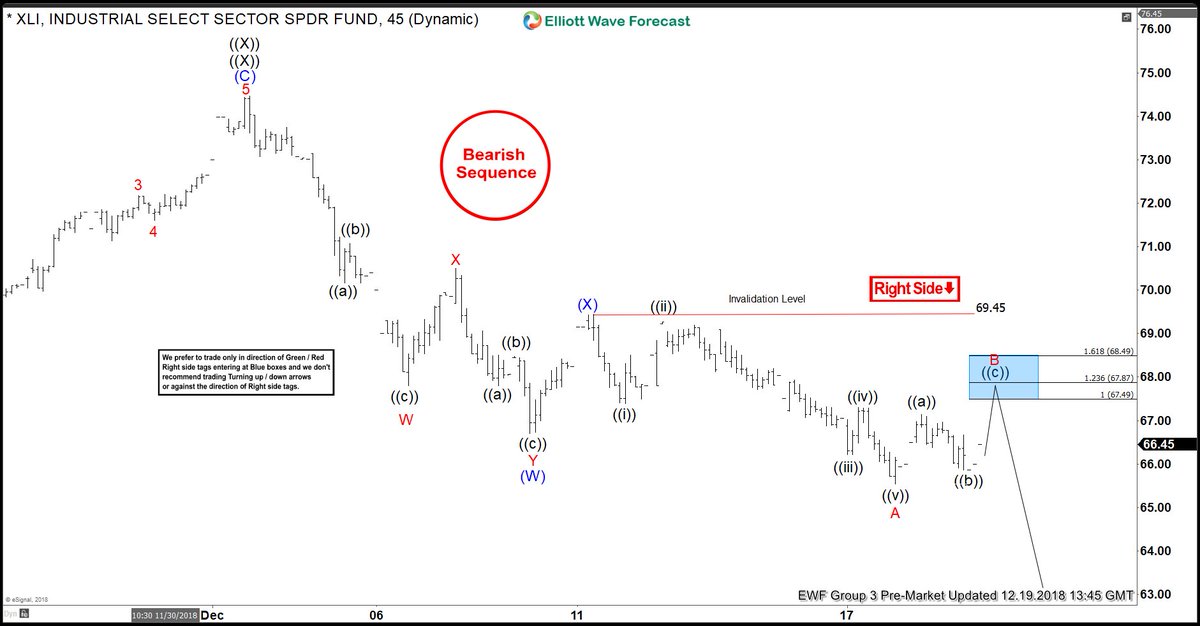

Today, we will have a look at Elliott Wave charts of XLI which we presented to our members in the past. You see the 1-hour updated chart presented to our clients on the 12/19/18. XLI had a Bearish sequence suggesting more downside.

XLI ended the cycle from 12/11/18 peak in red wave A at 12/17/18 low (65.51). Above from there, we expected a bounce to occur in red wave B. The bounce unfolded in an Elliott Wave Zig Zag correction structure. We advised members that XLI should continue lower. Therefore, we expected sellers to appear in the sequences of 3, 7 or 11 swings. At the 100 – 1.236 Fibonacci extension of black ((a))-((b)) which came at around 67.49-67.87 area and that was the first area for selling the ETF.

XLI 12.19.2018 1 Hour Chart Elliott Wave Analysis

In the last Elliott Wave chart. You can see that the ETF reached the blue box area and reacted lower. Any trades from our blue box area shown in the chart above were risk-free, which means the stop-loss should be moved to break even, and the ETF even hit the minimum target which produces a great gain. The minimum target was the equal legs of the blue wave (W)-(X) which came at 61.71-59.86. Please keep in mind that the 1-hour chart which I presented has changed. This blog should just illustrate how accurate our blue boxes are, and how our members trade our 3-7 or 11 swings strategy.

If you are interested in how to trade our blue box areas and want to understand how Elliott Wave works. Then I recommend you to get a shot on our special promotion which we are currently running below. We present a lot of trading setups in our 3 Live Trading Rooms.

XLI 12.19.2018 1 Hour Chart Elliott Wave Analysis

I hope you liked this blog and I wish you all good trades. And for all who are interested in learning more about our unique blue box areas and also want to trade profitably in 2019 those can sign up for our New Year promotion today and get 30% Discount on ALL monthly plans!!

We provide precise forecasts with up-to-date analysis for 78 instruments including Forex, Commodities, ZN (10 year note yields), World Indices, Stocks, ETFs and Bitcoin. Our clients also have immediate access to Market Overview, Sequences Report, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Daily & Weekend Technical Videos, Live Screen Sharing Sessions, Live Trading Rooms and Chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right side system is pivotal for long-term success in trading. If you want to become a member then Click on the Banner above. See you insight!

Back