In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

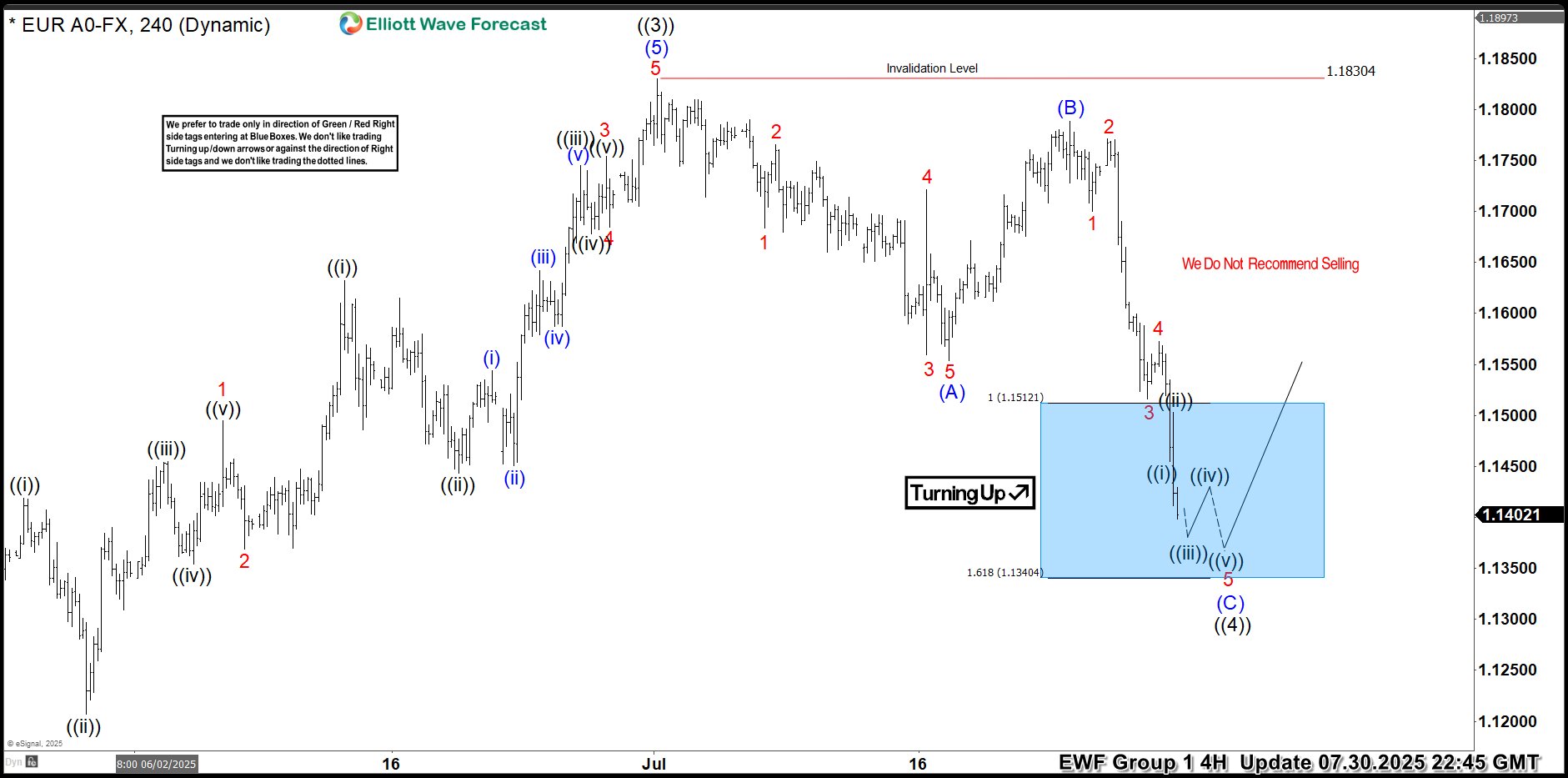

EURUSD Trading Setup Explained : Buying the Dips in the Blue Box

Read MoreAs our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in EURUSD. The pair has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this article, we’ll break […]

-

Elliott Wave Outlook: GBPJPY Set to Rally to Target 201.2

Read MoreGBPJPY has resumed higher in wave 5 from April 2025 low. This article and video look at the Elliott Wave path of the pair.

-

EURUSD Bullish Turn: Analyzing the Blue Box Area Reaction

Read MoreIn this technical blog, we have looked at the past 4-hour charts of EURUSD & analyzed bullish reaction higher from the blue box area.

-

USDCHF July Rally Stalls at Blue Box, Sellers Gain Advantage

Read MoreUSDCHF is selling from the blue box following a familiar market structure. Sellers at Elliottwave-forecast sold from the blue box and secured some profits already while looking out for more. This blog post looks at the structure that informed our decision to go short. Since January 2025, the USDCHF forex pair, like the U.S. dollar […]

-

EURUSD Elliott Wave Update Aiming for 1.191 in Wave 5 Extension

Read MoreEURUSD ended a 3 swing correction and is now turning higher to target 1.191. This article and video look at the Elliott Wave path.

-

Dollar Index (DXY) Elliott Wave : Selling Rallies at the Blue Box

Read MoreHello traders. In this article, we are going to present another Elliott Wave trading setup we got in Dollar Index . As our members know DXY index remains bearish against the 101.936 pivot. Recently Dollar made a clear 3 waves recovery completed precisely at the Equal Legs zone, referred to as the Blue Box Area. […]