In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

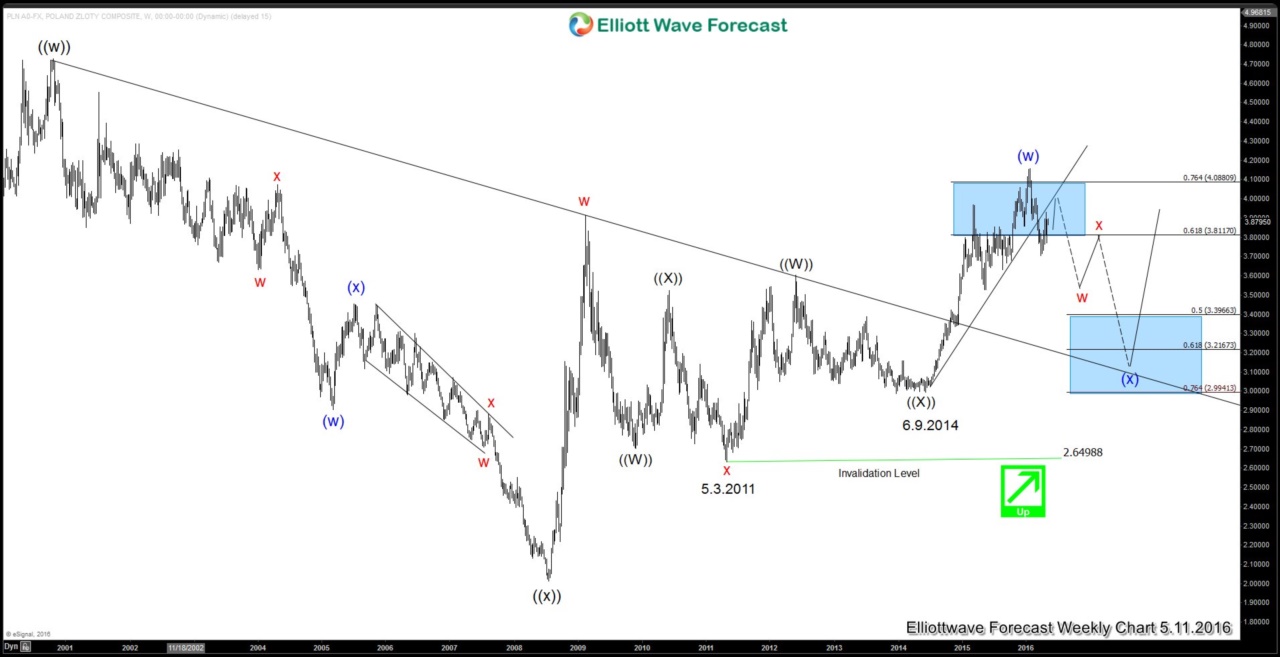

$USDPLN Short and Medium Term Outlook

Read MoreIn this article, we are going to analyze the fundamental and technical background of $USD/PLN (U.S. Dollar against Polish Zloty) to determine the short term and medium term path of the pair. From the U.S side, U.S. economy has slowed down in 2016. Most of the recent economic data coming out from U.S. has missed out […]

-

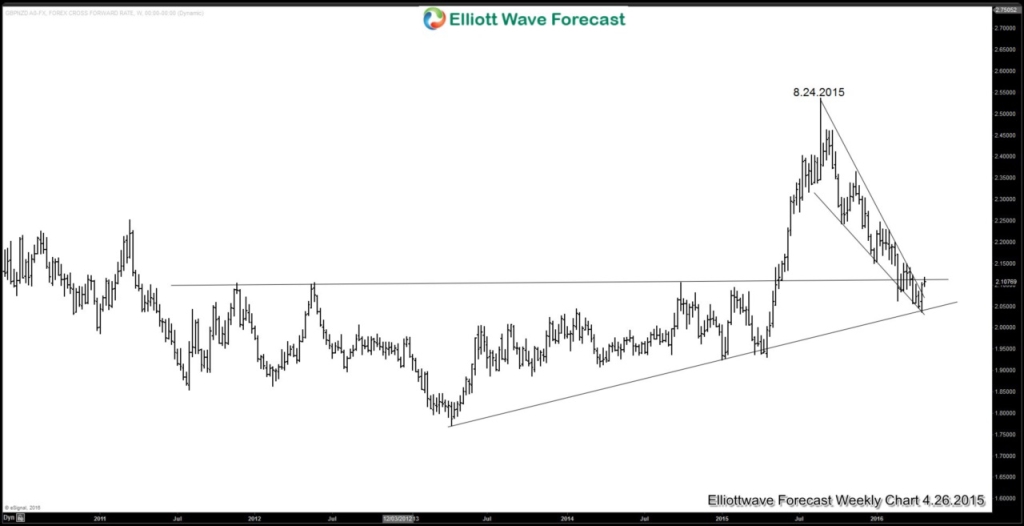

New Zealand Dollar Outlook in Q2 2016

Read MoreIn the last Monetary Policy Statement (MPS) in March, Reserve Bank of New Zealand (RBNZ) is not happy with the currency’s continued appreciation. They cited the New Zealand Dollar trade-weighted exchange rate is more than 4% higher than projected in December. In subsequent meeting in April 28, RBNZ decided to stay put with the OCR (Official Cash Rate) but RBNZ Governor Graeme […]

-

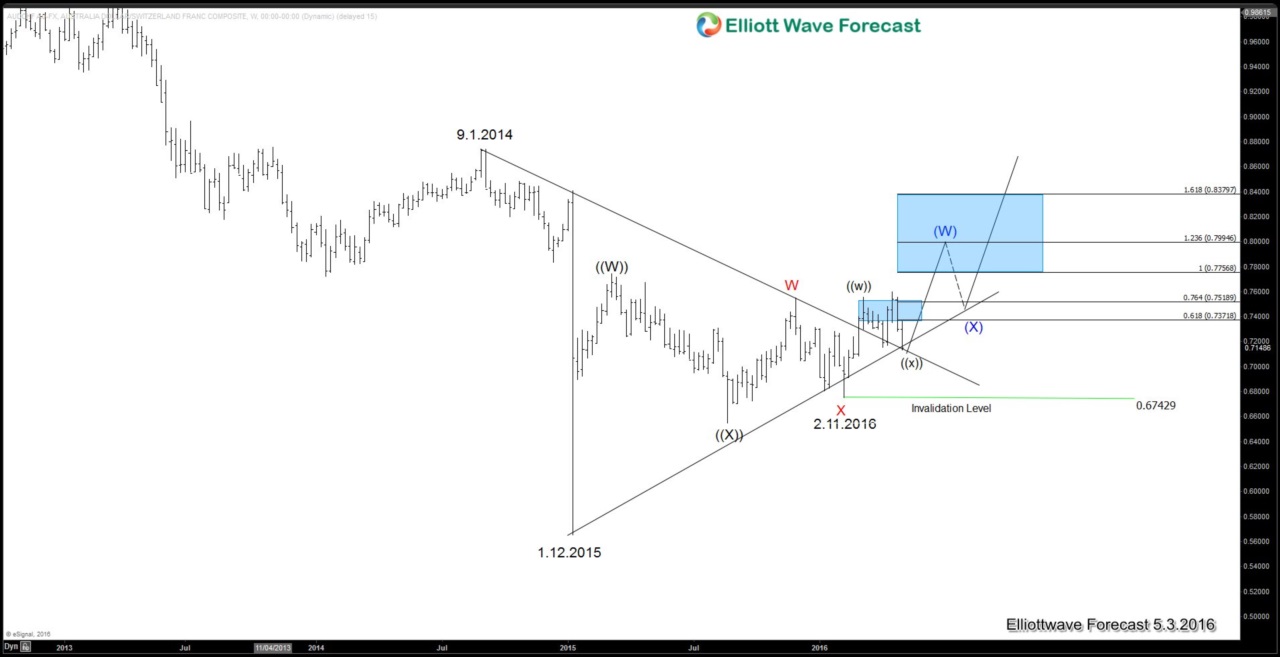

Australian Dollar Outlook after RBA cut

Read MoreReserve Bank of Australia (RBA) made a surprise cut of 25 bps earlier today, taking the interest rate to a record low of 1.75%. Before the meeting, analysts have put the probability of a rate cut as much as 50-50 after the dismal figure of CPI last Tuesday April 26. The CPI report last week showed that […]

-

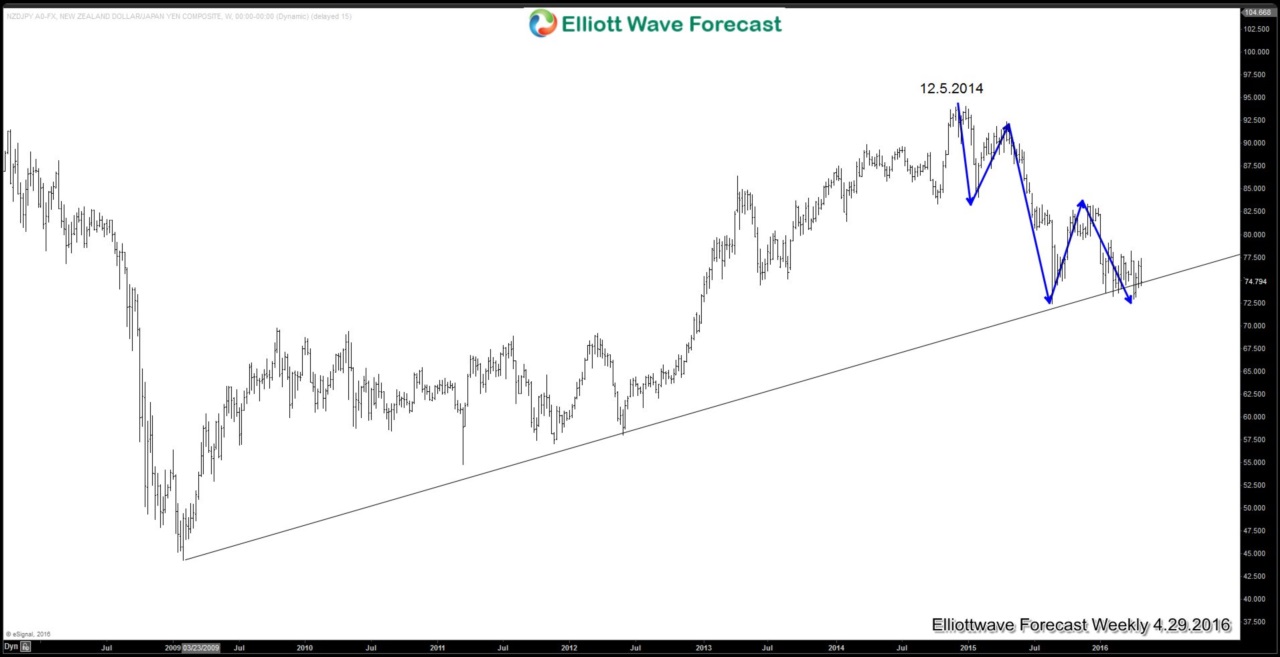

BOJ’s inaction may mean stronger Yen

Read MoreBank of Japan (BOJ) did not take any further easing action on Thursday (April 28) monetary policy meeting, sending Yen soaring more than 3% against the U.S. dollar and Nikkei tumbling 3.6%. Coming into the meeting, expectation by market participants was very high that BOJ would take further actions considering that Yen has strengthened for much of 2016, hitting the strongest […]

-

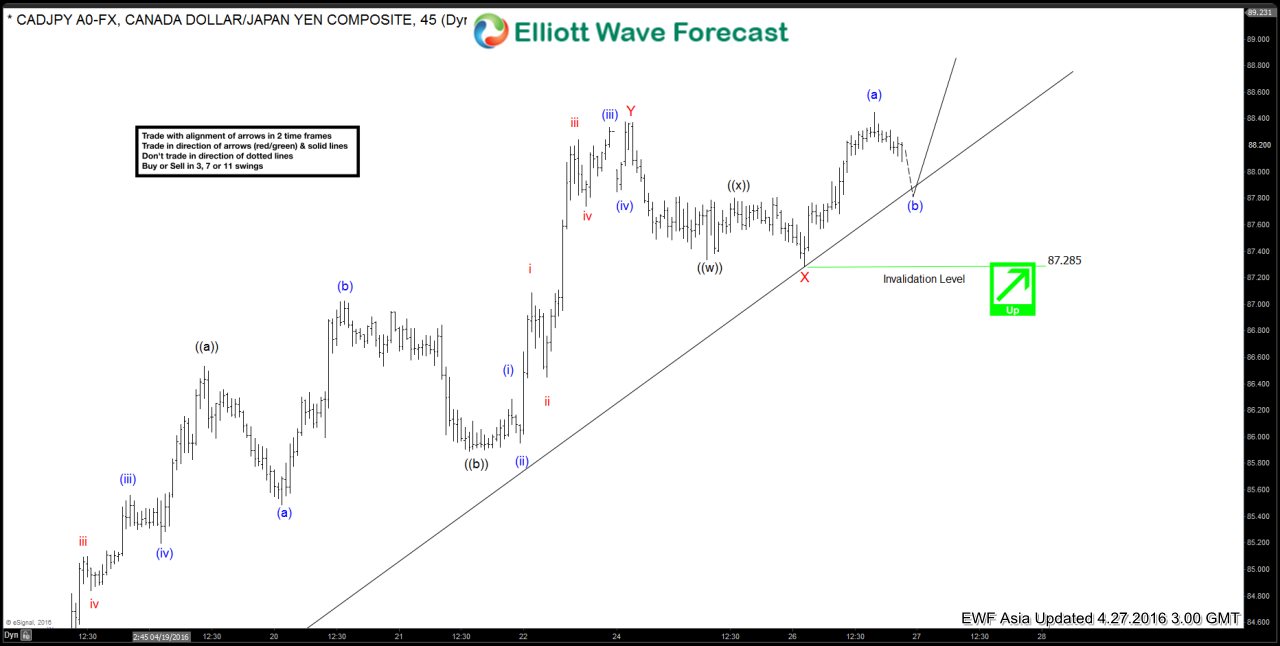

CADJPY Short-term Elliott Wave Analysis 4.27.2016

Read MoreShort term Elliottwave structure suggests that cycle from 4/7 low (81.7) remains alive as a triple three where wave W ended at 85.7 on 4/13, wave X ended at 83.07 on 4/18, wave Y ended at 88.37 on 4/25, and 2nd wave X pullback is proposed complete at 87.28 on 4/26. Near term, while dips stay above 87.28, pair is favored […]

-

CADJPY Short-term Elliott Wave Analysis 4.26.2016

Read MoreShort term Elliottwave structure suggests that cycle from 4/7 low remains in progress as a triple three where wave W ended at 85.7 (4/13 high), wave X ended at 83.07 (4/18 low), and wave Y is proposed complete at 88.37 (4/23 high). Second wave X pullback is in progress to correct the rally from wave X low […]