In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

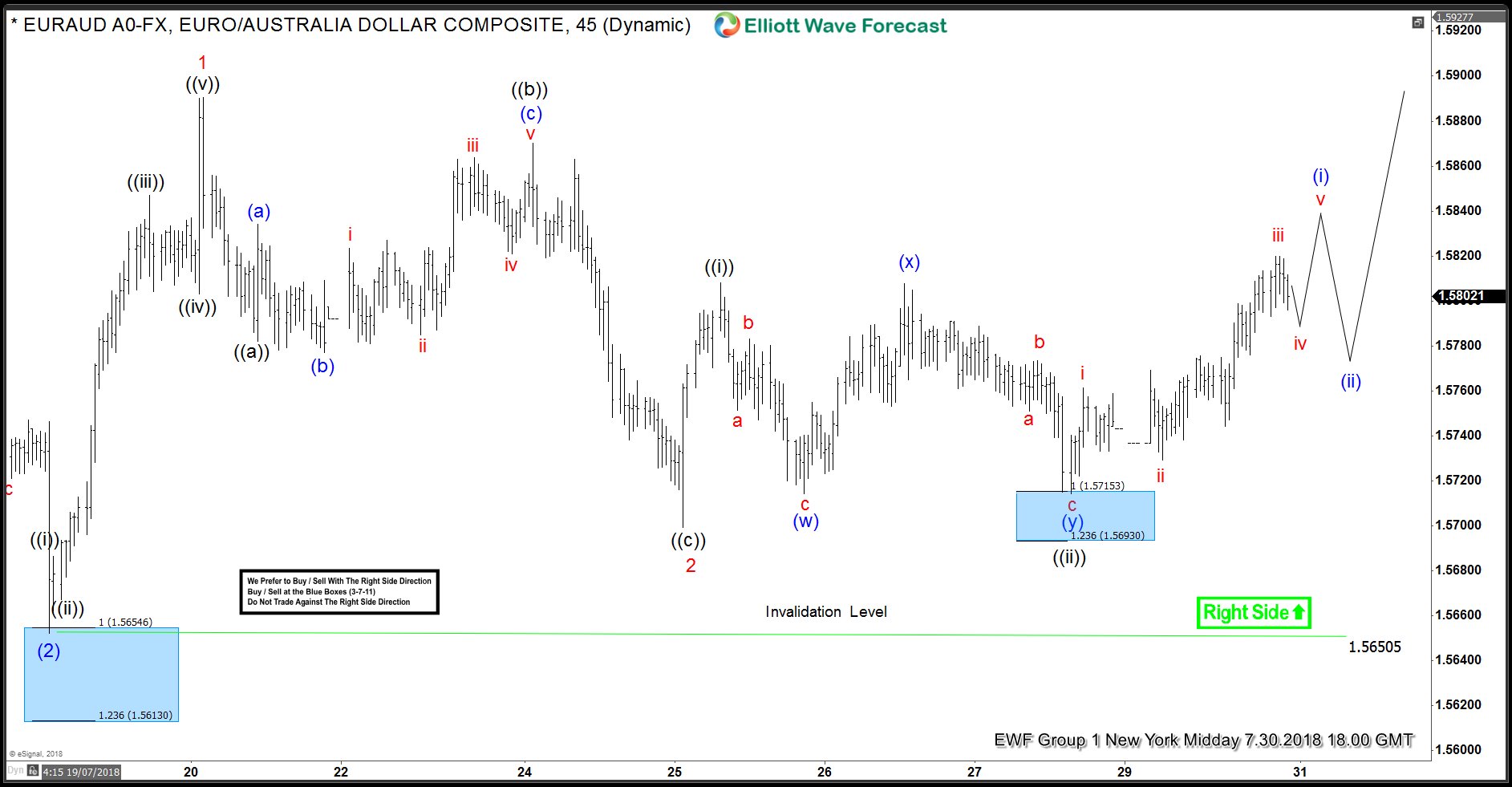

EURAUD Elliott Wave Analysis: Calling The Bounce From Inflection Area

Read MoreHello Traders, In this blog, I want to share with you our recent Elliott Wave charts of EURAUD which we presented to our members. Below, you see the 1-hour updated chart presented to our clients on the 07/26/18 suggesting that EURAUD ended the correction from 07/20 peak in red wave 2. EURAUD ended the cycle from 07/19 low […]

-

Bitcoin Elliott Wave Analysis: Close to Ending 5 Waves

Read MoreBitcoin Ticker symbol: $BTCUSD short-term Elliott wave analysis suggests that the decline to $6072 low ended Minor wave 2 pullback. The internals of that pullback unfolded as Elliott wave Flat correction where Minute wave ((a)) ended in 3 swing at $6445.31 low. Minute wave ((b)) bounce ended in 3 swing at $6820 high and Minute […]

-

Will Trump’s Remark Cap the US Dollar Strength?

Read MoreIn an interview with CNBC last Thursday, President Trump indicated that he is not thrilled about interest rate hikes. He went on to say that he did not agree with the Fed’s decision to keep raising the rate. Trump argued that the higher rate puts the U.S. at a disadvantage compared to the European Union […]

-

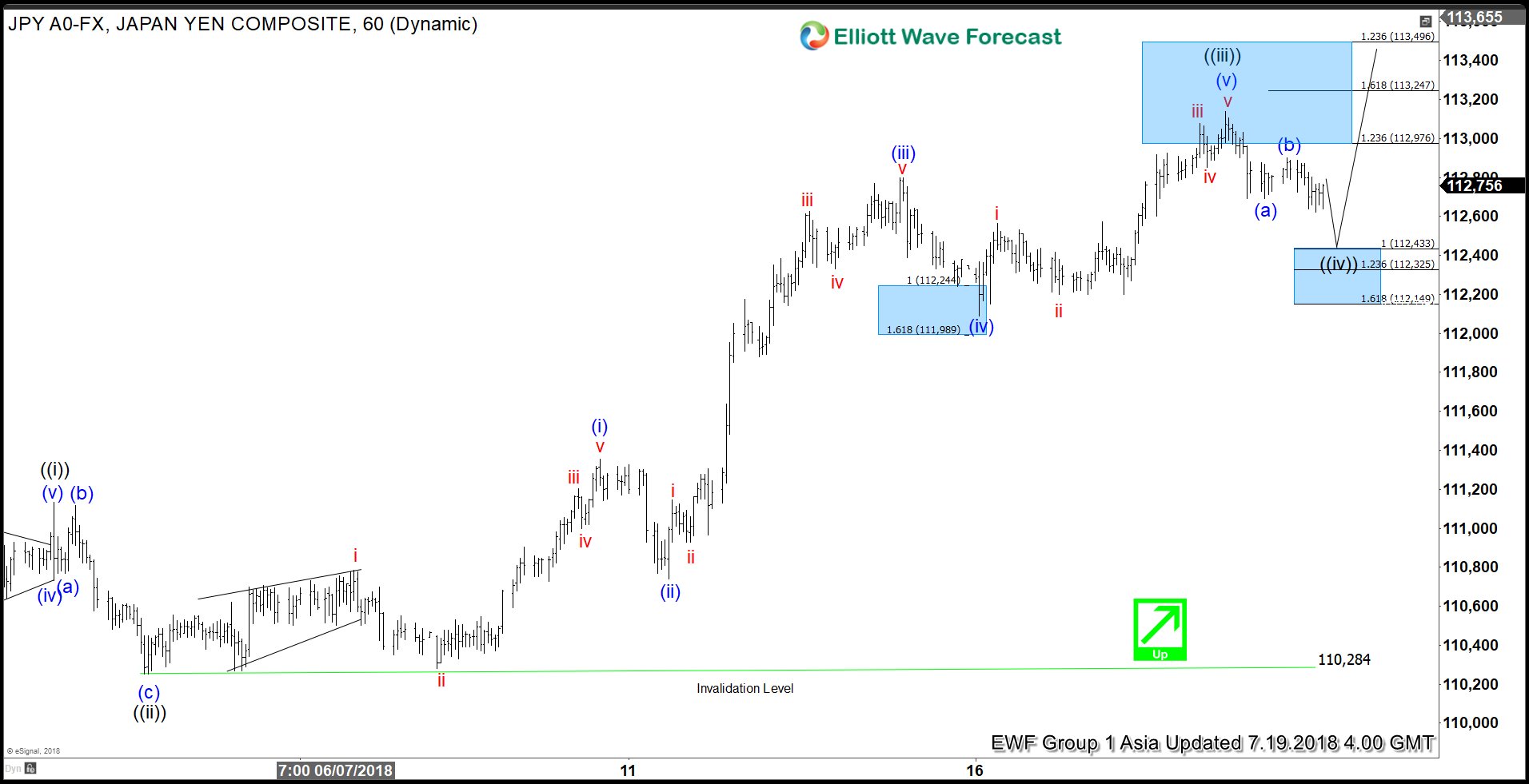

Elliott Wave Analysis: USDJPY Rallying Higher As Impulse

Read MoreUSDJPY short-term Elliott Wave analysis suggests that the pullback to 110.28 low ended Minute wave ((ii)) pullback. The internals of that pullback unfolded as Elliott wave Flat structure where Minutte wave (a) ended at 110.77. Up from there, bounce to 111.11 ended Minutte wave (b), and Minutte wave (c) of ((ii)) ended in 5 waves at 110.28 low. […]

-

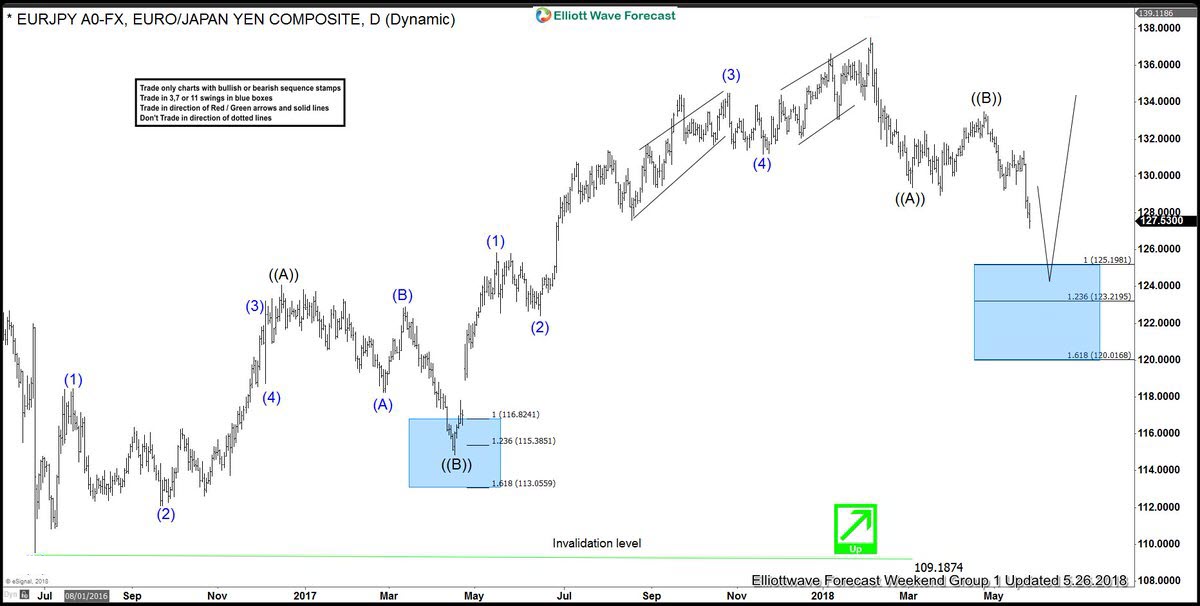

EURJPY Forecasting the Path & Buying the Dips

Read MoreHello Fellow Traders. Another instruments we have traded lately is EURJPY. As our members know, EURJPY has been correcting the cycle from the June 2016 low ( 109.187). We knew that price will find buyers as soon as it reaches extremes per Elliott Wave hedging strategy. We recommended members to wait for extremes to be […]

-

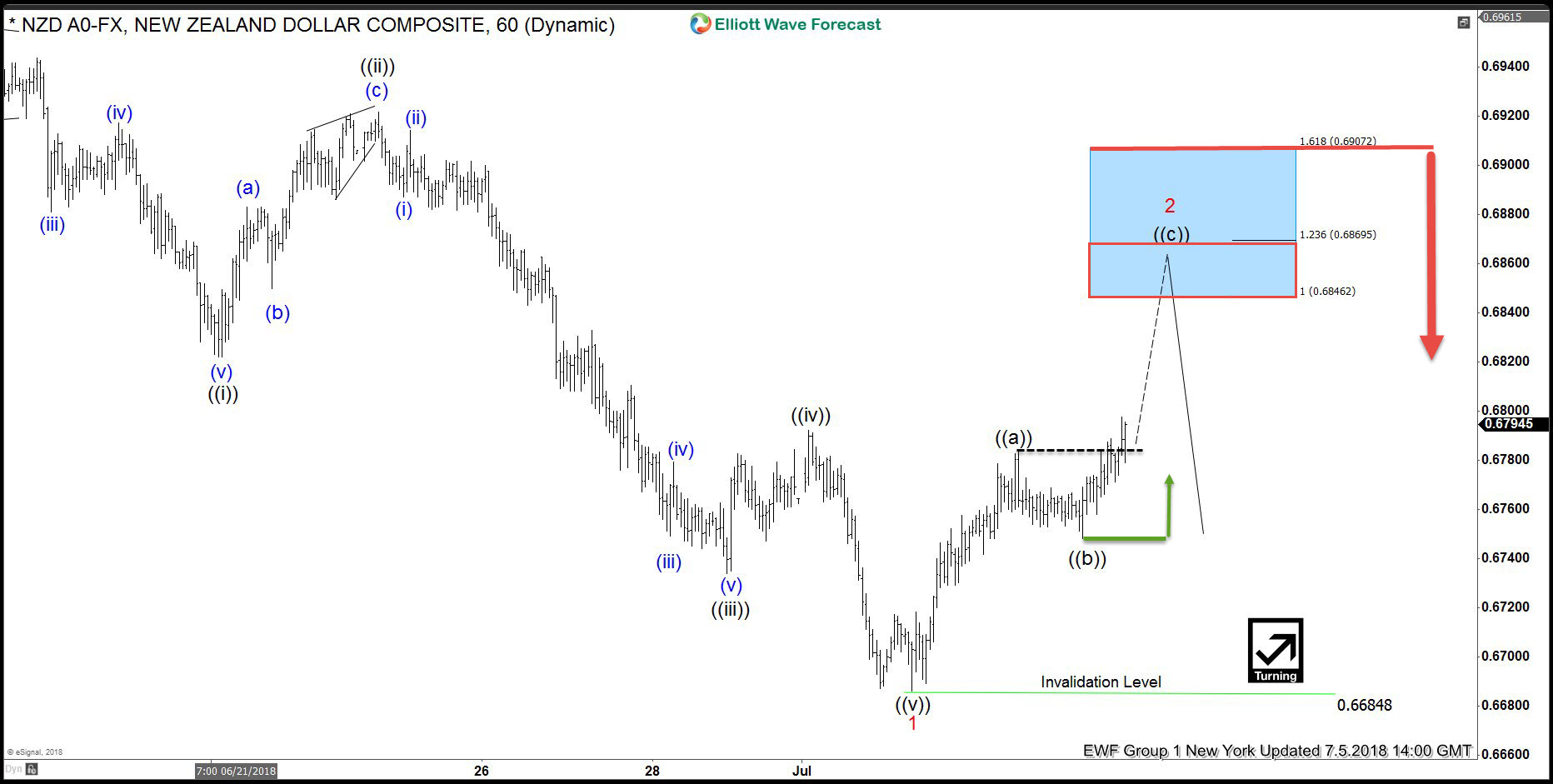

NZDUSD forecasting the path & selling the rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of NZDUSD . In further text we’re going to explain the Elliott Wave structure, forecast and trading strategy. As our members know, we were keep saying that NZDUSD has had incomplete bearish sequences in cycle from the July […]