Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

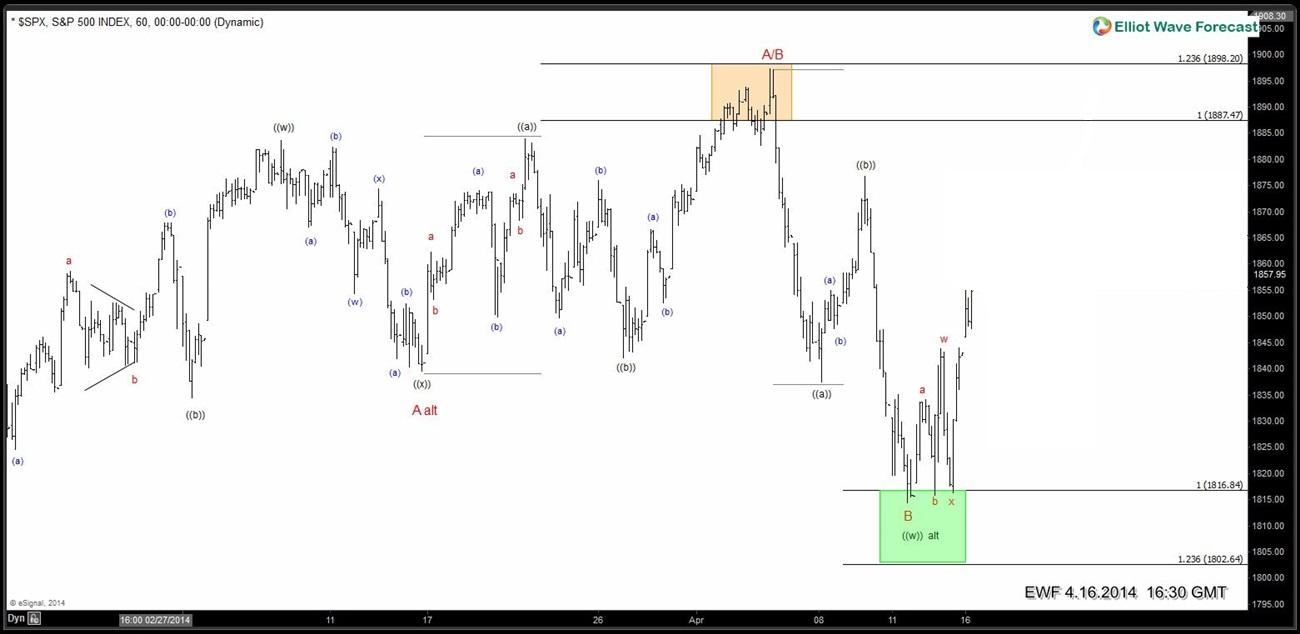

$SPX: Elliott Wave Long Setup

Read More$SPX turned lower sharply after making marginal new highs to 1897. Members knew this drop was coming and they had to exit the longs and wait for the dip to get long again. Let’s take a look at Elliott wave analysis from members area to see how it all unfolded and how Index reached the […]

-

$TNX (US 10 year yields) Elliott Wave Analysis 3.28.2014

Read MorePreferred view is that 10 year yields are consolidating in the form of a bullish triangle wave (( 4 )) with current leg B being part of wave ( D ) with a C higher toward 2.86 expected before we get the (E) dip. Ideally the current dip should hold above ( C ) wave […]

-

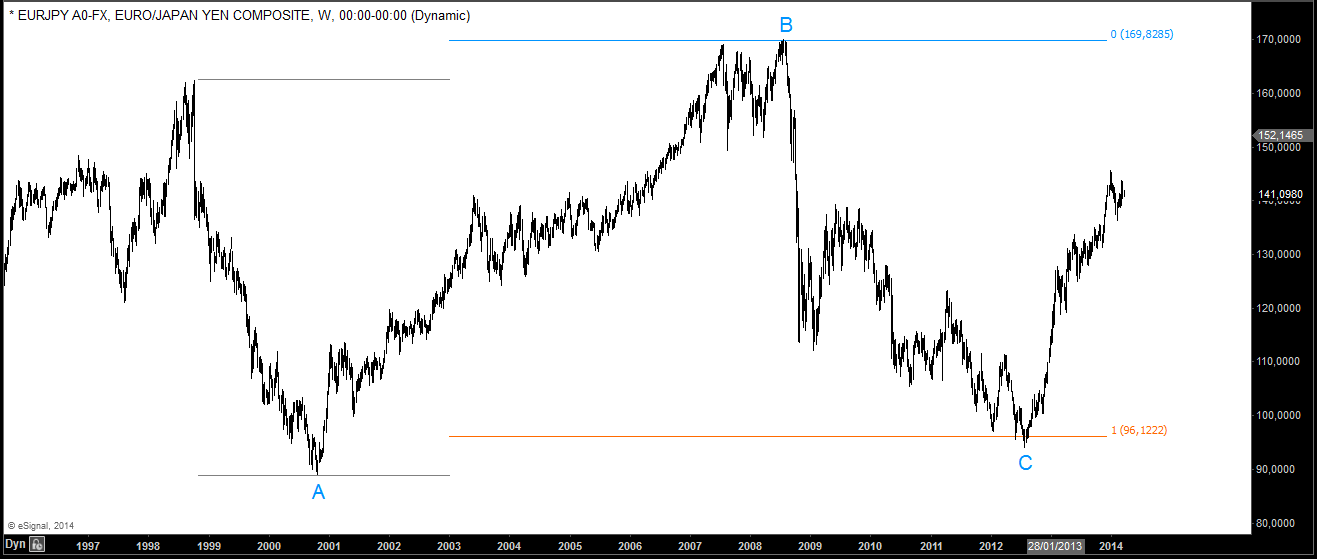

The Equal Legs What does it mean?

Read MoreThe Equal Legs is a term used in the technical analysis to indicate that the magnitude of a movement is equal to another movement joined by a correction. It is represented as follows: Where the magnitude of the swing A is equal in magnitude to the swing C (A = C) and B is the correction. This method is widely used in Elliott Waves identifying targets or […]

-

Elliott Wave Expanded Flat correction: Identification & Trading Strategies

Read MoreThe Expanded Flat correction is a common corrective structure seen in: Wave 2 and Wave 4 of a Motive Wave The connector wave in a Zig Zag pattern Any part of a Double or Triple Correction Structure of an Expanded Flat Correction In a Bullish Trend Scenario: Wave A – Price moves against the trend […]

-

$TNX (US 10 year yields) 1 Hour Elliott Wave Analysis

Read MorePreferred view now is that 10 year yields have completed wave ( B ) at 2.82% and have resumed the decline. Bounces should now prove corrective and as far as they stay below 2.82%, we would expect more downside in TNX. We don’t like buying into proposed bounces. Primary view calls for a drop to […]

-

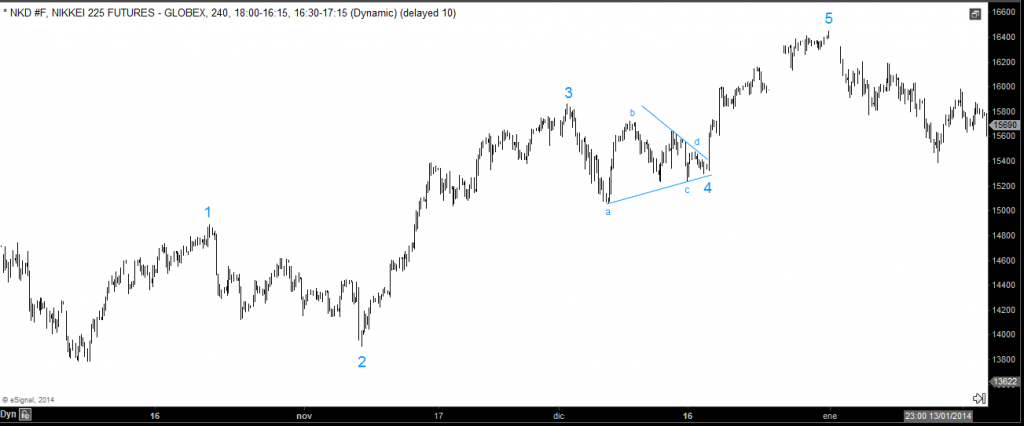

Triangle as a Wave 4

Read MoreIn the Chartism you could find out triangles any where using two trendlines to fix the geometric form. But there are certain triangles that are not so important by type but location and these are displayed on a wave 4 of a Elliott wave impulse. If you have a well structured impulsive count and after […]