In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

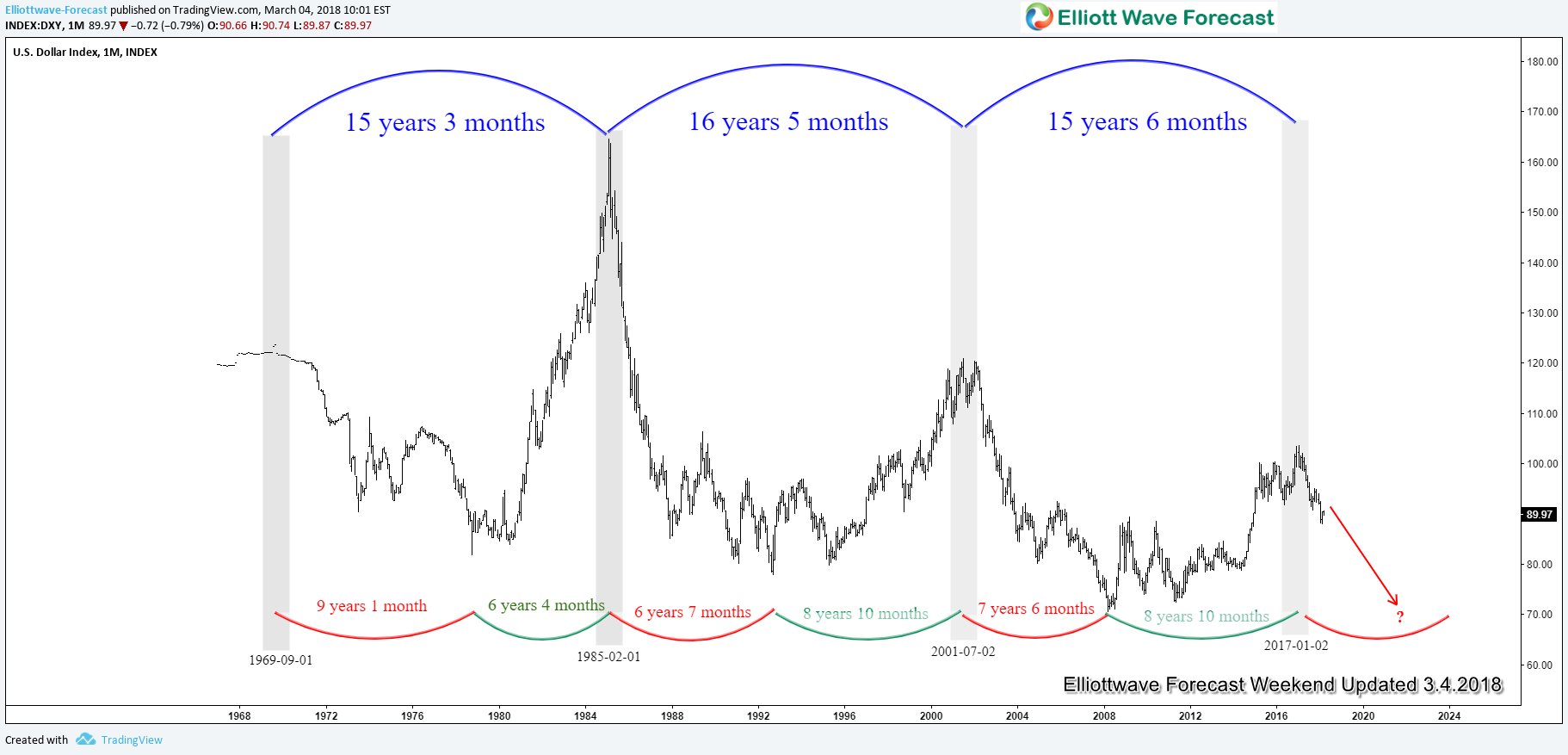

US Dollar at the Start of Multi-Year Downtrend

Read MoreSince the US Dollar trades freely in the 1970s, on average it has rallied and declined in a period of 7.5 years. The chart below shows short term and long term US Dollar cycle: Short Term and Long Term US Dollar Cycle From the chart above, we can see that since 1970s, the cycle in […]

-

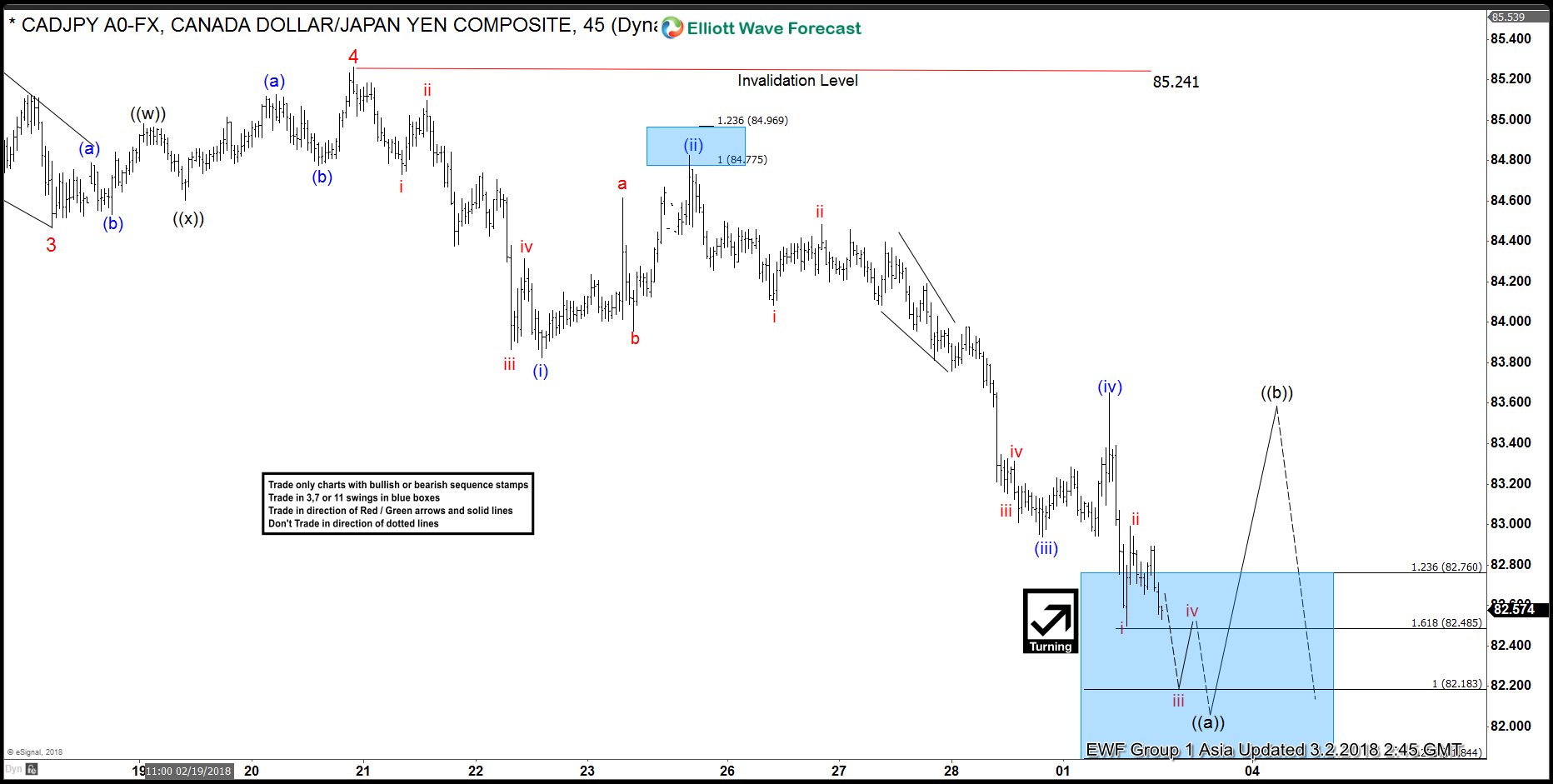

CADJPY Elliott Wave Analysis: Correction Expected Before Lower Again

Read MoreShort Term CADJPY Elliott Wave view suggests that the decline from 1/5/2018 high (91.58) is unfolding as an impulse Elliott Wave Structure where Minor wave 1 ended at 87.785, Minor wave 2 ended at 89.439, Minor wave 3 ended at 84.468, and Minor wave 4 ended at 85.24. Minor wave 5 remains in progress as […]

-

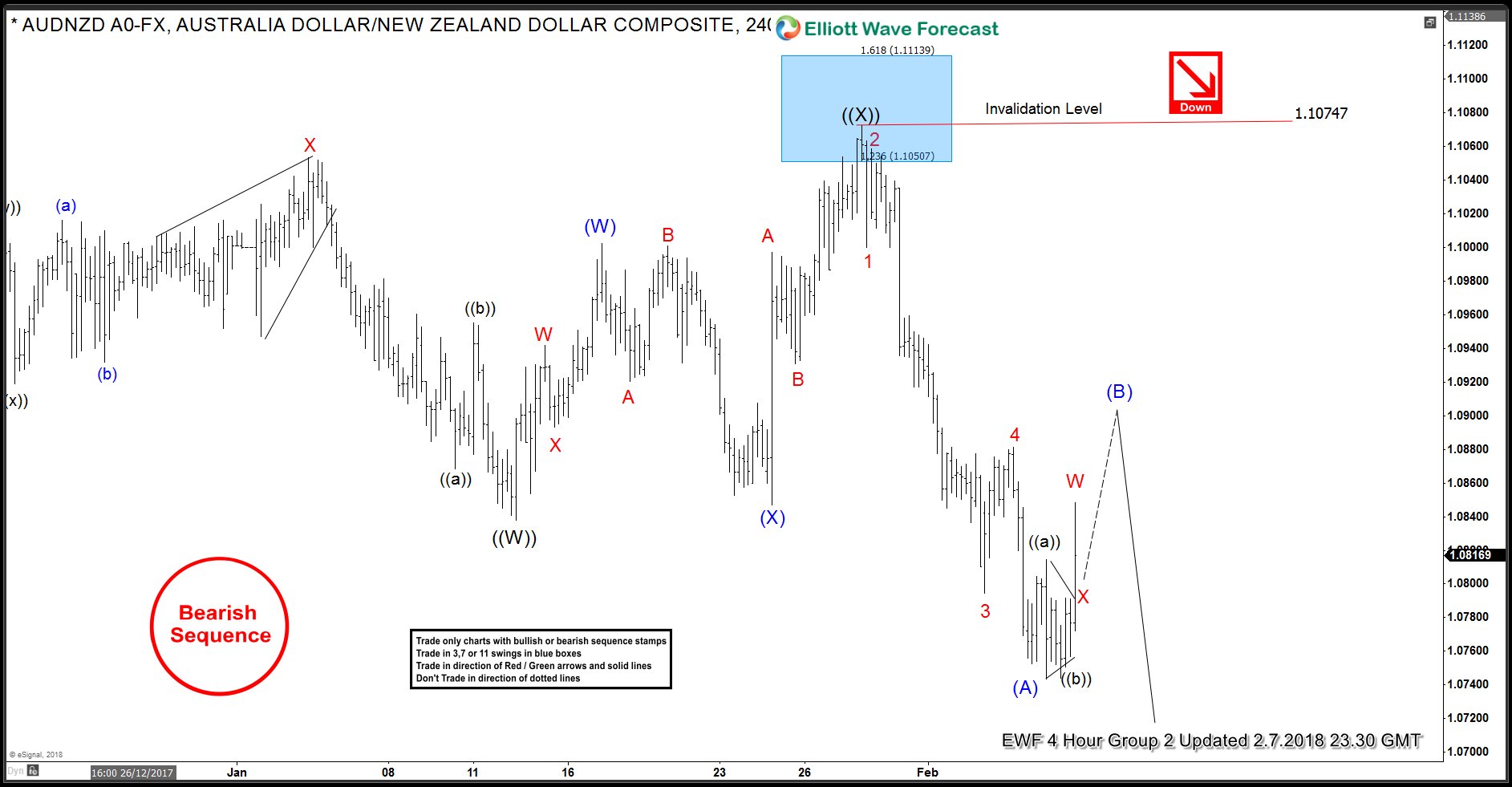

AUDNZD Selling the Elliott Wave bounces

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott wave chart performance of AUDNZD. Which we presented to our clients. We are going to explain the structure and the forecast. As our members know, we were pointing out that AUDNZD is having lower low bearish sequence from October 24.2017 peak. We advised […]

-

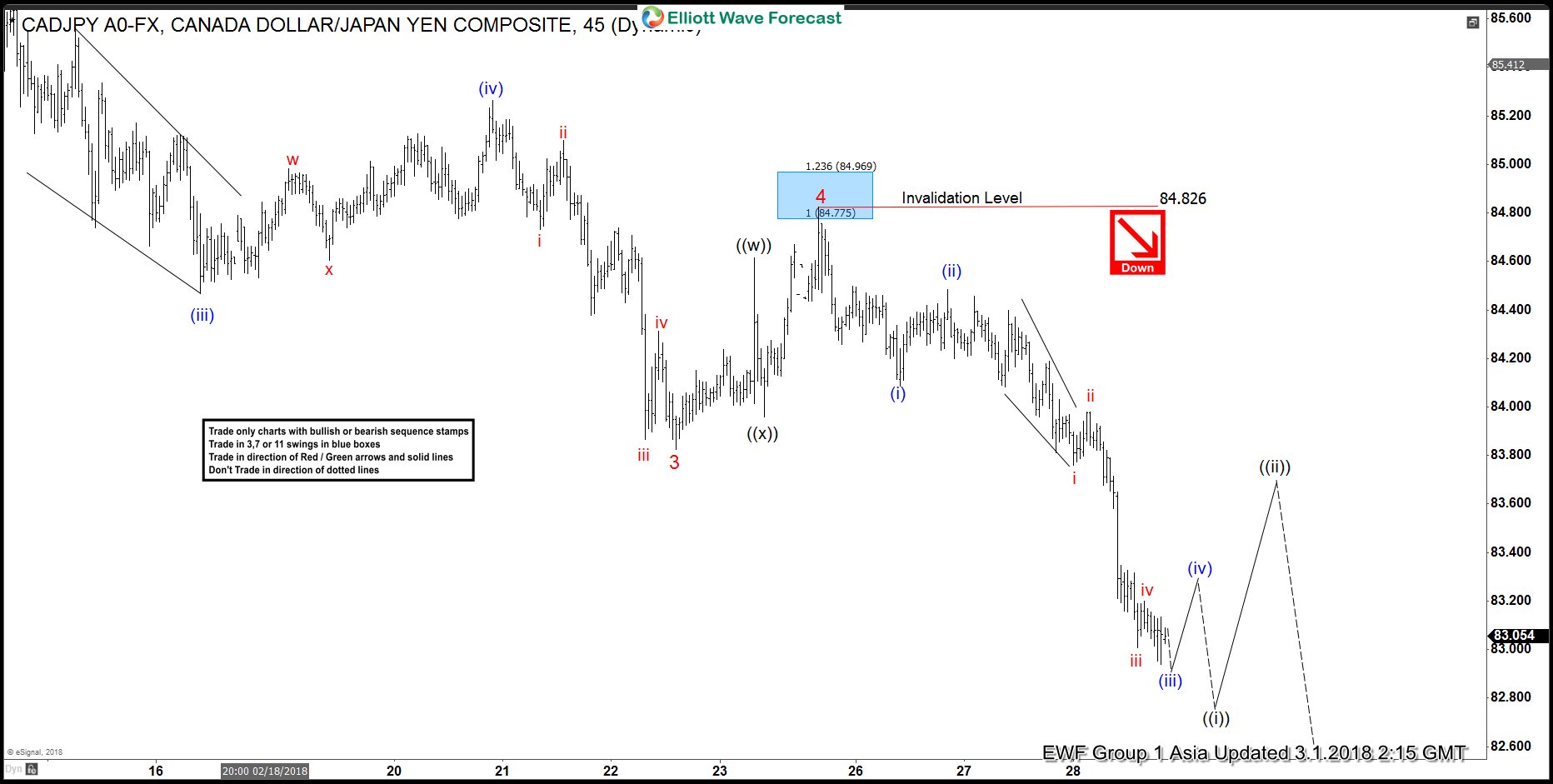

Elliott Wave Analysis: CADJPY within wave 5

Read MoreShort Term CADJPY Elliott Wave view suggests that the decline from 1/5/2018 high (91.58) is unfolding as an impulse Elliott Wave Structure where Minor wave 1 ended at 88.48, Minor wave 2 ended at 89.63, Minor wave 3 ended at 83.824, and Minor wave 4 ended at 84.82. Minor wave 5 is currently in progress […]

-

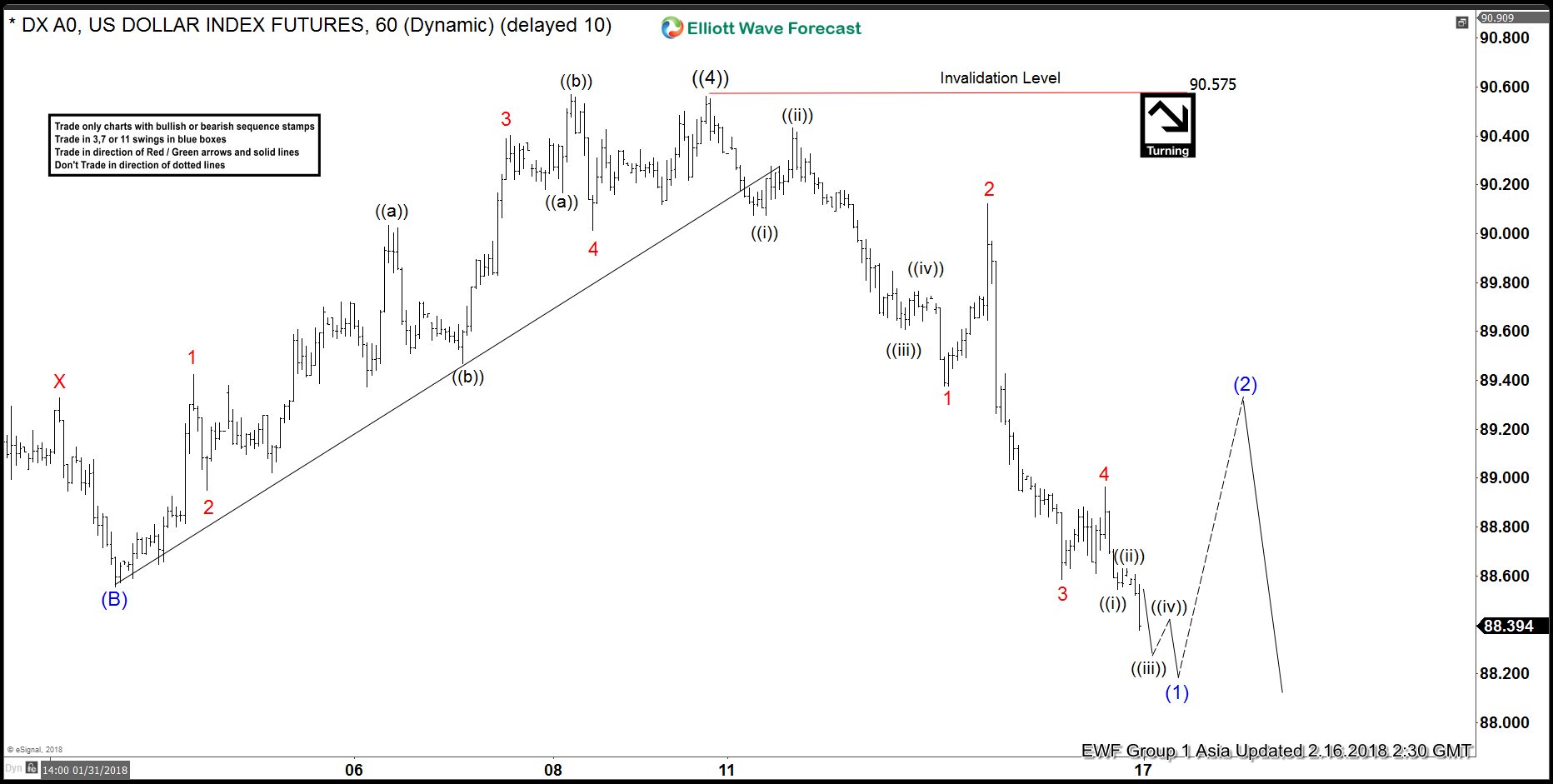

Elliott Wave View: DXY ending 5 waves decline

Read More$DXY US dollar Index Short-term Elliott Wave view suggests that the rally to February 09.2018 peak at 90.57 ended Primary wave ((4)) in a Flat correction. Down from 90.57 high the decline is unfolding as Elliott Wave Impulse Sequence, where each leg has an internal distribution of 5-3-5 structure thus favored being an Impulse sequence. The DXY has […]

-

Elliott wave Analysis: USDJPY calling for more downside

Read MoreUSDJPY Short-term Elliott Wave view suggests that the rally to 110.48 high ended Intermediate wave (4) bounce on February 02.2018 peak. Below from there, the decline is unfolding as an Ending Diagonal Structure within Intermediate wave (5) lower. Where Minor wave 1 ended at 108.44 low as Zigzag structure, Minor wave 2 bounce ended at 109.77 in a Double three […]