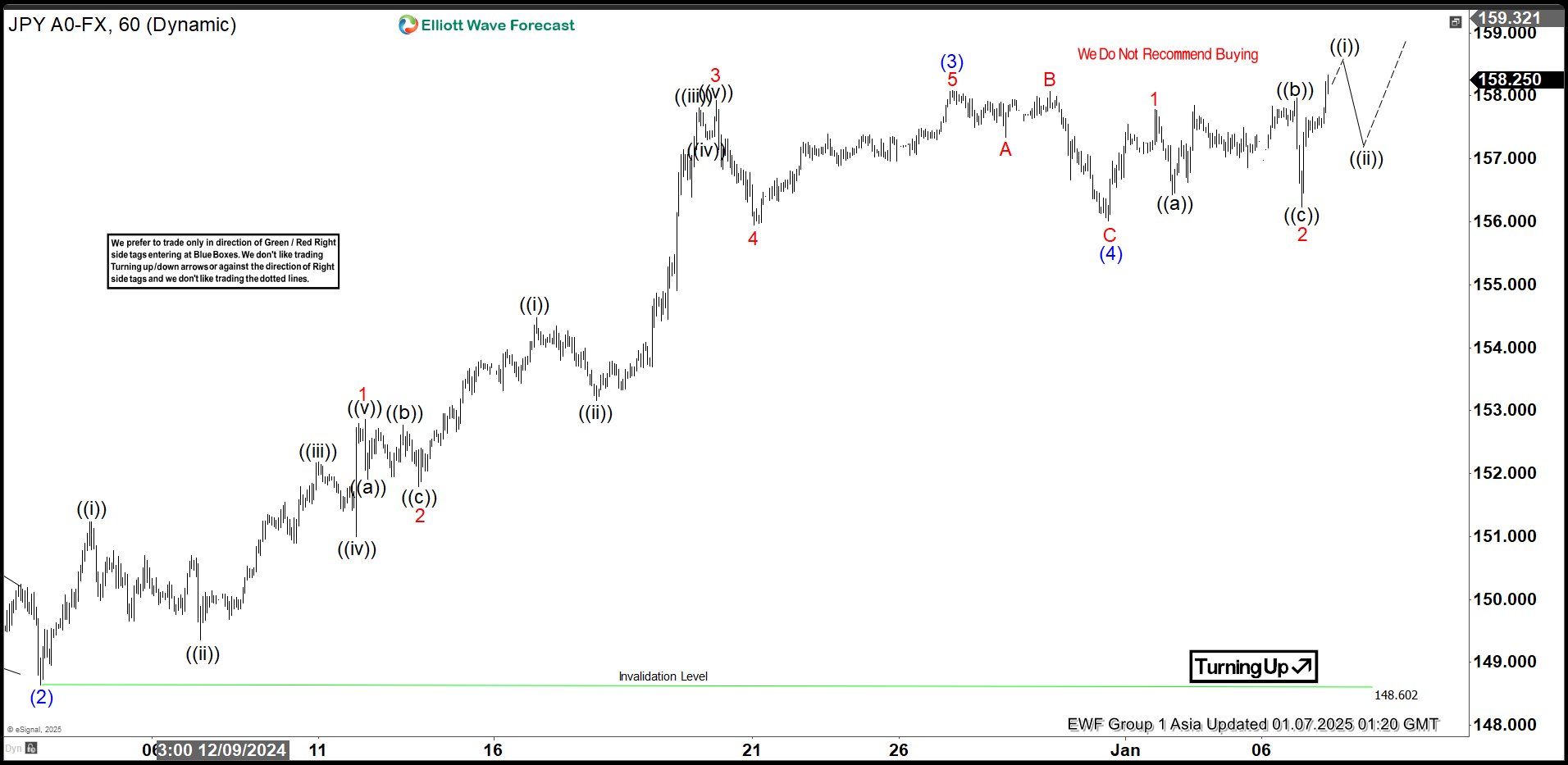

Short Term Elliott Wave view in USDJPY suggests rally from 9.16.2024 low is in progress as a 5 waves diagonal. Up from 9.16.2024 low, wave (1) ended at 156.74 and pullback in wave (2) ended at 148.64 as 1 hour chart below shows. Pair resumed rally higher in wave (3) with internal subdivision as an impulse. Up from wave (2), wave 1 ended at 152.86 and dips in wave 2 ended at 151.79. Pair resumed higher in wave 3 towards 157.92 and pullback in wave 4 ended at 155.94. Final leg wave 5 ended at 158.04 which completed wave (3) in higher degree. Pullback in wave (4) unfolded as a flat structure.

Down from wave (3), wave A ended at 157.34 and wave B ended at 158.07. Wave C lower ended at 156 which completed wave (4) in higher degree. Pair has resumed higher in wave (5). Up from wave (4), wave 1 ended at 157.78 and dips in wave 2 ended at 156.23. Near term, as far as pullback stays above wave (4) low at 156, and more importantly above 148.6 low, expect pullback to find support in 3, 7, or 11 swing for further upside.