In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

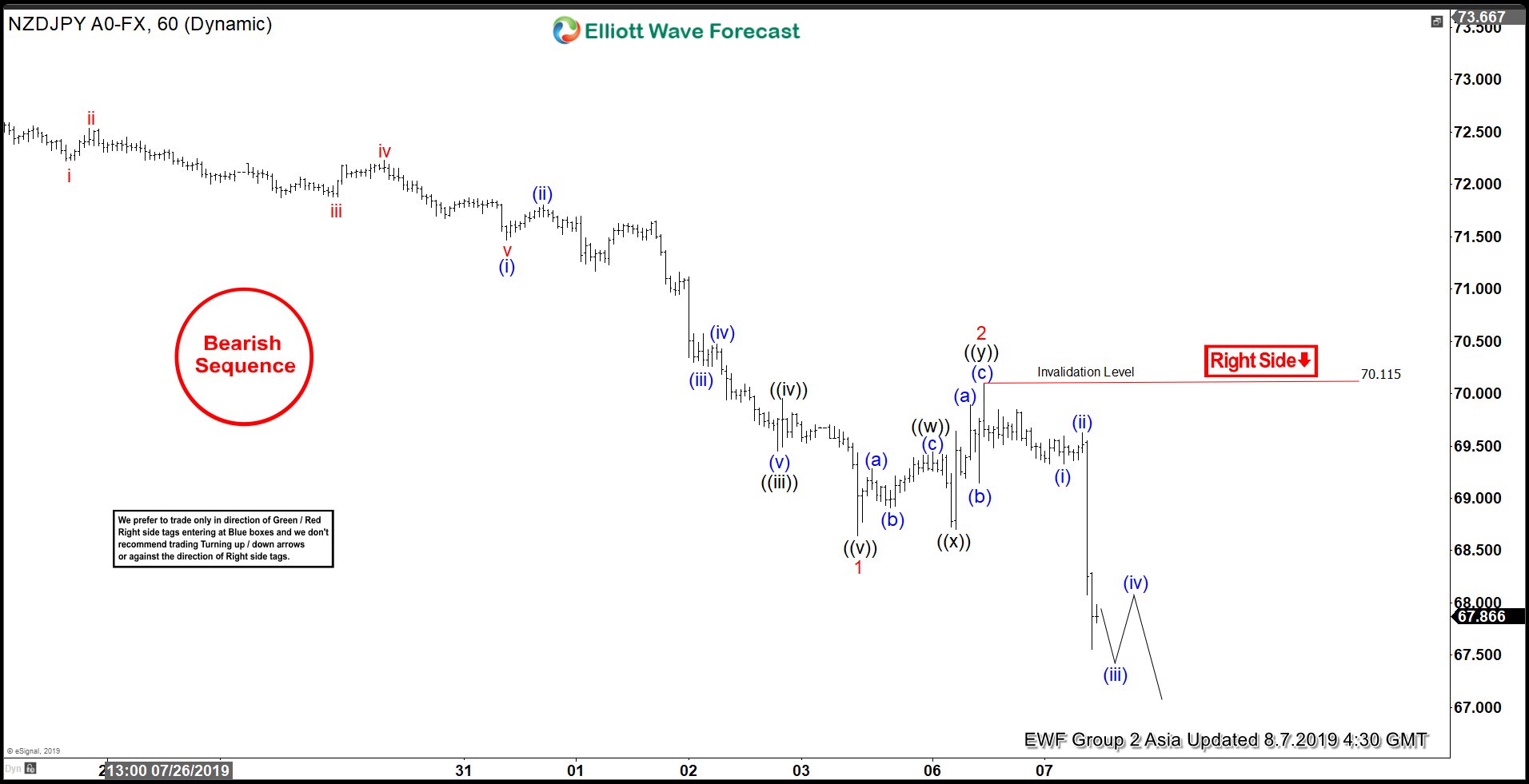

Yen Surged as Safe Haven On Demand Amidst Trade War Escalation

Read MoreLast week’s tweet by president Trump to slap a new round of tariffs to Chinese goods has sparked risk aversion in the market. Trump announced that he is imposing an additional 10% tariff on $300 billion of Chinese imports beginning on September 1. Trump said the additional tariff is due to China being slow to […]

-

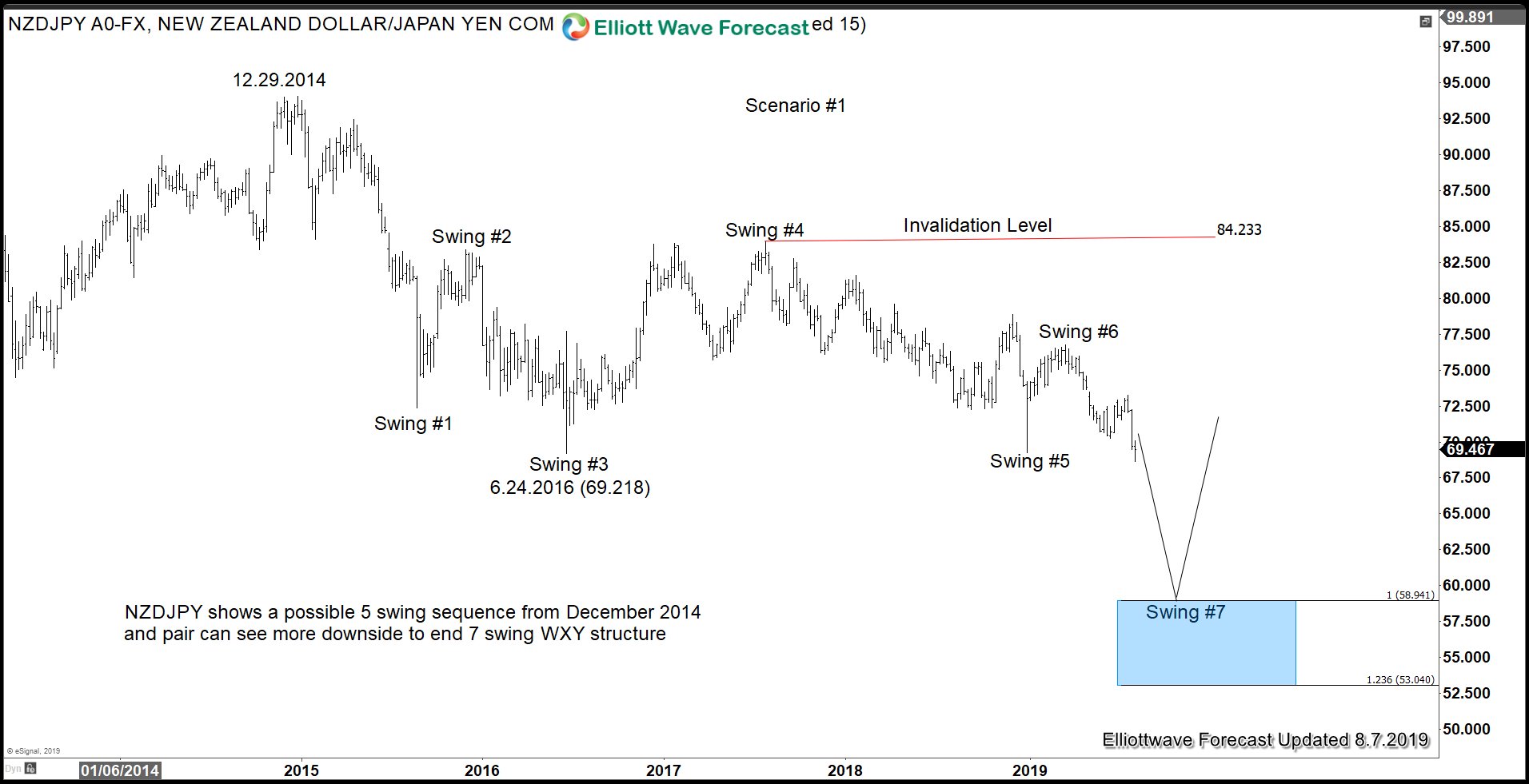

Elliott Wave View: NZDJPY Plunges after RBNZ 50 bp Rate Cut

Read MoreNZDJPY extends lower after the 50 bp rate cut by RBNZ. Elliott wave view suggests the pair shows incomplete bearish sequence favoring more downside.

-

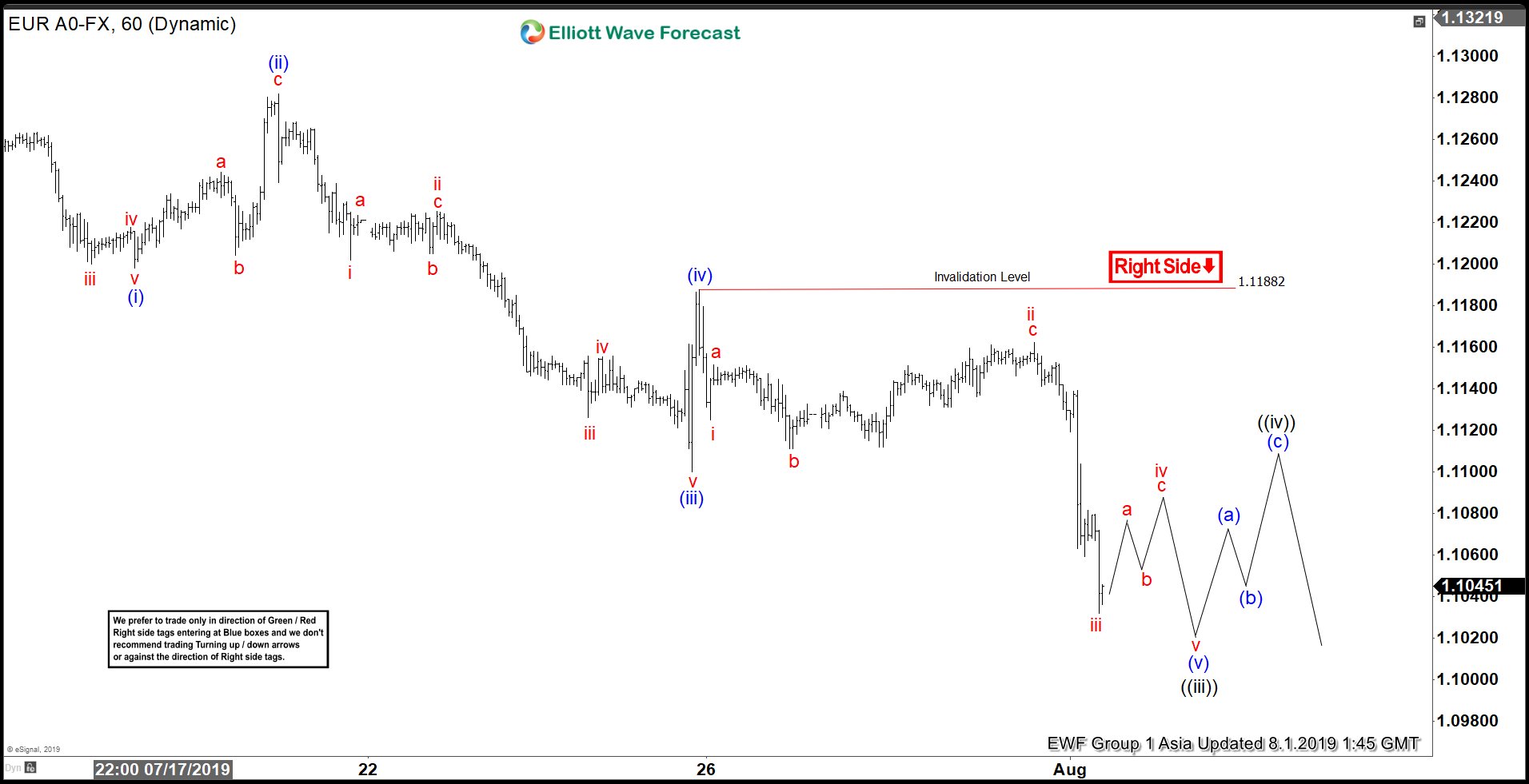

Elliott Wave View: EURUSD Continues Lower

Read MoreEURUSD shows incomplete sequence from Feb 2018 high favoring further downside. This article and video show the Elliott Wave path.

-

Can Binance Coin (BNB) Price Reach 100$ in 2020 ?

Read MoreBinance Coin (BNB) is cryptocurrency that was issued in July 2017 with Binance ICO and it’s used to pay fees on the Binance cryptocurrency exchange. In 2018, the cryptocurrency market saw a significant correction causing the majority of coins to drop more than 70% and BNB wasn’t any difference with an 80% decline. However, since December 2018, the […]

-

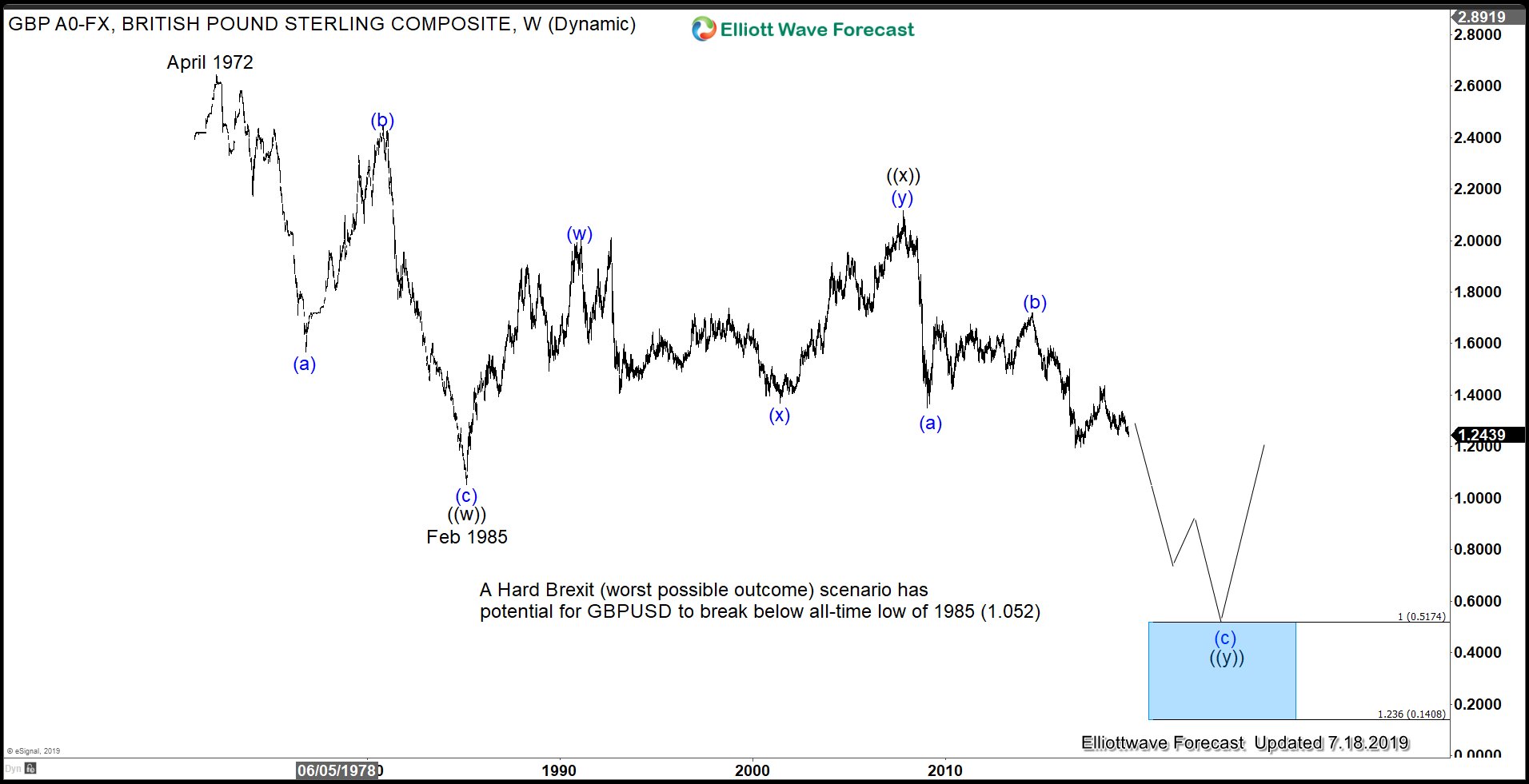

Fear of Hard Brexit Put Intense Pressure to Poundsterling

Read MoreSince Prime Minister Theresa May announced she stepped down from leadership position, the market has started to adjust the expectation for a hard Brexit scenario. Selling pressure on Poundsterling has intensified as the new prime minister hopefuls Boris Johnson and Jeremy Hunt adopted a hardline approach. Under the previous leadership of Theresa May, market previously […]

-

Elliott Wave View: GBPUSD Should Remain Weak

Read MoreGBPUSD shows a bearish sequence from June 25 high favoring further downside.This article and video shows the Elliott Wave path.