In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

AUDUSD Bearish Sequence Support More Downside

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7316 high ended intermediate wave (X). Down from there, intermediate wave (Y) remain in progress as a zigzag structure. Where initial decline to 0.7049 low ended in 5 waves impulse structure & also completed the Minor wave A lower. Also, it’s important to note that […]

-

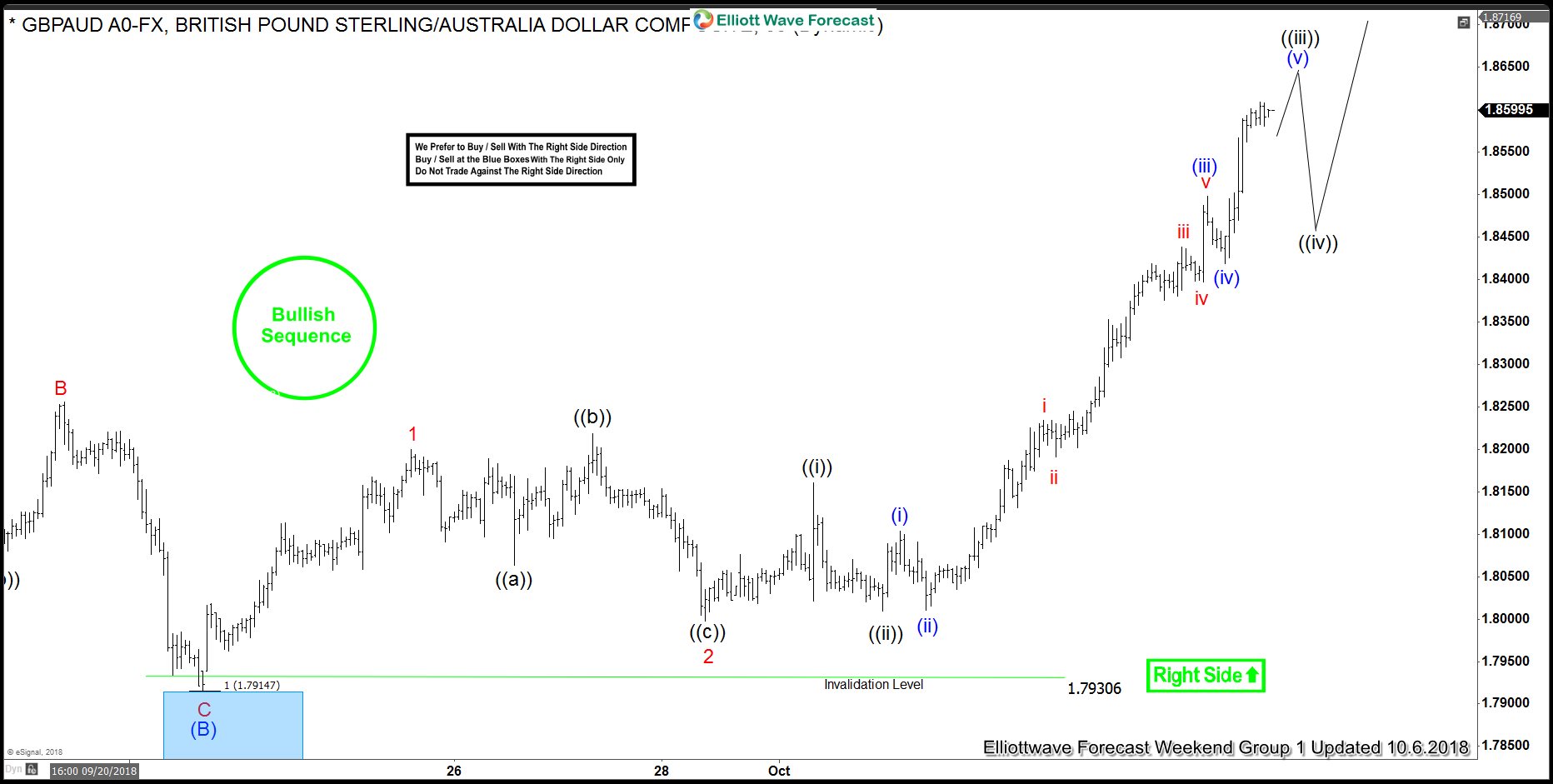

Prospect of Brexit Deal Supports Poundsterling

Read MoreThe UK is going to leave the EU on 29 March 2019. However, currently the EU and UK have not reached agreement on the Irish border issue. In the last few years, the potential for no Brexit deal has given pressure to Poundsterling. But last week, Poundsterling surged higher against other major currencies as EU’s […]

-

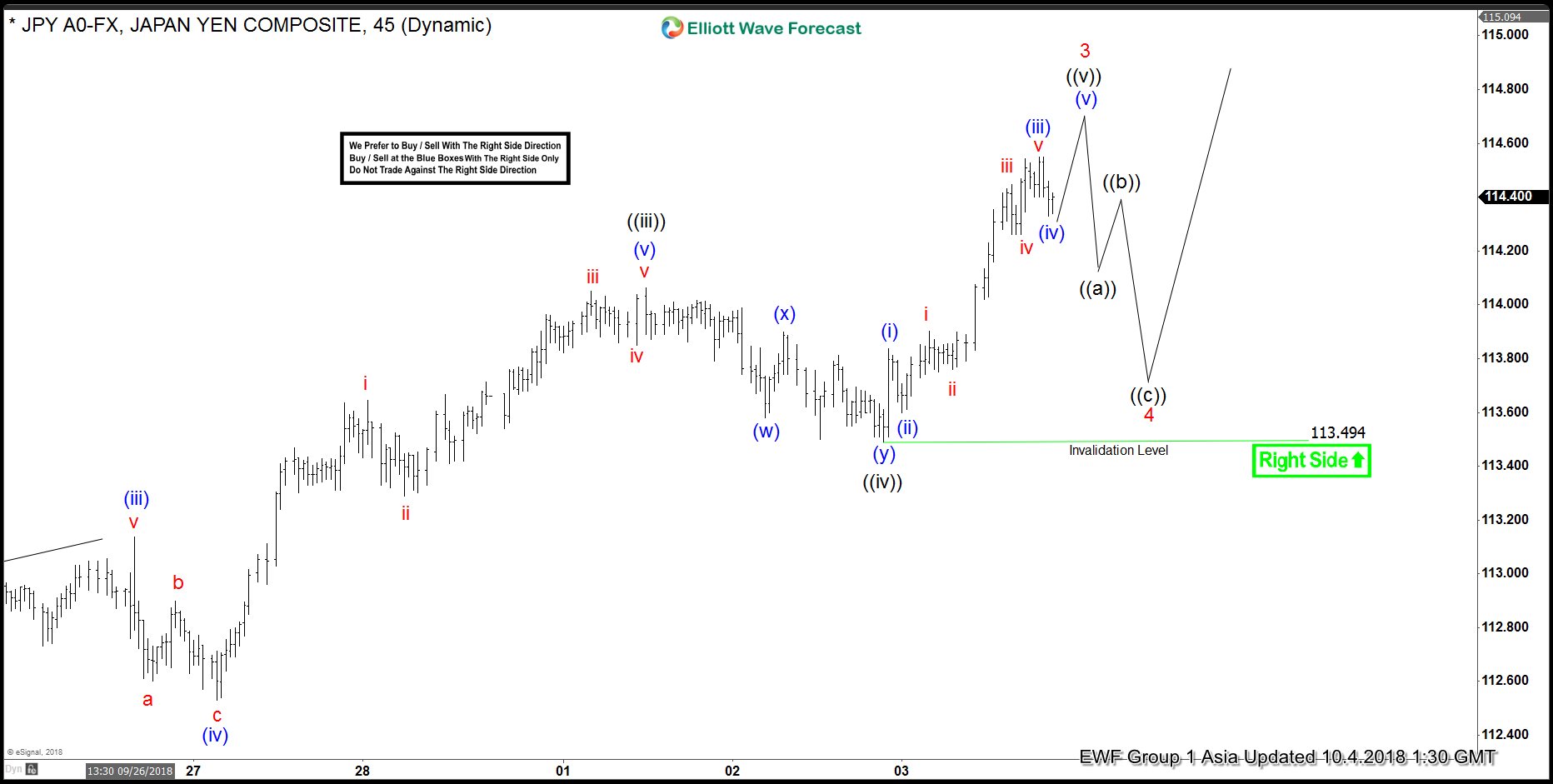

USDJPY Elliott Wave Suggest Extension Towards 118.24-120.30 Next

Read MoreUSDJPY short-term Elliott wave view suggests that the pair is nesting higher as impulse structure. Looking for an extension higher towards 118.24-120.30 100%-123.6% Fibonacci extension area from 3/23/2018 low. And until that area is reached dips are expected to remain supported in 3, 7 or 11 swings looking for upside extension. Currently, Minor wave 3 remain […]

-

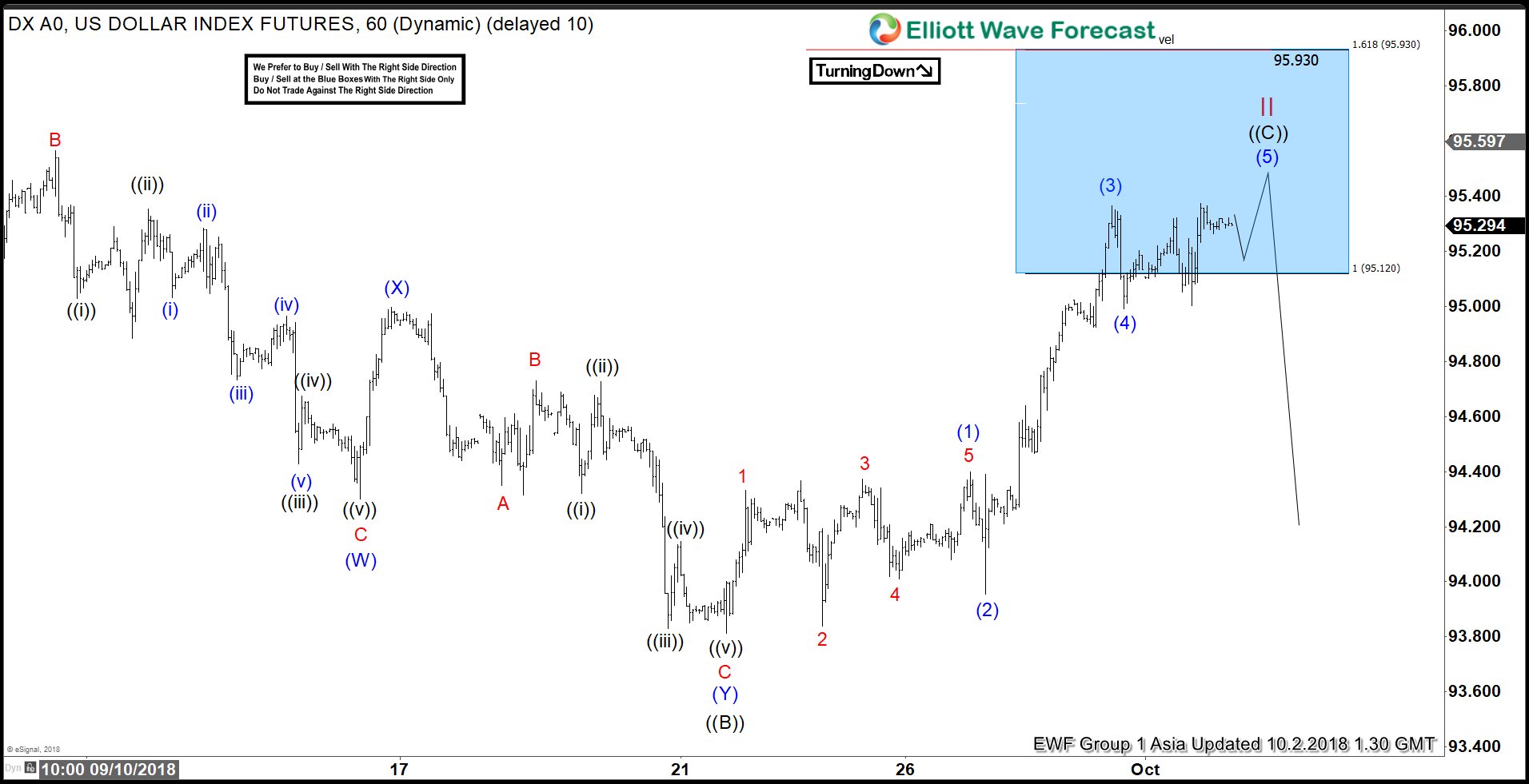

DXY Ending The Elliott Wave Flat Correction

Read MoreDXY short-term Elliott wave view suggests that the index is doing a Flat correction coming from 8/28/2018 low within cycle degree wave II. Meaning that the internal distribution of cycle from that low is showing the sub-division of 3-3-5 wave structure. Where primary wave ((A)) ended in 3 swings at 95.73 on 9/04 peak. Down […]

-

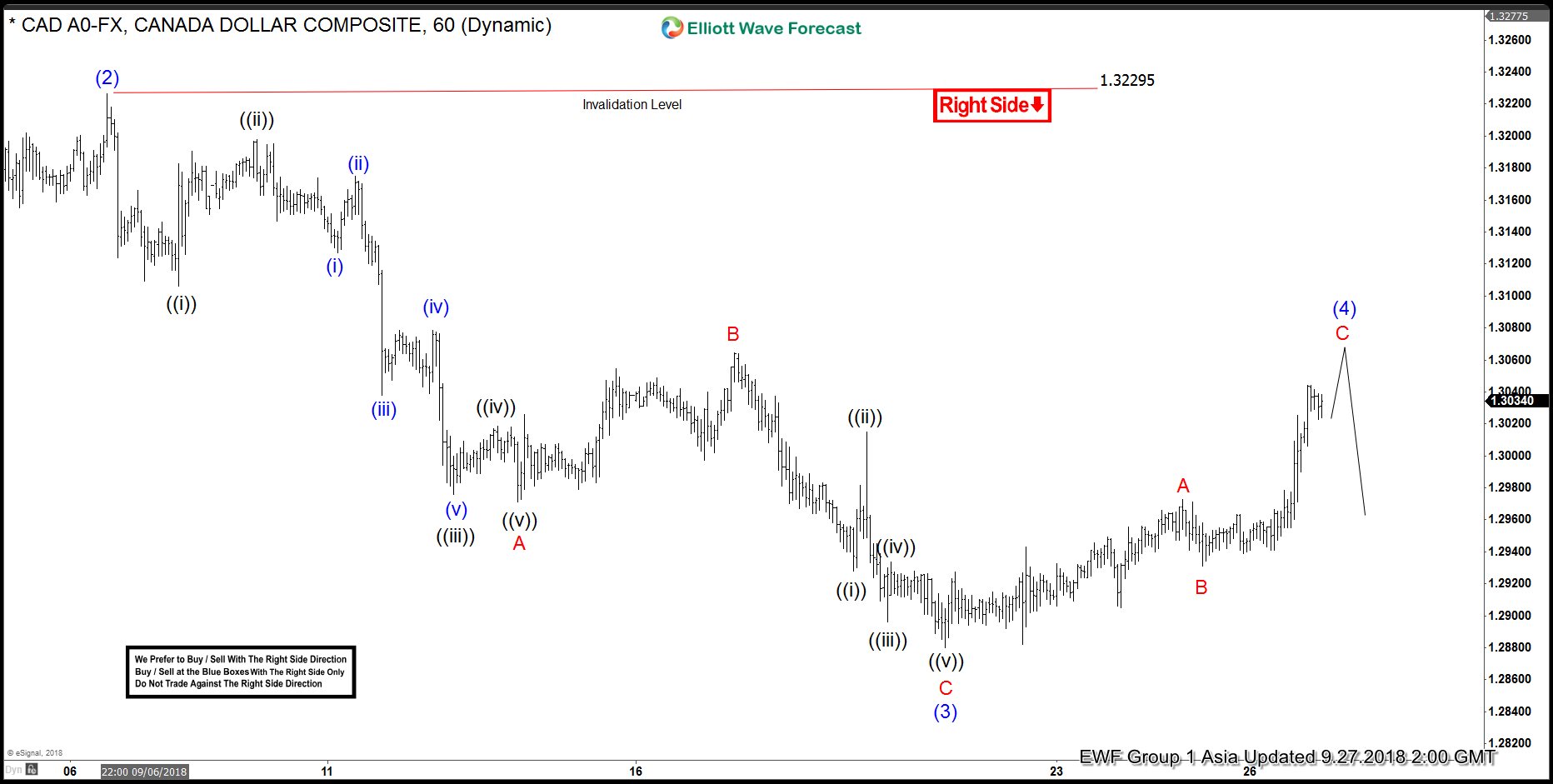

Canadian Dollar Rose after NAFTA agreement

Read MoreLast week, Canadian dollar rose to its strongest since May against US Dollar over speculation that Canada and U.S. will strike a deal on NAFTA. News then come late Sunday that Canada agreed to join the trade deal with the U.S. and Mexico. All three countries plan to sign on the pact which will save NAFTA […]

-

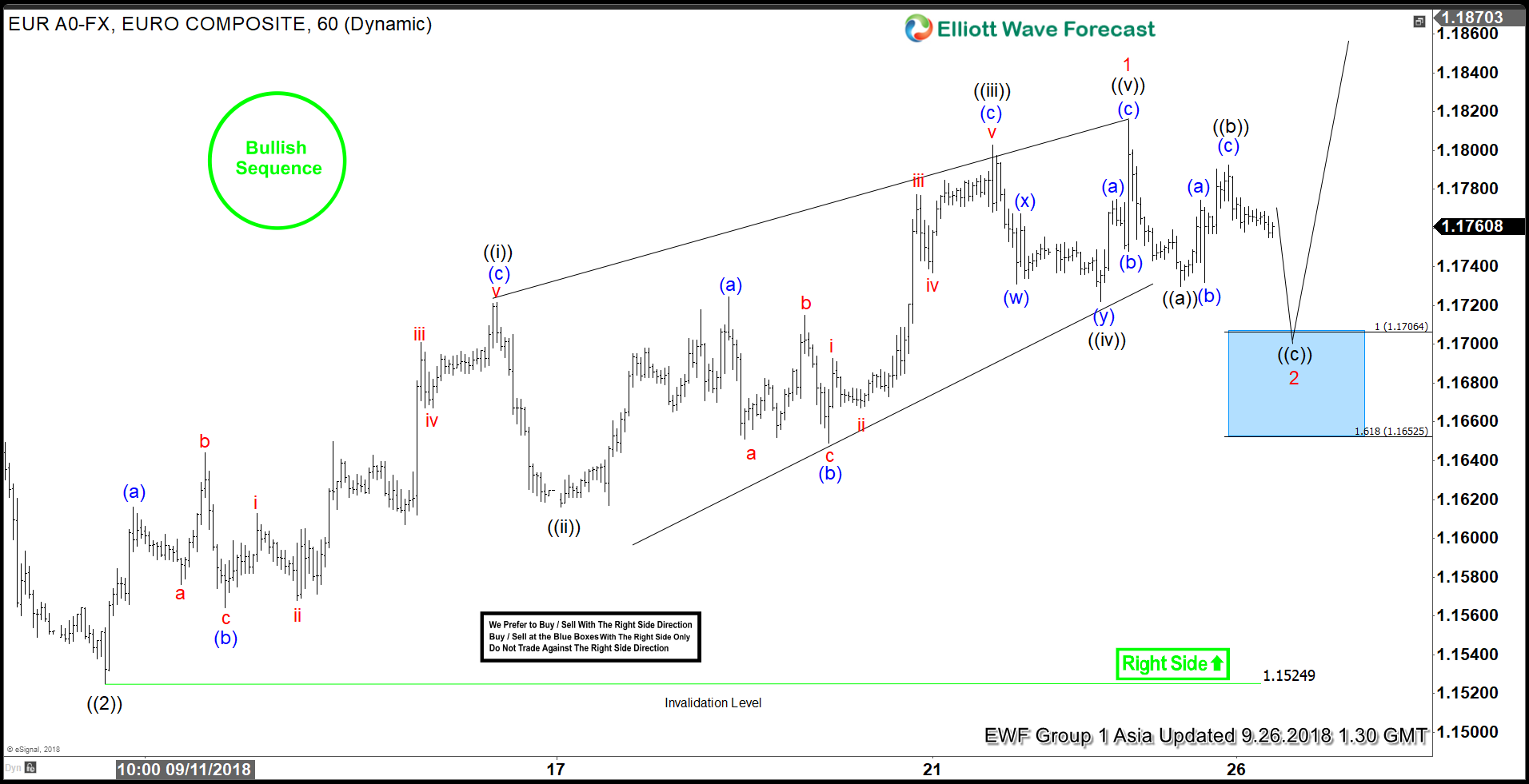

EURUSD Elliott Wave: Why Dips Should Remain Supported?

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1524 low ended Primary wave ((2)) pullback. Above from there, Primary wave ((3)) remain in progress as impulse structure looking for a further extension higher. It’s important to note that the pair is having bullish sequence tag & also the right side tag is calling higher. […]