In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

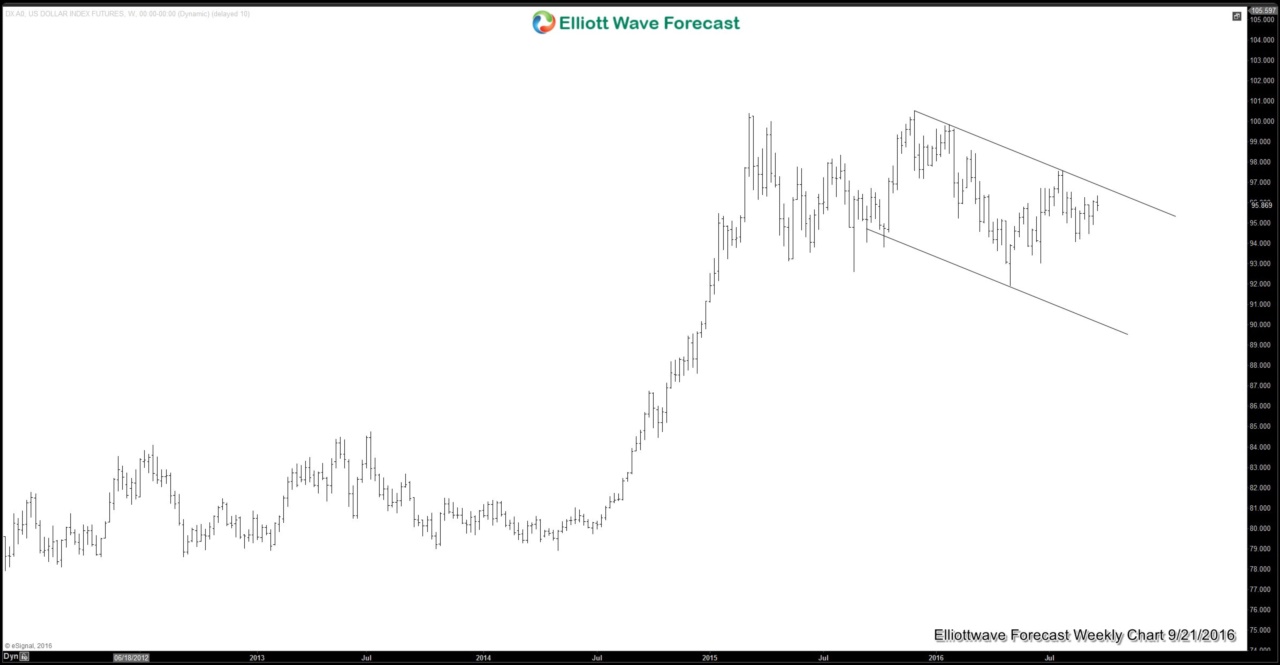

US Dollar outlook post FOMC

Read MoreThe Federal Reserve once again pushed back plans to raise interest rates at the September meeting, a widely expected after a series of mixed economic reports and various signals Fed officials measure. After its policy meeting two-day Federal Open market Committee voted to keep the federal funds rate from 0.25% to 0.50%, citing progress in […]

-

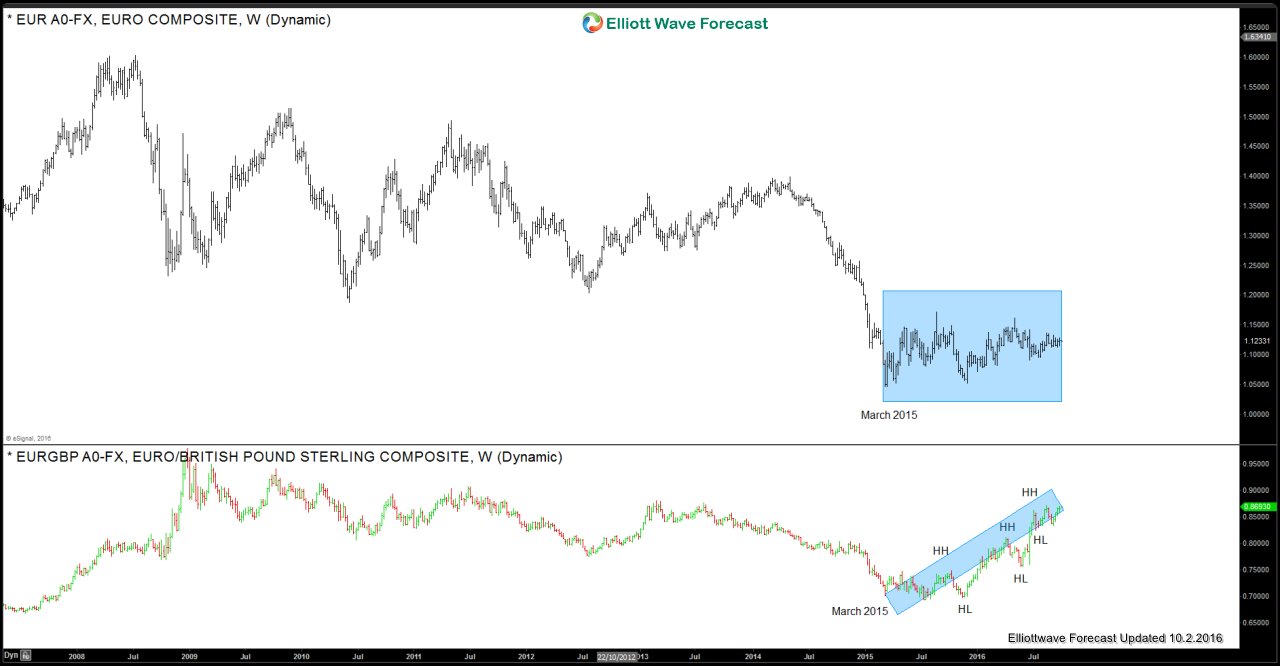

How to use cross pairs to get an edge in Trading

Read MoreMany traders are of the mind set that they should follow only one or a very few instruments and therefore, you would come across many traders who trade just EURUSD, GBPUSD, ES_F or Gold (XAUUSD) for example. We at www.elliottwave-forecast.com believe that market works as a whole and as a forecaster we need to analyse […]

-

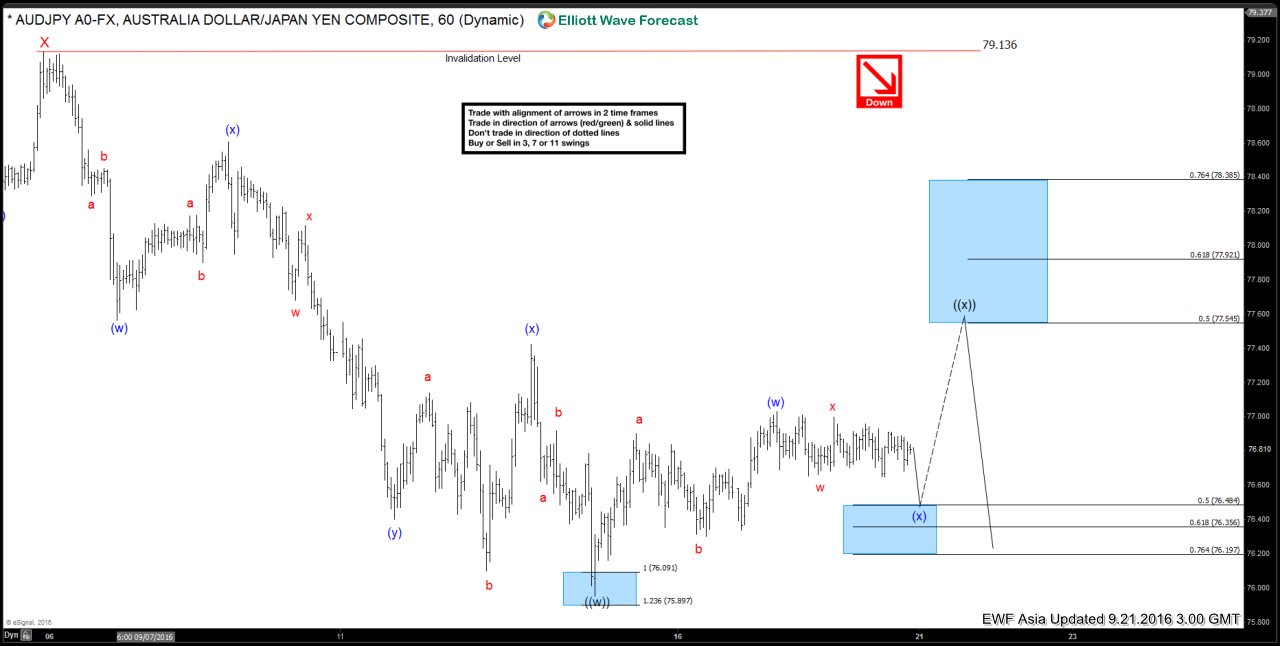

$AUDJPY Short-term Elliott Wave Analysis 9.23.2016

Read MoreShort term Elliott wave count suggests that rally to 79.13 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 75.95 and wave ((x)) bounce is in progress as a double three towards 77.77 – 78.15 area before the decline resumes. As far as pivot at 79.16 stays intact in the […]

-

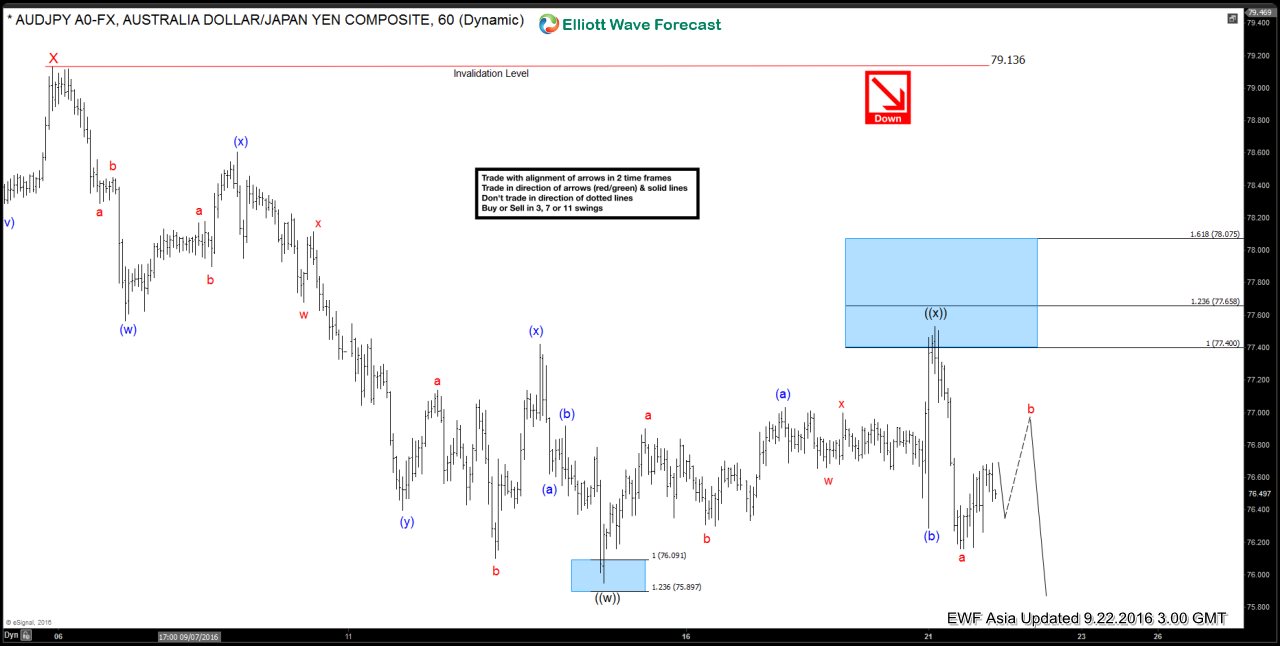

$AUDJPY Short-term Elliott Wave Analysis 9.22.2016

Read MoreShort term Elliott wave count suggests that rally to 79.13 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 75.95 and wave ((x)) bounce is proposed complete at 77.53. While bounces stay below there, and more importantly below 79.13, expect the pair to extend lower towards 73.6 – 74.35 area. […]

-

USD strength is likely limited into FOMC meeting

Read MoreThe latest US Consumer prices number last Friday rose by 1.1 percent year-on-year in August 2016, which is above the market consensus of a 1% rise. This number is the biggest inflation figure in 4 months. Annual core inflation, excluding food and energy, rose to 2.3%, also above market expectation of 2.2%. Although both numbers beat expectation, […]

-

$AUDJPY Short-term Elliott Wave Analysis 9.21.2016

Read MoreShort term Elliott wave count suggests that rally to 79.12 ended wave X. Decline from there is unfolding as a double three where wave ((w)) ended at 75.95 and wave ((x)) bounce is currently in progress to correct the cycle from 9/6 (79.13) peak towards 77.6 – 78 area before the decline resumes. As far as pivot at 79.13 […]