wave 3 towards 247.97. Internal subdivision of wave 3, it has a shallow wave ((i)) ended at 225.86 and retracement in wave ((ii)) ended at 224.73. From here, rally was strong to 245.59 to complete wave ((iii)). Then a zigzag wave ((iv)) took place ended at 241.20 and last push in wave ((v)) of 3 finished at 247.97. Wave 4 has taken the form of an expanded flat. Down from wave 3, wave ((a)) ended at 239.13 and rally in wave ((b)) ended at 249.83. Expect wave ((c)) to end soon which also completes wave 4. Afterwards, as far as pivot at 223.90 low stays intact, expect Microsoft to extend higher 1 more leg to complete wave 5 of (C) and the whole flat correction as wave ((B)) before turning lower again.