During the summer of 2015. EWF members knew that AUDJPY was in bearish cycle from the 97.255 high, that was looking for further decline toward our target area : 83.814-80.642. AUDJPY has had one of the clearest structures during that period.

Let’s take a quick look at Elliott Wave charts from the 27.July 2015. to see how we were guiding our members through the AUDJPY price structure.

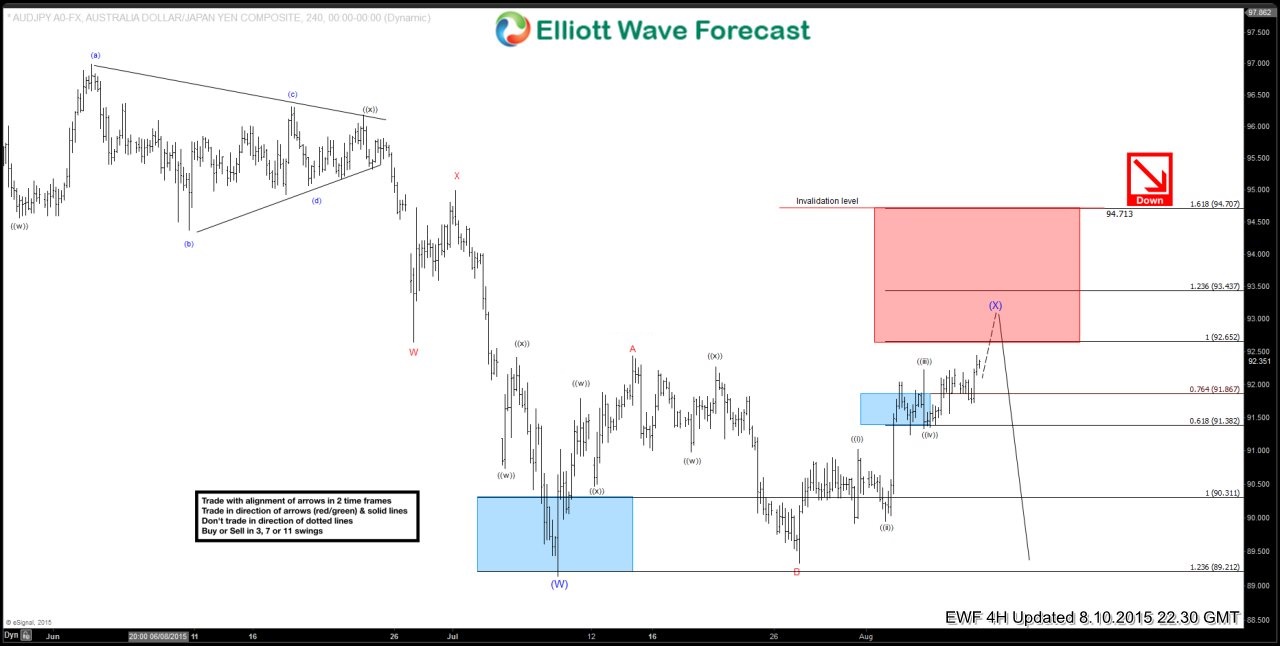

$AUDJPY 4h Update 7.27.2015 The price is close to previous low at 89.132, however our system sygested wave (X) daily recovery has not ended yet. The pair is still looking for another leg higher toward 50 fibonacci retracment area of the previous cycle which could be our potential sell zone.

$AUDJPY 4h UPDATE 8.10.2015 The price has been rejected from the low, and we got nice 5 wave rally , now assuming that wave (X) recovery has taken of form of Elliott Wave ABC FLAT structure. We’re currently in wave ((v)) of C, which is expected to end at h4 equal legs area 92.65-93.43 (sell zone). We strongly adviced selling the pair at mentioned area with invalidation above the 1.618 fib extension @ 94.707.

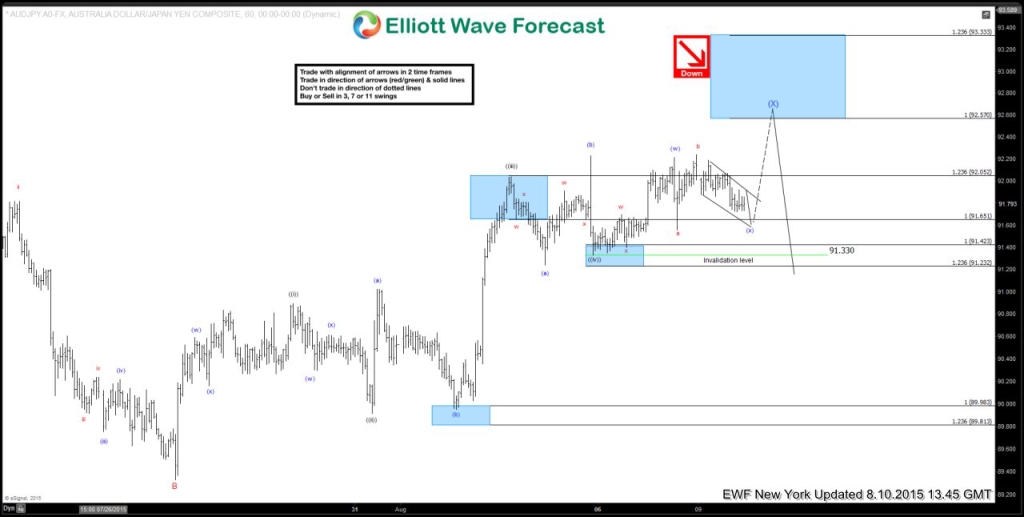

$AUDJPY H1 NY Update 8.10.2015 At this chart we can see what the wave ((v)) inner structure looks like. We’re about to complete wave (x) of ((v)) and while the price holds above the 91.33, another push higher is expected toward equal legs 92.57-93.33

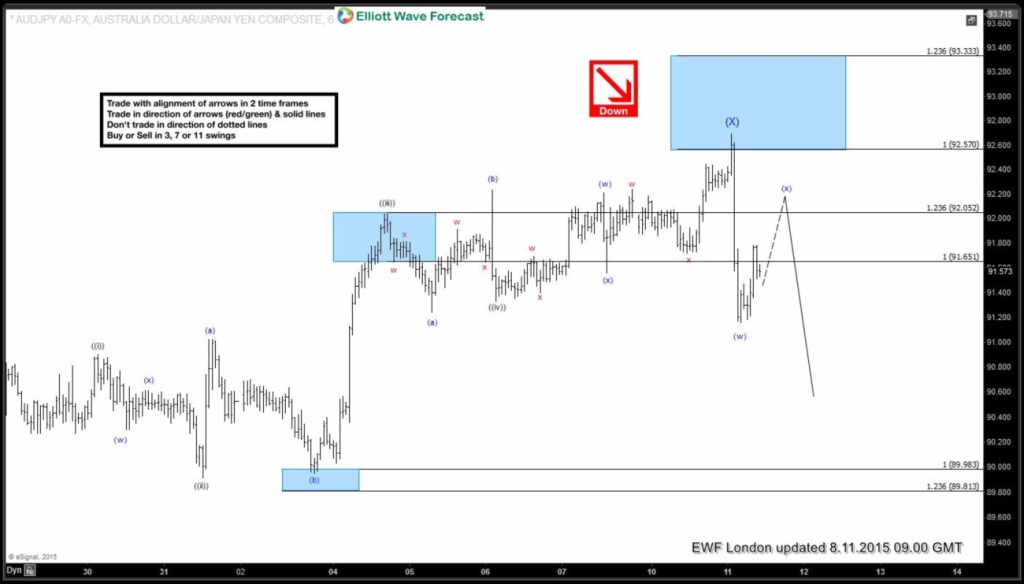

$AUDJPY H1 London Update 8.11.2015 The pair has given us nice decline right from the mentioned equal legs area and broken below wave ((iv)) low : 91.33 , so we assume that (X) is already done at 92.694. Short positions are active and positive.

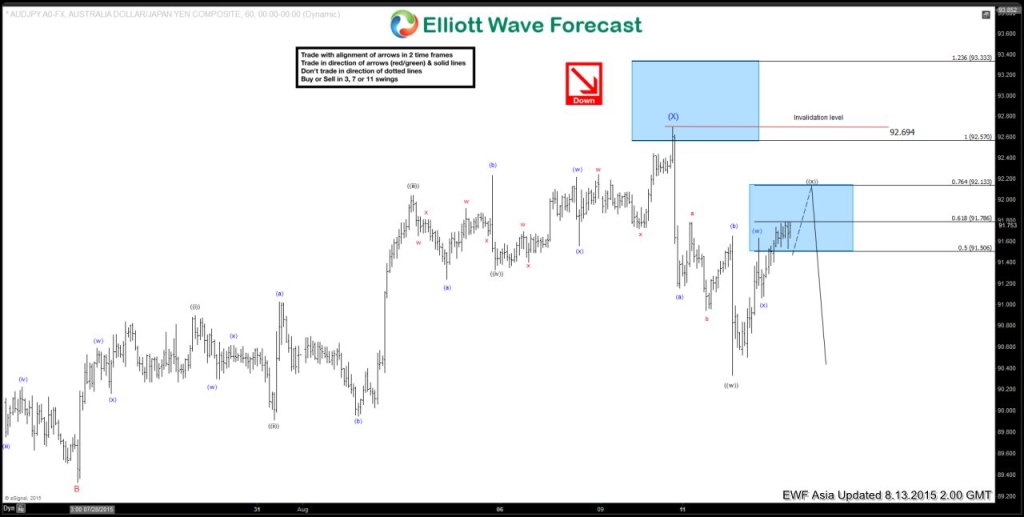

$AUDJPY H1 Asia Update 8.13.2015 Wave ((x)) bounce is correcting the decline from the 92.694. It’s expected to complete below that high and ideally below the 76.4 fib retracement level: 92.133

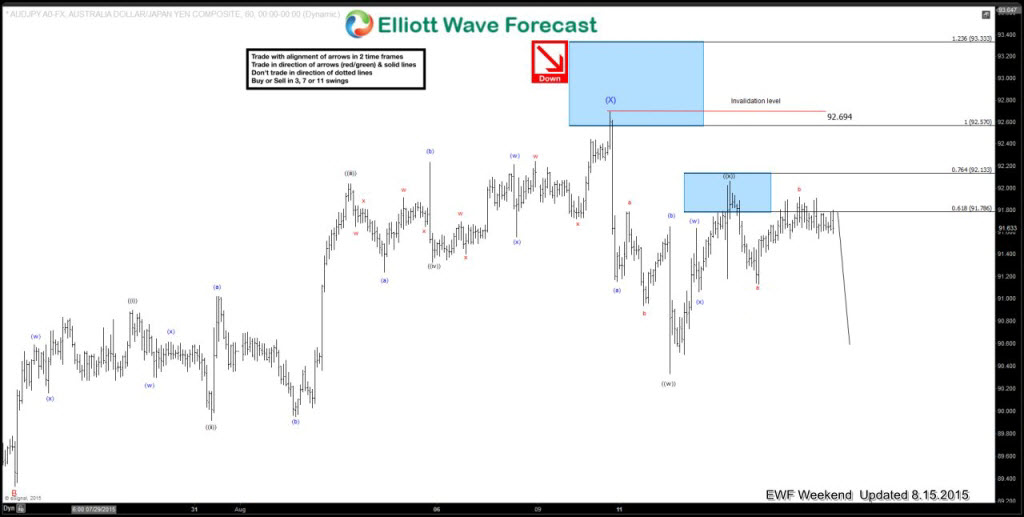

$AUDJPY h1 Weekend Update 8.15.2015 Wave ((x)) ended right below 76.4 fib retracement level and we assume wave b red bounce is also done. Further decline is expected toward new lows.

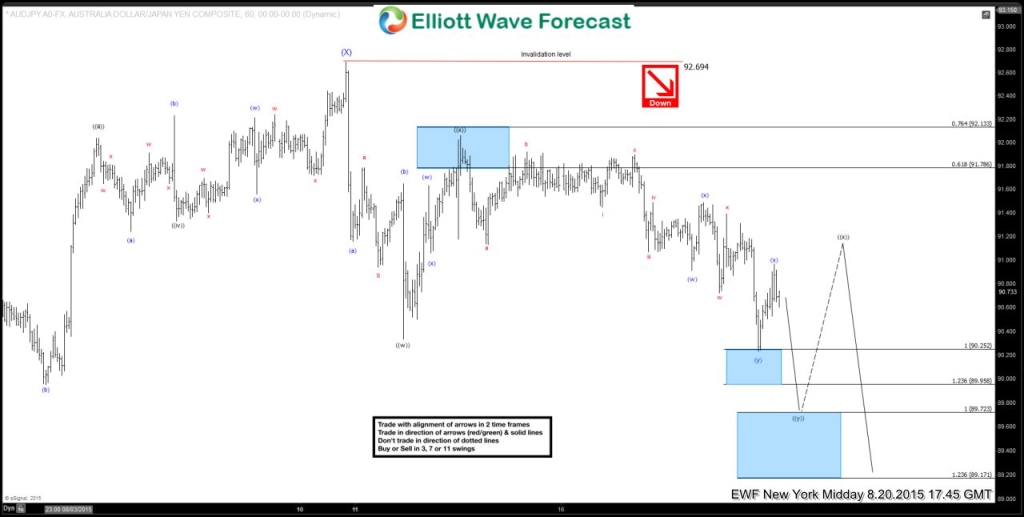

$AUDJPY NY Midday 8.20.2015 The pair extended little bit sideways but we finally got push lower and break below ((w)) low. We’re still staying short from the (X) high-92.694 area within a risk free positions.

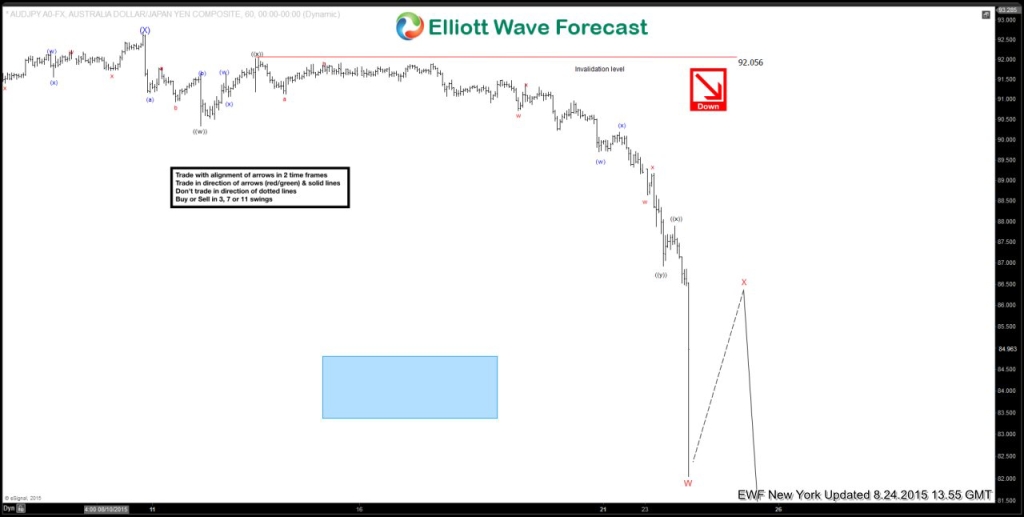

$AUDJPY NY Update 8.24.2015 Second ((x)) connector ended as quite shallow bounce and we got sharp decline toward our target area. 83.814-80.642. Short positions are now closed with profit. Profit is approximately +900 pips.

If you would like to have access of EWF analysis in real time, feel free to join us. Now You have an opportunity to sign up for 14 Days Trial here and get Full acces of Premium Plus Plan in 2 weeks. We provide Elliott Wave charts in 4 different time frames, 2 live webinars by our expert analysts every day, 24 hour chat room, market overview,daily and weekly technical videos and much more.

If you want to improve your Elliott Wave analysis and Trading Execution Skills, we advise you to check 3 Educational seminar recordings , you will learn a lot from our Market Experts. As our member you’ll get discount on them.

More information about subscription plans can be found here . Welcome to EWF !

Back