The Essential Structure of Wave Flats

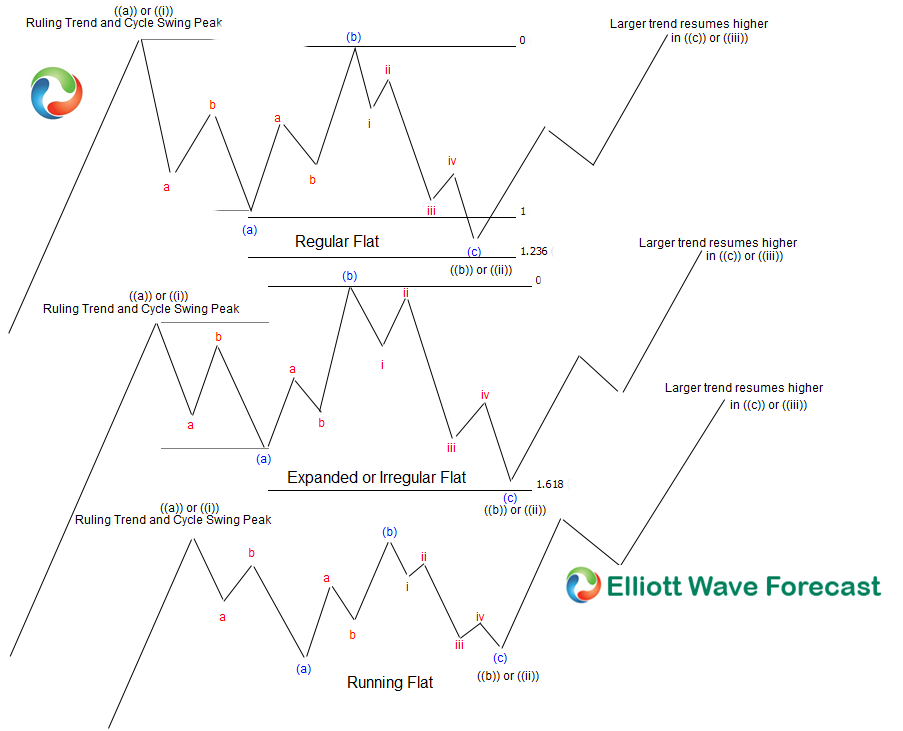

Flat corrections represent crucial 3-3-5 pullback patterns in Elliott Wave theory. These formations differ from zigzags by moving sideways before trend continuation. Three distinct types exist, each with unique characteristics.

1. Regular Flat Correction Pattern

While we primarily show bullish examples here, it’s important to note that the same structural patterns appear in bearish markets – simply inverted. In other words, every rule we discuss for uptrends applies equally but oppositely to downtrends. In a regular flat correction, wave “(b)” terminates about at the level of the beginning of wave (a), and wave (c) terminates a slight bit past the end of wave (a). Many times a flat like this, wave (c) of ((b)) will end around the equal legs of (a) to 123.6% Fibonacci extension of (a).

2. Expanded (Irregular) Flat Pattern

A more common variety called an irregular or expanded flat has a price extreme beyond that of the preceding ruling trend cycle peak . In expanded flats, after completion of the first swing against the trend in wave (a) , wave (b) of the 3-3-5 pattern terminates beyond the starting level of wave ((a)), and wave (c) of ((b)) ends more substantially beyond the ending level of the initial wave (a) many times around the 123.6% to 161.8% Fibonacci extension of the initial wave (a).

3. Running Flat Pattern

The less common variation on the 3-3-5 flat pattern is called a running flat, wave (b) terminates well short of making a new price high against a ruling trend cycle peak or low in the (b) wave & price in the (c) of ((b)) will fail to reach the price extreme of the initial wave (a).

Diagram comparing regular, expanded, and running flat corrections in Elliott Wave Theory

Thanks for looking, hope you enjoyed it. Feel free to come visit our website and take a trial subscription.

Kind regards & good luck trading. Lewis Jones of the ElliottWave-Forecast.com Team

Back