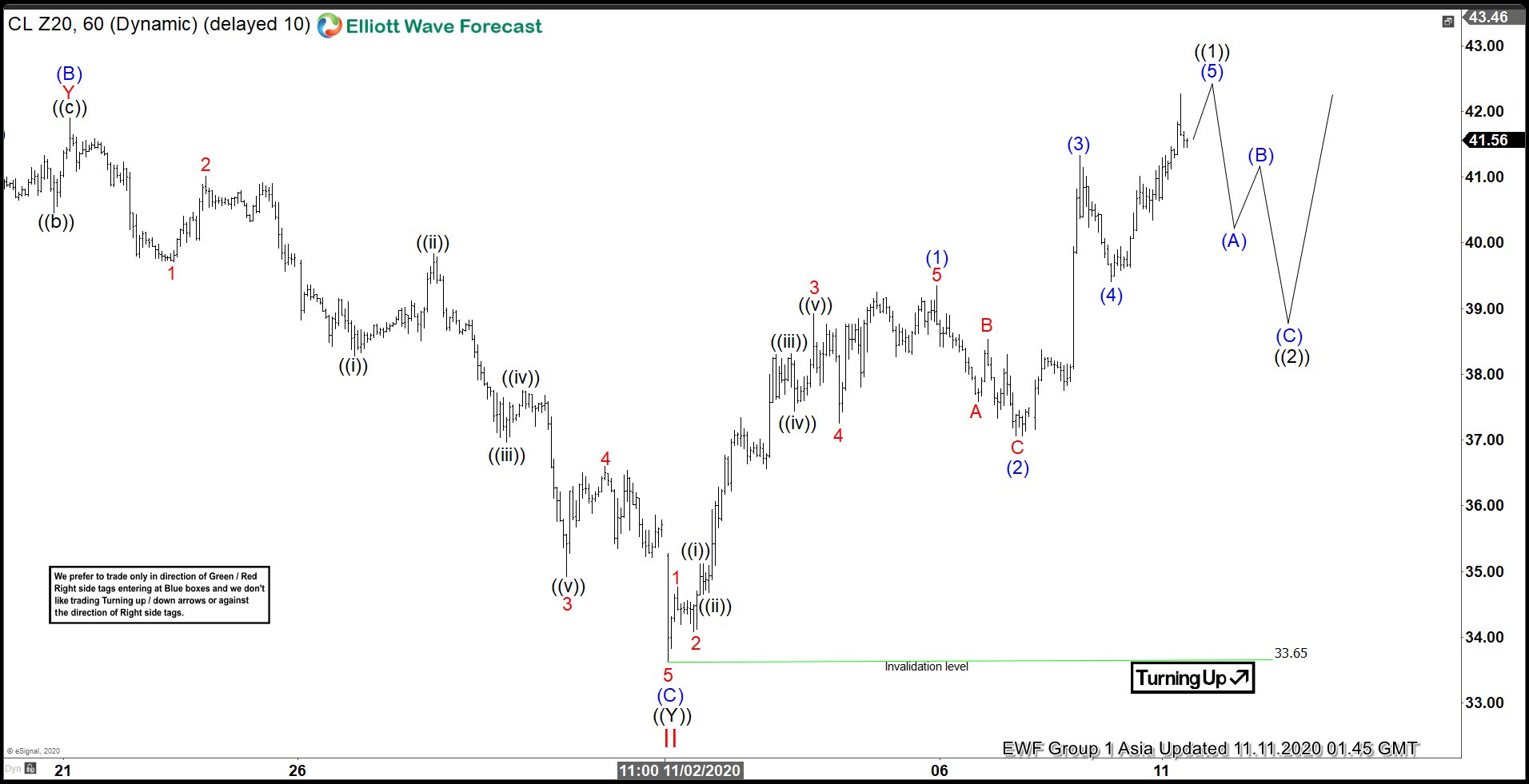

Short term Elliott Wave View in Oil (CL) suggests it ended wave II at $33.65 on November 2. Internal of wave II unfolded as a zigzag Elliott wave structure where wave (A) ended at $37.11, wave (B) ended at 41.90, and wave (C) ended at $33.65. This wave II is part of a 5 waves impulsive Elliott Wave structure which started on April 22 low.

Short term 60 minutes chart below shows Oil has turned higher in wave III. Up from wave II low at $33.65, wave 1 ended at $34.76 and wave 2 pullback ended at $34.09. The commodity has resumed higher in wave 3 towards $38.23, wave 4 ended at $37.26, and wave 5 ended at $39.35. This completed wave (1) of ((1)) in higher degree. From there, pullback in wave (2) ended at $37.06. It then resumed higher in wave (3) towards $41.33 and wave (4) pullback ended at $39.41.

Expect Oil to end wave (5) soon which should also complete wave ((1)) in higher degree. Afterwards, Oil should pullback in wave ((2)) to correct cycle from November 2 low before the rally resumes. As far as pivot at $33.65 low stays intact, expect Oil to find buyers in 3, 7, or 11 swing for more upside.