EUR/GBP is a pair that moves nearly all in corrective sequence of double three (WXY) or triple three (WXYXZ). That makes the pair to be very predictable and a pair to look for high probability setups. In this blog, we will take a look at how to trade a double corrective Elliott Wave Structure

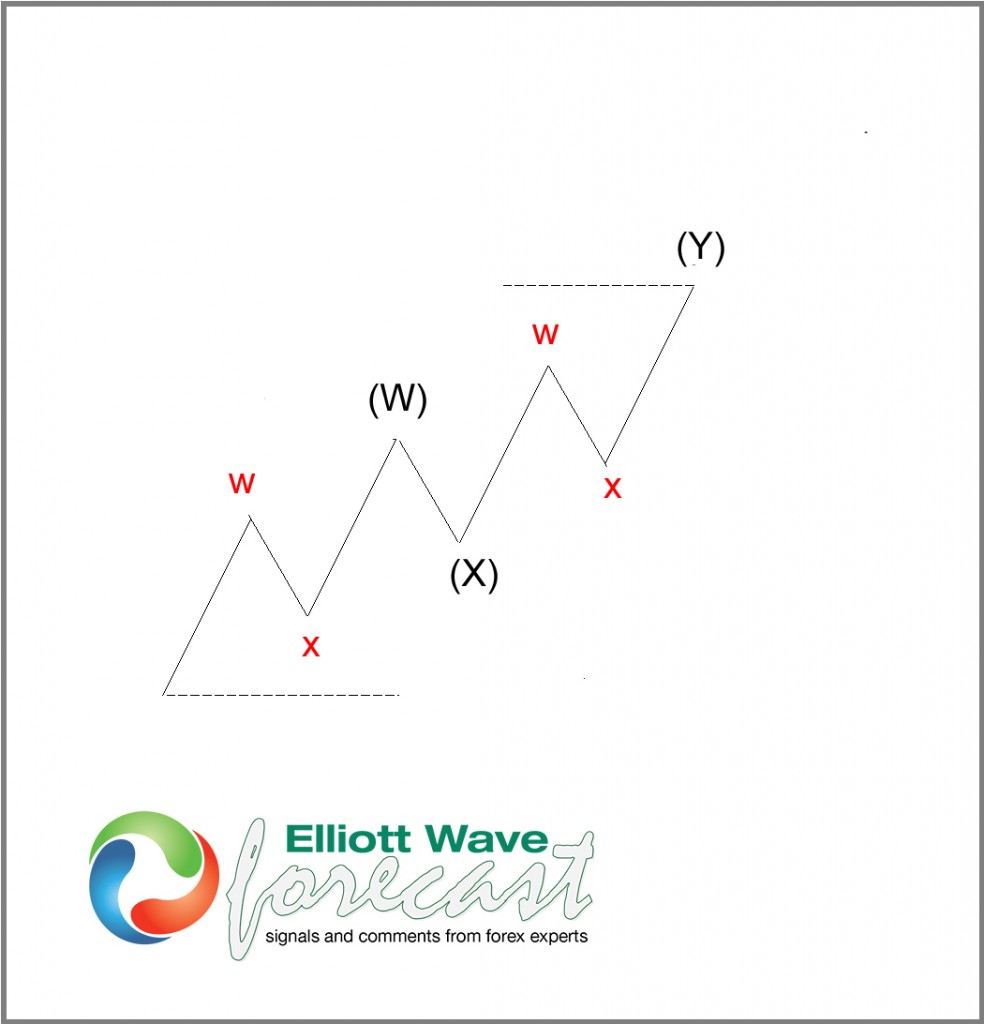

Double three structure is a 7 swing structure with the general structure below:

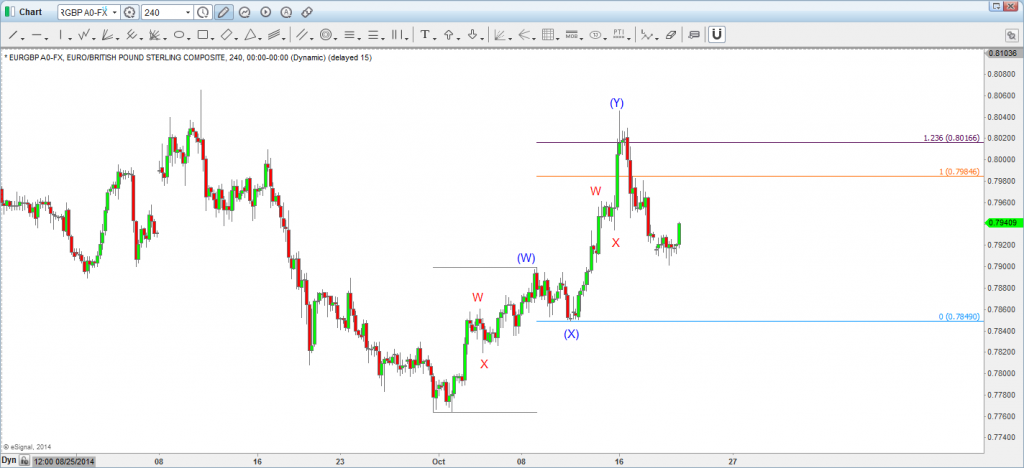

Let’s take a look at EUR/GBP recent move in double three below:

$EUR/GBP above made the 7 swing corrective structure with wave (Y) terminating at slightly above equal leg area. Equal leg is defined as an area between (Y) = (W) and (Y) = 1.236 ext.

A trader who anticipates a double three therefore can put a sell order at the equal leg area (0.7984 – 0.8016), then put stop loss above 1.618 ext (0.8068). The logic behind this placement of stop loss from Elliott Wave Principle is that wave 3 is normally 1.618 ext of wave 1. So when pair rallies towards 1.618 ext, then it can become impulsive structure.

This trade however requires traders to know the bigger time frame’s trend so that traders can trade with the trend, instead of against the trend.

Thank you for reading. If you would like to know the trend in EUR/GBP and the next path & potential trading setup in EUR/GBP or 25 other instrument, I invite you to join us with our 14 day Trial. We have 24 hour coverage of 26 instruments from Monday – Friday. We provide Elliott Wave chart in 4 different time frames, four times update of 1 hour chart throughout the day, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits.

Kind regards,

Hendra Lau – Technical Analyst at Elliott Wave Forecast

Back