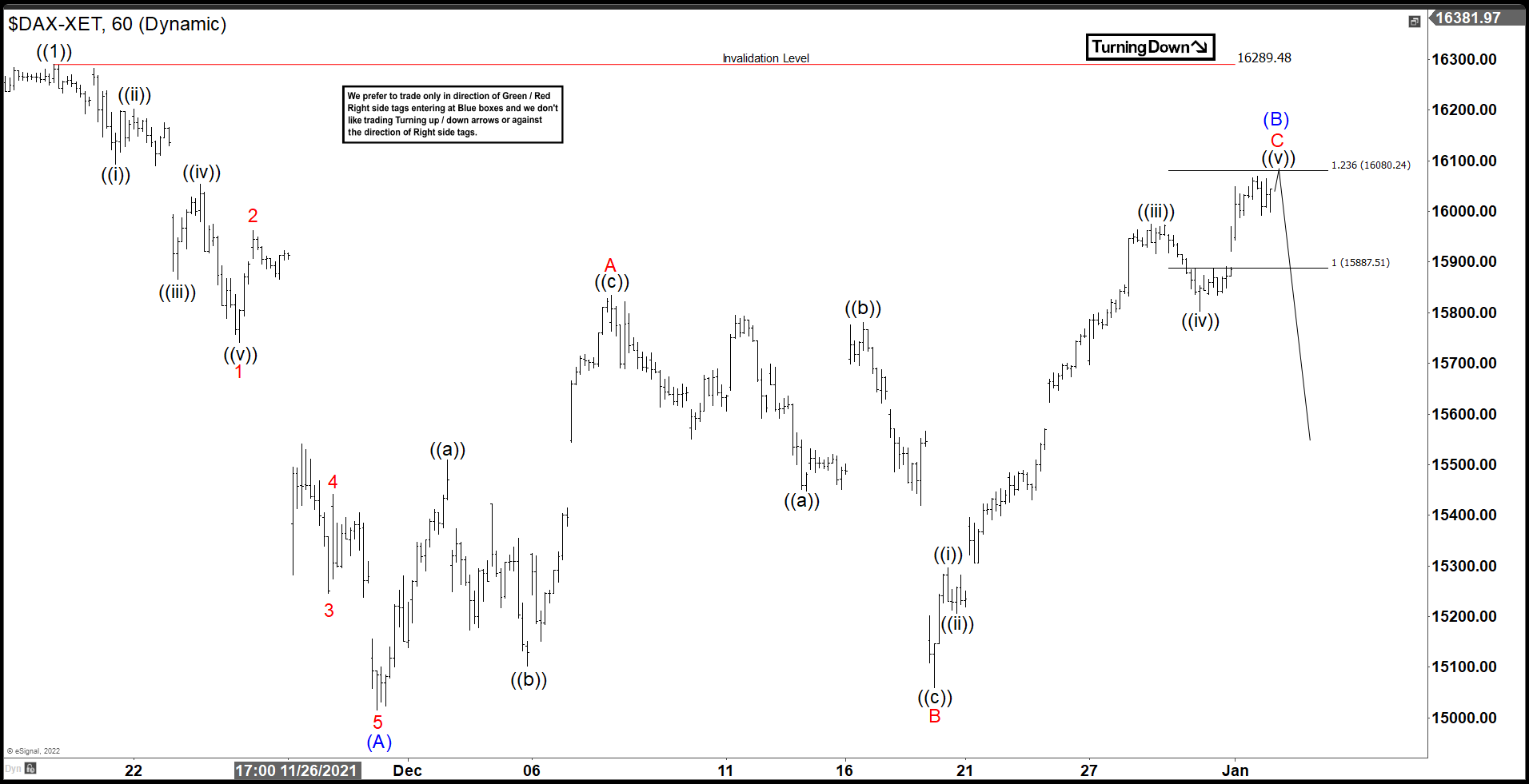

Elliott Wave View in DAX (DAX-XET) suggests it is correcting cycle from last October, 2021 low in larger degree 3 swings. The decline is unfolding as a zig zag elliott wave structure. Down from November 18 2021 peak (16289.48), wave (A) ended at 15015.42 and rally in wave (B) is in progress. This wave (B) is forming a flat correction (3-3-5) where wave A made 3 swings up ending at 15834.04 and then we saw 3 swings down to 15060.10 to complete wave B. From this low we should see 5 swings rally to complete flat correction structure as wave C and also wave (B).

Up from wave B, wave ((i)) ended at 15296.08 and pullback in wave ((ii)) ended at 15206.95. Wave ((iii)) higher ended at 15974.79 and wave ((iv)) correction ended at 15803.59. Near term, expect the last rally wave ((v)) to end soon. This should complete wave C and wave (B) where we should see a market rejection to indicate wave (C) has started. This wave (C) should continue lower to break 15015.42 wave (A) low. Near term, as far as pivot at 16289.48 high stays intact, expect the Index to turn lower soon.