In the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 as wave ((III)) and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 in June 2020. After these 3 swings, USDCNH should have continued with the downtrend. However, the pair turning up again breaking 7.1964 high suggesting that market is developing a double correction structure. (If you want to learn more about Elliott Wave Theory, please follow these links: Elliott Wave Education and Elliott Wave Theory)

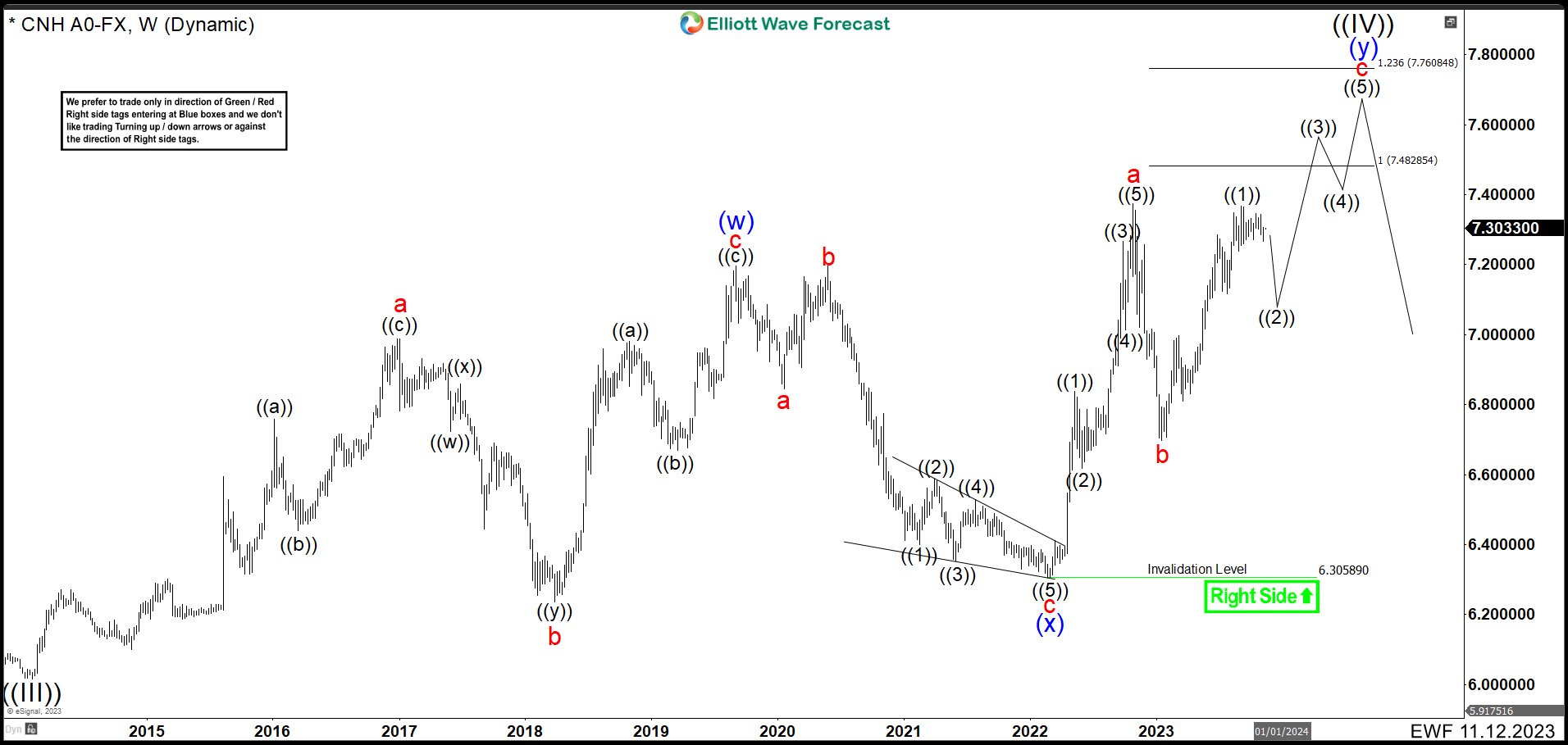

USDCNH November 2023 Weekly Chart

In the chart above, looks like the first leg of the wave “c” ended as wave ((1)). Up from 6.6883 wave “b” low, we can see 5 swings higher creating an impulse. First wave ended at 6.9967. Wave (2) pullback at 6.8107 low. Then USDCNH rally finishing wave (3) at 7.2855. Wave (4) correction completed at 7.1162 low. Last push to 7.3679 ended wave (5) and wave ((1)). Currently, we are expecting a correction as wave ((2)) of “c”. This movement should drop to 7.12 – 6.95 area correlating with USDX weakness that we are looking for. After finishing wave ((2)), pair should rally in 3 swings to build an impulse as wave “c” to 7.4866 – 7.7646 area. This also will finish the double correction wave (y), and the wave ((IV)) before renminbi continues with the downtrend.

USDCNH March 2024 Weekly Chart

After 4 months, We can see a pullback as we expected. The drop in wave ((2)) ended at 7.08 in the 7.12 – 6.95 area and it has bounced higher. The reaction is not what we expected and pair looks like is lagging. Therefore, we are calling the possibility that structure ended at 7.08 could be wave (A) of ((2)), the bounce the wave (B) of ((2)) and we should see one more low to end wave ((2)) before resuming the rally to 7.4866 – 7.7646 area to complete wave ((IV)) correction.

USDCNH March 2024 Alternative Weekly Chart

As alternative view, we cannot rule out that wave ((2)) is completed at 7.08 and the pair should continue to the upside to end the double correction as wave ((IV)).

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a 24 hours chat room where we will help you with any questions about the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back