In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

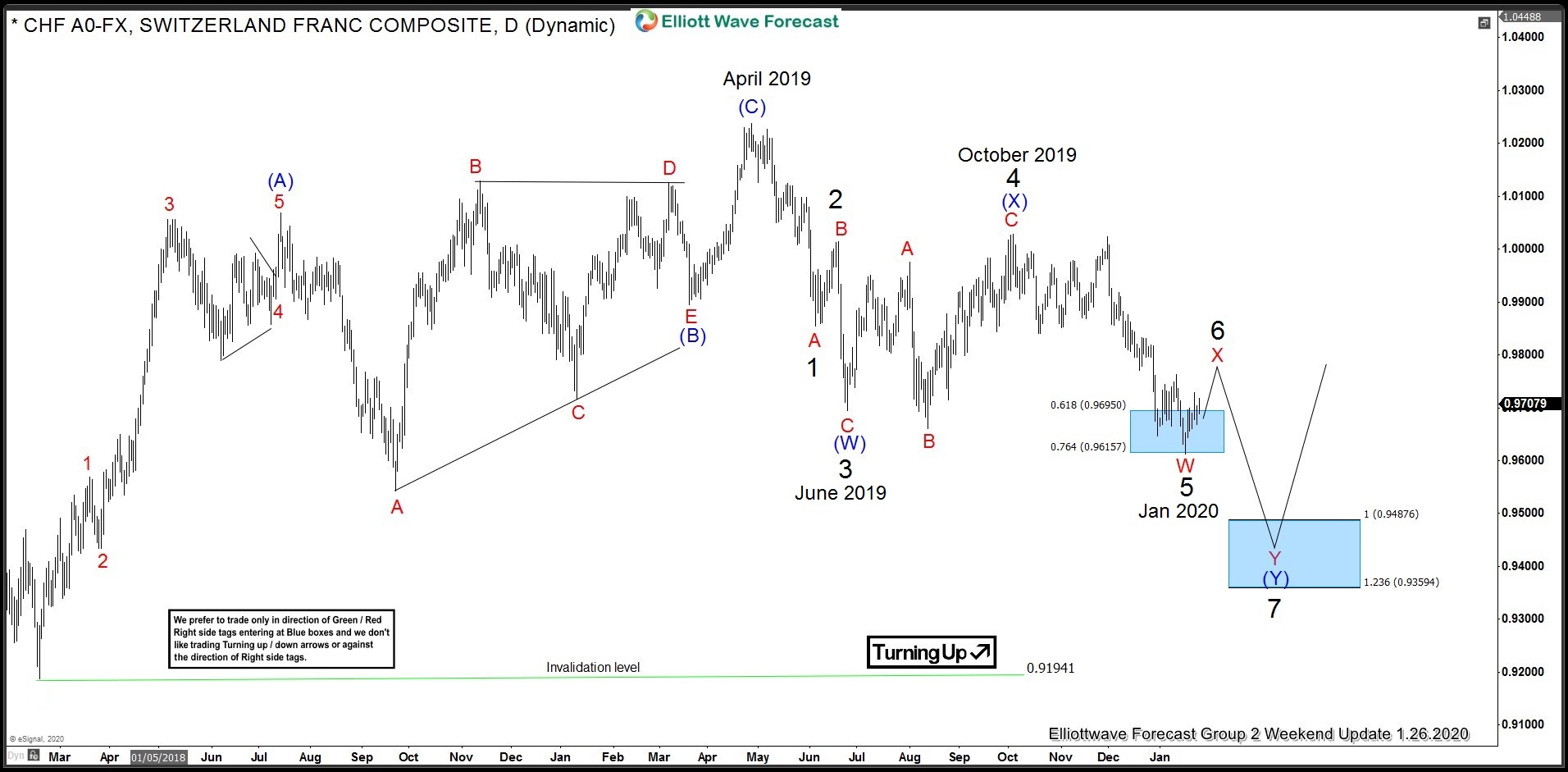

USDCHF Incomplete Elliott Wave Sequence Puts Sellers in Control

Read MoreUSDCHF found a low on 1.16.2020 (0.9610) and has been bouncing since then. Initial rally from 0.9610 to 0.9729 was in 3 waves which was followed by a pull back and pair has since then made a new high above 0.9729 and today, we would look at the structure of the bounce from 0.9610 and […]

-

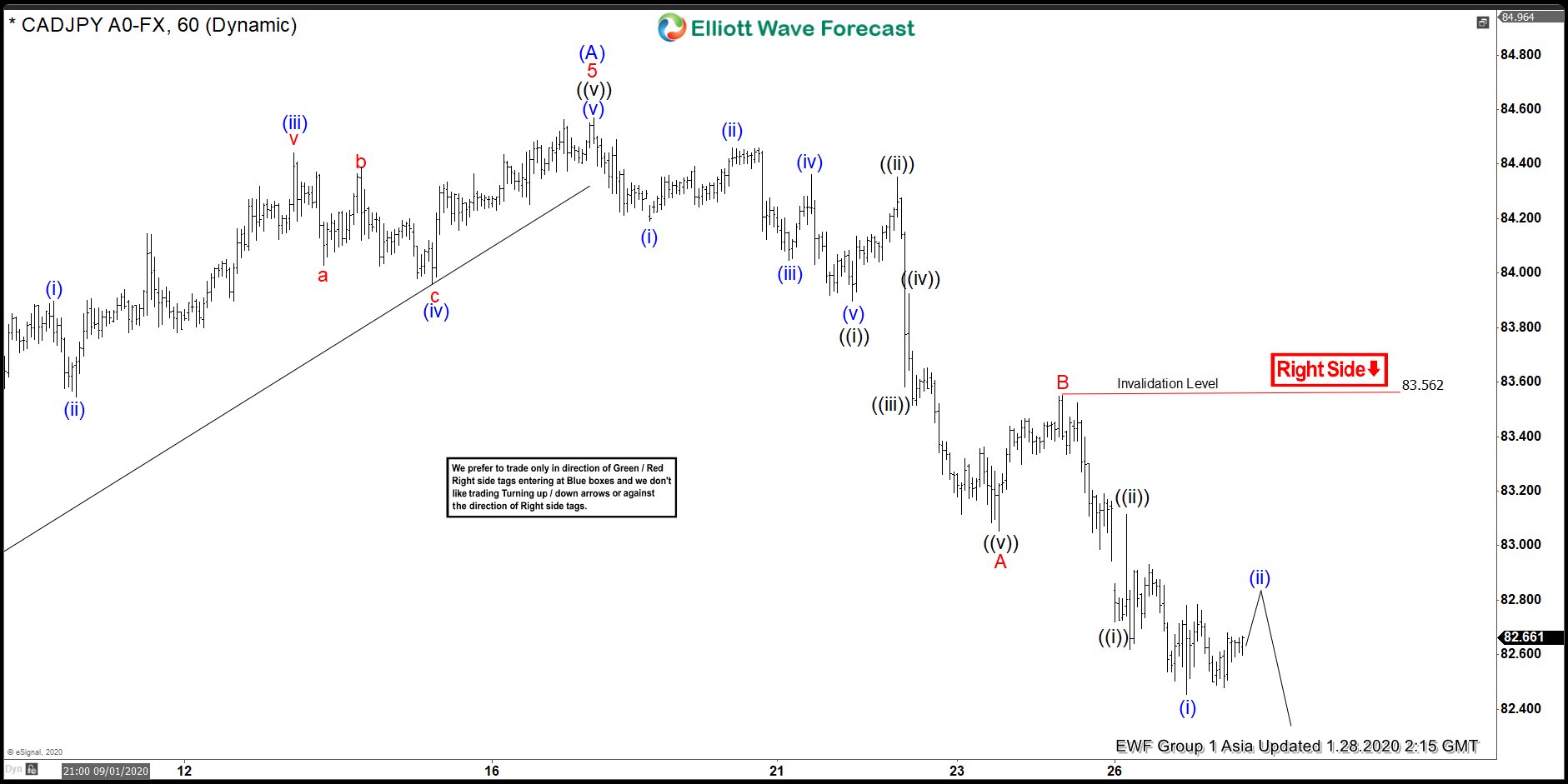

CADJPY Elliott Wave View: Pullback Another Opportunity To Buy?

Read MoreCADJPY is correcting the cycle from August 25, 2019 lows as a zigzag structure. This article & video show the Elliott Wave path.

-

NZDJPY Forecasting The Bounce From Blue Box Area

Read MoreIn this blog, we are going to take a quick look at the Elliottwave chart of NZDJPY. The chart from 1.22.2020 New York update showed that NZDJPY ended wave 4 at 71.234 low. The pair then extended higher in wave ((i)) of 5. Wave ((i)) ended at 73.343 high. From there the pair is proposed […]

-

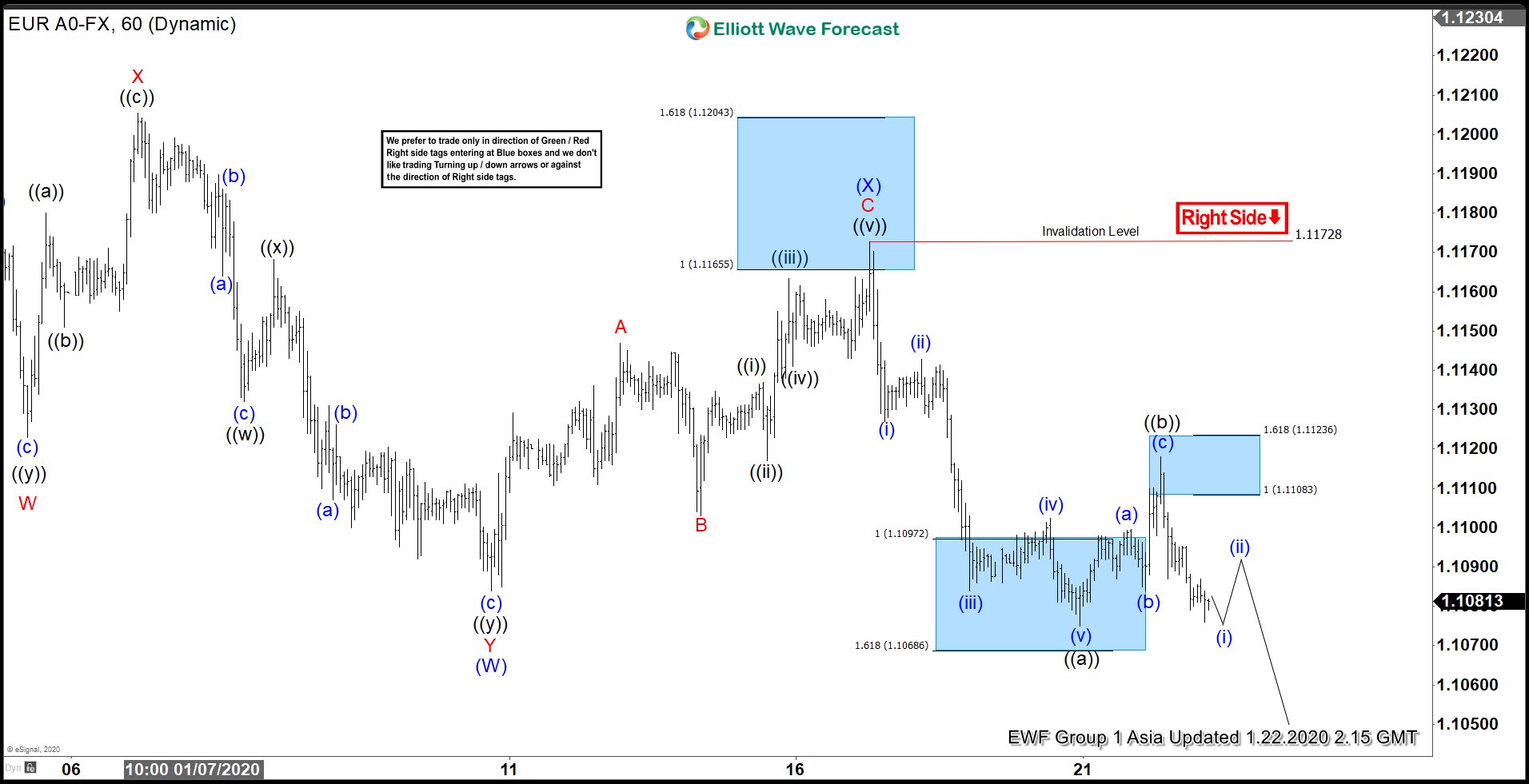

Elliott Wave View: EURUSD Can See Further Weakness

Read MoreEURUSD decline from Jan 6 high remains in progress as a double three Elliott Wave structure and pair can see further downside while below Jan 16 high.

-

Elliott Wave View: NZDUSD Zigzag Correction in Play

Read MoreNZDUSD correction remains in progress as a zigzag as far as rally fails below Jan 16 high. This article and video looks at the short term Elliott Wave path.

-

Swiss Franc Strengthens After Being Added Back to US Watch List

Read MoreSwiss Franc strengthens on Tuesday, January 14 2020, after the US Treasury Department added Switzerland to its watch list for countries labelled as “currency manipulator” alongside other countries such as Germany, Ireland, Italy, Japan, Malaysia, Singapore, South Korea and Vietnam. This is not the first time Switzerland has been added to the watch list. In […]